FCRA Law Letter Template for Compliance and Protection

Consumers have the right to accurate information when it comes to their financial history. Inaccuracies can lead to significant issues, including denial of credit or higher interest rates. It is crucial to know how to address these discrepancies effectively to ensure your rights are protected and that your credit history remains trustworthy.

One way to address errors in your credit records is by formally requesting corrections or providing necessary clarifications. These formal communications serve as a way to challenge incorrect data and initiate a review process. Ensuring that such requests are properly structured and legally sound is essential for a smooth resolution.

Crafting a precise and legally compliant communication can help prevent delays and facilitate quicker fixes. Understanding the key elements of such a request will empower you to take control of your credit information and avoid unnecessary setbacks.

Understanding the FCRA Law

The regulation that governs the accuracy and privacy of personal financial information plays a vital role in protecting consumers. It ensures that credit reporting agencies handle data responsibly and give individuals the right to dispute incorrect entries. This framework is essential for maintaining fairness in the credit evaluation process.

Consumers have the right to request corrections when they identify errors in their credit history. The framework sets clear guidelines on how these issues should be addressed by the agencies, ensuring that people can challenge discrepancies in a structured and effective manner. It’s a fundamental tool in safeguarding personal financial integrity.

Furthermore, the regulation outlines the responsibilities of financial institutions and credit bureaus, requiring them to provide accurate and timely updates. These measures protect individuals from potential harm caused by outdated or incorrect information that could affect their financial opportunities.

Importance of Accurate Credit Reporting

Accurate financial records are crucial for both individuals and financial institutions. The integrity of personal credit histories directly affects one’s ability to secure loans, mortgages, or even employment. Discrepancies in credit reports can lead to unfair disadvantages, making it essential to maintain precise and updated information.

Impact of Errors on Financial Opportunities

When inaccuracies appear in credit records, they can result in negative consequences. These errors may include incorrect debt information, outdated statuses, or even fraudulent activities that can lower an individual’s score and limit opportunities. Some common outcomes of inaccurate reporting include:

- Denial of credit applications

- Higher interest rates for loans

- Difficulty in renting property or securing a job

Ensuring Accuracy Through Regular Monitoring

Regularly reviewing credit reports helps individuals spot any potential issues early. Keeping track of updates allows consumers to address discrepancies quickly, minimizing the impact of incorrect data. Establishing a habit of monitoring one’s credit status ensures that any inaccuracies are dealt with before they cause significant harm.

When to Use an FCRA Letter

There are specific instances when it becomes necessary to formally challenge the accuracy of your financial information. These occasions often arise when you notice discrepancies in your credit record or when there is a need to clarify certain entries that could negatively impact your financial standing. Knowing when to initiate such a request is essential to resolving these issues promptly and effectively.

Identifying Inaccuracies in Your Credit Report

If you spot incorrect information, such as outdated debts, mistaken accounts, or data that doesn’t belong to you, it’s time to take action. A formal request helps initiate the correction process, ensuring that credit agencies investigate and address these discrepancies. This can prevent unnecessary damage to your credit score and allow for timely updates to your financial history.

Dealing with Identity Theft or Fraud

In cases where you suspect fraudulent activity, such as accounts opened in your name without consent, immediate formal communication is required. Reporting these issues quickly helps protect your financial security and limits the extent of any damage. A well-structured formal request will ensure that the situation is properly investigated and rectified.

Key Components of an Effective Template

When addressing issues with your financial records, having a well-structured communication is crucial. The right format ensures that the request is clear, concise, and legally effective. Including the necessary elements in your message will help facilitate a quicker response from the credit reporting agency and improve the chances of resolving the issue accurately.

