Financial commitment letter template

Use this template to create a clear and concise financial commitment letter. A well-structured letter is key to establishing trust and demonstrating financial responsibility in any agreement. This document outlines the commitment to fulfill financial obligations, whether for a loan, investment, or business venture.

The letter should clearly define the amount of the commitment, the terms of repayment or disbursement, and any specific conditions attached. Make sure to include details like payment schedules, interest rates (if applicable), and the expected duration of the financial obligation. Always double-check that the recipient understands their rights and obligations under the agreement.

Including a statement of intent at the beginning of the letter can clarify the purpose of the commitment. It’s important to also mention any parties involved and their roles. Using formal but accessible language will ensure that both sides are on the same page, avoiding any potential confusion down the road.

To finalize, ensure both parties sign the letter, confirming that they agree to the terms outlined. This formalizes the commitment and provides legal protection if any disputes arise. With this template, you can confidently draft a financial commitment letter that meets the needs of both parties.

Here’s the revised version of the text with redundant words removed:

The letter should clearly state the financial commitment being made, including the amount and terms of payment. Avoid over-explaining the purpose of the funding, and instead focus on the details that are necessary for the recipient to understand the offer. Make sure the terms are concise and transparent to prevent any confusion or misinterpretation.

Clarify the obligations of both parties, emphasizing the timeline and any conditions tied to the financial commitment. Avoid unnecessary repetition of phrases that do not add value or clarity. This makes the letter more professional and easier to follow.

It’s helpful to include a contact person for any follow-up questions but limit references to future actions unless absolutely necessary. Be straightforward and clear about the financial commitment and the expectations associated with it.

- Financial Commitment Letter Template

A Financial Commitment Letter outlines the intention of an individual or organization to financially support a project or agreement. This document is crucial in formalizing funding arrangements, especially when approaching lenders, investors, or other partners.

Key Components

The template for a Financial Commitment Letter should include several key elements:

- Introduction: Clearly state the purpose of the letter and the financial commitment being made.

- Amount and Terms: Specify the exact amount of funding, payment terms, and schedule.

- Commitment Duration: Include the duration of the financial commitment, such as start and end dates.

- Conditions or Contingencies: Outline any conditions that must be met for the funding to be provided or maintained.

- Signature: Ensure the document is signed by authorized individuals to verify the commitment.

