Financial Capability Letter Template for Various Needs

When dealing with financial transactions or securing agreements, one of the most important aspects is demonstrating your ability to meet obligations. This type of document serves as a formal declaration of your financial standing, often required in various legal and business situations. It helps establish trust and assures parties involved that you have the resources to follow through on commitments.

Whether you’re applying for a loan, entering into a business partnership, or securing an investment, providing proof of your financial stability is essential. This document typically includes key information about your financial background, such as income, assets, and liabilities. It’s a critical part of the process, offering transparency and reassurance to potential partners or lenders.

Understanding how to craft this document effectively can make all the difference in securing favorable terms or a successful outcome. A well-prepared statement ensures that all necessary details are clearly presented, showcasing your financial strength and readiness for future obligations.

Understanding a Financial Assurance Document

In many situations, you may be required to demonstrate your financial stability to ensure that you can meet any future obligations. This document plays a crucial role in showcasing your ability to manage and sustain financial responsibilities. It provides clear, transparent information about your financial situation, which can help build trust in various professional and legal settings.

Key Features of the Document

Such a statement generally includes essential details that validate your financial status. These features are designed to offer a comprehensive view of your current standing:

- Income Sources: Information on regular income from employment, investments, or other sources.

- Assets: A list of valuable possessions, such as property or savings.

- Liabilities: Any outstanding debts or obligations that need to be accounted for.

- Expenditure: A breakdown of regular expenses and financial commitments.

Why You Need This Document

This statement is essential for a variety of reasons, depending on your needs. It can be requested when you apply for loans, enter business contracts, or seek investments. It assures all parties involved that you have the means to fulfill the terms of agreements and shows that you are a reliable partner.

- Loan Applications: Lenders want to know you can repay the borrowed amount.

- Business Partnerships: Financial reliability is crucial for potential partners.

- Investment Opportunities: Investors seek assurance that their funds will be managed responsibly.

Essential Elements of the Document

For a document to be effective in conveying your financial stability, it must include several key elements. These components provide a clear picture of your current situation, allowing the recipient to assess your capacity to meet future obligations. The details presented should be comprehensive, accurate, and transparent.

Key Information to Include

The most important details are those that give a full overview of your financial position. The following sections are typically included:

- Income Details: A breakdown of your sources of income, including wages, business earnings, or other regular payments.

- Assets: A list of property, savings, or other valuables that demonstrate your ability to manage wealth.

- Liabilities: An outline of any current debts or obligations that may impact your financial flexibility.

- Monthly Expenditures: A record of regular financial commitments, such as bills and loan repayments.

Supporting Documentation

Along with the essential financial details, including supporting evidence enhances the credibility of the document. Such documentation may include:

- Bank Statements: Proof of available funds and financial transactions.

- Income Verification: Pay stubs, tax returns, or contracts that verify income levels.

- Asset Valuation: Appraisals or proof of ownership for valuable assets like property or investments.

Steps to Create a Capability Letter

Crafting a document that showcases your financial strength and responsibility involves several key steps. Each part must be carefully structured to ensure clarity and accuracy. Following a systematic approach helps present all relevant details effectively, giving the recipient confidence in your ability to fulfill obligations.

The process of creating such a document can be broken down into the following essential steps:

- Gather Financial Information: Collect all relevant financial details, including income, assets, and liabilities, to ensure an accurate representation.

- Organize the Content: Arrange the information logically, starting with personal or business details followed by financial specifics.

- Provide Supporting Evidence: Attach any documentation, such as bank statements or proof of income, that supports the claims made in the document.

- Write Clearly: Use simple, direct language to convey your financial standing. Avoid complex jargon that could confuse the reader.

- Review and Edit: Double-check all facts and figures, ensuring everything is accurate. Also, make sure the document is free from grammatical errors.

By following these steps, you can create a well-organized and reliable document that effectively demonstrates your financial preparedness.

Practical Applications of Financial Letters

This document serves a variety of important purposes, particularly in contexts where proving your economic stability or trustworthiness is essential. From securing loans to entering business agreements, such documents are vital in demonstrating that you are financially capable of meeting the requirements of an agreement. They help establish credibility and ensure all parties involved are confident in the transaction.

Loan and Credit Applications

When applying for a loan or credit, financial institutions require a clear overview of your ability to repay the debt. This document provides a comprehensive summary of your financial position, helping lenders assess whether you’re a reliable borrower. It often includes details about your income, assets, liabilities, and any other relevant financial information that may influence their decision.

Business Partnerships and Investments

In business dealings, demonstrating financial reliability is crucial when entering into partnerships or attracting investment. By providing this type of document, you show potential partners or investors that you have the necessary resources to honor your commitments. It plays a significant role in building trust and facilitating negotiations.

