Executor letter to beneficiaries template

Use the following template to create a letter from an executor to the beneficiaries. This document should inform the beneficiaries about the probate process and provide essential details about the estate distribution. Make sure to customize it with the specific details of the estate and beneficiaries.

Dear [Beneficiary’s Name],

As the appointed executor of the estate of [Decedent’s Full Name], I am writing to inform you about the status of the estate and your share as a beneficiary. Please be aware that the probate process is underway, and I will keep you updated as things progress. It is my responsibility to ensure that all instructions in the will are followed and that the estate is administered according to the law.

If you have any questions about the distribution or require any additional documents, do not hesitate to reach out to me. I will provide further details as soon as they are available, ensuring transparency throughout the process.

Thank you for your patience during this time. I will continue to keep you informed and address any concerns you may have.

Sincerely,

[Executor’s Full Name]

[Executor’s Contact Information]

Executor Letter to Beneficiaries Template

Begin the letter by clearly identifying yourself as the executor of the estate. Include the full name of the deceased, along with the date of their passing, and explain that you are handling the estate’s administration. Address the beneficiaries directly, providing a sense of transparency and clarity about your role.

Next, offer a brief outline of the estate’s current status. Include any immediate steps that have been completed, such as the inventory of assets, and inform them about the anticipated timeline for the next steps. This helps beneficiaries understand where things stand.

In this section, outline what each beneficiary should expect regarding their inheritance. Be specific about the distribution of assets, whether it involves real estate, financial accounts, personal items, or other assets. This ensures there is no confusion about what beneficiaries will receive.

Address any pending matters, such as tax obligations or debts that need to be settled before distributions can be made. Providing this information shows that you are diligently managing the process and helps set realistic expectations.

End the letter by offering a point of contact for questions or concerns. Include your contact details, such as phone number or email address, to ensure that beneficiaries can reach out for further clarification.

| Action | Details |

|---|---|

| Identify yourself as executor | State your role and the deceased’s name and date of death. |

| Estate status update | Summarize steps completed and what remains to be done. |

| Details on distributions | Outline what each beneficiary will receive and the distribution method. |

| Address debts and taxes | Inform about any obligations before assets can be distributed. |

| Provide contact information | Include how beneficiaries can reach you for questions. |

Understanding the Purpose of an Executor Letter

An executor letter serves as an official communication from the executor to the beneficiaries of an estate. It informs them about the responsibilities, procedures, and expectations following the death of the decedent. This letter is a vital part of the estate administration process, providing transparency and clarity to those involved.

