Finra Rule 3210 Letter Template Guide

In the financial industry, there are strict guidelines that professionals must follow to ensure transparency and avoid conflicts of interest. One important aspect of maintaining ethical standards is providing proper documentation when certain actions or relationships are established. This process helps ensure that individuals and firms remain accountable and compliant with regulatory expectations.

When it comes to managing accounts, trading, or engaging in activities that might create a potential conflict, proper notification to the appropriate bodies is required. These communications serve as a way to outline key details and ensure that all involved parties are aware of any potential risks or obligations. Clear and accurate documentation plays a crucial role in preventing legal complications or misunderstandings down the line.

Understanding how to draft and submit this form is essential for anyone working in the finance sector. Knowing the exact structure, required information, and common practices can simplify the process and help avoid unnecessary delays. Having a solid grasp of these requirements also makes it easier to stay in good standing with regulatory authorities and maintain trust with clients and colleagues alike.

Understanding the Regulatory Requirements

In the financial sector, transparency and accountability are fundamental to maintaining trust and ensuring fair practices. Regulatory bodies impose specific requirements to prevent conflicts of interest and ensure that all parties involved in financial transactions adhere to the established guidelines. These requirements often include formal notifications to relevant authorities whenever certain actions are taken or relationships are formed, especially those that may have an impact on the market or client interests.

Importance of Compliance

Adhering to these standards is critical for both individuals and firms. By submitting the appropriate forms and documentation, professionals can demonstrate their commitment to ethical conduct and regulatory obligations. This not only helps avoid potential penalties but also promotes a culture of integrity within the industry. Failing to comply can lead to serious consequences, such as fines, suspension, or even the loss of professional licenses.

When Compliance Documentation is Required

Documentation is typically required in situations where a potential conflict of interest might arise. This includes scenarios involving personal trading accounts, outside business activities, or gifts and gratuities that could influence decision-making. In these cases, providing the necessary forms ensures that all parties are informed and that any potential issues are addressed before they escalate. It’s an essential practice to uphold the integrity of the financial services industry and to protect both clients and professionals from unintended consequences.

Why You Need a Compliance Notification

In the financial industry, maintaining proper documentation is essential to ensure ethical behavior and prevent conflicts of interest. A compliance notification serves as a formal declaration that provides transparency about personal or professional activities that could influence your financial decisions or relationships. Submitting this form is not only a regulatory requirement but also a safeguard that helps protect both individuals and firms from legal and reputational risks.

Here are a few reasons why submitting this type of communication is necessary:

- Ensures Transparency: It provides a clear record of your activities that could potentially impact your professional conduct.

- Mitigates Conflict of Interest: By disclosing certain personal interests, you can prevent situations where your financial decisions may appear biased.

- Protects Legal Standing: Meeting regulatory requirements reduces the risk of facing fines or disciplinary action for non-compliance.

- Builds Trust: Clients and colleagues are more likely to trust professionals who demonstrate a commitment to ethical standards and compliance.

- Improves Accountability: A formal declaration holds you accountable for your actions and ensures that all stakeholders are informed.

In many cases, failing to submit this required form could lead to serious consequences, such as loss of professional credentials or legal ramifications. Therefore, understanding when and how to complete this process is a crucial part of staying compliant within the industry.

