Financial planning annual review letter template

Make your financial review process smooth and clear by starting with a well-crafted letter that highlights key updates, goals, and strategies. Begin by outlining the changes in the client’s financial situation, reflecting on adjustments or growth. Clearly state any shifts in priorities and review investment performance over the past year.

Provide personalized recommendations based on current trends, helping the client make informed decisions. Be sure to highlight any opportunities or risks that may impact their financial trajectory. Discuss any specific goals from the previous year, noting progress or areas needing more attention.

Conclude the letter by outlining the next steps for continued success. Offer clarity on how to proceed with revised plans, rebalancing portfolios, or addressing emerging financial needs. Ensure that the tone remains clear and direct, yet friendly, to maintain a strong advisor-client relationship.

Here’s the revised version:

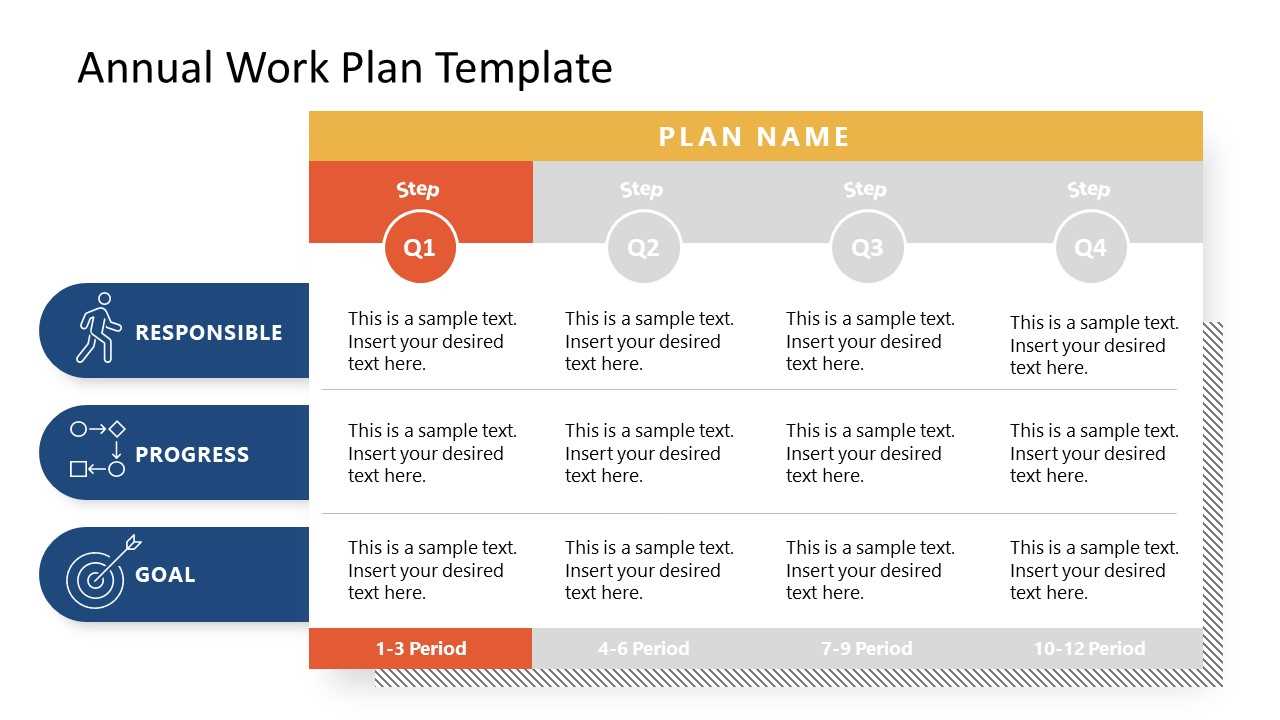

Begin by reviewing your financial goals from the previous year and comparing them to actual results. This provides insight into any discrepancies and highlights areas for improvement. Adjust your goals based on current circumstances and ensure they align with long-term objectives. Make sure to reassess your budget and expenses to reflect any changes in your income or spending habits. Regularly track your investments and savings growth to stay on target.

Actionable steps for next year:

Set specific, measurable goals for the upcoming year, such as increasing retirement contributions or saving for an emergency fund. Revisit your asset allocation strategy to ensure it matches your risk tolerance and financial objectives. Don’t forget to factor in tax implications and potential adjustments to minimize liabilities. Regularly evaluate your progress and adjust your plan as needed to keep your financial strategy on course.

Financial Planning Annual Review Letter Template

How to Start Your Annual Review Letter

Key Updates to Include in Your Letter

Personalized Client Information: Customizing the Document

Communicating Performance Metrics and Financial Health

Recommendations for Adjustments in Strategy

Finalizing the Letter: Tone and Call to Action

Begin by addressing your client by name and acknowledging the ongoing relationship. State the purpose of the letter clearly–reviewing their financial progress and planning for the upcoming year. For example: “I am excited to share your annual financial review, highlighting key developments and our next steps together.”

