First time penalty abatement letter template

To begin, drafting a penalty abatement letter is a clear and direct approach to resolving your tax issues. When writing this letter for the first time, make sure to clearly explain the reason for your non-compliance. The IRS often considers first-time penalty relief for taxpayers who have a good history but missed a payment or filing deadline due to circumstances beyond their control.

Start by addressing the letter to the IRS and clearly stating your request for penalty abatement. Mention your previous compliance, and explain the specific reason why you failed to meet the deadline. Be honest and concise, as the IRS reviews these requests based on the accuracy and clarity of the explanation.

Ensure you include any documentation or proof that supports your claim. This can include medical records, evidence of a natural disaster, or proof of mail delays. The more concrete your evidence, the better your chances of having the penalty reduced or removed.

Remember, it’s important to remain polite and professional throughout the letter. Your tone should express understanding of the mistake and convey a willingness to correct it moving forward. Be clear in your closing by requesting a review of your situation and providing contact information for follow-up.

Here is the revised version:

Begin by addressing the IRS in a respectful tone. Clearly state the reason for your request and provide the necessary context for the penalty. Include details such as the specific circumstances that led to the mistake or delay, ensuring the explanation is honest and concise. Mention any steps you’ve taken to avoid future issues, such as setting up reminders or adjusting your financial practices. Offer a brief but clear reason why you believe a penalty abatement is warranted in this case. Close by expressing your willingness to cooperate and your commitment to fulfilling your tax obligations moving forward.