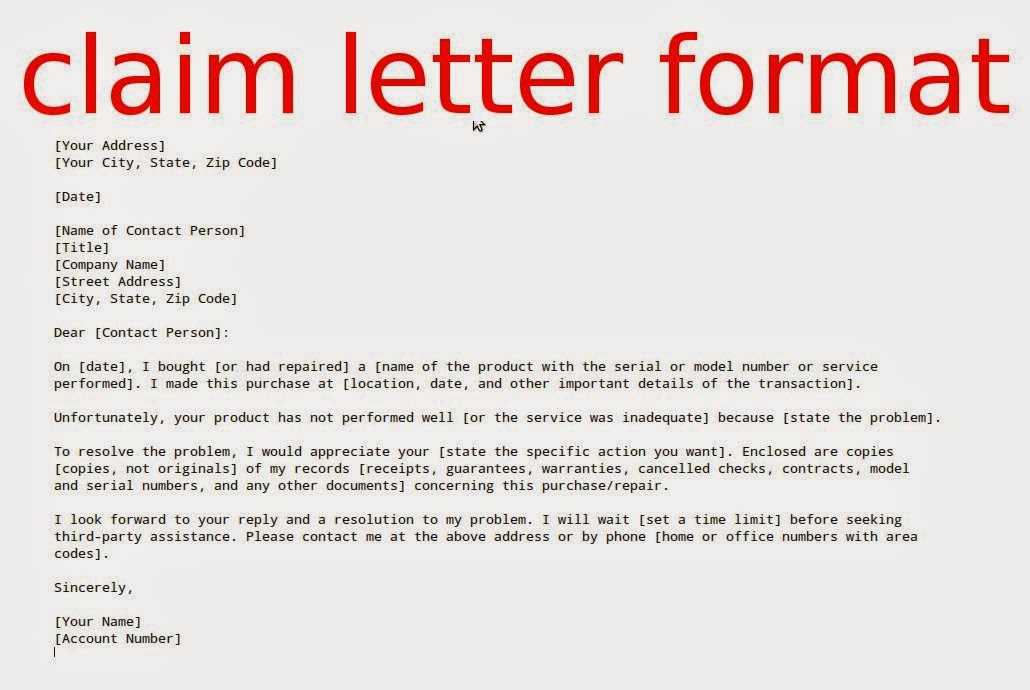

Key Elements of the Document

When preparing the necessary form for regulatory compliance, it is important to include specific details that ensure the document meets all requirements. Each section should provide clear, accurate, and complete information to avoid delays in processing or issues with regulatory bodies. Understanding the key components of this document helps you efficiently navigate the submission process and fulfill your obligations without error.

Essential Information to Include

The form should contain several critical elements that provide full disclosure of the relevant financial activities. These sections ensure the submission is comprehensive and effective:

| Element | Description |

|---|---|

| Personal Information | Details such as your name, professional title, and contact information. |

| Account Information | Information regarding any financial accounts or transactions that need to be disclosed. |

| Conflict Disclosure | Details of any potential conflicts of interest that could arise from personal or professional activities. |

| Affiliations | Information about outside business activities or partnerships that may impact your financial decisions. |

| Signature | A signed declaration affirming the truthfulness and accuracy of the provided information. |

Formatting and Submission Requirements

It is important to follow the specific formatting and submission guidelines set by the regulatory body to ensure that your document is processed without issue. This includes using the appropriate language, adhering to required submission formats (e.g., electronic or paper), and submitting within the specified deadlines. By following these guidelines carefully, you help streamline the compliance process and avoid unnecessary complications.

