Financial Hardship Letter Template for Easy Use

When facing challenging times due to unforeseen circumstances, it may become necessary to explain your current situation to creditors or other organizations. This process helps to outline the difficulties you’re encountering and request consideration for temporary relief or an adjustment to your financial obligations. Having a structured approach can make your communication clearer and more effective.

Essential Components for Crafting a Request

To ensure that your request is well-received, it is important to include certain key details. These elements help present your case in a professional manner and increase the likelihood of a positive response.

- Personal Information: Clearly state your full name, account number, and contact details to allow for quick identification.

- Description of Situation: Provide a concise yet detailed explanation of the events or conditions that have led to your financial struggles.

- Impact on Finances: Explain how the situation has specifically affected your ability to meet obligations.

- Requested Action: State what type of support or modification you are seeking, whether it be a payment deferral or reduced rates.

- Future Plan: Assure the recipient of your intention to resolve the situation, outlining steps you’re taking to improve your financial stability.

Common Mistakes to Avoid

In order to create a compelling and respectful message, it’s crucial to avoid certain missteps. These can weaken your request or even result in it being dismissed altogether.

- Overly Vague Details: A general explanation without enough context can seem insincere or uninformed.

- Demanding Language: Requests should be polite and professional, not forceful or entitled.

- Failure to Offer a Solution: It’s important to propose a reasonable course of action rather than simply asking for assistance without a plan in place.

