Duplicate payment letter template

Address any duplicate payment issues quickly and professionally by using a well-structured letter. A clear, polite, and direct approach helps resolve the situation efficiently. Include key details such as payment date, amount, and relevant transaction identifiers. A well-written template ensures both parties understand the issue and can take action without confusion.

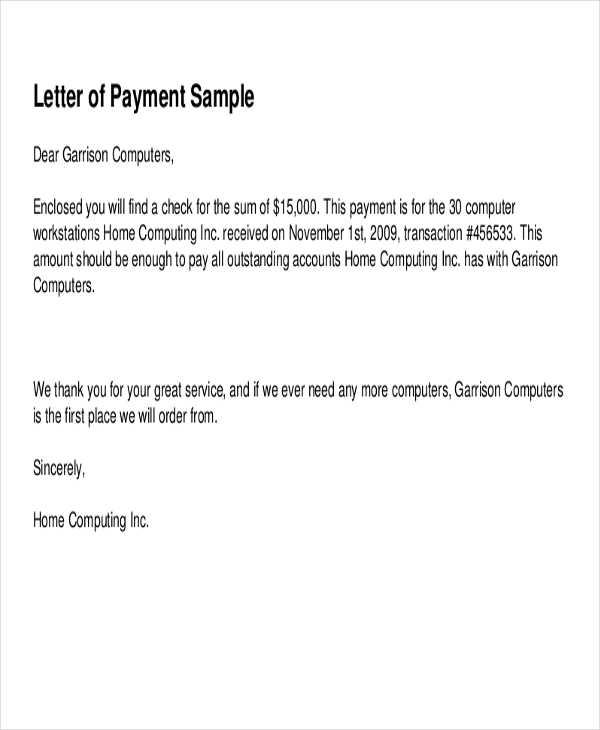

Start with a clear subject line that specifies the nature of the communication. Be sure to mention the duplicate payment upfront, providing a brief explanation of what occurred. This sets the tone and ensures the recipient immediately understands the context.

Provide the necessary payment details, such as transaction numbers, dates, and amounts. Include any supporting documents or payment confirmations that clarify the situation. This transparency helps prevent further delays and strengthens the request for a refund or correction.

Lastly, keep the tone respectful and professional, regardless of the frustration you may feel. Offer a clear next step, whether requesting a refund or providing instructions on how to resolve the issue. A concise and effective letter helps streamline the resolution process and avoids unnecessary back-and-forth.

Here’s the revised version with minimized repetition:

To address duplicate payments effectively, start by clearly stating the error. Acknowledge the payment that was mistakenly processed and outline the necessary steps for resolving the issue. Ensure all relevant transaction details are included for clarity.