Key Updates to Include in Your Letter

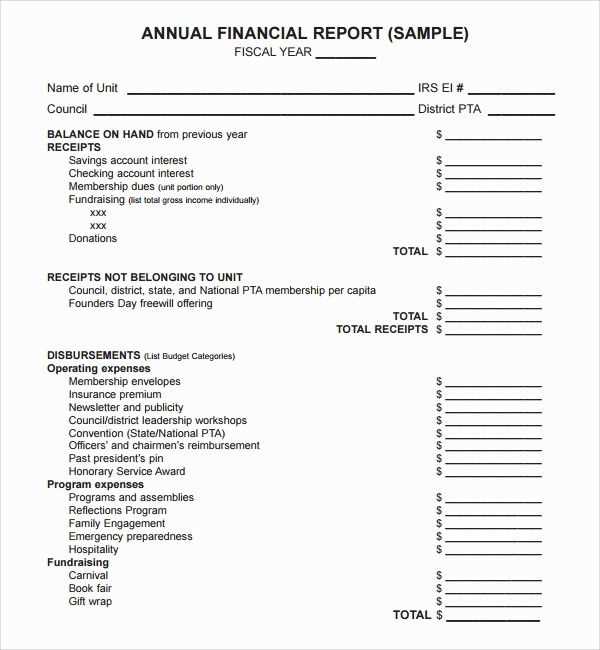

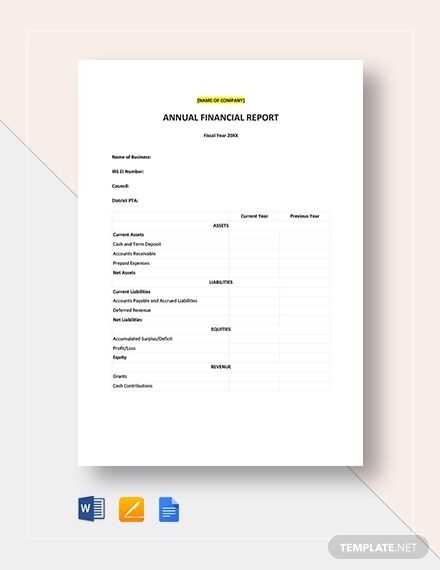

Provide a snapshot of the past year’s performance. Outline investment gains, asset allocation changes, or significant financial milestones. Include tax implications, insurance updates, and any estate planning adjustments. Give a clear view of where the client stands today.

Personalized Client Information: Customizing the Document

Tailor the letter to the individual’s goals and life changes. Mention specific financial goals discussed in previous meetings, such as retirement planning or funding education. If the client experienced major life events like marriage or the birth of a child, reference how these impact their financial plans.

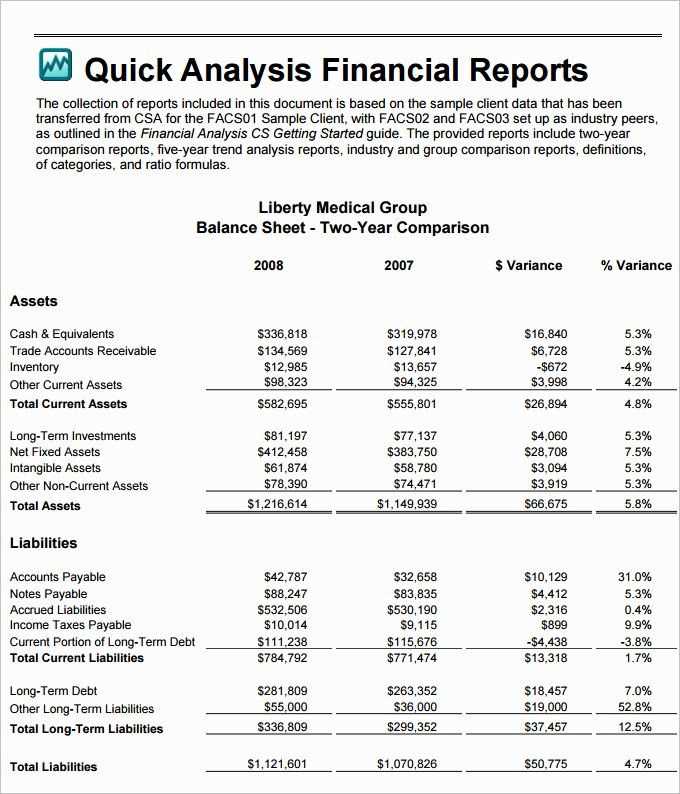

Communicating Performance Metrics and Financial Health

Provide an easy-to-understand summary of their portfolio’s performance. Highlight growth, any losses, and explain market conditions that may have affected results. Use simple metrics, like percentage growth or comparison against a benchmark, ensuring it’s clear and relatable.

Recommendations for Adjustments in Strategy

If changes are necessary–whether it’s adjusting investment strategies or reallocating funds–recommend them in a clear, actionable manner. Explain the reasoning behind each suggestion and how it aligns with their evolving goals.

Finalizing the Letter: Tone and Call to Action

End the letter with a friendly and open invitation for further discussion. Encourage the client to schedule a meeting or call to review the suggestions. Offer reassurance that you’re available to support them in making informed decisions for the coming year. Example: “Please don’t hesitate to reach out with any questions or to schedule a meeting to discuss these updates further.”