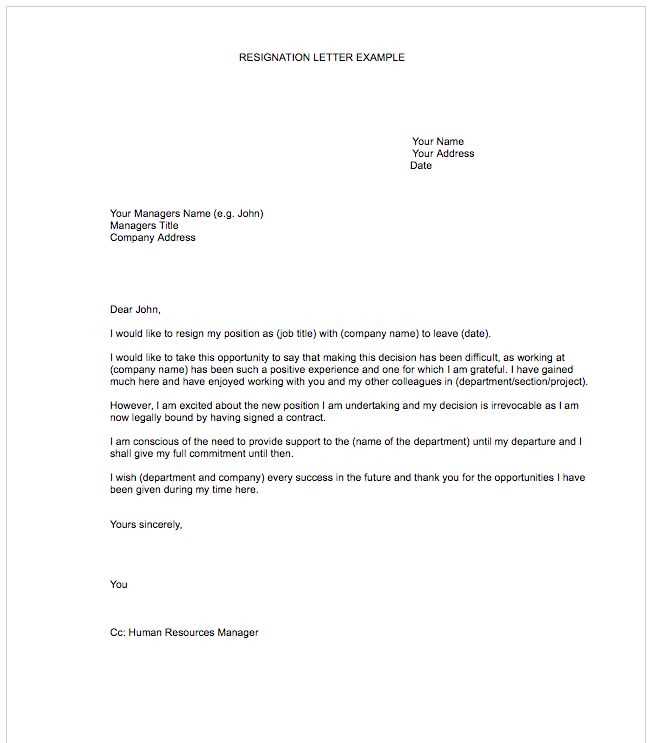

Step-by-Step Guide to Drafting the Document

Creating the necessary compliance form requires attention to detail and a clear understanding of the required information. Each step must be followed carefully to ensure that all required data is included and accurately presented. By following a systematic approach, you can efficiently complete the form while meeting all regulatory requirements.

Step 1: Gather Necessary Information

Before starting, ensure you have all relevant information at hand. This includes personal details, account information, and any potential conflicts of interest that must be disclosed. Having everything prepared ahead of time will help you fill out the form without missing crucial elements.

Step 2: Complete the Form Sections

Start filling in the form by addressing each section systematically. Begin with your basic details–name, contact information, and professional title. Follow this by providing any relevant account or financial information, ensuring that all disclosures are complete. If you have outside affiliations or activities, make sure to include them as well.

Once all sections are filled out, review the information for accuracy and clarity. It is important that the form clearly reflects your activities and any relationships that might impact your professional conduct. Ensure that the language is straightforward and that all required disclosures are included.

Finally, ensure you sign and date the form, as this serves as your formal declaration of the truthfulness and completeness of the information provided. Double-check for any missing details before submitting the document to the appropriate authorities.

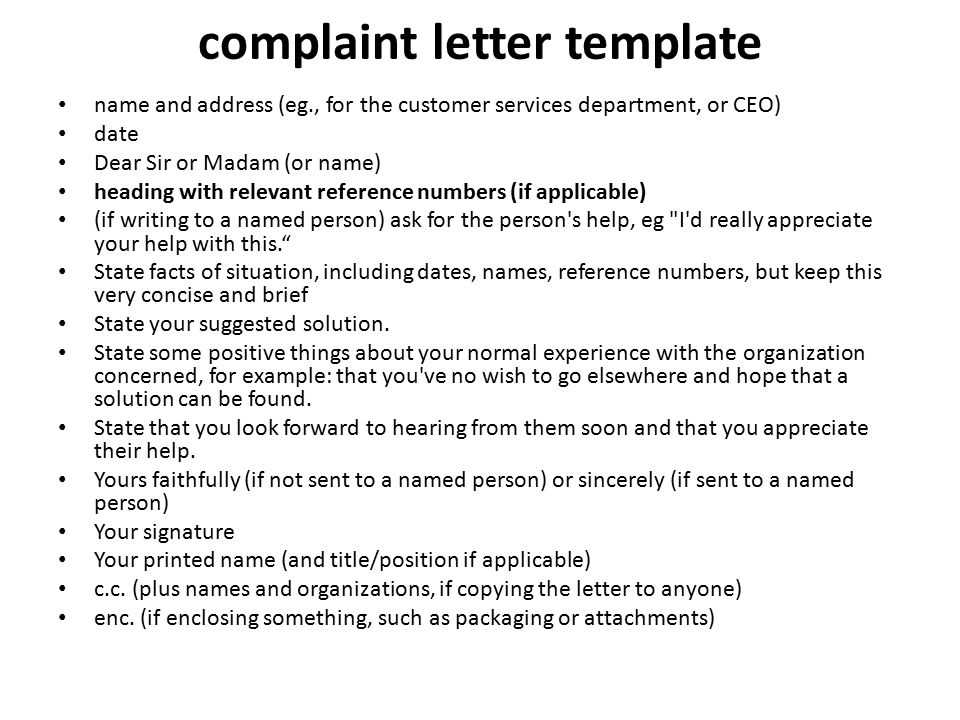

Common Mistakes to Avoid in Compliance

When submitting the necessary documents for regulatory compliance, it’s essential to avoid common errors that could lead to delays or penalties. Failing to meet requirements or making mistakes in the provided information can result in complications that could affect your professional standing or legal standing. Being aware of these common mistakes and taking steps to avoid them will ensure the process goes smoothly.

