Guide to Writing a Down Payment Gift Letter Template

When preparing to make a significant financial commitment, it’s often necessary to provide proper documentation that outlines the origin of your resources. This process ensures transparency and builds trust between all involved parties.

Such forms of verification are commonly required by financial institutions or lenders to confirm that the resources you’re using are legitimate and meet their standards. These documents play a key role in preventing misunderstandings and ensuring compliance with regulatory requirements.

In this article, we’ll explore how to craft an effective statement to meet these expectations. You’ll learn about the essential components, the importance of accuracy, and how to avoid common mistakes when drafting these types of documents.

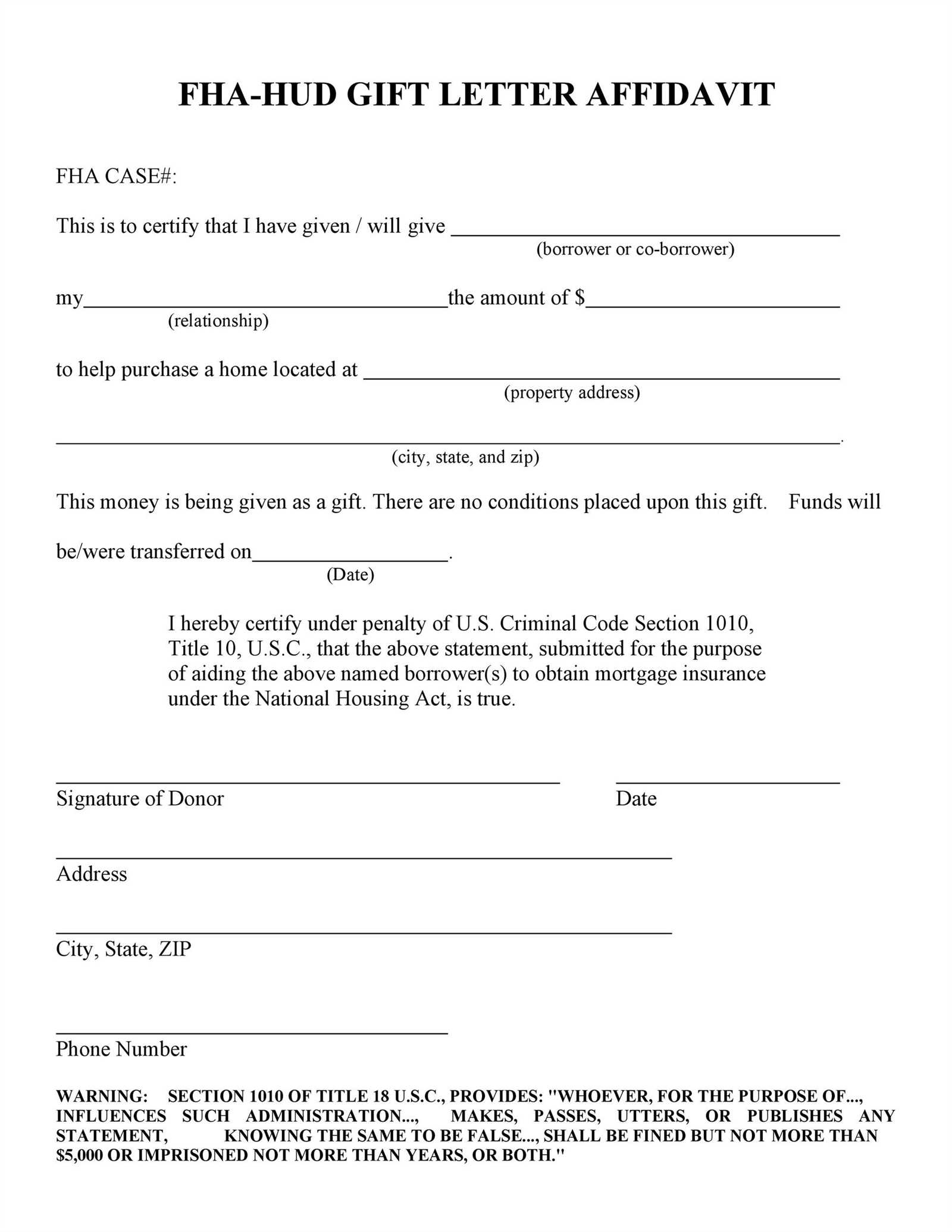

Understanding the Purpose of a Gift Letter

In financial transactions, providing clarity about the origin of funds is crucial. Documentation ensures that contributions are legitimate and comply with the requirements of institutions overseeing the process. This fosters trust and reduces the likelihood of complications.

