How to Identify and Avoid Fake IRS Letter Templates

Receiving an unexpected notice from the tax authorities can be concerning, but it’s important to remain cautious. Many of these documents are designed to deceive and trick individuals into providing personal information or making payments. Recognizing a fraudulent notification requires understanding how these scams work and being aware of common tactics used by criminals.

Common Signs of Deceptive Tax Documents

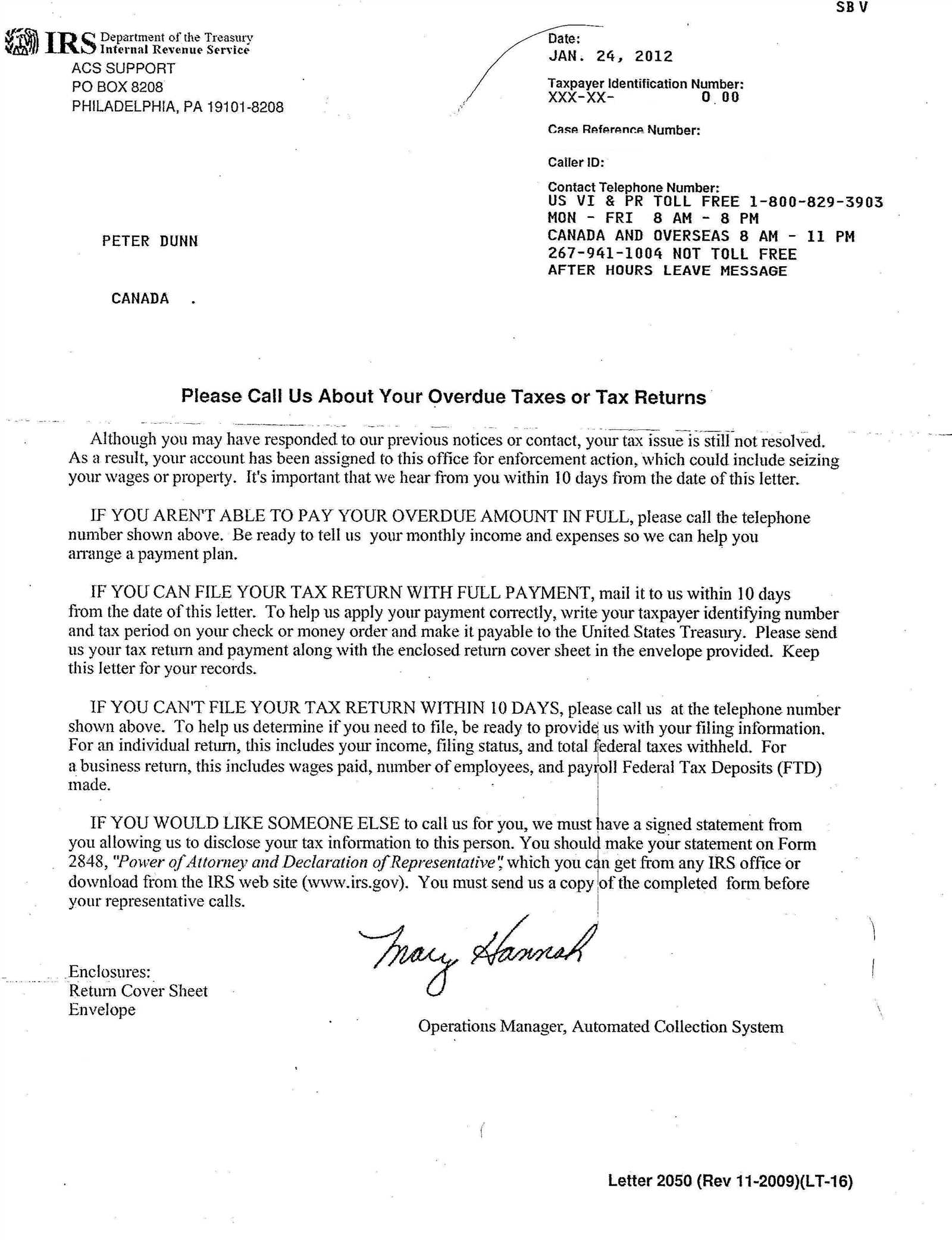

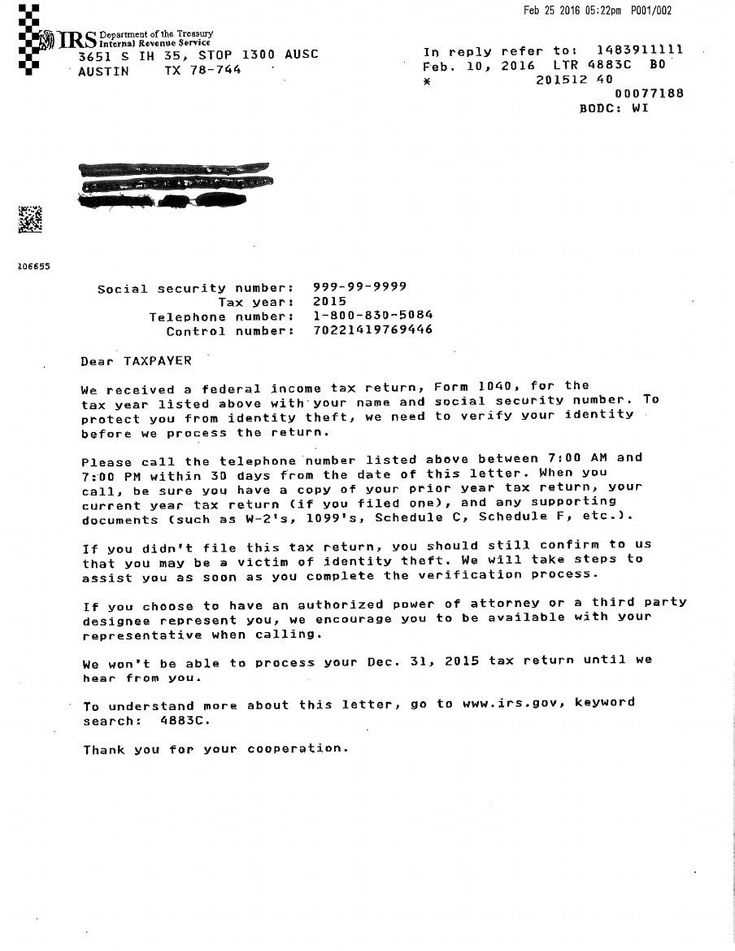

Fraudulent messages often include several telltale signs that can help you distinguish them from genuine correspondence. Below are some common features:

- Urgent language: Scammers often create a sense of urgency to force quick action. Phrases like “immediate payment required” or “failure to respond will result in legal consequences” are red flags.

- Unfamiliar contact methods: Tax agencies will never initiate communication via email, text message, or social media. Official notices typically come through mail.

- Errors in details: Mistakes in the letter, such as incorrect names, addresses, or reference numbers, indicate that the document is not legitimate.

How to Verify the Authenticity

If you receive a suspicious communication, the best approach is to directly contact the tax authorities using official channels. Here’s what you can do:

- Look up the official phone number or website of the tax agency.

- Do not use any contact details provided in the document you received.

- Ask for confirmation about the legitimacy of the message and if any action is required from you.

What to Do if You’re a Victim

If you have already responded to a fraudulent communication, it’s crucial to act quickly. Take the following steps:

- Report the incident: Inform the tax authorities about the scam as soon as possible.

- Monitor your accounts: Watch for any suspicious activity on your bank accounts or credit cards.

- Change passwords: If you’ve provided any login details, change your passwords to protect your personal information.

Protecting Yourself from Deceptive Messages

Prevention is key to avoiding falling for scams. Always be skeptical of unexpected communications and use caution when providing personal information online or over the phone. By staying informed and alert, you can significantly reduce your chances of being tricked.

Recognizing Deceptive Tax Communications

It’s essential to be aware of fraudulent notices that aim to mislead individuals into divulging personal information or making unnecessary payments. These scams often mimic official communications, making it difficult to differentiate them from legitimate documents. By understanding common traits and following certain verification steps, you can protect yourself from falling victim to such schemes.

How to Spot Fraudulent Tax Notices

Fraudulent messages are designed to evoke a quick response, often through misleading language or urgent demands. Common signs include:

- Suspicious tone: Fraudulent documents often use threatening language or claim immediate consequences, such as legal action or severe penalties, if no action is taken.

- Inaccurate or generic details: Legitimate correspondence will have accurate personal details, while fake notices may include errors like incorrect names or reference numbers.

- Unusual contact methods: Fraudulent communications might come through unsolicited emails, text messages, or phone calls. Official organizations use formal channels such as registered mail.