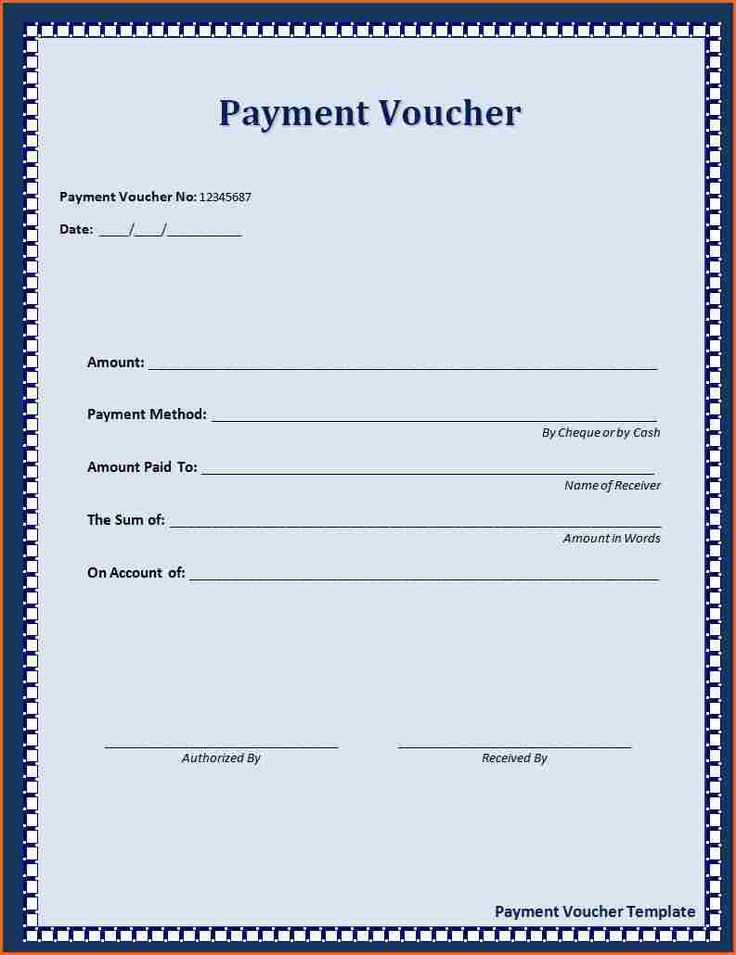

Payment Details

Clearly list the following details to avoid any ambiguity:

| Transaction ID | Date | Amount |

|---|---|---|

| 12345678 | 2025-01-15 | $200 |

| 87654321 | 2025-01-15 | $200 |

Next Steps

Explain what action will be taken to rectify the error, such as issuing a refund or credit. Confirm the expected time frame for resolution, and provide a point of contact for any follow-up questions.

