Family Member Gift Letter Template for Easy Use

When providing financial support or assets to a loved one, it’s important to create a formal document that clarifies the nature of the transaction. This ensures both parties understand the terms and avoids confusion down the line. Such a declaration typically includes key details about the transfer and confirms that no repayment is expected. It’s a practical way to protect both the giver and the receiver in case of future questions from institutions or tax authorities.

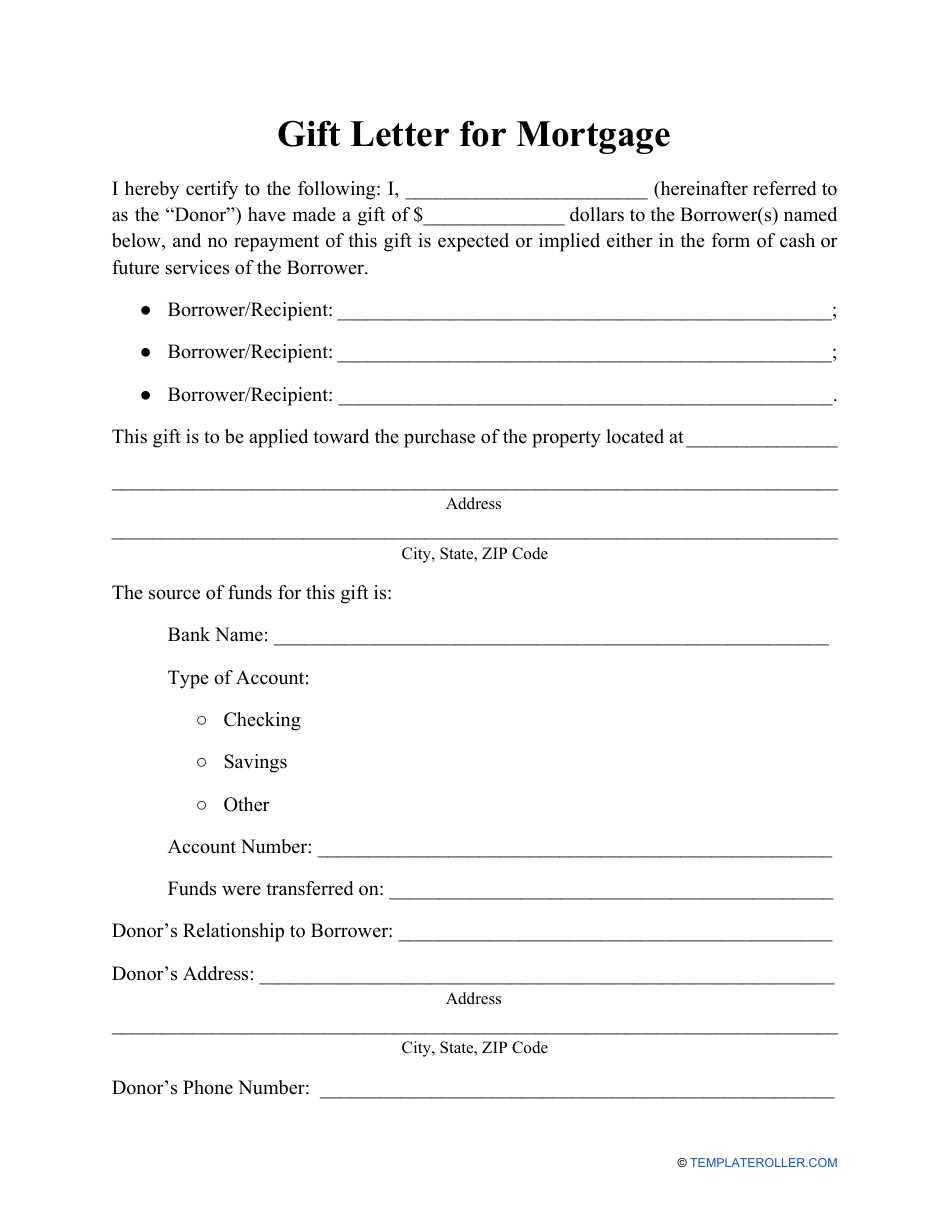

Key Elements to Include in Your Document

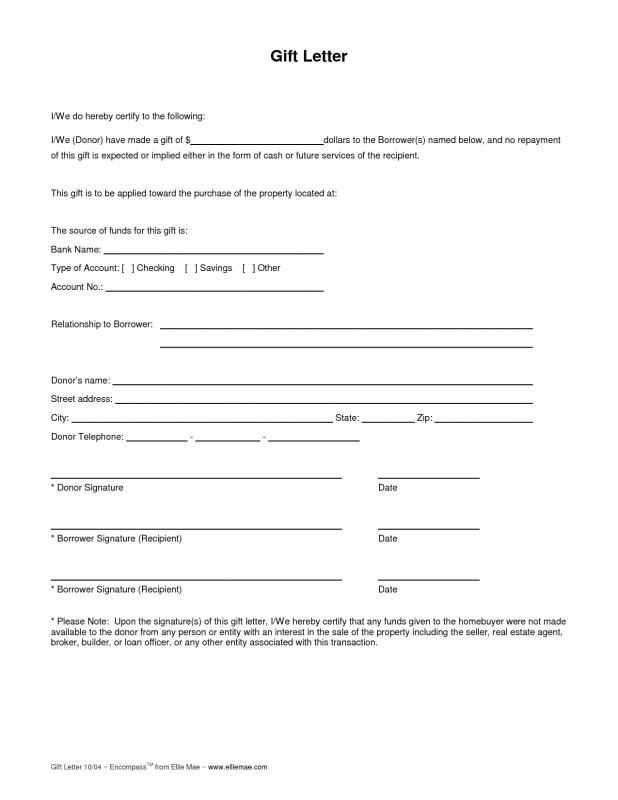

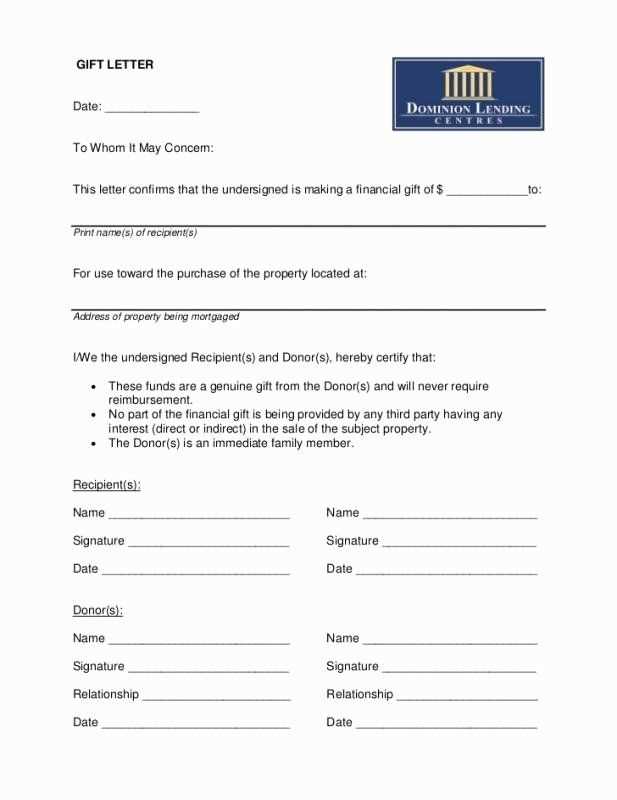

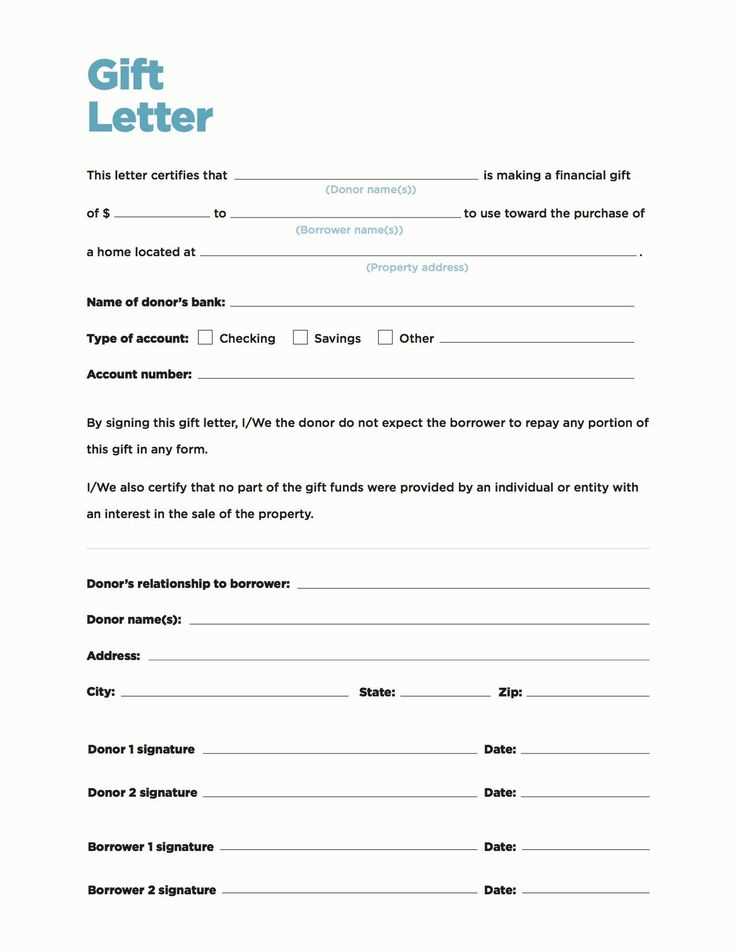

A well-crafted statement should cover several important points to ensure clarity and transparency. Be sure to include the following:

