Fha gift letter template

When applying for an FHA loan, a gift letter is a crucial document if someone is providing you with financial assistance for your down payment. The letter serves as proof that the money is a gift and not a loan, which is important to avoid any complications with the loan process. Ensure your gift letter includes specific details to meet FHA requirements.

The gift letter should clearly state the donor’s name, address, and relationship to you. It must also confirm that the gift is indeed a gift, not a loan, and specify the exact amount of money being given. Additionally, the donor should mention that no repayment is expected. To make the process smoother, include the donor’s contact information and any other relevant details, such as the date the gift was provided.

Using the right format will streamline your FHA application. Be sure to keep the letter simple, straightforward, and signed by the donor. You can also include proof of the gift, such as bank statements or wire transfer receipts, to further verify the transaction. Providing a properly formatted and clear gift letter will help prevent any delays in your loan approval.

Here’s the revised version of the text with repetitions reduced:

Start by confirming the gift amount and its source in the letter. Specify that the funds are a gift and not a loan, ensuring there’s no expectation of repayment. Provide the relationship between the donor and recipient, as this helps the lender verify eligibility for the FHA loan. Include the donor’s contact information, such as address and phone number, to facilitate any follow-up if needed. Clearly state the date of the gift transfer, and make sure the letter is signed by the donor to confirm its authenticity.

Key Points for the Gift Letter

Ensure the donor includes a statement that they are not expecting repayment of the funds. The letter should also include the full name and address of both the donor and recipient to meet FHA requirements. Donors may need to provide proof of their ability to give the gift, such as account statements or evidence of funds. The letter should be concise, direct, and accurate to avoid delays in the mortgage process.

- FHA Gift Letter Template

An FHA gift letter is a formal document used to confirm that a financial gift was given to a borrower for the purpose of purchasing a home. This letter helps to ensure that the funds are not considered a loan, which could affect the borrower’s ability to qualify for an FHA loan. Below is a straightforward template for creating an FHA gift letter.

FHA Gift Letter Template

[Donor’s Name]

[Donor’s Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Recipient’s Name]

[Recipient’s Address]

[City, State, Zip Code]

Dear [Recipient’s Name],

I, [Donor’s Name], confirm that I am gifting the amount of $[Amount] to [Recipient’s Name], for the purpose of assisting with the purchase of a home located at [Property Address]. This gift is made voluntarily and does not require repayment, either in part or in full.

The funds are not a loan, and no repayment is expected. This gift is provided without any expectation of services, goods, or future benefits in exchange. I understand that this letter will be used as part of the mortgage application process for the recipient’s FHA loan.

If you require any additional information, please feel free to contact me at [Donor’s Phone Number] or [Donor’s Email Address].

Sincerely,

[Donor’s Signature]

[Donor’s Printed Name]

Key Details to Include

Amount of Gift: Specify the exact dollar amount being gifted.

Relationship: Clarify the relationship between the donor and recipient (e.g., parent, relative, friend).

Gift’s Nature: Clearly state that the gift is not a loan and does not require repayment.

Purpose: Indicate that the funds are for the specific purpose of purchasing a home.

This template helps you write a clear and accurate FHA gift letter that aligns with lender requirements and facilitates a smooth home loan process.

Begin by including the donor’s full name, address, and contact information at the top of the letter. Clearly state that the gift is not a loan and does not require repayment. Specify the exact amount of the gift and the date it was given. Mention the relationship between the donor and the recipient, whether it’s family, close friend, etc.

Provide Details About the Gift

Include the donor’s statement confirming the funds are a gift, not a loan, and will not be expected to be repaid. Make sure the donor also affirms that they are financially able to make the gift and that it will not affect the recipient’s mortgage qualifications.

Include Documentation of the Transfer

Attach proof of the transfer, such as a bank statement or wire transfer confirmation, showing the exact amount given. This step ensures transparency and meets the lender’s requirements for gift documentation.

Ensure the gift letter clearly identifies the donor and recipient. Include full names, addresses, and relationships. Mention the exact amount of the gift and specify that it is a gift, not a loan. State there is no expectation of repayment. Add the date the gift was given and any additional context if necessary.

Specify the source of the funds, confirming they are the donor’s personal funds. If the donor is a relative, include their relationship to the recipient. If the gift is substantial, the donor should also confirm they are aware of the impact on the recipient’s ability to meet mortgage obligations.

Lastly, include a statement from the donor confirming they have no claim on the property or the proceeds from its sale. This provides the lender with reassurance that the gift is unconditional and will not affect the transaction.