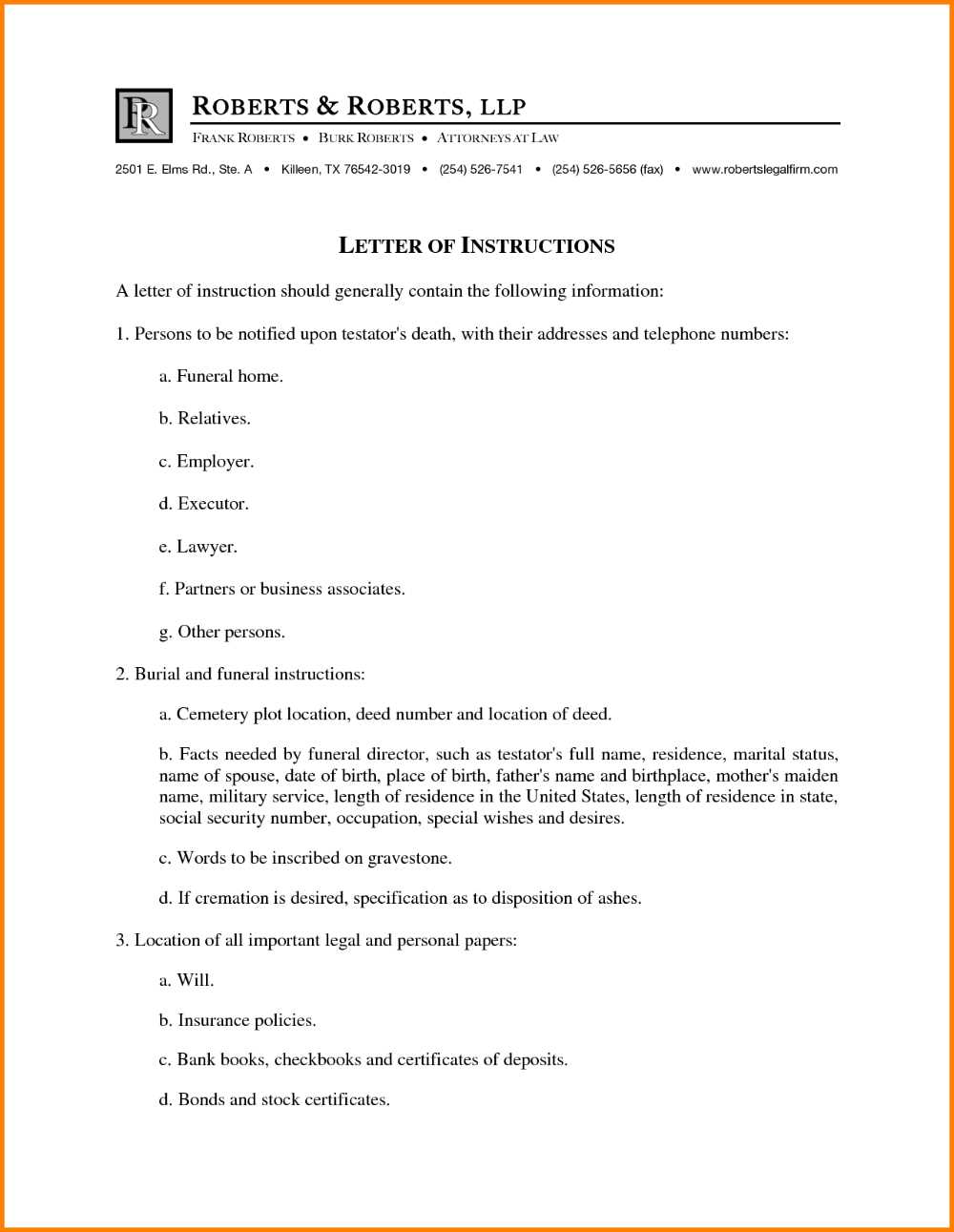

The primary function of an executor letter is to establish communication and outline the steps the executor will take. Beneficiaries often need to know what to expect, when distributions might occur, and how to address any concerns during the process. Here are the key components to include in an executor letter:

- Introduction and Executor’s Role: The letter should start by clearly identifying the executor and their duties.

- Estate Overview: It is helpful to briefly outline the status of the estate, including any initial assessments or legal requirements.

- Next Steps: Mention any key actions the executor will be taking, such as paying debts, filing taxes, or distributing assets.

- Timeline: Providing a rough estimate of when beneficiaries can expect further updates or asset distribution can manage expectations.

- Contact Information: Ensure beneficiaries know how to reach the executor for updates or questions.

The letter is also a way for the executor to remind beneficiaries of the importance of patience. Estate administration can take time, and some processes, such as asset liquidation or handling debts, may not be immediate. Keeping beneficiaries informed and involved helps to reduce confusion and ensure smoother cooperation.

For both the executor and the beneficiaries, a clear, well-written letter sets the tone for the estate administration, ensuring everyone is on the same page and understands the steps to take next.