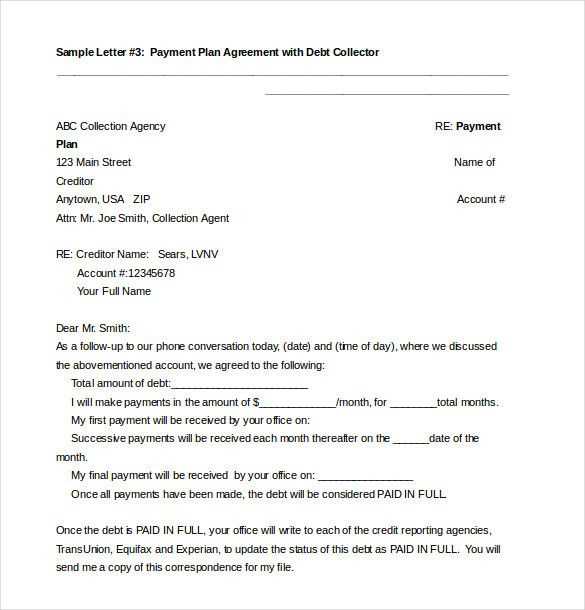

- Duplicate Payment Letter Template

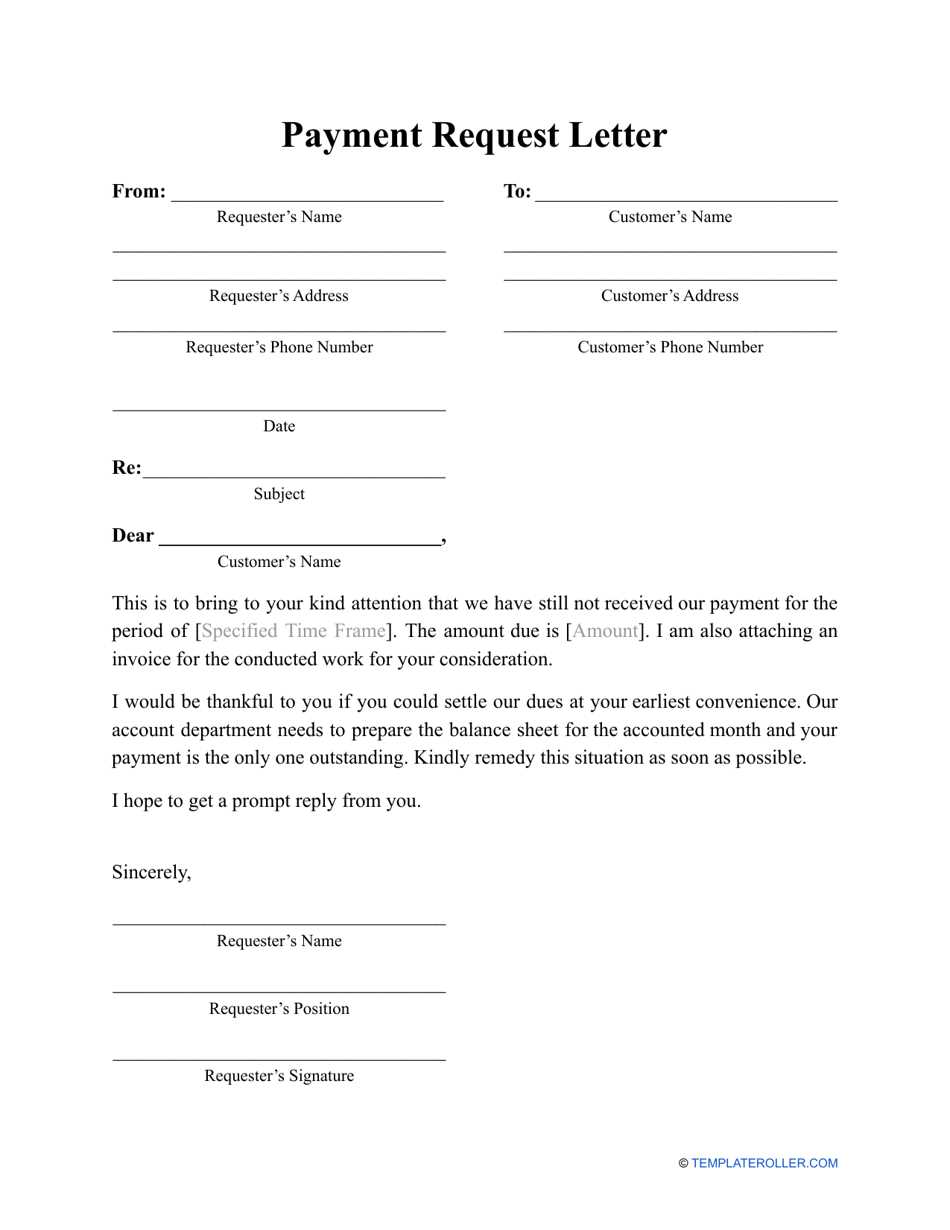

To address a duplicate payment situation, use the following points in your letter template:

- Subject Line: Clearly mention the purpose of the letter, such as “Duplicate Payment Notification” or “Notice of Duplicate Payment.”

- Recipient’s Information: Start by addressing the recipient with their correct title and name. Ensure to use the appropriate salutation like “Dear [Recipient’s Name],”.

- Clear Reference to Payment: Mention the transaction details, including the date, amount, and reference number. Make it easy for the recipient to identify the payment in question.

- Explanation of the Error: Briefly explain the situation and how the duplicate payment occurred, e.g., “It appears that an error led to the payment being processed twice.”

- Amount and Payment Method: Confirm the amount that was duplicated, and specify the payment method used. If possible, attach a copy of the payment confirmation or bank statement for reference.