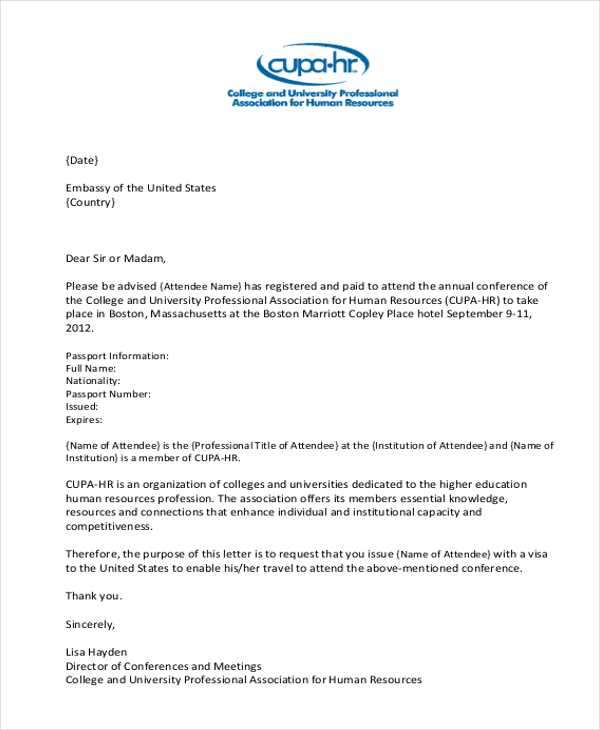

Additionally, such documents may also be used in various other situations, such as applying for housing, securing government contracts, or even for visa applications, where proof of financial security is required.

Best Practices for Professional Writing

When crafting any formal document, clarity, professionalism, and accuracy are key to ensuring your message is effectively communicated. By following established writing guidelines, you can produce a well-structured and persuasive document that instills confidence in the reader. Proper attention to detail is essential for making the right impression and conveying information in a clear, organized manner.

Here are some best practices to follow when writing professionally:

- Keep it Clear and Concise: Avoid unnecessary jargon or overly complex sentences. Use straightforward language that gets to the point without being too wordy.

- Use Proper Formatting: Organize your document with clear headings, bullet points, and well-structured paragraphs to make it easy to read and understand.

- Be Accurate: Ensure that all financial data or supporting details are correct and up to date. Mistakes can undermine the credibility of your message.

- Maintain a Formal Tone: Use professional and respectful language. Avoid slang, overly casual expressions, or overly familiar phrasing.

- Proofread: Always review your work for grammar, spelling, and punctuation errors. A polished document makes a much stronger impact.

By adhering to these guidelines, you ensure that your writing remains effective, professional, and persuasive, ultimately achieving its intended purpose.

