Executor Estate Letter Template for Effective Estate Management

Managing the responsibilities following someone’s passing requires clear and organized communication. One of the essential tasks is preparing a formal document that outlines key actions, duties, and expectations for all parties involved. This type of communication is critical in ensuring that all necessary steps are taken in accordance with legal requirements.

Creating a well-structured document that conveys the administrator’s responsibilities and provides guidance on managing assets is an important step. Such a document ensures transparency, minimizes confusion, and helps the involved parties understand their roles and obligations. It should cover all necessary aspects and be easily understood by anyone who may be involved in the process.

With the right approach, this form of written communication can streamline the process, avoid disputes, and ensure everything is handled in a timely manner. Knowing how to craft this document with clarity and precision can make a significant difference in the overall management of affairs.

Understanding the Administrator’s Role in Asset Management

When managing the assets and affairs of a deceased individual, one key figure takes on the responsibility of overseeing the process. This role requires not only organization and attention to detail but also a thorough understanding of the legal and financial aspects involved. The person in charge must ensure that everything is handled according to the deceased’s wishes, while also complying with applicable laws.

Key Responsibilities of the Administrator

The administrator’s duties include gathering and securing assets, paying any outstanding debts, and distributing the remaining property to the rightful beneficiaries. They must carefully follow the guidelines outlined in legal documents and ensure all actions are legally binding. Additionally, communication with beneficiaries, legal representatives, and financial institutions is crucial to keeping everyone informed and ensuring transparency throughout the process.

Legal and Financial Considerations

In addition to organizational tasks, the administrator must be well-versed in the legal implications of their actions. This includes understanding the laws surrounding inheritance, taxes, and the proper handling of personal property. Any mistakes or oversights can lead to complications or legal challenges, which is why precision and careful consideration are paramount. Proper legal guidance and attention to detail help mitigate risks and ensure a smooth process for all involved parties.

Importance of Writing a Clear Document for Asset Distribution

Effective communication is crucial when managing someone’s personal property after their passing. A well-crafted document provides a clear outline of how assets should be distributed, ensuring that all parties understand their roles and responsibilities. The clarity of this communication can help prevent misunderstandings and legal issues, streamlining the entire process.

Preventing Confusion and Disputes

One of the main reasons for creating a well-defined document is to avoid confusion among family members and other involved individuals. Clear instructions regarding how and when assets will be distributed can prevent disagreements. Detailed communication helps all parties know what to expect and when, reducing the likelihood of conflicts and legal disputes later on.

Legal Protection and Compliance

A clearly written document also serves as a legal safeguard. It ensures that the intentions of the deceased are honored and that all actions are taken within the boundaries of the law. By explicitly stating how assets are to be managed and distributed, the document provides protection to both the administrator and the beneficiaries. Properly outlining these processes minimizes the chance of legal challenges or errors that could delay the process or cause financial loss.

