Explanation letter to mortgage underwriter template

When submitting an explanation letter to a mortgage underwriter, clarity and professionalism are key. Address the specific issues raised during the review of your application with concise details. This letter should serve as a direct response, outlining any discrepancies or concerns that require clarification.

Begin by stating the purpose of the letter upfront, mentioning the loan application number or any reference number that ties your letter to the specific case. Provide a clear, straightforward explanation of the issue. For example, if there were recent changes in employment, you can explain the circumstances, including dates and relevant details, to assure the underwriter of your financial stability.

Use factual information and avoid unnecessary embellishments. Keep the tone professional but approachable. This will help the underwriter quickly understand your situation without getting lost in excessive detail. If applicable, include supporting documents like pay stubs, tax returns, or bank statements to further clarify your point.

Finally, close the letter with a brief statement reaffirming your commitment to providing any additional information or documents they may require. A polite and confident conclusion will leave a positive impression and increase your chances of approval. Be sure to proofread the letter before sending it to ensure it is clear, accurate, and free of errors.

Here are the corrected lines with minimal repetition of words:

Address the underwriter directly. Explain your situation clearly, without repeating details unnecessarily. Use concise language to convey the most important points. Ensure each paragraph serves a distinct purpose, without redundancy.

Example of a well-structured explanation letter:

The following example demonstrates how to communicate your situation effectively:

| Original Line | Corrected Line |

|---|---|

| My financial situation has changed recently, and I have faced some difficulties in paying my bills. | I’ve encountered financial challenges recently that impacted my ability to pay bills on time. |

| I am looking to resolve this issue and work out a plan with my creditors. | I am actively working on resolving this matter and negotiating with creditors. |

| I have spoken to my creditors about this situation, and they are aware of the problem. | My creditors are aware of the situation and we are in discussions to find a solution. |

Key tips for an effective explanation letter:

1. Use clear, straightforward language. Avoid repeating points in different ways.

2. Focus on the key aspects of your situation.

3. If mentioning actions you’ve taken, specify them without restating unnecessary details.

4. Make sure each paragraph adds new information, avoiding redundancy.

- Explanation Letter to Mortgage Underwriter Template

An explanation letter to a mortgage underwriter provides clarity about issues or discrepancies that may arise during the underwriting process. It’s vital to be concise, clear, and direct while addressing any concerns the underwriter may have. Below is a practical template you can use for your letter.

Template for Explanation Letter

- Your Contact Information

Include your full name, address, phone number, and email address at the top of the letter.

- Date

Provide the date the letter is being sent.

- Underwriter’s Contact Information

Include the underwriter’s name, title, and the lending institution’s name and address.

- Subject Line

Clearly state the purpose of the letter, such as: “Explanation Regarding Discrepancy in Employment History” or “Clarification of Recent Bank Deposit”.

Letter Body

- Salutation

Address the underwriter with a polite greeting, such as “Dear [Underwriter’s Name],”.

- Introduction

Briefly introduce yourself and explain the purpose of the letter. For example: “I am writing to provide clarification regarding the recent inquiry about my financial history.”