Such written confirmations are often used to prove that specific resources provided are non-repayable and free from any hidden conditions. They serve as a safeguard, helping to prevent misunderstandings between contributors and recipients.

By ensuring transparency, this type of document helps meet regulatory standards while also streamlining the approval process. Understanding its role can make the entire procedure much smoother and more efficient for all involved.

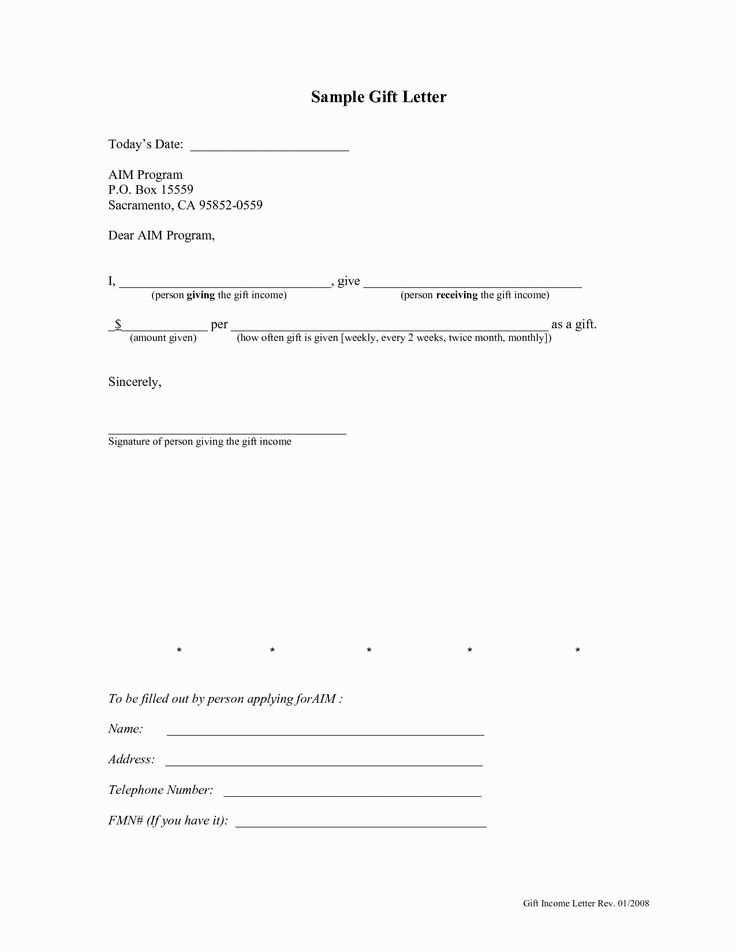

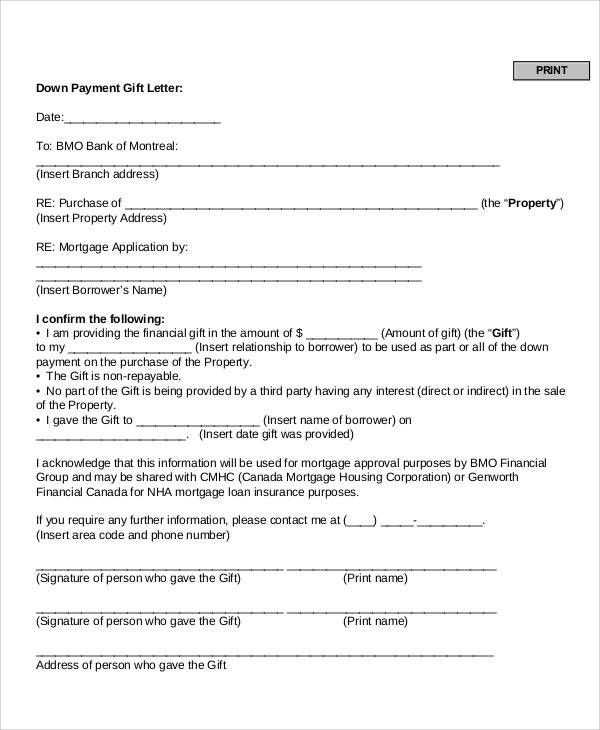

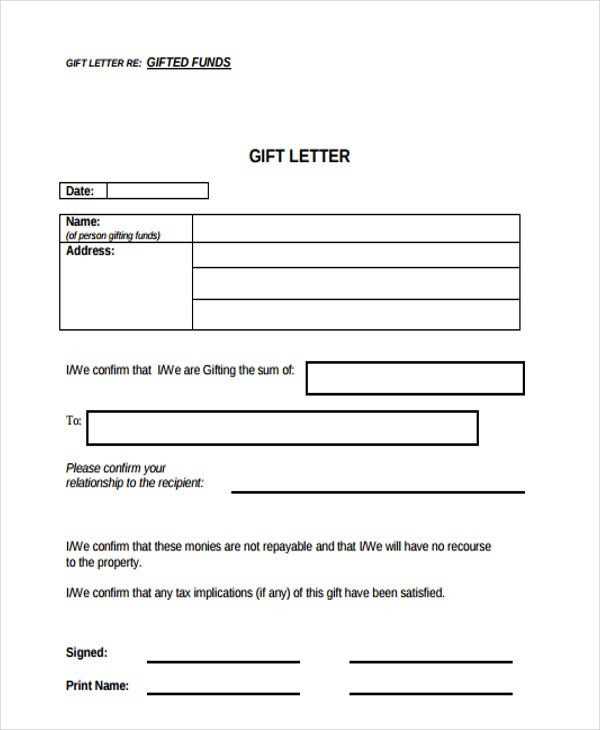

Key Elements to Include in the Letter

To ensure clarity and acceptance by financial institutions, specific details must be included in your documentation. These components provide proof of authenticity and outline the nature of the financial contribution, making the process straightforward for all parties involved.

- Names and Relationships: Clearly state the full names of both the contributor and the recipient, along with their relationship.

- Amount Provided: Specify the exact figure being contributed to avoid any confusion.

- Statement of Intent: Confirm that the funds are provided without any expectation of repayment.

- Source of Resources: Describe where the contributed amount originated to verify legitimacy.

- Date and Signature: Ensure the document includes the date it was created and signatures from all parties to validate it.

Including these elements ensures that the document meets institutional requirements and provides a comprehensive overview of the transaction.