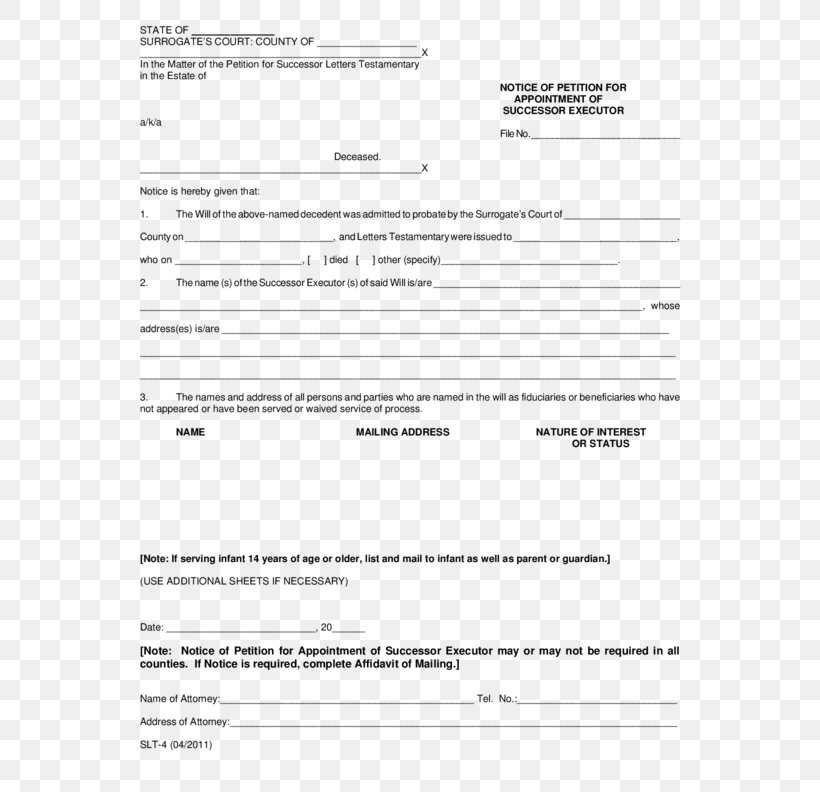

Key Elements to Include in the Document

When creating a formal document for managing a deceased person’s assets, it is essential to include specific details to ensure clarity and legality. These elements provide a structured approach that helps both the person overseeing the distribution and the beneficiaries involved. Below are the critical components that should be addressed in such a document.

- Identification of the Deceased – Include full legal names, dates of birth, and other identifying details of the deceased to avoid any confusion.

- Statement of Intentions – Clearly outline the intentions of the deceased regarding asset distribution, along with any special instructions or wishes.

- List of Assets – Provide a detailed inventory of the possessions, including real property, financial accounts, and personal belongings.

- Beneficiaries – Identify all parties who are entitled to receive portions of the estate, and clearly specify what each individual or group is to receive.

- Responsibilities of the Administrator – Define the duties and powers of the person managing the assets to ensure smooth administration of the process.

- Legal Clauses – Ensure that all necessary legal protections are in place to avoid disputes and ensure compliance with applicable laws.

By including these essential elements, the document will serve its purpose of guiding the responsible party through the process, while also providing clarity and protection for all involved. Clear, detailed communication can prevent confusion and reduce the chances of legal challenges.

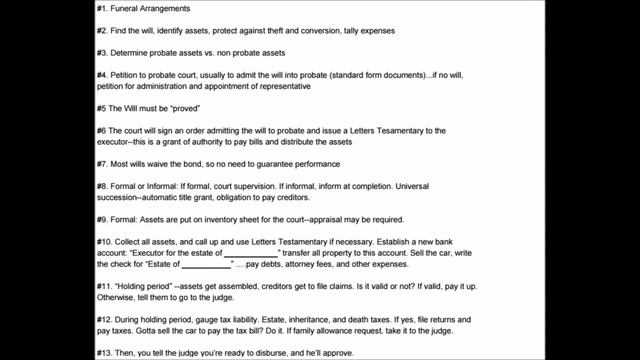

How to Structure Your Document for Asset Distribution

Creating an organized and clear document is essential when overseeing the distribution of someone’s assets. The structure of this communication plays a vital role in ensuring that all necessary information is conveyed in a logical order. A well-structured approach not only helps in making the document easy to read but also ensures that all important details are included for legal and practical purposes.

Starting with an Introduction

The first section of the document should briefly introduce the purpose of the communication. It is essential to clarify the role of the person responsible for managing the assets and provide context regarding the deceased. This will help set the tone for the rest of the document and allow the reader to understand the objectives from the outset.

Organizing the Body of the Document

The body should include a step-by-step outline of the actions to be taken, including the division of assets and any specific requests left by the deceased. Each section should be clearly marked, and the instructions should be straightforward and detailed. Important information such as beneficiary names, specific assets, and any debts should be addressed with precision to avoid confusion later.

Lastly, it is critical to conclude the document by reiterating the responsibilities of the person handling the distribution, and providing any necessary instructions for contacting legal or financial professionals if needed. By following a logical structure, the process becomes easier for all parties to navigate.