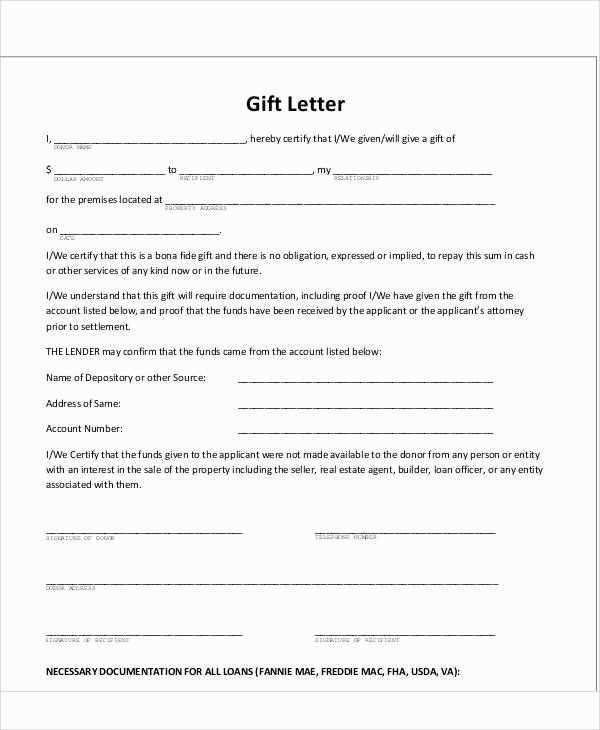

Donors must provide accurate and clear information in the gift letter. Ensure the letter states the relationship between the donor and recipient, the exact amount being gifted, and confirm that the gift is non-repayable. This avoids confusion and ensures compliance with FHA guidelines. Avoid including language that may imply the money is a loan.

Key Details to Include

| Information | Explanation |

|---|---|

| Donor’s Name | Include full name of the donor for identification. |

| Recipient’s Name | Clearly state the name of the person receiving the gift. |

| Gift Amount | State the exact amount of the gift in dollars. |

| Gift Relationship | Explain how the donor and recipient are related (e.g., parent, grandparent, etc.). |

| Statement of Non-Repayment | Clarify that the gift is not a loan and does not require repayment. |

Why Clarity Matters

Donors should ensure the letter avoids ambiguity. The FHA will scrutinize the terms of the gift to ensure it does not create debt obligations for the borrower. A well-written letter protects both parties and helps streamline the mortgage process.

FHA gift letters are crucial for securing a mortgage, but errors in these letters can lead to delays or even denial of the loan. Here are the most common mistakes to watch out for:

1. Missing Donor Information

Ensure that the donor’s full name, address, and relationship to the borrower are clearly stated. FHA guidelines require these details to verify the source of the gift and its legitimacy.

2. No Clear Statement of Gift Intent

The letter must explicitly state that the money is a gift, not a loan. Any ambiguity regarding repayment can cause the lender to question the authenticity of the gift.

3. Inadequate Documentation

Failure to include supporting documents like bank statements or a copy of the check can lead to complications. Always include these to verify the transfer of funds.

4. Missing Donor’s Signature

The gift letter must be signed by the donor. Without this, the letter will be considered incomplete and may result in delays.

5. Incorrect Date on the Gift Letter

FHA guidelines require that the date on the letter matches the date of the gift transfer. Make sure both the letter and any related documents reflect the same date.

6. Failure to Specify Gift Amount

Clearly state the exact amount being gifted. Vague wording, like “a large sum,” will not meet FHA requirements and can lead to confusion.

7. Not Including a Statement About Gift Funds Not Coming from an Ineligible Source

The letter should also specify that the gift funds are not sourced from a restricted party, such as a seller or a third party involved in the transaction.

8. Overcomplicating the Letter

The gift letter should be simple and direct. Avoid adding unnecessary details that could cause confusion or raise questions with the lender.

To prove the legitimacy of a gift in FHA applications, the donor and recipient must provide specific documentation. The key steps are:

- Gift Letter: The donor should sign a gift letter that clearly states the amount of the gift, the donor’s relationship to the borrower, and the fact that the gift is not a loan and does not require repayment.

- Bank Statements: Both the donor and the borrower need to submit recent bank statements showing the transfer of funds. This ensures the money came from a legitimate source and confirms the gift’s authenticity.

- Donor’s Ability to Give the Gift: The donor must prove they have sufficient funds available to make the gift. This can be done through a bank statement or financial documents showing the donor’s assets.

Additional Documentation

In some cases, additional information may be requested. This can include:

- A letter from the donor’s bank confirming the transfer or gift amount.

- If the gift comes from a third party, a detailed explanation of the relationship and source of the funds may be required.

Ensure that all required documents are provided upfront to avoid delays in the FHA application process.

Submit your FHA gift letter early in the home buying process, ideally right after your offer has been accepted. The gift letter proves that the funds you received are a gift and not a loan, which is necessary for meeting FHA requirements.

When to Submit

Present the gift letter during the mortgage application phase. This is typically when you will be asked to provide supporting documents. Ensure that the letter is submitted before the final underwriting process, as the underwriter will need to confirm that the gift complies with FHA guidelines.

How to Submit

Include the gift letter along with other financial documentation. If you are submitting documents electronically, scan and upload the letter to the lender’s portal. If submitting in person, provide the letter directly to your loan officer. Make sure it includes the donor’s information, the amount of the gift, and a clear statement confirming that the funds are a gift and not a loan.

Creating an FHA Gift Letter

For an FHA loan, the gift letter must state that the funds are a gift and not a loan. Begin by listing the donor’s name, address, and relationship to the borrower. Clearly mention the amount of money being gifted and that it is not expected to be repaid. This helps avoid confusion during the approval process.

Important Details to Include

Ensure the letter includes the donor’s statement that the money is a gift with no obligation for repayment. It should also contain the borrower’s name and a note specifying the purpose of the gift for the down payment.

Additional Requirements

Some lenders may request additional verification, such as proof of the donor’s ability to give the gift or recent bank statements. This verifies that the funds are legitimately available for the down payment.

Keep the letter simple and direct, ensuring all necessary details are covered without excessive repetition. This ensures clarity and expedites the loan approval process.