- Explanation of the Issue

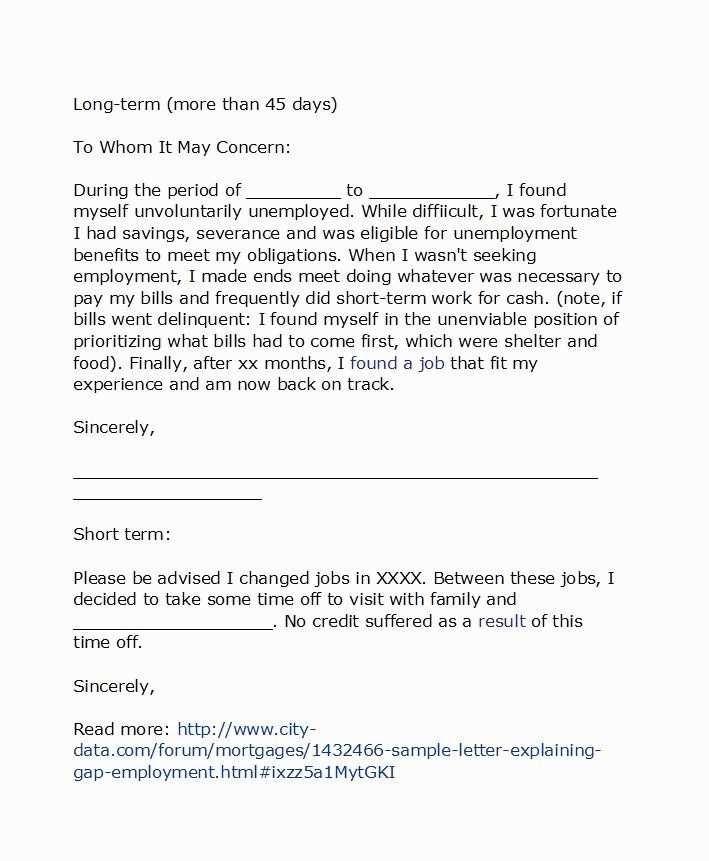

Clearly and directly explain the issue the underwriter has flagged. Be honest and transparent. For example: “The inconsistency in my employment history arises from a gap between my previous job and current position, which was due to personal reasons.”

- Supporting Information

If applicable, provide additional documents or details that support your explanation, such as pay stubs, bank statements, or medical records.

- Conclusion

Reaffirm your commitment to the process and express your willingness to provide further information if needed. For example: “I hope this clarifies the situation. Please let me know if any further details are required.”

- Sign-Off

Close with a polite sign-off, such as “Sincerely” or “Best regards,” followed by your full name.

This template will help ensure that you address the underwriter’s concerns in a professional, clear, and structured manner. Be sure to tailor the letter to fit the specifics of your situation.