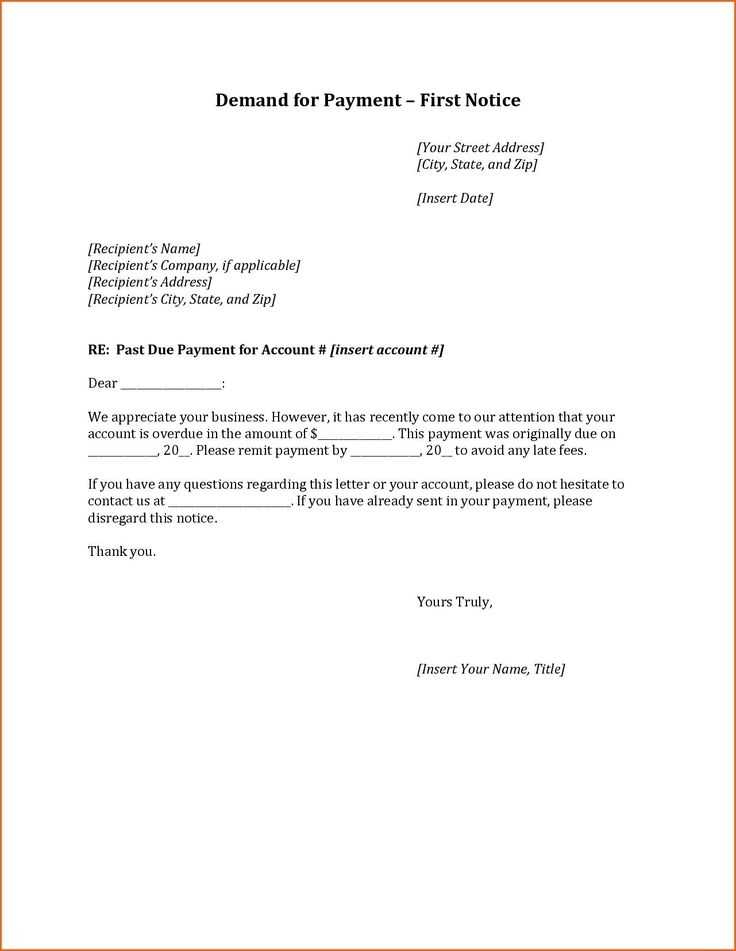

- Requested Action: Politely request a refund or adjustment. Be clear and direct about what action you are seeking, such as, “Please arrange for the reimbursement of the duplicate payment at your earliest convenience.”

- Contact Information: Provide your contact information for any follow-up questions or clarifications. This could include a phone number or email address.

- Closing: End the letter with a polite closing phrase such as “Thank you for your prompt attention to this matter” and sign with your name and position.

Make sure to review your letter for accuracy and clarity before sending it. This will help avoid any confusion and ensure a smooth resolution of the issue.

Review your transaction records regularly for duplicate entries. Start by comparing transaction amounts, dates, and vendor details. Use spreadsheet tools or accounting software to filter and highlight any identical entries. These tools often have built-in features that detect duplicates based on transaction details like invoice numbers, payment references, and amounts.

If you’re handling manual records, check for recurring payment references or similar dates. Cross-reference bank statements with your internal records to spot any repeated charges. Pay close attention to transaction numbers, as slight differences can sometimes indicate duplicates.

Keep a checklist of common payment methods and their respective patterns. Recognize common duplication scenarios like double payments for the same invoice or accidental double entries for online subscriptions. Sorting your records by amount or date will also help you spot patterns that could indicate a duplicate transaction.

Begin with clear identification of the payment in question. Include details like the transaction date, the invoice number, and the amount expected. These references help pinpoint the issue quickly.

Payment Details

List the amounts involved in the discrepancy. Mention what was paid, what should have been paid, and where the difference lies. Be direct and transparent to prevent any confusion.

Supporting Documentation

Attach any relevant evidence, such as bank statements or receipts. This validates your claim and adds clarity to your communication.

Close the letter by requesting a resolution, such as a refund, correction, or further investigation, and specify a reasonable timeframe for response. Keep your tone respectful but firm throughout the letter.

Begin by clearly identifying the payment issue. Mention the date of the payment and the amount involved. This will provide the recipient with the necessary context for understanding the discrepancy. If relevant, reference any invoice numbers or account identifiers to ensure the correct transaction is addressed.

Describe the discrepancy in detail. Specify whether the payment was short, duplicated, or missing. If applicable, mention any previous communications or actions taken to resolve the issue, such as partial refunds or corrections made by the company.

Provide supporting evidence. Attach payment receipts, bank statements, or screenshots that clearly show the payment and highlight the error. Clear documentation helps the recipient verify the issue quickly and take appropriate action.

State your expectations or request for resolution. Whether you’re seeking a refund, correction, or clarification, clearly express what you want to be done. Be concise and specific, outlining how you would like the discrepancy resolved.

