Down payment gift letter template canada

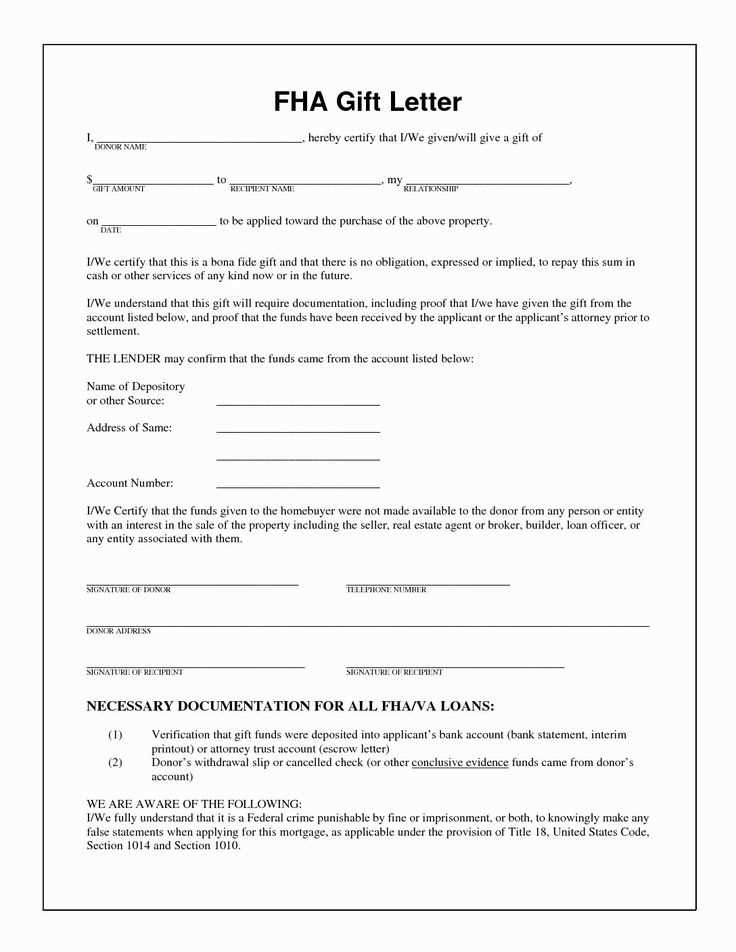

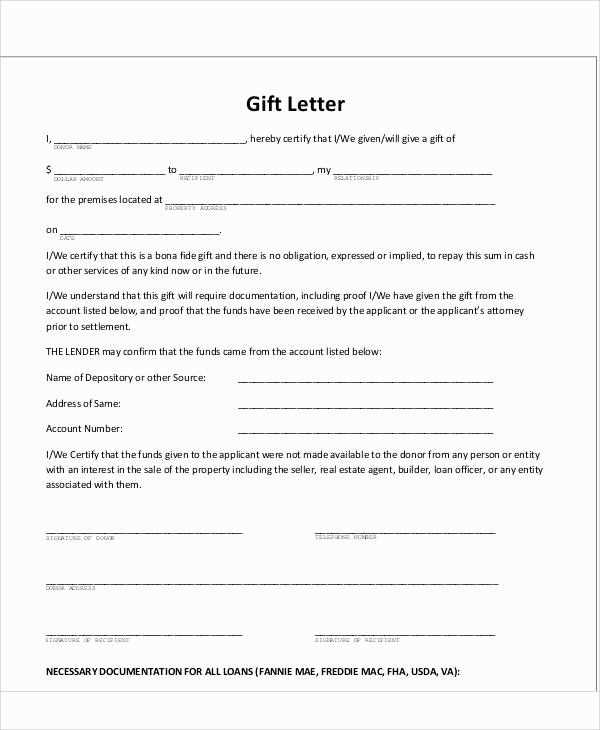

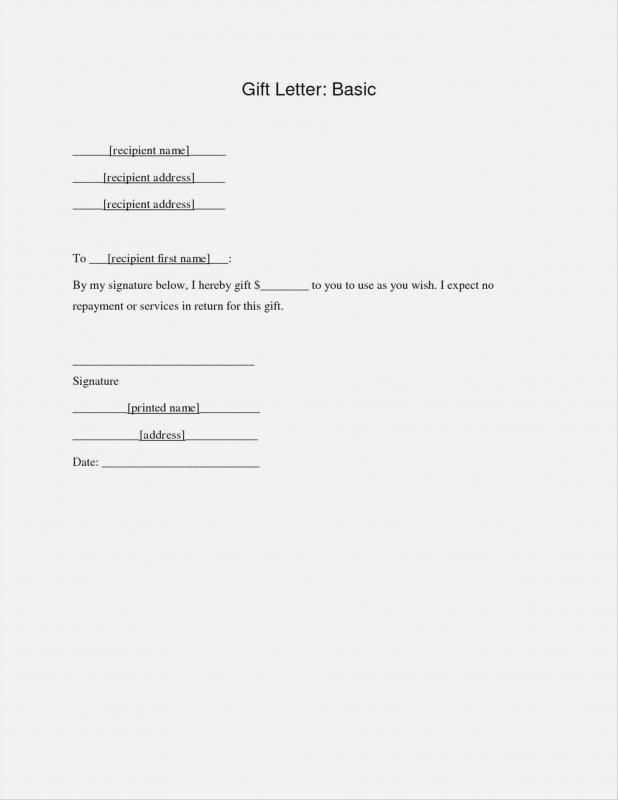

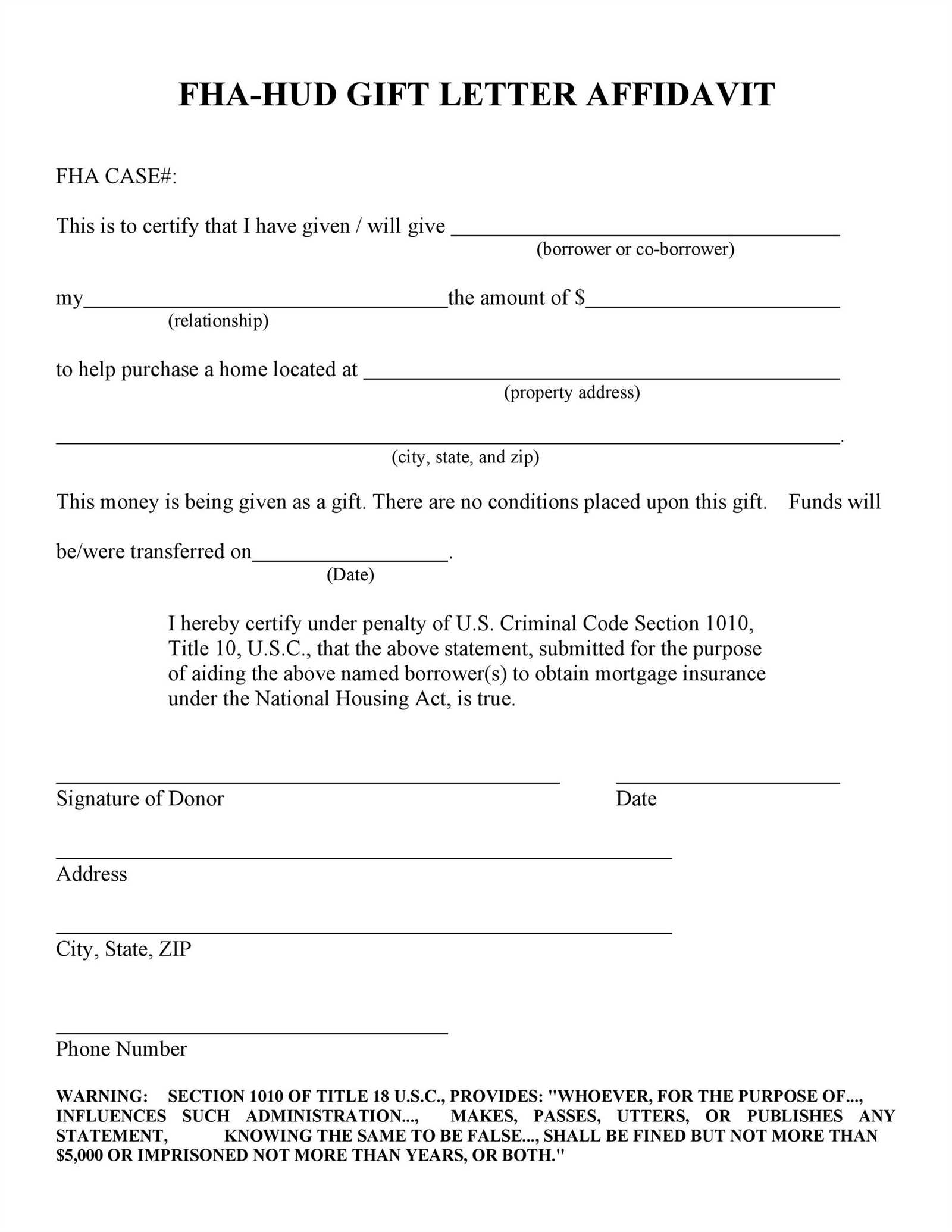

When you’re receiving a gift to help with your down payment, having a clear and well-structured gift letter is essential. This letter serves as confirmation that the funds are indeed a gift, not a loan, which is crucial for the mortgage process. Ensure that the letter includes all the necessary details to avoid any issues down the line.

Start by clearly stating the relationship between the donor and the recipient. For example, if it’s from a family member, mention the nature of your relationship. The letter must specify the amount being gifted and confirm that the donor is not expecting repayment. Additionally, it should include both the donor’s and recipient’s full names, addresses, and contact details.

To make the process smoother, you should also include the donor’s signature and the date the gift was provided. This serves as a record for both parties and the lender. If possible, include the donor’s financial institution details to further verify the legitimacy of the gift.