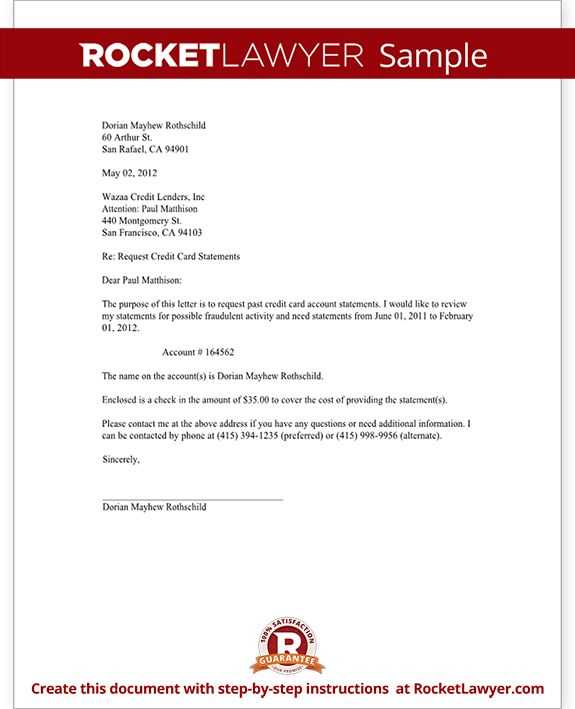

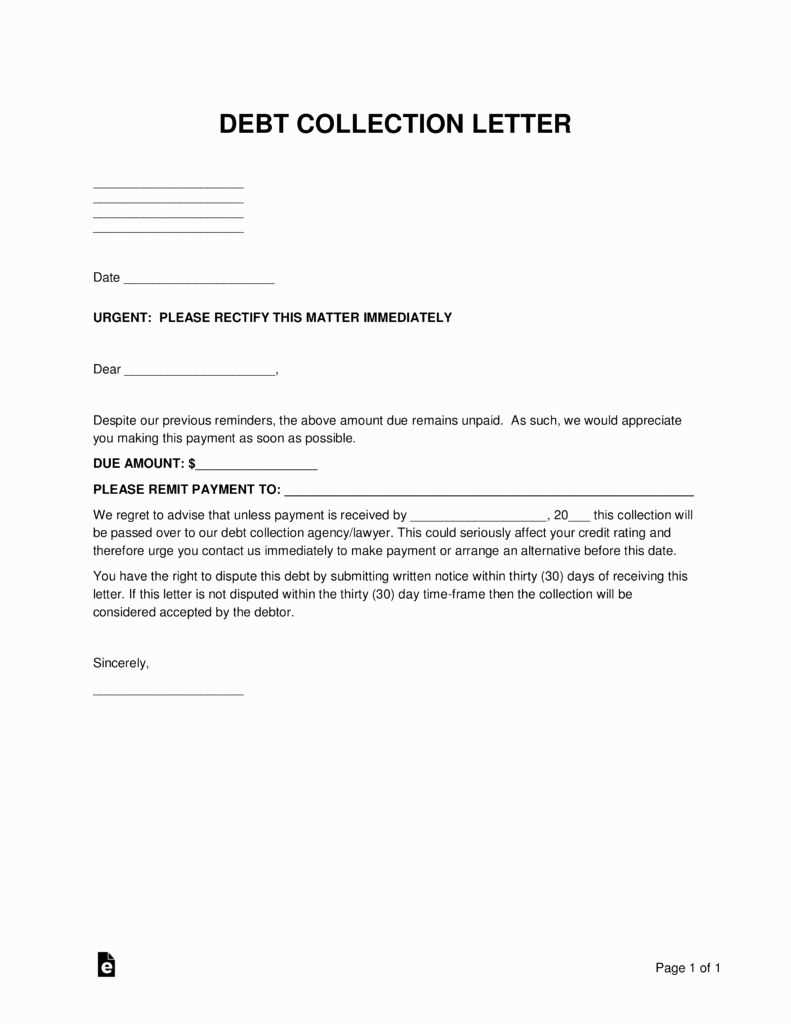

The communication should begin with a formal introduction that includes your personal information, such as your full name, address, and any relevant account details. This helps the recipient identify you and your records quickly. Additionally, outlining the specific error or issue in your financial history should be clear and detailed, with references to the exact data that needs correction.

Another important component is a request for the desired outcome, whether that is correcting incorrect information or investigating a fraudulent activity. Providing supporting evidence, such as documentation or proof of the error, will strengthen your case and help the recipient process the request efficiently. Lastly, a polite yet firm tone, along with a clear deadline for response, ensures that your communication is taken seriously and addressed promptly.

How to Customize Your FCRA Letter

To effectively address discrepancies in your credit record, it is essential to personalize your request to suit the specific issue at hand. A one-size-fits-all approach often lacks the necessary details to ensure a swift resolution. Customizing your communication to include precise information will help speed up the process and improve the likelihood of a favorable outcome.

Include Relevant Personal Information

Start by adding your full name, address, and any associated account numbers or details. This ensures that the credit bureau or financial institution can easily locate your records. Providing this information helps establish your identity and clarifies which records need attention.

Clearly State the Issue and Desired Outcome

Next, outline the exact error or problem in your financial information. Whether it’s a wrong balance, outdated account status, or fraudulent activity, being specific will help the recipient understand your request. Also, mention the action you would like them to take–whether it’s correcting an error or conducting an investigation–so there is no confusion about the resolution you expect.

Ensuring Legal Compliance with Your Letter

When addressing financial discrepancies or reporting issues, it is crucial to ensure that your communication adheres to the necessary legal standards. A well-crafted request not only increases the likelihood of a favorable response but also protects your rights throughout the process. Ensuring compliance with the applicable rules guarantees that your actions are legally sound and respected by the institutions involved.

Follow Proper Format and Guidelines

To ensure that your communication is legally valid, it is important to follow a clear structure and adhere to the prescribed guidelines. This includes using formal language, including all required details, and following any specific instructions from the credit reporting agency or institution. A well-structured request can help avoid delays and prevent the rejection of your case due to non-compliance.

Provide Supporting Evidence and References

Back up your claims with the appropriate documentation. Attach any proof that supports your case, such as account statements, contracts, or official correspondence. This strengthens your position and ensures that your request is taken seriously. Additionally, referencing specific sections of relevant regulations, if applicable, can further demonstrate that you understand your rights and the obligations of the institution.