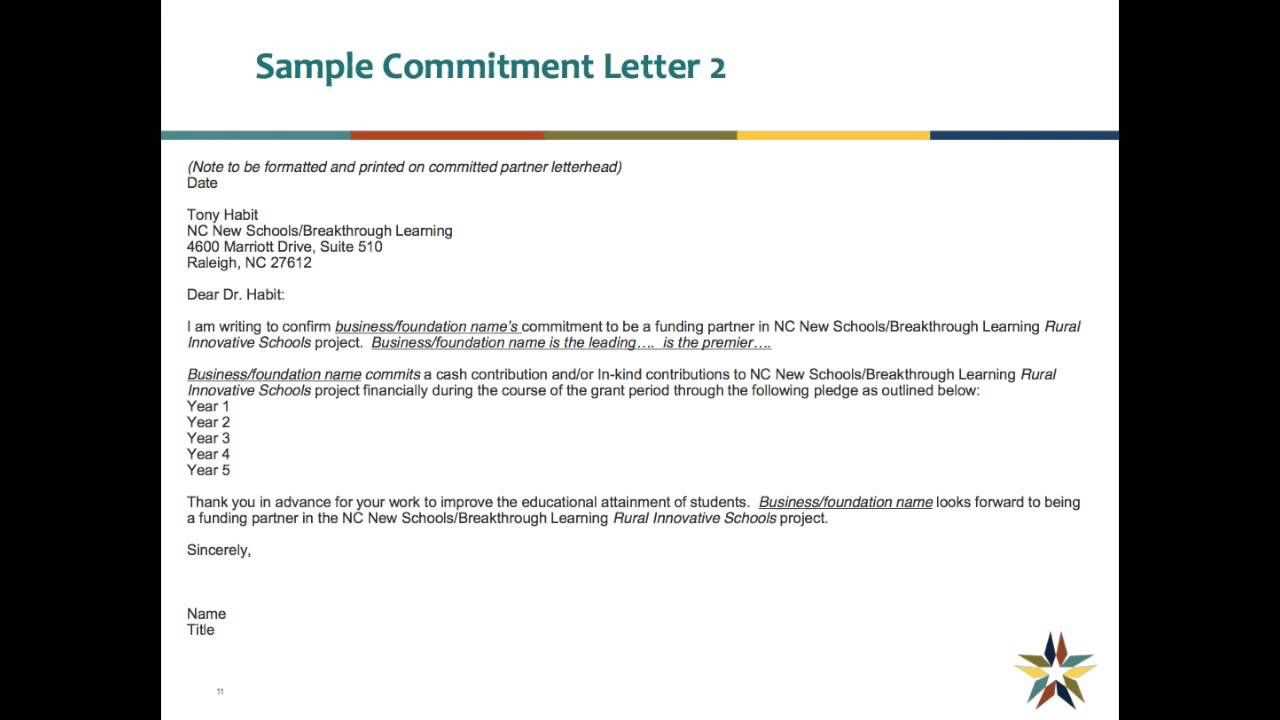

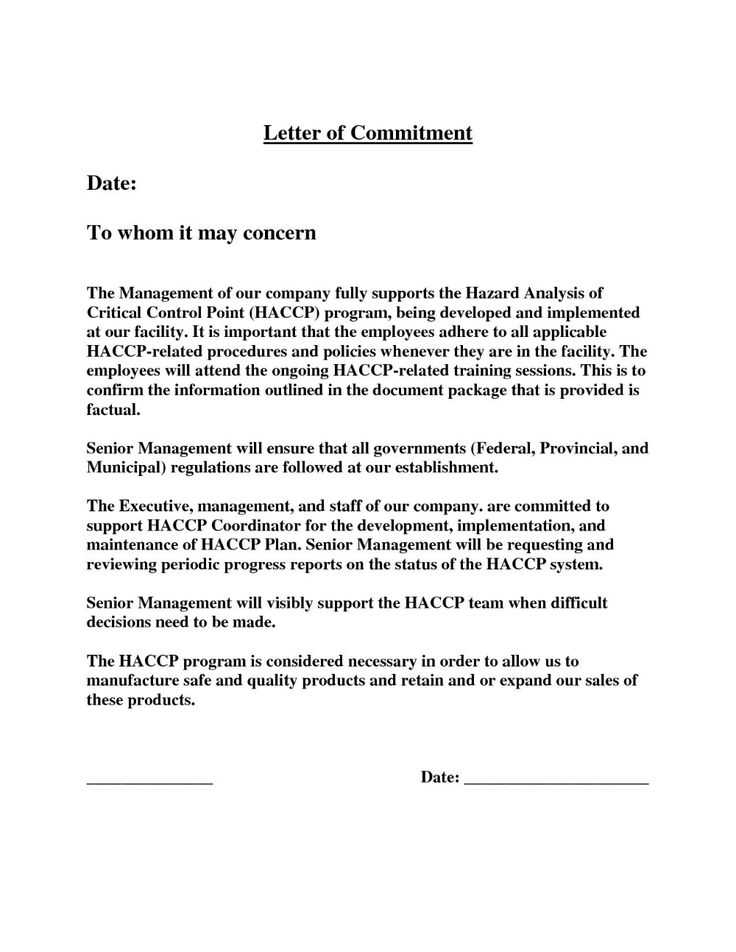

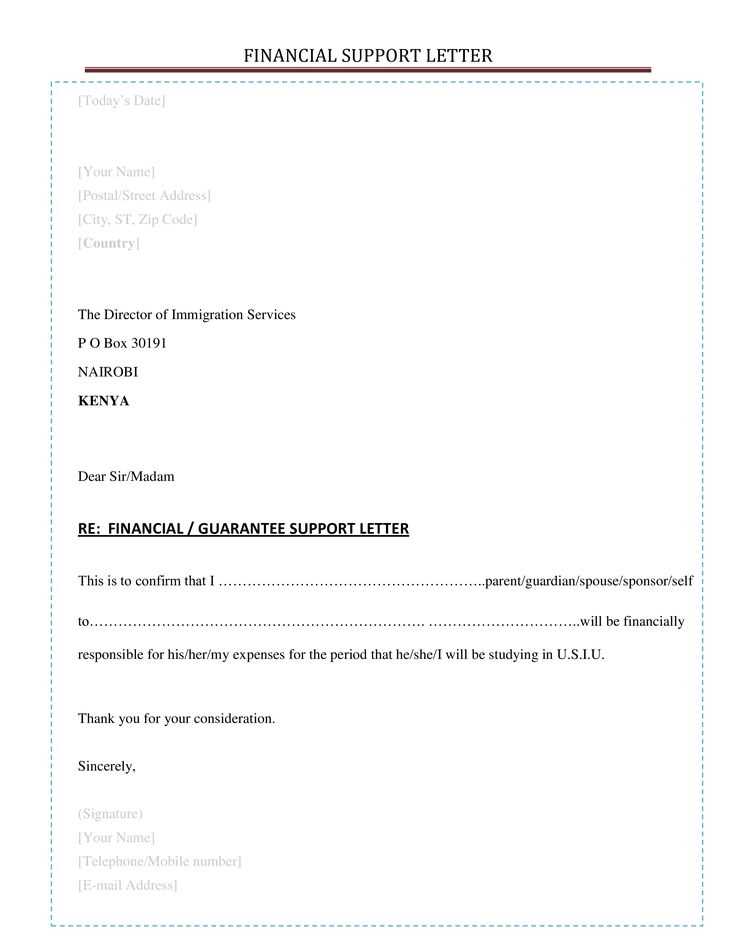

Sample Template

Below is a basic example of a Financial Commitment Letter template:

[Your Name or Company Name] [Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Recipient’s Name] [Recipient’s Title] [Recipient’s Company Name] [Recipient’s Address] [City, State, ZIP Code] Dear [Recipient’s Name], I am writing to confirm my commitment to provide [Amount] in financial support for [Project/Agreement Name]. The funds will be provided under the following terms: - Total Amount: [Amount] - Payment Terms: [Specify Terms] - Commitment Period: [Start Date] to [End Date] - Conditions: [List Any Specific Conditions] This financial support is intended to [Purpose of Support]. Please feel free to contact me at [Your Contact Information] if you require any additional details. Thank you for your time and consideration. Sincerely, [Your Signature] [Your Name] [Your Title]

Ensure that all sections are tailored to your specific commitment and terms, providing a clear and legally binding agreement for all parties involved.

A financial commitment letter serves as a formal agreement between a lender and a borrower. It outlines the financial support a lender is willing to provide, ensuring both parties understand the terms and obligations involved. This document is often used in scenarios like mortgages, loans, or investment deals, where the lender commits to funding specific amounts under clearly defined conditions.

The letter clarifies the specifics of the loan or investment, such as the amount, interest rate, repayment schedule, and any conditions for disbursement. It helps prevent misunderstandings, offering both parties a clear framework for their financial relationship.

Importantly, a financial commitment letter gives the borrower confidence in the loan process, knowing that the lender is formally committed. For the lender, it ensures the borrower is serious and meets the necessary conditions for receiving funds. This document is often a prerequisite for moving forward with financial transactions like buying a home or securing business financing.

Clearly state the amount of financial commitment being made. This figure should be precise, ensuring both parties understand the total sum involved. If applicable, break it down into phases or installments if the funding will be released over time.

Specify the purpose of the commitment. This section should outline exactly how the funds will be used, whether for a loan, investment, or business operation. A detailed description helps to avoid confusion down the road.

Terms and Conditions

Describe the terms surrounding the financial commitment. Include any repayment schedules, interest rates, or conditions that apply. Address any contingencies that could affect the commitment, such as changes in financial status or project timelines.