Key Points to Include:

- Full name, address, and contact information of both the donor and the recipient

- Amount being gifted

- Confirmation that the gift is not a loan and does not require repayment

- Donor’s signature and date

- Donor’s financial institution information (optional but helpful)

Having these elements in place ensures a smooth down payment process and can help avoid any delays or complications with your mortgage approval.

Sure, here’s the updated version with reduced repetition:

To streamline the process of gifting a down payment in Canada, you can follow a few key steps. Begin by ensuring that the gift letter is clear and provides the necessary details. This includes the names of both the donor and recipient, the relationship between them, the amount of the gift, and a statement confirming that the gift is not a loan. It is important to note that the donor cannot expect repayment for the gift. A simple format for the letter is provided below for reference:

| Donor’s Name | [Donor’s Full Name] |

|---|---|

| Recipient’s Name | [Recipient’s Full Name] |

| Gift Amount | [Amount of Gift] |

| Relationship | [Nature of Relationship] |

| Statement | This is a gift, and no repayment is expected. |

Once the letter is drafted, it may need to be signed by both parties. Depending on the lender’s requirements, additional documentation such as proof of the gift transfer may be requested. Keep the letter simple and direct to avoid confusion during the mortgage approval process.

- Down Payment Gift Letter Template in Canada

When you receive a gift for your down payment in Canada, it is crucial to have a clear and formal gift letter. This letter assures the lender that the funds are not a loan and do not require repayment. Make sure the letter includes the following key details:

- Donor’s Information: Full name, relationship to the recipient, and address of the person giving the gift.

- Gift Amount: Clearly state the exact amount of the gift, as well as the currency (Canadian dollars).

- Statement of No Repayment: A statement confirming that the gift is non-repayable, with no expectation of repayment in the future.

- Source of Funds: The donor should indicate where the gift money is coming from (e.g., savings, investment, sale of property).