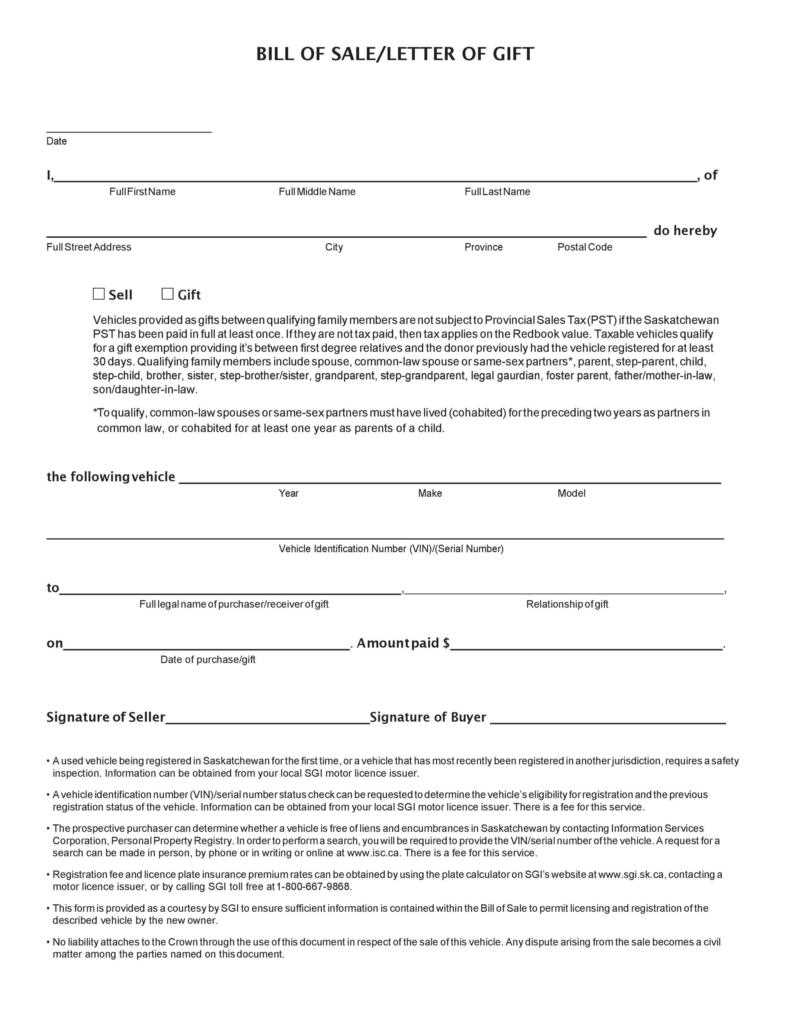

Legal Requirements and Documentation Tips

Ensuring that your financial records comply with legal standards is a critical part of the process. Properly prepared documents not only validate the authenticity of contributions but also protect all parties involved from potential disputes or misunderstandings.

Essential Legal Considerations

Understanding the specific regulations set by financial institutions or governing bodies is crucial. These often include clear identification of parties, transparency about the source of funds, and confirmation of the nature of the contribution. Non-compliance can lead to delays or rejection of your application.

Recommended Documentation Practices

To ensure your document meets all requirements, follow these guidelines for accuracy and clarity:

| Requirement | Details |

|---|---|

| Full Identification | Include full names, addresses, and contact details of both parties. |

| Non-Repayable Declaration | Explicitly state that the provided resources are not subject to repayment. |

| Verified Source | Provide documentation to confirm the origin of the funds, such as bank statements. |

| Signatures and Dates | Ensure all parties sign and date the document to validate it. |

Adhering to these guidelines ensures your documentation is complete, reliable, and legally sound.

How to Format a Gift Letter

Creating a properly structured document is essential to ensure clarity and acceptance. A well-organized layout simplifies the process for recipients and institutions, minimizing the chance of errors or misunderstandings.

Start by using a clear and professional format. The document should be concise but include all necessary details to convey the purpose and authenticity of the contribution. Each section should be easy to read and logically arranged.

Key formatting tips include:

- Use a formal tone: Write in a way that reflects professionalism and seriousness.

- Include headings: Organize the content under relevant sections for better readability.

- Maintain consistency: Use the same font and size throughout the document for a polished appearance.

- Focus on simplicity: Avoid unnecessary information or overly complex language.

By following these guidelines, your document will not only meet expectations but also leave a positive impression on those reviewing it.

Common Mistakes to Avoid

When preparing important financial documents, overlooking key details or making errors can lead to complications or delays. Understanding and avoiding these common pitfalls ensures a smoother process and prevents potential setbacks.

Providing Incomplete Information

One of the most frequent errors is failing to include all the necessary details. Missing essential elements, such as accurate names, dates, or clear descriptions, can make the document invalid. Always double-check for completeness before submission.

Unclear or Ambiguous Language

Using vague or unclear language can cause confusion for those reviewing the document. Ensure the wording is straightforward and leaves no room for misinterpretation. Be specific and direct to convey the intended message effectively.

Avoiding these mistakes helps create a reliable and professionally prepared document, reducing the risk of unnecessary complications.

Tips for Providing Proof of Funds

When submitting financial documentation, it’s important to ensure that you present clear and verifiable evidence to support the legitimacy of the resources. Proper documentation helps build trust and ensures compliance with institutional requirements.

Use Bank Statements

One of the most reliable ways to prove the origin of resources is by providing recent bank statements. These should clearly show the account holder’s name, the transaction details, and the relevant deposits to avoid confusion.

Provide Supporting Documentation

If the funds come from sources other than a bank account, such as a sale of assets or personal savings, include additional supporting documents. This may include sales agreements, asset transfer documents, or other relevant paperwork that links the funds to their original source.

By following these tips, you ensure the legitimacy of the financial resources and streamline the approval process, preventing unnecessary delays.