Steps to Confirm the Authenticity

If you suspect a message might be fraudulent, the first step is to verify its legitimacy. Follow these actions:

- Contact the relevant authorities using official contact details from their website, not from the suspicious message itself.

- Do not respond to the message, and do not share any personal or financial information.

- Request confirmation of whether any outstanding issues or payments exist under your name.

What Fraudsters Want from Misleading Documents

Scammers are looking to obtain sensitive information that can be used for identity theft, unauthorized access to accounts, or fraudulent financial transactions. Personal identifiers such as Social Security numbers, bank account details, and credit card numbers are frequently targeted in these schemes.

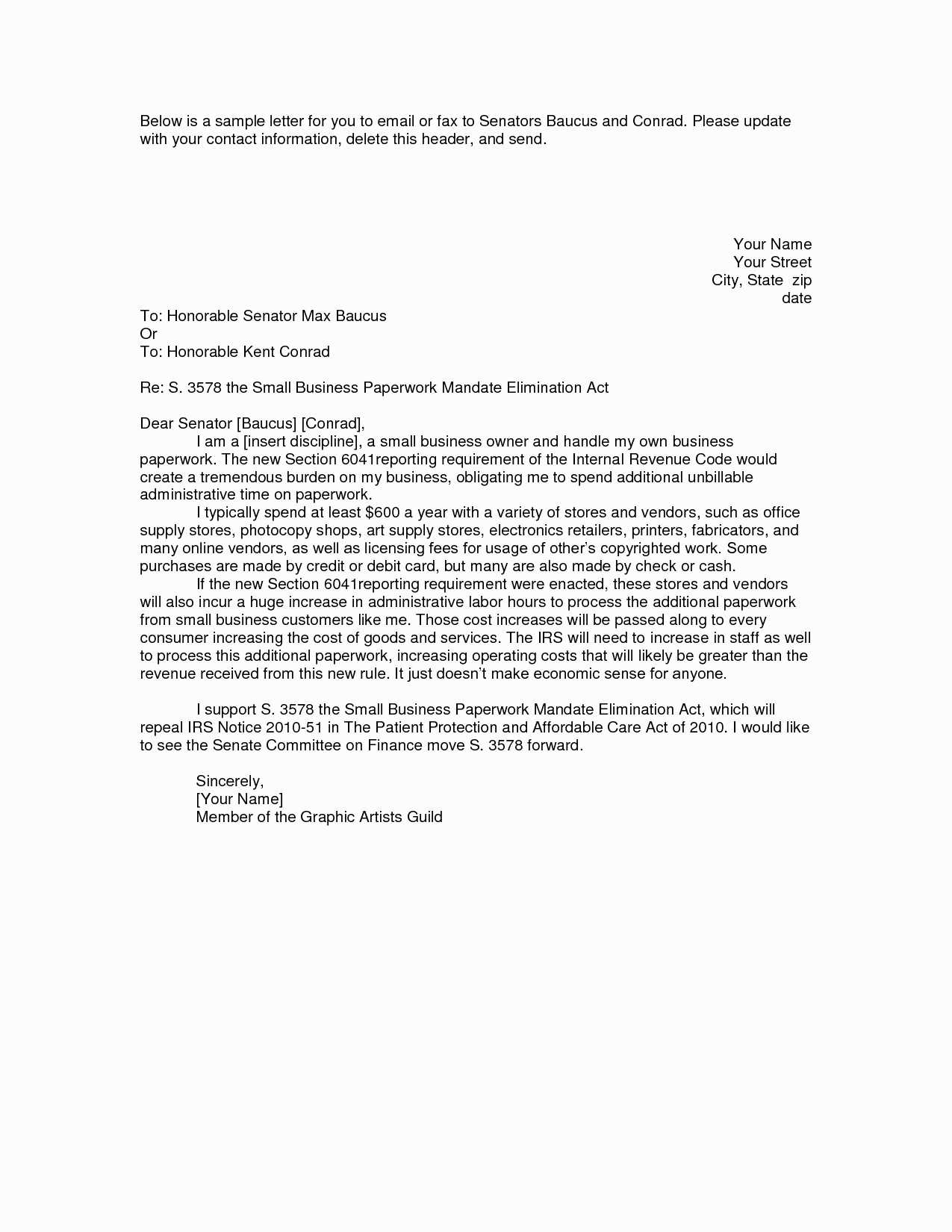

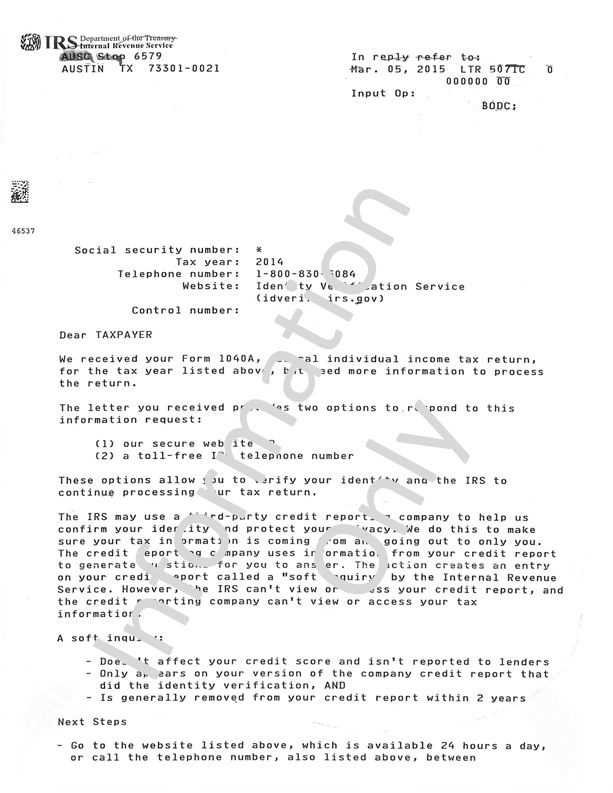

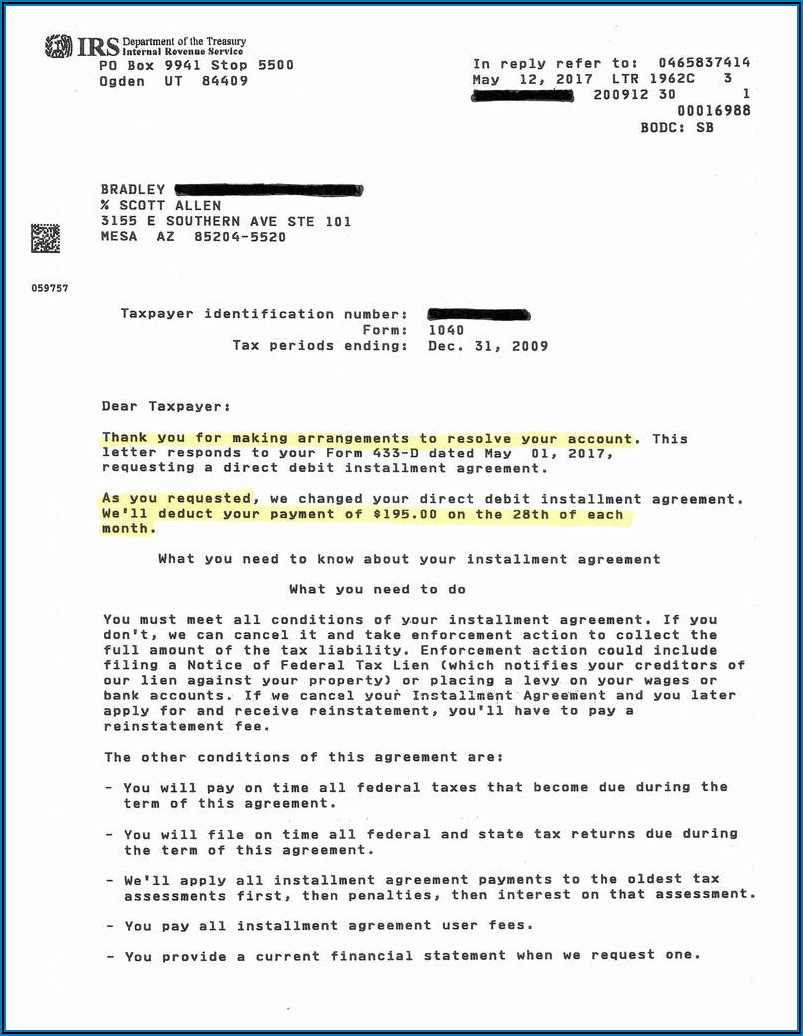

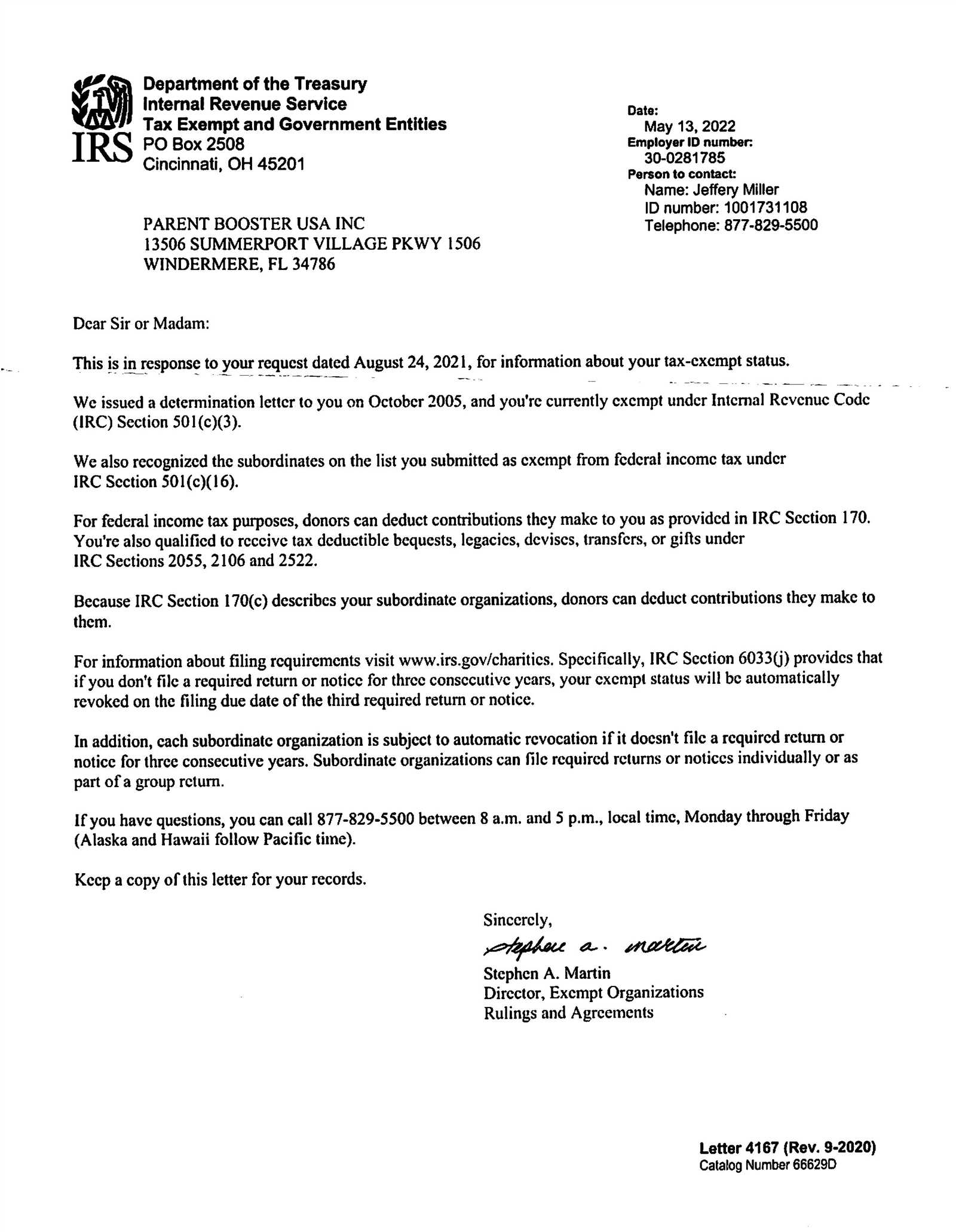

Distinguishing Real from Deceptive Tax Documents

Real tax communications follow a formal format, include detailed information about the recipient, and are issued through reliable postal services. Fraudulent documents often lack these elements, and may show inconsistencies, unusual formatting, or improper grammar.

Risks of Falling for Tax Scams

Falling for deceptive tax messages can lead to significant financial loss, identity theft, and unauthorized withdrawals from your accounts. In some cases, scammers may gain access to private records, causing long-term damage to your credit and reputation.

How to Safeguard Yourself from Fraud

The best defense against fraud is vigilance. Regularly monitor your financial accounts, never share sensitive information over unsecured channels, and educate yourself about common scams. Being proactive will reduce the risk of becoming a victim of these deceptive tactics.