Here are some of the most frequent errors to watch out for:

- Incomplete Information: Leaving out essential details or failing to fully disclose necessary data can cause the form to be rejected. Always double-check that every section is filled out properly.

- Failure to Update Details: Ensure that any changes in your personal or professional circumstances are reflected in the form. Failure to update could lead to non-compliance and potential penalties.

- Incorrect Formatting: Adhering to the correct formatting and submission guidelines is vital. Ensure that the document is presented in the specified manner to avoid delays in processing.

- Missing Signatures: A common mistake is neglecting to sign the form. Remember that signatures confirm the authenticity of the document and are essential for its acceptance.

- Late Submissions: Submitting the required documents past the deadline can result in penalties or missed opportunities. Always make sure to submit on time to maintain compliance.

By staying mindful of these potential pitfalls, you can ensure that your submission is accurate, complete, and timely, avoiding any unnecessary complications during the compliance process.

How to Submit the Compliance Documentation

Submitting the required compliance forms is a crucial step in ensuring that your activities align with industry regulations. The submission process varies depending on the specific requirements set by the regulatory body, but it generally involves providing the necessary information in a timely and accurate manner. Understanding the submission method and ensuring that all guidelines are followed will help avoid delays or complications.

Here’s a guide on how to properly submit the required documentation:

- Check Submission Guidelines: Review the regulatory body’s instructions to determine whether the form should be submitted electronically or in paper format. Each method may have specific rules to follow.

- Ensure Complete Documentation: Double-check that all required fields are filled out completely and accurately. Missing or incorrect information could result in the form being rejected.

- Submit on Time: Make sure to submit your form by the specified deadline. Late submissions can lead to penalties or complications that may impact your professional standing.

- Confirm Receipt: After submission, verify that your form has been successfully received and processed. If submitting electronically, you should receive a confirmation email or notification.

- Keep Records: Retain a copy of the submitted form and any confirmation notices for your own records. This ensures you have documentation in case any issues arise in the future.

By following these steps, you ensure that your submission is correct and complies with the necessary regulations. Proper submission helps maintain transparency and trust within the industry, protecting both your professional standing and legal compliance.

Tips for Maintaining Ongoing Compliance

Maintaining compliance in the financial sector is an ongoing responsibility that requires regular attention to detail and adherence to industry standards. It is not enough to simply complete the necessary documentation once; continuous monitoring and updates are essential to staying in good standing with regulatory authorities. By following a few key practices, you can ensure that you remain compliant over the long term and avoid any potential risks or issues.

Here are some helpful tips for keeping your compliance status up-to-date:

- Regularly Review Your Information: Make it a habit to periodically review your personal and professional details. Any changes in your financial activities or affiliations should be promptly updated in your records.

- Stay Informed on Regulatory Changes: Regulations can evolve over time. Keep yourself informed about any updates or new requirements that may impact your obligations. This will help you stay ahead of any compliance changes.

- Document Everything: Always maintain accurate records of all relevant activities and communications. Proper documentation will help you stay organized and ensure that you can quickly respond to any inquiries or audits.

- Set Up Alerts and Reminders: Use calendar reminders or compliance management software to keep track of important deadlines, updates, and any required filings. This will help you avoid missing crucial submission dates.

- Consult with Experts: If you are unsure about specific compliance requirements, seek advice from legal or regulatory experts. They can provide valuable guidance to help you navigate complex requirements.

By staying proactive and diligent, you can ensure that you remain compliant throughout your career, minimizing the risk of penalties or other legal complications. Consistency is key to maintaining the trust and confidence of clients and regulatory bodies alike.