- Signatures: Both the donor and recipient should sign the letter. The donor’s signature is particularly important to validate the authenticity of the gift.

Sample Template:

Donor’s Name: [Donor’s Full Name]

Relationship to Borrower: [Relationship]

Amount of Gift: [Gift Amount in CAD]

Date of Gift: [Date]

Source of Funds: [Source]

Statement: I, [Donor’s Name], confirm that I am giving a gift of [Gift Amount in CAD] to [Recipient’s Name]. This gift is non-repayable and does not require reimbursement.

Important Reminder: Lenders may require additional documentation or verification, such as bank statements, to confirm the source of funds for the gift. Double-check with your lender for any specific requirements.

A Down Payment Gift Letter is a document provided by a donor to confirm that the funds given for a home purchase are a gift and not a loan. It is essential for buyers who receive financial assistance from family members or friends for their down payment. The letter clarifies that the money does not need to be repaid, ensuring that the buyer’s debt-to-income ratio remains unaffected by the gift. This documentation is required by mortgage lenders to ensure compliance with lending regulations and avoid any misrepresentation of the buyer’s financial situation.

Key Information in a Down Payment Gift Letter

The letter should include the donor’s name, relationship to the buyer, the gift amount, and a statement confirming that the funds are a gift with no repayment obligation. The donor may also need to provide their contact information and confirm the source of the funds. Some lenders may require additional documentation to verify the legitimacy of the gift, such as bank statements or proof of transfer.

Why It’s Required

Lenders ask for a Down Payment Gift Letter to ensure that the buyer is not taking on additional debt through the gift, which could affect their loan eligibility. Without the letter, lenders may assume the buyer is taking out an additional loan to cover the down payment, which could disqualify them from receiving a mortgage.

A gift letter for a down payment must include specific details to be valid. Ensure that the following information is present:

Donor Information

The full name, address, and contact details of the gift giver must be provided. This identifies the person offering the gift and confirms their relationship to the recipient. Include their relationship to the buyer, such as “parent” or “grandparent”.

Recipient Information

The recipient’s name and address should be clearly stated. This connects the gift directly to the buyer and ensures there are no discrepancies regarding the intended recipient.

Gift Amount

Clearly state the exact amount of the gift being provided. Be specific and avoid vague terms. The down payment amount should be mentioned without any ambiguity.

Statement of No Repayment

The letter must confirm that the gift is not a loan and does not need to be repaid. This clarification helps avoid any misunderstanding with the mortgage lender and ensures there is no expectation of future repayment.

Source of Funds

Sometimes, the letter will need to include the donor’s source of funds. Lenders may ask for this information to confirm the legitimacy of the gift.

Signature

The gift letter should be signed by the donor, verifying all the information provided is correct and accurate. This ensures the authenticity of the document.

Family members are the most common source of gift funds for a down payment. This typically includes parents, grandparents, siblings, or even children in some cases. However, the relationship needs to be genuine and verifiable to avoid any suspicion of loaning rather than gifting.

Close relatives such as parents or grandparents are generally accepted by lenders, as they can easily demonstrate a personal connection. Gifts from extended family members or friends may also be acceptable, though lenders may require further documentation to ensure there is no expectation of repayment.

Some lenders may even accept gifts from employers or business partners, but this is rarer and often comes with additional scrutiny. Any gift provided must be well-documented, with a clear gift letter specifying that the funds do not require repayment.

In all cases, the gift must be a true gift, with no strings attached. Lenders will want to ensure that the money is not a disguised loan, which could affect your debt-to-income ratio and your ability to qualify for a mortgage.

Clearly state the relationship with the donor and confirm that the gift is not a loan. Include specific details like the donor’s full name, address, and contact information. Mention the exact amount of the gift and state that there is no expectation of repayment.

Key Elements to Include

Provide the donor’s statement that they do not expect repayment or any financial return. This declaration should clarify that the funds are a genuine gift. Include a reference to the real estate transaction, specifying the recipient’s name and the property being purchased. Ensure that both the donor and recipient sign the letter, confirming the details and intentions.