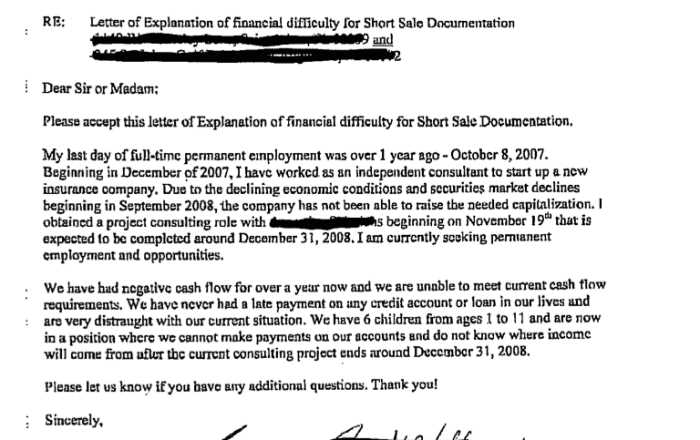

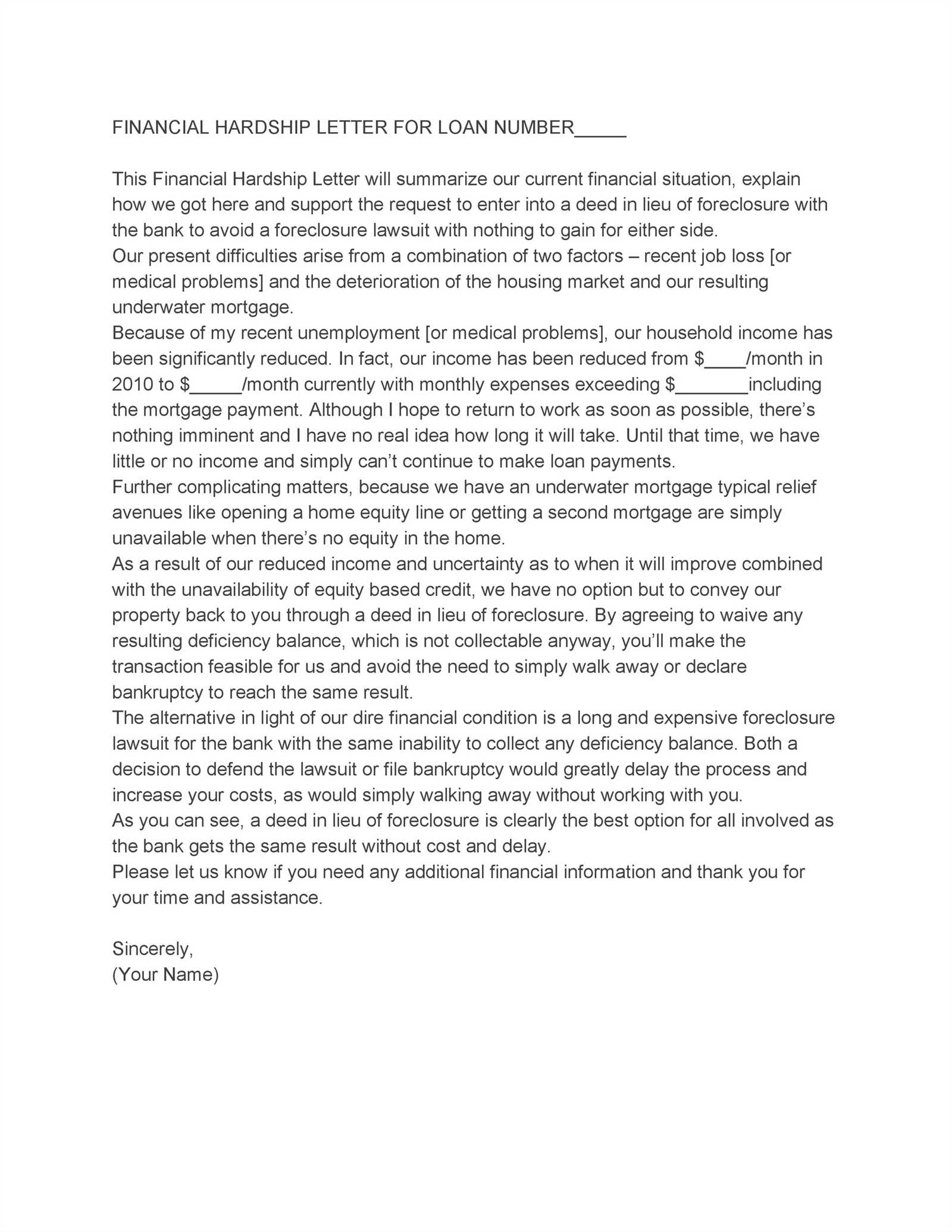

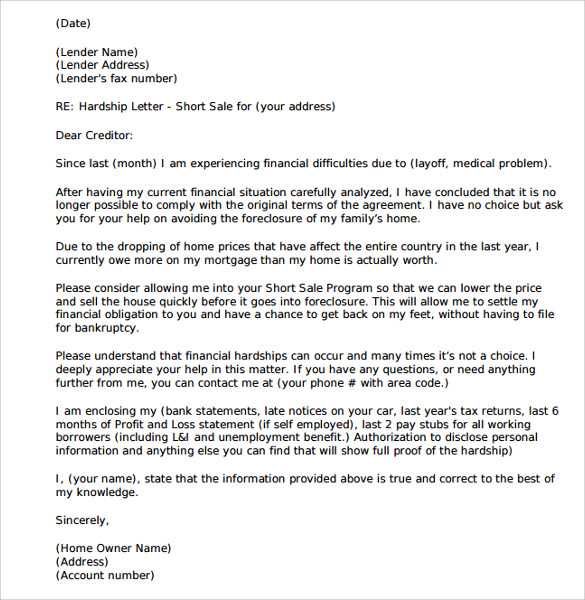

Example of a Well-Structured Request

Below is a sample format that can be used as a guide when drafting your own communication:

- Introduction: Start by identifying yourself and your account.

- Describe the Issue: Outline the specific reasons for your current situation.

- State the Request: Clearly indicate the relief you are seeking.

- Offer Assurance: Include your commitment to resuming payments when possible and the steps you’re taking to recover financially.

- Close with Gratitude: Thank the recipient for their consideration and express your willingness to discuss further.

By following this structure and including all necessary details, your request will be both clear and professional, helping you navigate your financial challenges more effectively.

Steps to Create a Financial Relief Request

When facing challenging financial circumstances, crafting a well-structured communication to seek assistance or renegotiate payment terms can make a significant difference. This section will guide you through the process of creating a clear, professional request for support, helping you present your situation effectively.

Key Elements to Include in Your Request

Ensure your message contains all the necessary details to explain your situation and convey your needs. Include personal information, such as your name and account details, to identify yourself clearly. Describe the issue, outlining how it has impacted your ability to meet obligations. Finally, specify the type of help you are requesting, whether it’s an extension, payment reduction, or another form of relief.

Avoiding Common Pitfalls

While preparing your request, avoid vague statements or a tone that could be perceived as demanding. Stay concise and respectful, explaining the situation with clarity. Failing to offer a solution or not demonstrating your intent to improve the situation can weaken your request.

Timing is another critical factor. Submit your request as soon as you anticipate difficulties, giving the recipient time to review and process your case. Waiting too long can create complications in finding a resolution.

Customizing your request based on your unique situation adds a personal touch. Make sure the tone is sincere and the plan to resolve the issue is realistic. Providing an example of how others have approached similar challenges can be beneficial.

Finally, ensure you know how to effectively communicate with the organization or creditor. A direct but polite approach can foster understanding and a willingness to assist you during difficult times.