Legal Considerations for Administrators and Documents

When overseeing the management and distribution of a deceased person’s belongings, there are several legal factors that must be taken into account. These considerations ensure that the process adheres to the law and respects the wishes of the deceased. It’s important to have a clear understanding of the legal responsibilities and potential pitfalls that can arise when drafting and implementing a document to handle such affairs.

Key Legal Aspects to Consider

There are various legal requirements that must be fulfilled in order to ensure that the distribution process is done correctly. Below is a table outlining some of the main legal aspects that administrators need to be aware of:

| Legal Consideration | Description |

|---|---|

| Validity of the Document | The document must comply with local laws to be considered valid and enforceable. |

| Tax Implications | There may be taxes due on the assets being distributed, depending on local tax laws. |

| Beneficiary Rights | Ensure the rights of all beneficiaries are honored and that no one is unfairly excluded. |

| Debts and Liabilities | Any outstanding debts or liabilities must be addressed before distributing assets. |

| Legal Disputes | Proper documentation and clear communication can help prevent disputes among heirs and beneficiaries. |

Ensuring Legal Compliance

It’s essential to consult with legal professionals to ensure the document complies with all applicable laws and regulations. Legal guidance can help prevent complications that could arise from improper administration, and it provides peace of mind that everything is handled according to the law. By considering the legal implications at every stage, administrators can avoid costly mistakes and ensure a smooth transition for all parties involved.

Common Mistakes to Avoid When Writing

When drafting a document to manage someone’s assets, precision and clarity are crucial. Many individuals make errors that can lead to confusion, legal challenges, or delays in the distribution process. Understanding the common pitfalls and how to avoid them can help ensure that the process runs smoothly and that all parties are on the same page.

One of the most frequent mistakes is a lack of detail. Vague instructions or missing information about the distribution of property can create uncertainty and lead to disputes among beneficiaries. It’s essential to clearly outline the wishes of the deceased and be specific about the distribution process, including dates and amounts wherever applicable.

Another common error is not considering legal requirements. Failing to consult with legal professionals or ensure that the document complies with relevant laws can result in the invalidation of the entire process. Not understanding the legalities surrounding taxes, inheritance, and debts can create complications that delay or disrupt the proper handling of the deceased’s assets.

Additionally, leaving out key parties or failing to properly identify all beneficiaries can lead to further issues. Incomplete or incorrect beneficiary information can cause confusion and legal challenges, so it’s important to double-check all details before finalizing the document.

Finally, another mistake is a lack of proper communication. Keeping all involved parties informed is crucial. Failing to notify beneficiaries, legal representatives, or financial institutions about their roles can lead to misunderstandings or even litigation. Clear and transparent communication helps avoid these potential conflicts and ensures a smoother process.

How to Tailor the Document for Different Asset Distributions

Every individual’s situation is unique, and the process of managing and distributing assets should reflect the specific circumstances of the deceased. When drafting a formal document, it’s important to tailor it to the particular needs and complexities of each case. This ensures that the document is both relevant and effective for all parties involved.

Factors to Consider When Customizing the Document

Several factors should be taken into account when adjusting the structure and content of the document:

- Complexity of the Assets – If the assets include real estate, businesses, or unique collections, the instructions should be detailed to ensure proper handling and distribution.

- Number of Beneficiaries – For estates with multiple beneficiaries, the document should clearly outline each person’s share and any specific instructions regarding their inheritance.

- Specific Wishes – Some individuals may leave personal or sentimental requests, such as care for pets or donations to charities, which should be carefully addressed in the document.

- Legal Requirements – Different regions may have varying laws concerning inheritance and asset division. Be sure to adapt the document to meet all local regulations.

Steps for Adapting the Document to Different Circumstances

To ensure that the document is tailored appropriately, follow these steps:

- Assess the scope and nature of the assets involved, ensuring that the document includes specific instructions for each type of property.

- Identify and clearly list all beneficiaries, paying attention to any unique needs or arrangements for each one.

- Consult with legal professionals to ensure the document aligns with relevant laws and regulations.

- Provide any additional instructions, such as how debts should be settled or if there are any special conditions tied to the inheritance.

By considering these factors, you can create a more effective and relevant document that reflects the individual’s wishes and ensures a smooth distribution process.