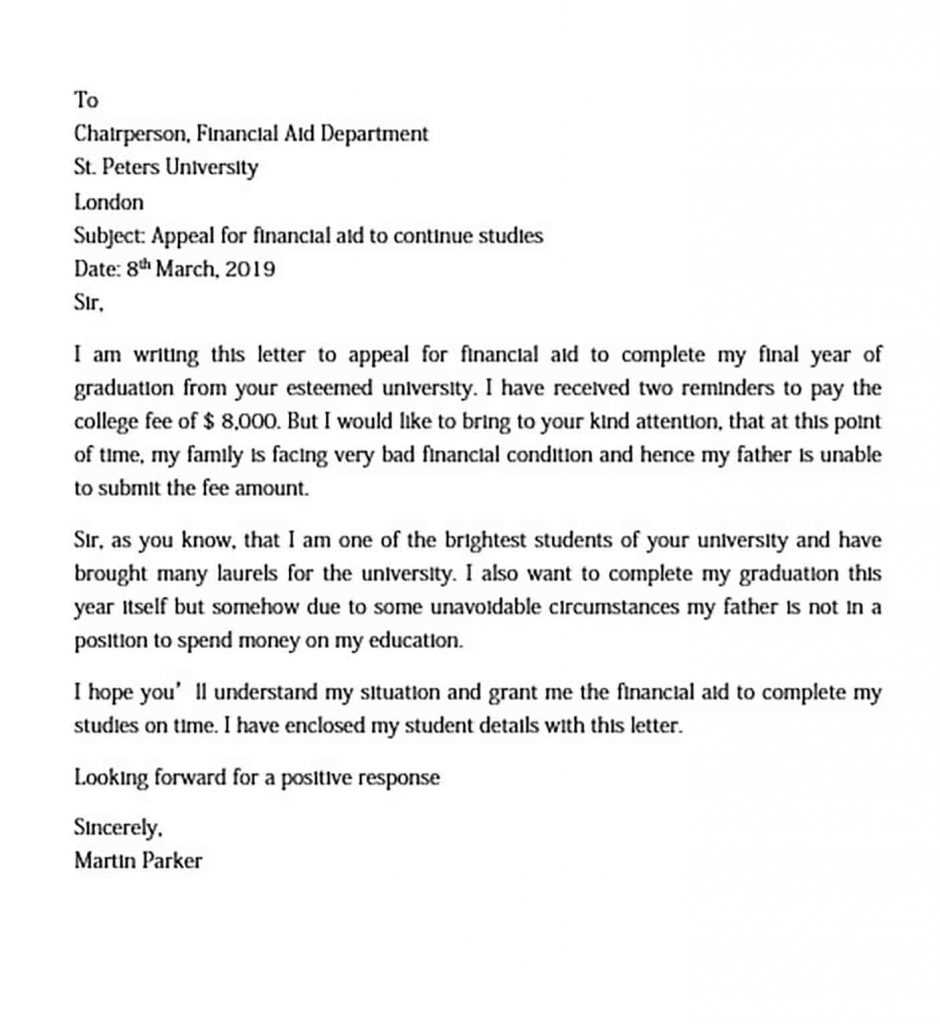

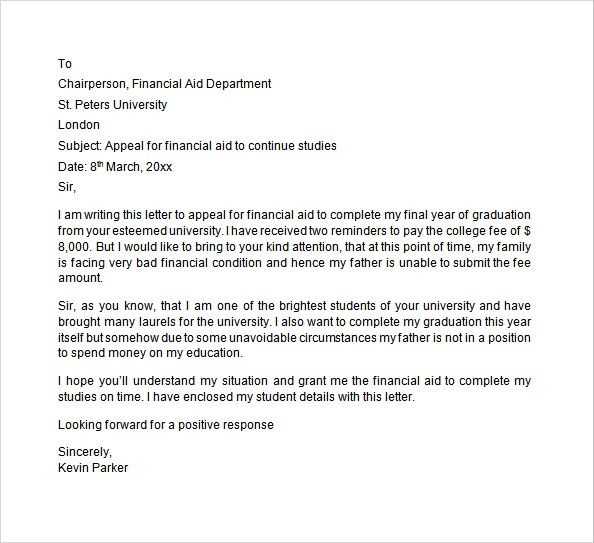

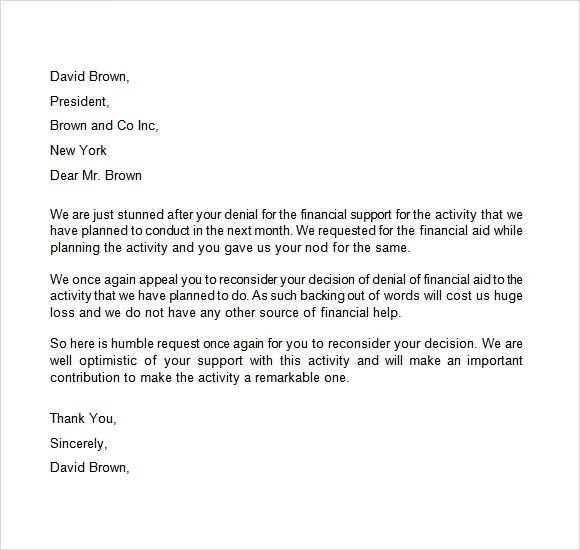

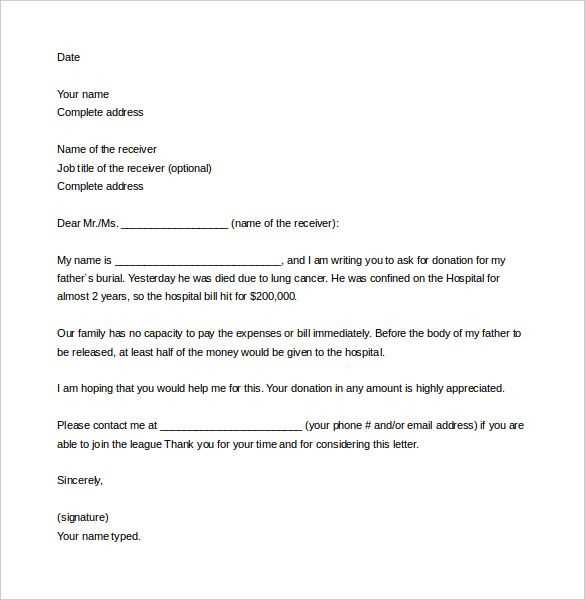

Sample Templates for Financial Capability Letters

Having a sample structure can be extremely helpful when drafting a document to demonstrate your financial reliability. Below are examples of formats that highlight the key information needed in such documents. These samples outline the essential elements and can serve as guides for writing your own document in a clear, professional manner.

| Section | Details to Include |

|---|---|

| Introduction | State the purpose of the document, introduce the individual or entity presenting the information, and provide the context for the document. |

| Financial Overview | Summarize the financial status, including income sources, assets, liabilities, and available resources that prove the ability to meet financial obligations. |

| Supporting Documentation | List the attached documents such as bank statements, tax returns, or other proof of income and assets. |

| Conclusion | Reaffirm the financial stability of the individual or organization and express the willingness to provide further information if necessary. |

This structure ensures that all important aspects are covered in a professional and logical manner, making the document clear and compelling for its intended recipient.