Key Elements to Include in the Letter

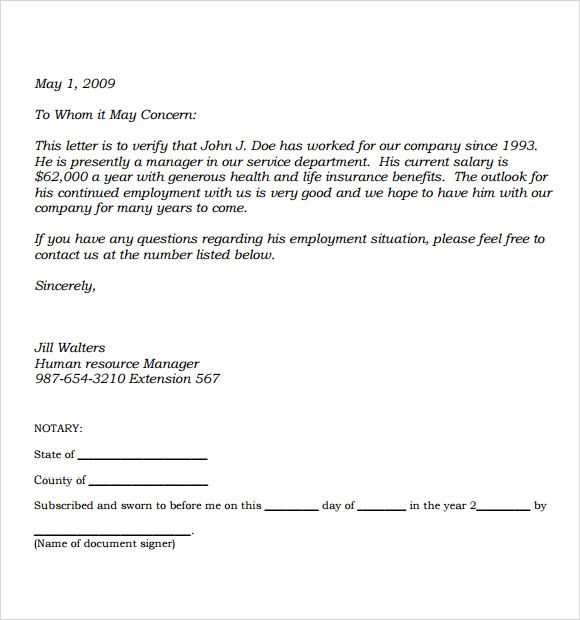

Begin with a clear introduction stating your role as the executor and your responsibility for the estate. Provide the full name of the deceased and specify your legal authority to communicate with the beneficiaries. This sets the tone and context for the letter.

List all beneficiaries by name and detail their share of the estate, ensuring accuracy. Be transparent about any changes or decisions made regarding asset distribution, and explain the reasoning behind them. If there are delays or complications in the process, mention them briefly and set expectations for timelines.

Include instructions for beneficiaries on how to claim their share, such as any forms to complete or actions they must take. If there are specific requirements for claiming assets, provide clear directions.