- First Time Penalty Abatement Letter Template

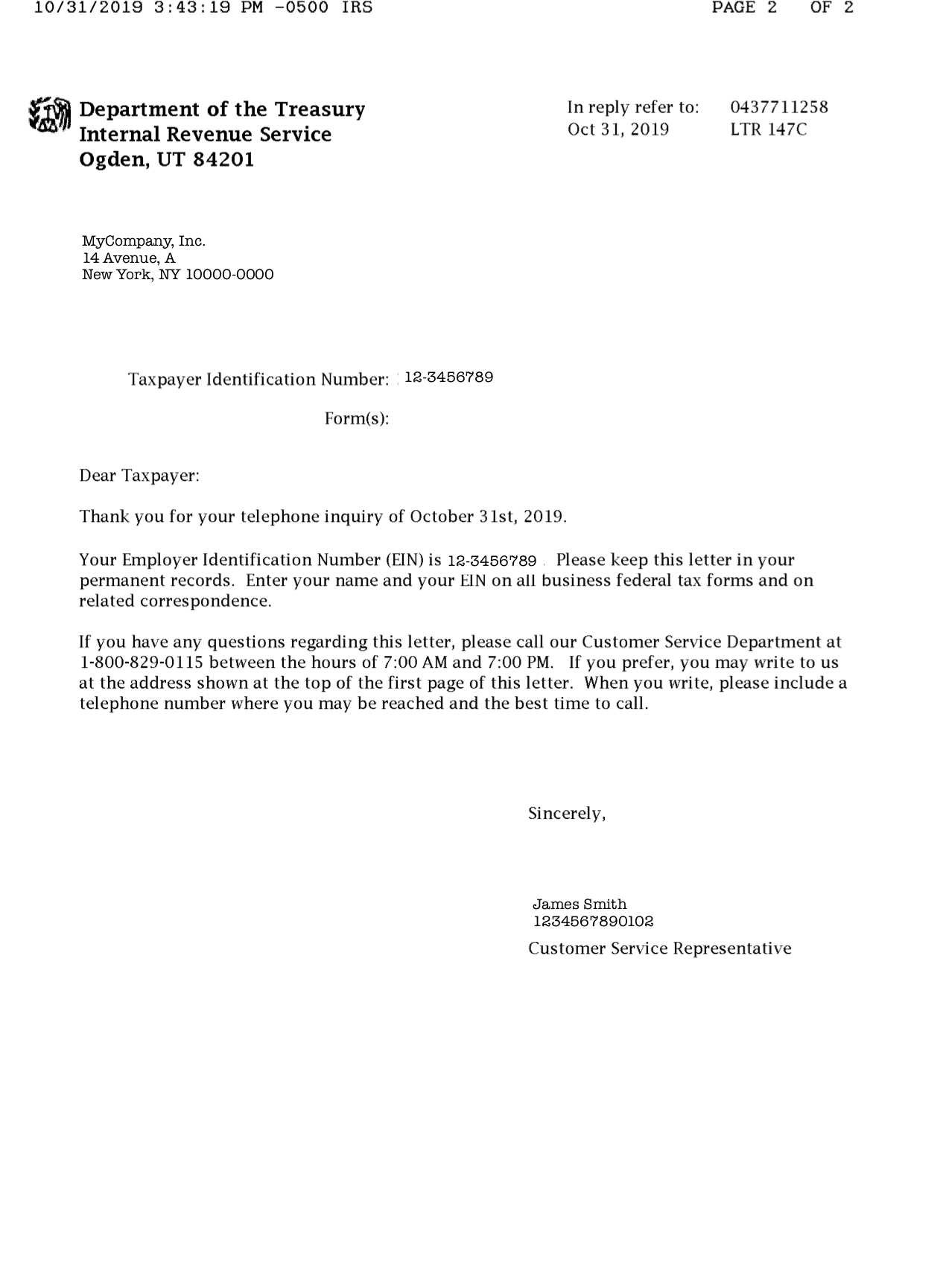

Begin your letter by addressing the IRS or relevant authority clearly, including your full name, address, and taxpayer identification number. Mention the tax year related to the penalty and the specific penalty you are requesting to be abated. Be concise and professional in your approach.

State the Reason for Request: Explain the reason you are asking for penalty relief. Acknowledge that you missed a deadline or made an error, but emphasize that this was a one-time occurrence due to reasonable cause, such as a serious illness, a family emergency, or other unexpected situations.

Provide Supporting Documentation: Attach relevant documents that support your request, such as medical records, proof of emergency circumstances, or a letter from an employer. This strengthens your case and shows that your situation was beyond your control.

Express a Willingness to Comply: Reinforce your commitment to future compliance with tax laws. Clearly state that you understand the importance of meeting deadlines and that you are taking steps to prevent this from happening again, such as setting reminders or seeking professional tax advice.

Conclude Politely: End the letter with a polite request for the penalty to be removed. Thank the authority for considering your request and express your hope for a favorable resolution. Provide your contact information for follow-up if needed.

Example:

Dear Sir/Madam,

My name is John Doe, and I am writing to request the abatement of a penalty assessed for the tax year 2023 (Taxpayer ID: 123-45-6789). Due to a medical emergency in my family, I was unable to file my tax return by the deadline. I understand the importance of filing on time and have attached relevant medical records to support my claim.

I have taken steps to ensure that I meet all future deadlines, including setting up automatic reminders. I kindly request that you consider removing the penalty based on this first-time occurrence.

Thank you for your time and consideration. I look forward to your response.