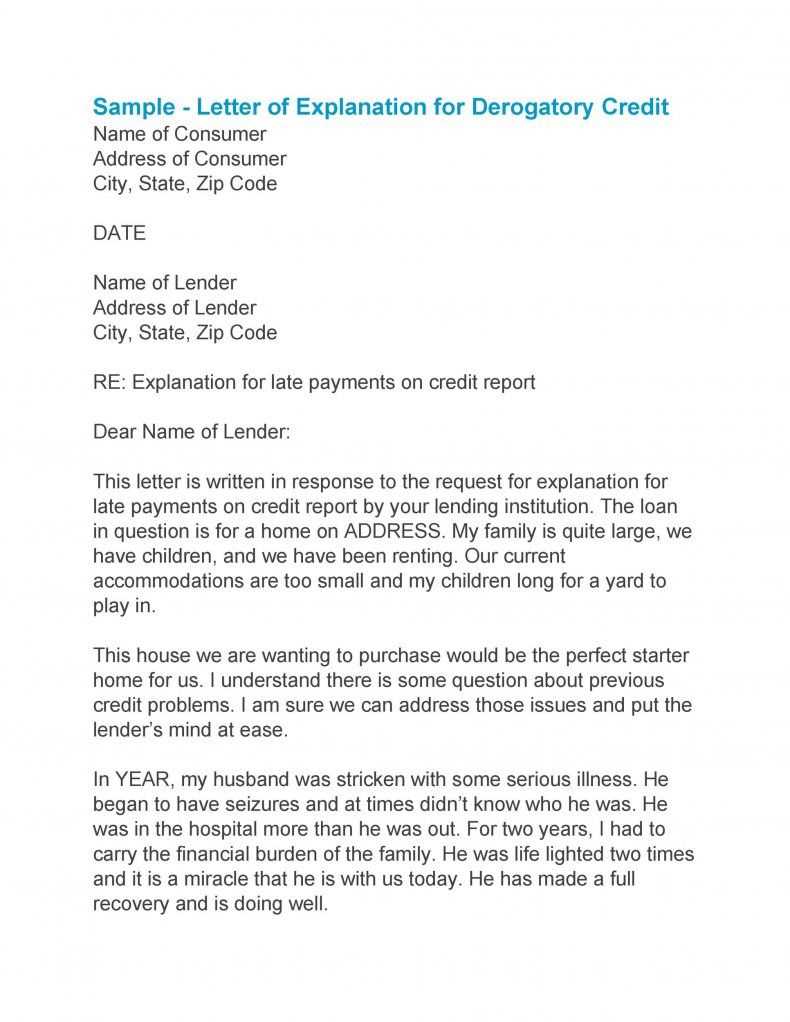

The mortgage underwriter evaluates the risk of lending to a borrower by reviewing their financial background, credit history, and the property’s value. They assess whether the borrower meets the lender’s criteria for loan approval based on various factors like income, debt-to-income ratio, and employment stability. If any discrepancies arise in the application or supporting documents, the underwriter requests further clarification from the borrower to ensure all information is accurate and complete.

The underwriter uses specific guidelines to make decisions, and their role is to determine if the loan is a sound financial risk for the lender. A detailed explanation letter from the borrower can assist in clearing up any uncertainties or issues found during the review process. Clear, concise, and honest communication is key to ensuring a smoother approval process.

If a loan is denied, the underwriter provides a reason based on their findings. It’s important to address these concerns promptly with a well-structured letter, explaining any issues that may have caused the denial. By directly addressing any potential red flags, you can demonstrate your commitment to fulfilling the requirements of the loan.