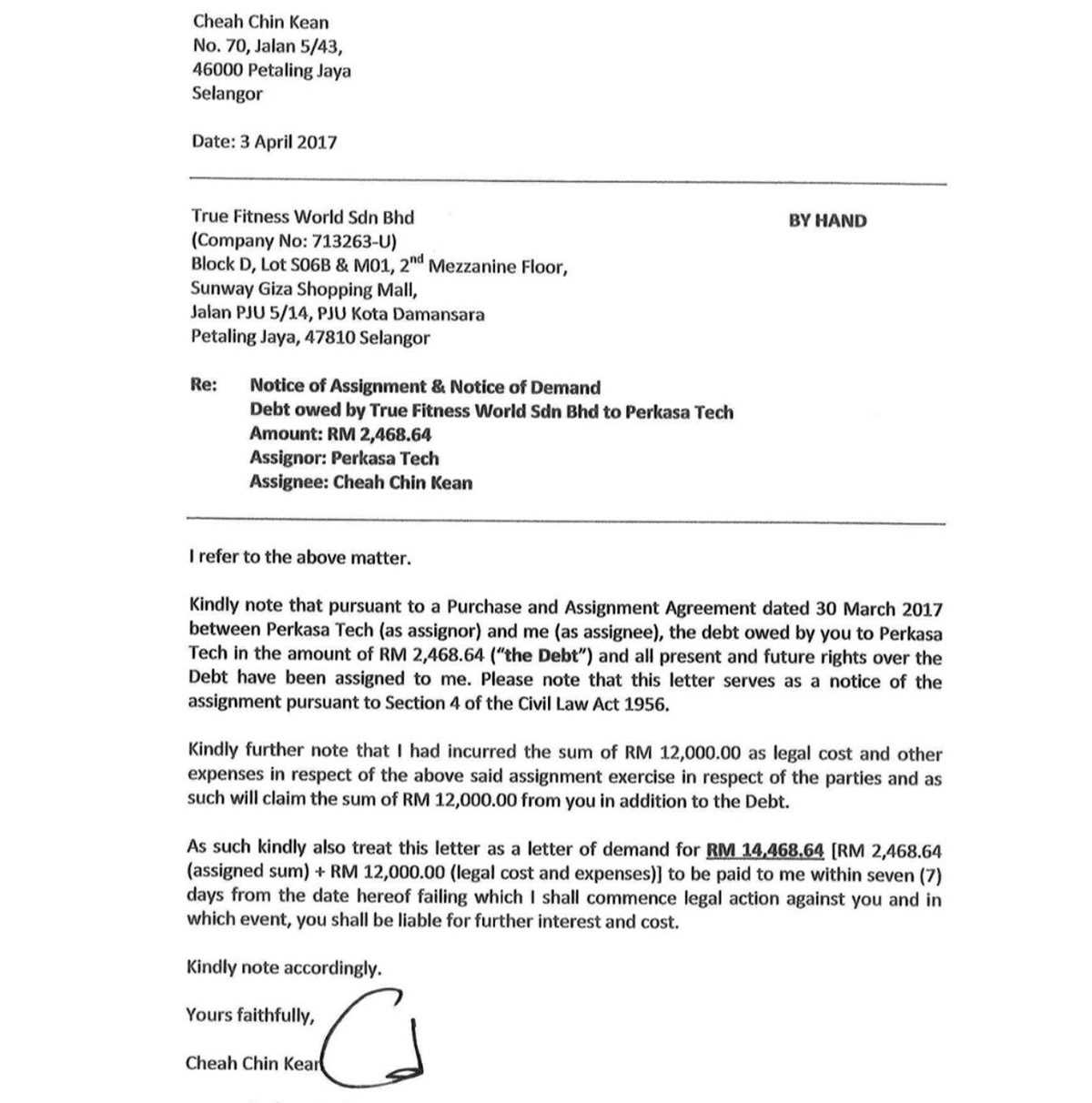

Address any tax obligations or debts associated with the estate. Outline what beneficiaries need to know about taxes, the probate process, or other financial responsibilities. Transparency about these matters prevents confusion.

Provide your contact information and encourage beneficiaries to reach out with any questions. Offer assistance or guidance for any concerns they may have regarding the estate or the letter itself.

How to Address Beneficiaries Appropriately

Use clear, respectful, and personal language when addressing beneficiaries. Begin by using their full name to establish a formal tone, especially if the relationship is not close. If you have a more familiar connection, you may opt for a more casual greeting, but always maintain professionalism. Refer to each beneficiary individually, ensuring you personalize each letter rather than addressing them collectively. This adds a thoughtful touch and ensures clarity in communication.

Address beneficiaries with titles like “Mr.” or “Ms.” unless you are aware of a preferred alternative, such as “Dr.” or “Mrs.” Pay attention to cultural differences regarding titles and forms of address. If in doubt, it is safer to lean towards a more formal tone, showing respect and recognition of their individual status.

Keep the tone warm but direct. Beneficiaries often appreciate straightforwardness, so ensure that your messages are concise and to the point. Always sign off with a polite closing such as “Sincerely” or “Best regards” followed by your name, emphasizing a respectful and formal closing to each letter.