Sincerely,

John Doe

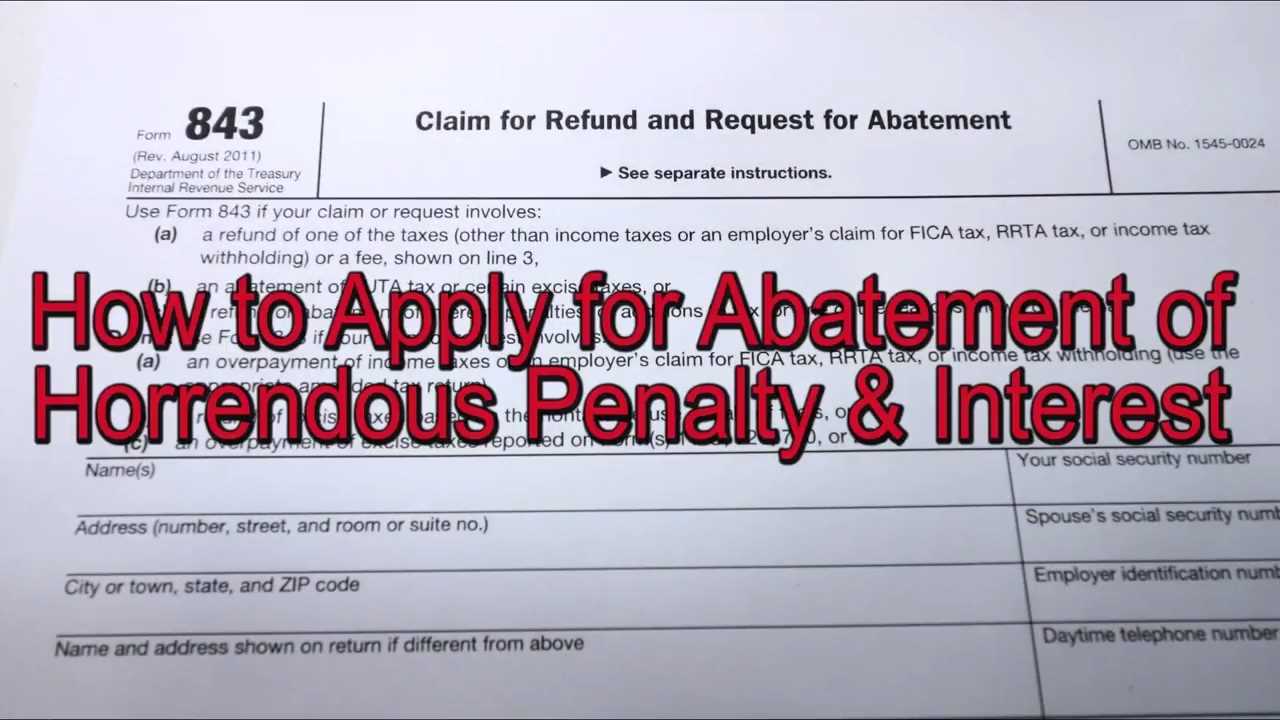

Penalty abatement refers to the process of reducing or eliminating a penalty assessed by a tax authority, often due to circumstances beyond the taxpayer’s control. The IRS offers this option if the taxpayer can demonstrate reasonable cause for failing to meet tax obligations on time. This could include issues such as illness, natural disasters, or serious financial difficulty. Abatement allows taxpayers to avoid additional penalties, easing the burden of their financial obligations.

To request penalty abatement, taxpayers should present clear, compelling evidence supporting their case. The IRS typically looks for proof that the taxpayer made efforts to comply with the law and that the penalty was not due to negligence or willful disregard of the rules. Providing relevant documents and being honest about the situation can improve the chances of approval.

Write the subject line clearly to indicate the purpose of the letter. Keep it simple, such as “Request for First-Time Penalty Abatement”.

1. Address the IRS Correctly

Begin the letter by addressing the appropriate IRS office. Include your personal details, such as your name, address, and taxpayer identification number (TIN) to help them identify your case.

2. State Your Request Clearly

Immediately after the greeting, clearly state that you are requesting a penalty abatement due to your first-time mistake. Keep the language direct and polite.

3. Explain the Situation

Briefly describe the error or misunderstanding that led to the penalty. Be specific and provide any relevant context that supports your request, such as reasons for late payment or filing.

4. Demonstrate Compliance

Highlight your history of timely filings or payments. Emphasize that this is your first penalty, showing that you have a good track record with the IRS.

5. Request Abatement

Politely request the removal of the penalty based on your clean record and the circumstances you’ve described. Express your willingness to comply in the future.

6. Close the Letter

End with a polite closing statement, thanking the IRS for considering your request. Sign your name at the end of the letter.

7. Attach Supporting Documents

If applicable, attach any supporting documents such as payment receipts or notices of previous compliance.

Sample Structure

| Section | Details |

|---|---|

| Subject Line | Clear statement like “Request for First-Time Penalty Abatement” |

| Greeting | Use IRS office and your taxpayer info |

| Request Statement | State that you are requesting penalty abatement |

| Explanation | Describe the cause of the mistake |

| Compliance | Show that you have a history of compliance |

| Closing | Thank the IRS for their time and consideration |

Be clear and concise when writing your penalty abatement request. Here are the key elements to include:

- Taxpayer Information: Provide your full name, address, Social Security number (SSN) or Employer Identification Number (EIN), and tax identification number. This ensures your request is properly linked to your tax records.