- The names of both parties involved in the transaction

- The amount or value being transferred, along with any relevant details

- A clear declaration that the transfer is a gift, not a loan

- The date of the transaction to avoid any potential confusion

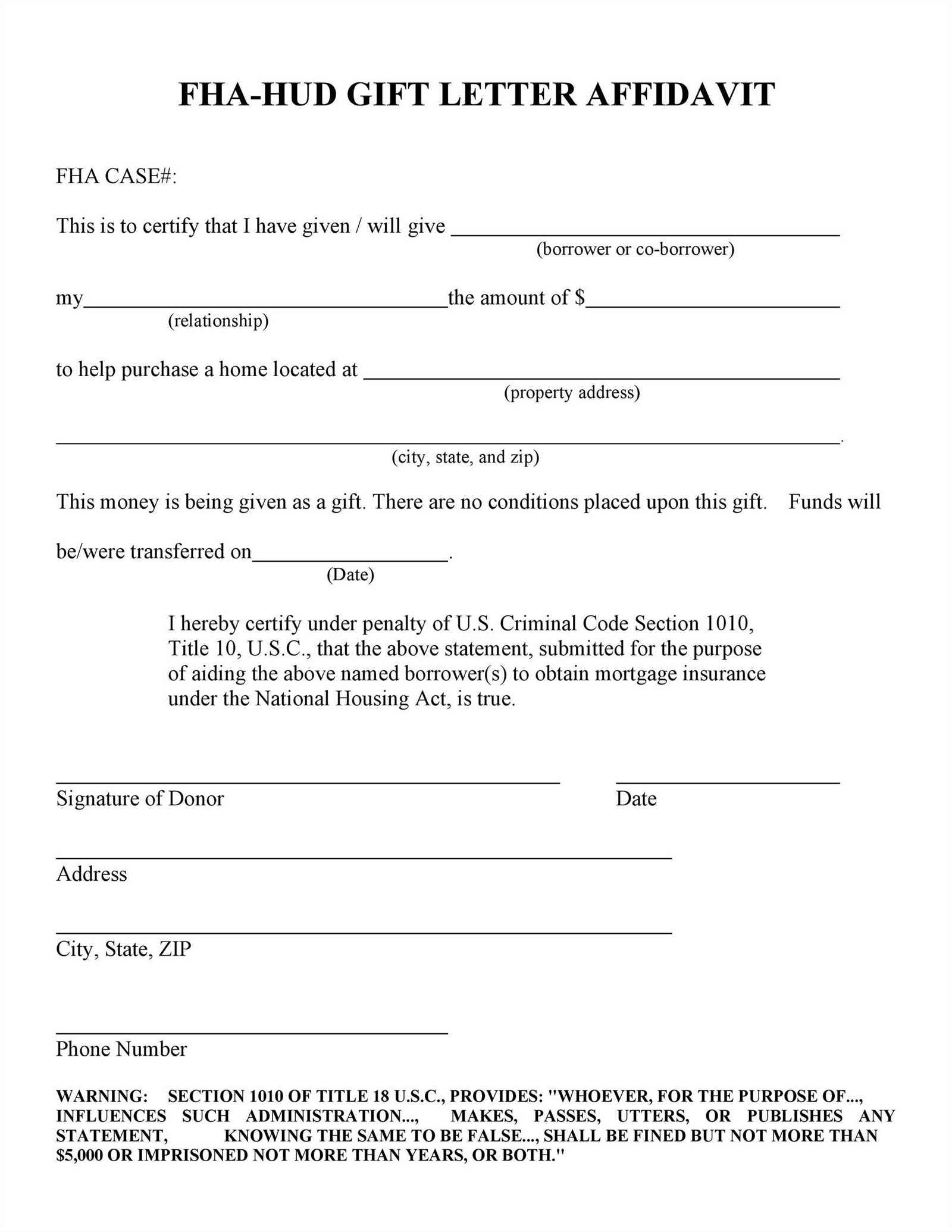

Creating a Clear Declaration

The most important part of the statement is ensuring that it is explicitly stated that the transfer is a gift, and not a loan or repayment for a service. This section should confirm that the funds or assets being given are not expected to be returned under any circumstances. Without this clear wording, there could be future disputes or misunderstandings.

Why Keep It Simple?

Don’t complicate things unnecessarily. The simpler and more direct the language, the less likely it is that something will be misinterpreted later. Avoid using overly complex legal terms, unless required by specific regulations. Stick to straightforward phrasing that both parties can easily understand.

Practical Examples and Uses

These kinds of documents are typically used when transferring money, property, or other valuable assets to close relatives. They can be necessary for avoiding tax complications or for clarifying a financial arrangement when dealing with inheritance or other legal matters. Whether you’re assisting a sibling, parent, or another relative, drafting this document will help ensure that both sides are protected.

Tax Considerations

While the primary purpose of this document is to clarify the nature of the transaction, it can also serve as a safeguard when it comes to tax implications. Be aware that depending on the amount being transferred, certain thresholds may apply that could require reporting to tax authorities. Always check the current guidelines to ensure compliance.

Why a Written Statement is Necessary

When transferring assets or funds to a loved one, documenting the transaction ensures clarity for both parties. A formalized declaration helps prevent future misunderstandings, ensuring that both the giver and the receiver are on the same page regarding the nature of the transfer. This can also protect both parties in case of inquiries from financial institutions or government agencies.