Guidance on Distributing Estate Information

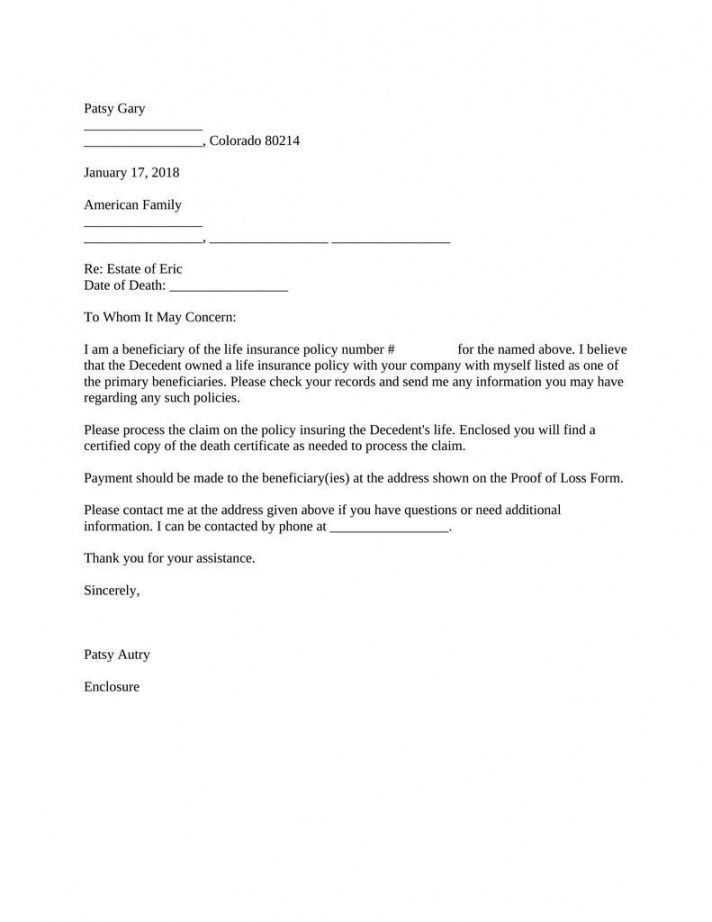

Provide beneficiaries with clear, concise details about the estate distribution process. Begin by sending them a formal letter, outlining the estate’s key assets and their respective shares. Make sure all documents related to the will and estate plan are included for transparency. If there are any delays or complexities, offer updates promptly to maintain trust.

For each beneficiary, provide specific instructions about their portion, including any financial assets, property, or sentimental items. Clarify the timing of the distribution, whether immediate or spread over a period, and explain any conditions tied to receiving their share.

Communicate openly about the responsibilities you have as the executor, especially if there are steps yet to be completed, such as tax filings or settling debts. This keeps everyone informed and ensures they understand the status of the estate.

Ensure all sensitive information is shared securely, especially when dealing with financial details. Utilize secure communication channels, such as encrypted emails or physical meetings, to safeguard privacy and avoid any miscommunication.

Lastly, encourage beneficiaries to reach out with any questions. Maintaining an open line of communication throughout the process helps manage expectations and reduces misunderstandings.

Legal Considerations and Compliance with Probate Law

Ensure the executor complies with the probate law by following the procedures set forth by the court. It is crucial to file the will with the probate court and notify all beneficiaries and creditors as required by law.

Make sure to follow these key steps:

- Submit the death certificate and will to the probate court.

- Take inventory of the deceased’s assets, including real estate, bank accounts, and personal property.

- Notify all creditors and handle any debts according to the terms of the will.

- Distribute the assets to beneficiaries as directed, ensuring each receives their rightful share.

- Complete any tax filings, including estate taxes if applicable.

It is essential to adhere to the deadlines established by probate law to avoid delays or complications. Executors may also need to obtain court approval for certain actions, such as selling property or distributing assets before the debts are fully settled.

Familiarize yourself with state-specific rules to avoid any compliance issues. Probate law varies from state to state, and understanding the local regulations will help ensure smooth administration of the estate.

Examples of Wording for Sensitive or Complex Situations

For cases where beneficiaries may feel uncomfortable or uncertain, clarity is key. Use clear language to avoid misunderstandings. For example:

“I understand that receiving this information may be difficult, but I want to ensure you are aware of the next steps and your rights as a beneficiary.”

When dealing with unexpected complications, acknowledge the situation without making promises. For example:

“There have been unforeseen delays in the process. I am actively working to resolve them and will keep you updated regularly.”

In situations where there is confusion about the distribution of assets, be transparent and explain the reasoning behind decisions. For instance:

“The estate’s assets are being divided according to the wishes outlined in the legal documents. I can help clarify any questions you may have about this process.”

If you need to address disagreements, keep the tone respectful and offer to engage in open communication:

“I understand there are differing views regarding the estate’s distribution. I am here to address your concerns and find a solution that respects everyone’s interests.”

For situations where there is a misunderstanding of legal processes, provide simple, non-legal jargon explanations:

“I know the legal procedures can seem complex. Let me break down the steps and explain how they apply to your situation.”

Always reassure beneficiaries that you are available to discuss any concerns or answer questions:

“Please don’t hesitate to reach out if you need any clarification or have further questions. I am here to support you through this process.”