Additional Tips

If possible, attach documentation proving the donor’s ability to give the gift, such as bank statements or proof of savings. This helps establish the legitimacy of the gift and satisfies lender requirements.

Clearly outline the relationship between the gift giver and the recipient in the gift letter. Avoid vague references or generalized terms like “a friend” or “acquaintance.” Lenders want to know the exact nature of the relationship to ensure there is no expectation of repayment.

1. Missing or Incorrect Signatures

One of the most frequent mistakes is failing to include both the donor’s and recipient’s signatures on the gift letter. This small detail is crucial for verifying that both parties acknowledge the transaction. Ensure both signatures are in the appropriate places, along with the date.

2. Lack of Specific Dollar Amount

It’s vital to specify the exact amount of the gift. Avoid leaving this detail vague, such as using phrases like “a substantial amount” or “a generous gift.” Clearly stating the dollar value shows transparency and helps avoid any confusion later on.

3. Not Stating the Source of Funds

Another error is not mentioning the source of the funds for the gift. Lenders may require documentation of where the gift money originated. This can include a bank statement or proof of income from the giver to confirm that the gift is legitimate and not a loan.

4. Failing to State the Gift is Non-Repayable

Make sure to specify that the gift is non-repayable. Lenders may question the arrangement if the letter does not clearly state that the money is a gift and not a loan that will need to be paid back later. Include clear language that the funds do not need to be repaid.

5. Not Providing Proper Documentation

In addition to the gift letter, include supporting documentation such as bank statements or transaction records to back up the gift’s authenticity. Without these documents, the lender may find the gift letter incomplete, leading to delays or complications in the mortgage approval process.

6. Ignoring Lender Requirements

Every lender may have specific requirements for a gift letter. Ensure that the gift letter complies with the lender’s guidelines. Double-check the details and format required by your lender, including information like the donor’s contact details and the date the gift was given.

7. Omitting a Statement of Relationship

Clearly explain the relationship between the donor and the recipient. Avoid ambiguous terms like “close friend” without specifying the nature of the relationship. Lenders may request this detail to verify that the gift is legitimate and not a disguised loan.

Providing a down payment gift can positively influence your mortgage approval process, but it requires careful documentation and compliance with lender requirements. Lenders view down payment gifts as a sign of financial support, which can improve your chances of getting approved, especially if you’re struggling to meet the standard down payment threshold.

To ensure the gift is accepted, follow these steps:

- Clearly document the source of the gift with a gift letter. This letter should state that the money is a gift, not a loan, and that there’s no expectation of repayment.

- Ensure the gift comes from a close family member, as most lenders restrict gift sources to relatives. The closer the relationship, the more likely the gift will be accepted.

- Keep bank statements showing the transfer of funds. These will verify the gift’s legitimacy and show the origin of the funds.

- Be ready to explain your financial situation and demonstrate that the gift is not intended to cover other expenses, like closing costs or other obligations.

Having a down payment gift can reduce the amount you need to save on your own, potentially lowering your loan-to-value ratio, which may improve your mortgage terms. However, you should be prepared for the lender to scrutinize the gift carefully. Ensure all necessary paperwork is in place, and be transparent about the financial assistance you’re receiving.

Down Payment Gift Letter Template

Provide clear and specific details in your down payment gift letter. The letter should include the donor’s full name, address, and relationship to the recipient. Explicitly state the gift amount, confirming that no repayment is expected. Be sure to mention the date of the gift and confirm it as a non-refundable donation.

Key Information to Include

- Donor’s full name and contact information

- Recipient’s name and relationship to donor

- Exact amount of the gift

- Confirmation of no repayment obligation

- Date of gift transaction

- Statement indicating the gift is non-refundable

Additional Considerations

If the donor is contributing a large sum, a statement about the source of the funds is often required. Ensure the letter is signed and dated by the donor to verify authenticity. Some financial institutions might ask for additional documentation to support the gift, so check with the lender before finalizing the letter.