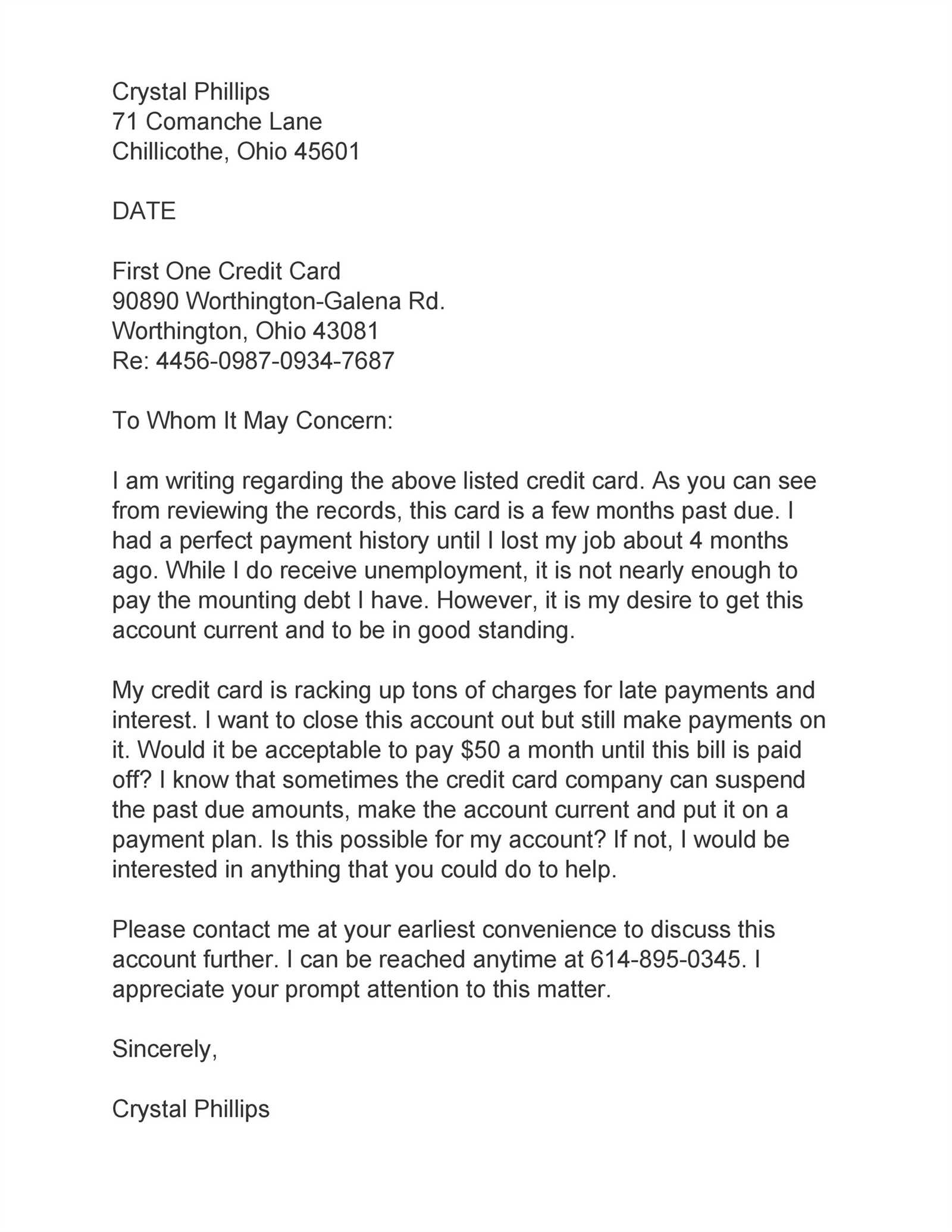

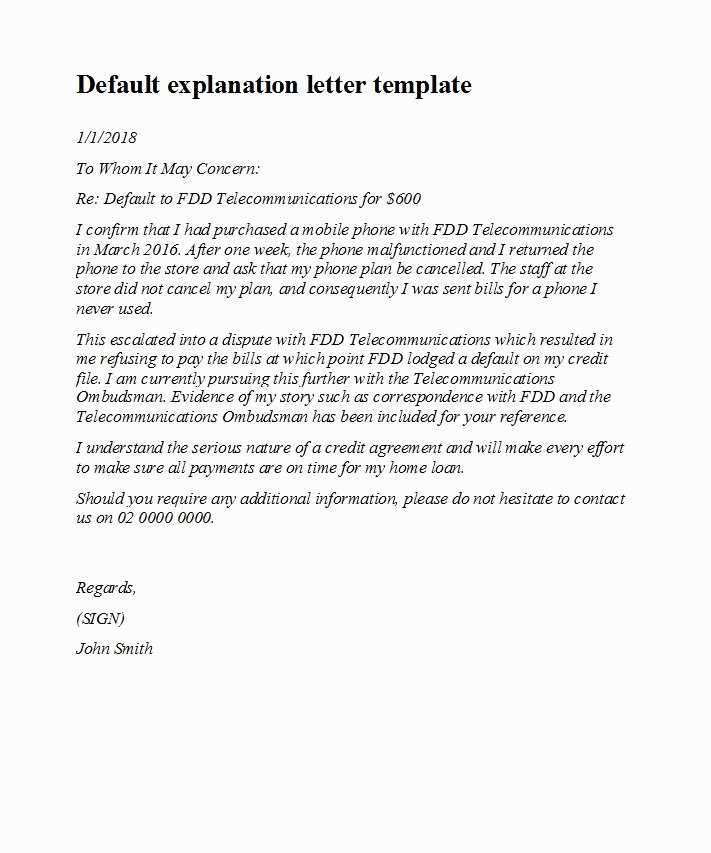

Be clear and concise when outlining the reason for the mortgage issue. Start with a direct explanation of the event or circumstance that led to the issue, whether it’s a credit score drop, missed payments, or employment gap. Clearly state the dates and specific events to show the timeline and avoid any ambiguity.

Provide Supporting Documentation

Attach any relevant documents that can support your explanation. This could include medical bills, job termination notices, or proof of unemployment benefits. The goal is to show the underwriter that the situation was temporary and has been resolved or is actively being managed.

Outline Steps Taken to Improve Financial Situation

Demonstrate how you’ve taken steps to fix the issue and prevent it from happening again. Whether it’s setting up a payment plan, securing a new job, or building an emergency fund, highlighting your proactive approach shows responsibility and reliability.

Be transparent and direct when explaining any financial issues. Begin by clearly identifying the issue, whether it’s a temporary setback, past debt, or a decrease in income. Include specific dates or events that affected your finances, such as job loss, medical emergencies, or unexpected expenses. Avoid ambiguity and provide facts that support your situation.

Provide Context and Solutions

Instead of merely stating the problem, offer a solution or show how you’ve taken steps to improve your financial situation. For instance, if you had a temporary drop in income, mention the new job you secured or any steps you’ve taken to stabilize your finances. This shows the underwriter that the situation has been addressed and won’t impact your ability to repay the mortgage.