How to Create an Effective Statement

Writing an effective document is straightforward, as long as the key points are clearly outlined. Begin by stating the amount or value being transferred, the identities of the individuals involved, and most importantly, the fact that it is a one-time transaction with no expectations of repayment. Avoid any confusing language that might leave room for ambiguity. Keep it brief, formal, and to the point.

Key Information for a Valid Transaction

For the document to be valid and legally sound, it must include specific details such as: the names of both parties, the precise amount or value of the assets, the date of the transaction, and a clear statement that no repayment is required. These elements are critical for avoiding disputes and ensuring that the transfer is recognized appropriately in any future legal or financial matters.

Common Mistakes to Avoid in Statements

Many individuals overlook some of the essential components when drafting such a document, which can lead to issues down the line. For instance, not including the date of the transaction, using vague language, or failing to explicitly state that no repayment is expected can cause confusion. Ensure the language is simple and clear to avoid misinterpretations.

Sample Document for Asset Transfers

A sample document for such transfers typically includes the key elements mentioned: the names, the amount being transferred, the date, and a statement confirming that it is not a loan. It’s important to follow a template that is clear and concise while ensuring all necessary information is included to make the transaction straightforward and legitimate.

Tax Considerations for Asset Transfers

It’s essential to be aware of the potential tax implications when transferring significant sums of money or valuable assets. Depending on the jurisdiction and the amount, taxes may apply, and a written document serves as a useful record for tax reporting purposes. Always check with a tax professional to ensure the transfer complies with current regulations.