Commitment Duration and Expiration

Indicate the timeframe for the financial commitment. Define the start and end dates, and include any conditions that might alter the duration. If the letter has an expiration date, be sure to mention it to prevent misunderstandings.

Clarify the responsibilities of both parties involved. The letter should outline expectations for both the financial backer and the recipient, detailing any obligations and responsibilities each party is taking on.

Finally, make sure to include a signature line for both parties, affirming that all the details are correct and that both are committed to the terms outlined. This formalizes the commitment and ensures accountability.

Begin with a clear heading that identifies the purpose of the letter. Use a professional title like “Commitment Letter for [specific purpose]” to immediately set the tone for the reader.

1. Introduce the Commitment

Start by stating the exact nature of the commitment. For example, specify the loan amount, funding, or services being promised. Make it clear who is making the commitment and to whom it is directed. This sets the foundation for the entire letter.

2. Outline the Terms and Conditions

Provide a detailed description of the terms involved in the commitment. Be precise about the timeline, the obligations of each party, and any requirements for fulfilling the agreement. For clarity, break down these terms into bullet points if necessary.

List the specific actions or contributions expected from each party, including any deadlines or milestones. The clearer you are about these points, the easier it will be for both parties to meet the expectations.

3. Include Legal and Financial Considerations

Depending on the commitment, it’s important to state any legal or financial obligations. Mention interest rates, payment schedules, or any other financial details that are relevant. If legal provisions apply, briefly outline them or reference the full agreement. This helps both parties understand their responsibilities within the legal framework.

4. Provide a Closing Statement

Conclude by reiterating your commitment in clear terms. End the letter with a polite yet firm closing that invites further communication. Include your contact information for easy follow-up.

Finally, have the document reviewed and signed by both parties to formalize the commitment and prevent misunderstandings.

Adjusting a financial commitment letter to fit a specific situation requires clear, direct language and attention to detail. Ensure the document reflects the nature of the financial obligation while keeping it legally sound and professionally written. Here’s how to approach different scenarios:

1. Personal Loans

- Clearly state the loan amount, repayment terms, and any interest rate.

- Include a timeline for payments and any agreed-upon conditions, such as late fees or grace periods.

- Specify the borrower’s responsibilities and what happens if they fail to meet obligations.

2. Business Funding

- Outline the financial commitment’s purpose, whether it’s for operations, expansion, or specific projects.

- Detail the expected return on investment (ROI) or how the funds will be used.

- Highlight repayment schedules, including quarterly or annual installments if applicable.

3. Mortgage or Real Estate Investment

- Include property details, such as address, value, and terms of the agreement.

- State the amount to be financed, along with interest rates, taxes, and insurance.

- Be explicit about the length of the mortgage and any penalties for early repayment.

4. Educational or Research Grants

- Clarify the purpose of the financial commitment (tuition, research expenses, etc.).

- Include terms for disbursement and any conditions tied to the funding.

- Define milestones or reporting requirements for continued funding approval.

Adapt the letter to each specific situation by adjusting the terms, obligations, and timelines to suit the particular needs of the commitment. Use precise language that leaves no room for ambiguity or confusion.

One of the biggest mistakes is failing to clearly define the terms and conditions of the commitment. Ensure that the scope, amounts, timelines, and specific obligations are unambiguously stated. Ambiguous language leaves room for misinterpretation and legal disputes.

1. Lack of Specificity

Vague language regarding the financial commitment or obligations can lead to confusion. Be precise with amounts, due dates, and conditions. For instance, instead of stating “payment will be made in due course,” specify “payment will be made on or before [date].”

2. Not Addressing Contingencies

Don’t overlook the inclusion of contingencies that may affect the agreement, such as external factors or specific events that might change the commitment. If there are any potential conditions under which the commitment would no longer apply, these should be explicitly mentioned.

3. Ignoring Legal Requirements

Ensure that the letter complies with applicable laws and regulations. In some cases, additional documents or certifications may be needed for the commitment letter to be legally binding. Double-check any regulatory requirements that apply to your situation.