Conclude by expressing your willingness to cooperate in resolving the issue promptly. Thank the recipient for their attention and indicate your availability for further communication if needed. A polite tone fosters a productive resolution process.

Address overpayments clearly and directly, without causing confusion. Acknowledge the overpayment promptly and outline the next steps. Be transparent about how the situation will be handled and ensure the client understands what will happen next.

Clarity in Communication

Explain the amount overpaid and the corresponding balance in simple terms. Offer a clear explanation of how the error occurred and how it will be rectified. Clients appreciate straightforward information, which builds trust.

Offer Quick Solutions

Provide multiple options for refunding the overpaid amount. Whether it’s a direct refund or credit towards future services, be clear about how soon they can expect a resolution. Offering options helps clients feel in control of the situation.

Maintaining a friendly yet professional tone is key to reducing any potential frustration. A well-crafted communication shows your commitment to fairness and customer satisfaction.

Contact the payment provider immediately if you notice a duplicate charge. Provide all transaction details, including order numbers and payment dates, to expedite the process. Keep a record of all communications for future reference.

Steps for Resolving Payment Issues

- Review your bank or payment statement to confirm the duplicate charge.

- Contact the merchant and provide proof of the duplicate charge with supporting details.

- If the merchant does not resolve the issue, reach out to your payment provider with all relevant documentation.

- Monitor your account for any updates or changes regarding the dispute.

Ensuring Proper Refunds

- Request a clear timeline for when the refund will be processed and ensure it aligns with company policies.

- If there is no response within the given timeframe, follow up with a polite but firm reminder.

- Confirm that the refund is processed back to the correct payment method.

Always verify the payment terms and conditions outlined in the agreement or contract before initiating any refund request. Ensure that the payment was indeed excess and not an error in invoicing or processing. Carefully document all relevant transactions, including payment dates, amounts, and any correspondence regarding the overpayment.

Ensure the request is made within the statute of limitations for refund claims, as time limits for pursuing refunds may vary depending on the jurisdiction and the nature of the transaction. Some contracts may also specify a particular timeframe for refund requests, and failure to adhere to this can result in the claim being denied.

In your communication, be clear about the excess payment amount and reference the specific transaction in question. Attach relevant supporting documents, such as receipts or payment confirmations, to strengthen your case. If possible, request that the refund be processed through the same payment method originally used to make the overpayment.

If the payment dispute involves a business entity or large organization, ensure that your refund request is addressed to the proper department or contact person. Some organizations have specific procedures for handling excess payments and refunds, and it’s essential to follow these protocols to avoid delays or complications.

In cases where the refund is not forthcoming, consider alternative dispute resolution methods, such as mediation or arbitration, as outlined in the original agreement. This can help resolve the issue without resorting to costly and time-consuming litigation.

| Action | Recommendation |

|---|---|

| Verify payment | Check the payment terms and verify that the payment was excessive. |

| Document transactions | Maintain records of the transaction, including receipts and confirmation emails. |

| Timely request | Submit refund requests within the legal or contractually stipulated time frame. |

| Attach supporting documents | Include receipts and payment confirmations when requesting a refund. |

| Follow procedures | Ensure your request follows the business’s or organization’s refund process. |

Thus, the meaning remains intact, but the words “duplicate” and “payments” appear no more than twice in each point.

To ensure clarity and avoid redundancy, follow these steps when drafting a letter for duplicate transactions:

- Start by identifying the specific invoice or transaction that has been processed multiple times. This will help you reference the exact payment in your communication.

- Next, confirm the total amount involved in the double charge and provide clear figures. This prevents confusion regarding the exact financial discrepancy.

- Address the recipient in a polite and direct manner, ensuring you explain the situation without over-explaining the mistake. Concise language will help avoid misunderstandings.

Key Points to Include:

- State the transaction number and date to provide reference.

- Outline the actions being taken to resolve the issue, such as a refund or adjustment.

These clear, straightforward details will convey the necessary information without overwhelming the recipient with unnecessary wording.