Clarify Any Outstanding Debts

If applicable, list any outstanding debts and explain the measures you’re taking to manage or reduce them. This can include payment plans, debt consolidation, or other financial adjustments. Be honest about your financial situation but also highlight the positive steps you’ve taken to ensure your finances are under control.

Stay concise and clear in your writing. Focus on the facts and present them logically. Avoid unnecessary details that do not directly address the issue or question. Keeping it brief ensures your explanation is easy to follow and impactful.

Be Direct, Yet Polite

Use a straightforward approach without sounding accusatory or defensive. Stick to the point and maintain a neutral tone. This helps avoid any potential misinterpretation while conveying respect for the underwriter’s role.

Use Formal Language and Avoid Slang

Opt for professional language and avoid casual expressions. This maintains a level of professionalism and shows that you take the process seriously. Using correct grammar and punctuation also contributes to a polished presentation.

Stay clear of vague or overly general statements. Instead, provide specific details that address the underwriter’s concerns. Avoid using phrases like “I was going through a difficult time,” which do not explain the situation in a concrete way. Offer a clear, factual account of the circumstances with dates, events, or documentation where possible.

1. Being Too Brief

Keep your explanation letter concise but thorough. Do not omit key details. Underwriters rely on the information you provide to make their decision. Failing to elaborate on the situation or leaving out important facts can raise more questions than answers.

2. Providing Incomplete or Misleading Information

Be honest and transparent. Avoid exaggerating or misrepresenting the situation. Misleading information can harm your credibility and hurt your chances of approval. If you don’t know the full details, it’s better to acknowledge that rather than guess or assume.

Finally, ensure your letter is free of spelling and grammatical errors. A well-written letter shows professionalism and care, which can positively influence the underwriter’s perception of your application.

Use clear, concise language to enhance readability. Focus on presenting information in a logical, easy-to-follow order. Avoid cluttering the letter with unnecessary details and stick to the key points that address the underwriter’s concerns directly.

1. Use Short Paragraphs

Keep paragraphs short and focused on a single idea. This prevents the letter from feeling overwhelming and makes it easier for the reader to digest each point.

2. Organize Information with Bullet Points

- Present facts or details in bullet points for better clarity.

- Bullet points highlight key points and make them stand out to the reader.

- Use them for listing income sources, financial obligations, or important dates.

3. Break Complex Ideas into Sections

- Divide your letter into clear sections, each addressing a specific issue, such as income verification or debt explanation.

- Use headings or subheadings to signal each section’s purpose, making it easier to follow.

4. Be Concise and Direct

Use simple sentences and avoid excessive details. Stick to the necessary facts that directly relate to your financial situation. Keep the tone professional but approachable.

5. Use Clear and Consistent Formatting

- Choose a professional, readable font such as Arial or Times New Roman.

- Use appropriate spacing and margins to give the letter room to breathe.

- Keep the font size between 10 and 12 points for easy readability.

These formatting guidelines ensure that the underwriter can easily find the relevant information without feeling overwhelmed. A well-organized letter makes your case more compelling and helps speed up the review process.

Now repetition of words is minimized, maintaining accuracy and meaning.

To create a clear and concise explanation letter to a mortgage underwriter, avoid using redundant phrases. Focus on providing specific details about your financial situation without restating the same point in different ways. Each section should present new information, keeping the reader engaged and making it easy to understand your position. This approach ensures that the underwriter can review your case efficiently without being overwhelmed by unnecessary repetition.

Structure your letter logically

Begin with a brief introduction that outlines the purpose of your letter. Provide the necessary context, such as the reason for the letter, without repeating previous details found in your application. In the body, address any specific concerns raised by the underwriter and respond to each one clearly and directly. Always ensure your statements are factual and supported by relevant documents. Finish with a closing that reinforces your commitment to resolving any issues, but avoid rephrasing your previous points.

Focus on clarity and precision

Use simple language and direct explanations to convey your situation. Each sentence should add value by providing useful information or clarification, not by restating the obvious. When explaining complex details, break them down into smaller parts. This will help the underwriter to follow your reasoning without feeling overwhelmed by redundant information.