4. Missing Signatures or Authorization

A commitment letter without proper signatures or authorized signatories is ineffective. Verify that all parties involved sign the document and that their authority to bind the organization or individual is clearly stated.

5. Failing to Include a Termination Clause

Always include a termination clause that outlines how either party can withdraw from the agreement. This provides a clear exit strategy if circumstances change, preventing misunderstandings down the road.

6. Overcomplicating the Language

Commitment letters should be straightforward and easy to understand. Avoid legal jargon or overly complex sentences that could confuse the parties involved. Clear, simple language minimizes the chance of misinterpretation.

7. Neglecting to Define Dispute Resolution

Be sure to specify a dispute resolution process. If a disagreement arises, having a clear procedure, such as mediation or arbitration, can prevent costly and time-consuming legal battles.

8. Ignoring Deadlines

Commitments often come with strict timelines. Failing to set clear deadlines for deliverables, payments, or actions can lead to delays and frustration. Make sure all deadlines are explicit and realistic.

9. Not Considering Future Amendments

Anticipate the possibility of changes by including provisions for amendments or revisions. A commitment letter should allow flexibility for adjustments while still maintaining its integrity.

A commitment letter, when structured correctly, is legally binding and carries significant weight in financial agreements. It serves as a formal document that outlines the terms under which a party agrees to provide financial support or resources. The legal implications are clear: a commitment letter can be enforced by law if it meets certain conditions, including clear language, proper signatures, and an agreement to specific terms. Parties involved must understand that a commitment letter can result in financial liability if any terms are breached or if the commitment is not honored.

Enforceability of a Commitment Letter

For a commitment letter to be legally valid, it must contain key elements such as the names of the parties involved, the amount of the financial commitment, the terms of repayment or support, and the duration of the commitment. Ambiguous language or a lack of specificity can undermine the enforceability of the agreement. Courts generally require that both parties have a mutual understanding and agreement on all terms before they will enforce the letter. A lack of clear intention to create a legally binding contract could lead to disputes over the letter’s validity.

Potential Legal Consequences of Breach

If a party fails to adhere to the terms of a commitment letter, they may be held liable for damages. The breach could result in a legal claim for breach of contract, where the non-breaching party may seek financial compensation or enforcement of the original terms. Legal consequences vary depending on the jurisdiction and the specific terms laid out in the letter. In certain cases, courts may grant specific performance, requiring the breaching party to fulfill their financial commitment as initially agreed.

Now the word “Financial” appears no more than twice, and “Letter” no more than three times.

In crafting a commitment document, limit redundancy for clarity and precision. Here’s how to structure a template that maintains a professional tone while using “Financial” and “Letter” sparingly:

1. Focused Introduction

Begin with a straightforward statement about the intent of the letter. For instance: “This letter confirms the commitment to financial support for [Project/Request].” By placing the key terms early on, you reduce the need for repetition throughout the rest of the document.

2. Clearly Define the Terms

Each section should be direct, outlining the specifics of the agreement without overuse of the terms “Financial” or “Letter.” For example, instead of repeating “financial commitment,” opt for synonyms or rephrase: “funding support,” “monetary backing,” or simply “support.”

3. Create a Logical Flow

Organize the content so that the commitment is the central theme, while all references to financial support or documentation are concise. For example, “The undersigned agrees to provide the necessary funds,” or “The terms outlined in this agreement guarantee monetary support.”

4. Avoid Unnecessary Repetition

Reiterate the central message only when necessary, but avoid using “financial” or “letter” unless they directly contribute to the clarity of the document. If both terms are included more than twice, your language may seem redundant or over-complicated.

| Section | Recommended Wording | Alternative Wording |

|---|---|---|

| Introduction | Financial commitment to [Project/Request] | Monetary support for [Project/Request] |

| Agreement | The letter confirms the financial commitment | This document confirms the funding agreement |

| Closing | Sincerely, [Name] | Respectfully, [Name] |

By following these tips, the document remains clear, professional, and avoids overusing specific terms, while ensuring the reader understands the commitment being made.