- Tax Period: Specify the tax period(s) for which you are requesting penalty abatement. Include the relevant year or time frame to avoid confusion.

- Reason for Request: Explain the reason for your request. If it’s due to a first-time penalty, state that clearly and provide any supporting evidence or circumstances, such as illness, personal hardship, or a mistake made by the IRS.

- Payment History: Highlight your history of filing and paying on time. If you have a clean record, mention it to strengthen your case.

- Steps Taken to Correct the Issue: Describe any actions you’ve already taken to address the issue, such as submitting late payments or correcting errors on your tax return.

- Contact Information: Include your phone number or email so the IRS can reach you if further information is needed.

Additional Tips

- Be polite and professional in your tone. Keep the language straightforward and avoid emotional appeals.

- Ensure all documents are organized and submitted according to IRS guidelines for faster processing.

Start by focusing on accuracy. Incorrect or incomplete information can significantly delay the process or result in the rejection of your request. Ensure that all necessary details, such as the exact penalty amount, date of occurrence, and reasons for the mistake, are clearly stated. Double-check for any errors that might confuse the reader.

1. Failing to Provide Supporting Documentation

Support your claim with evidence. If applicable, include any documents that verify your explanation for why the penalty should be waived. This can include medical records, financial hardship statements, or any proof that the penalty was caused by circumstances beyond your control. Without this, your letter might not be taken seriously.

2. Using an Impersonal Tone

Make your letter personal and direct. Address the letter to the appropriate person or department and avoid a generic tone. A personalized request is more likely to be considered sympathetically. Avoid sounding robotic or overly formal, which can make the request feel less genuine.

| Mistake | Impact | How to Avoid |

|---|---|---|

| Failure to proofread | Errors in the letter can make it seem careless | Carefully proofread before submission |

| Over-explaining the situation | Long-winded explanations can bore the reader | Be clear and concise |

| Not being specific enough | Unclear reasoning may make your case weaker | Provide clear, detailed explanations |

To submit your penalty abatement request, follow these clear steps:

1. Prepare Required Documents

- Gather any supporting documents that demonstrate why the penalty should be removed, such as medical records, natural disaster evidence, or proof of financial hardship.

- Ensure that all documents are legible and relevant to your claim.

2. Submit Through the Correct Channel

- Submit the request to the appropriate government agency, typically the IRS for tax-related penalties. Double-check the contact details on their website.

- If applicable, use the agency’s online portal or mail the request to the specified address.

3. Provide Clear and Concise Information

- In your letter, explain the circumstances leading to the penalty and why it should be abated. Be direct and avoid unnecessary details.

- Include your taxpayer identification number, the relevant tax period, and a request for a review of the penalty.

4. Follow Up

- If you don’t receive a response within a reasonable timeframe, contact the agency for updates on the status of your request.

- Stay polite and persistent in your communication with them.

Once you’ve submitted your penalty abatement request, stay proactive. Check your email regularly for any communication from the IRS. They may request additional documentation or clarifications. If you don’t receive a response within a few weeks, consider following up to confirm that your request was processed.

If your request is accepted, you’ll receive a notice outlining the updated penalty status. Keep this confirmation for your records. On the other hand, if your request is denied, take note of the reasons provided. You may be able to submit additional information to support your case or appeal the decision within the prescribed time frame.

Stay organized by keeping a detailed record of all correspondence and forms sent. This will help if any issues arise later or if you need to reference your request during future communications with the IRS.

Make sure your letter is clear, concise, and polite. State that it’s your first-time offense and explain why the penalty occurred. Acknowledge the mistake and mention any corrective steps you’ve taken or plan to take. Ensure you include your account information and any relevant details that support your case.

Example: “I understand the importance of complying with the regulations and sincerely regret the mistake that led to this penalty. I’ve reviewed my processes and have already implemented measures to prevent it from happening again.”

Request that the penalty be waived, citing your clean record (if applicable) and your willingness to comply moving forward. Attach any documentation that may help your case, such as proof of payment or steps taken to correct the situation.

Example: “As this is my first infraction, I kindly request a reduction or removal of the penalty. I have taken the necessary steps to prevent this in the future, and I hope my good standing with your organization will be taken into account.”