Forbearance letter template

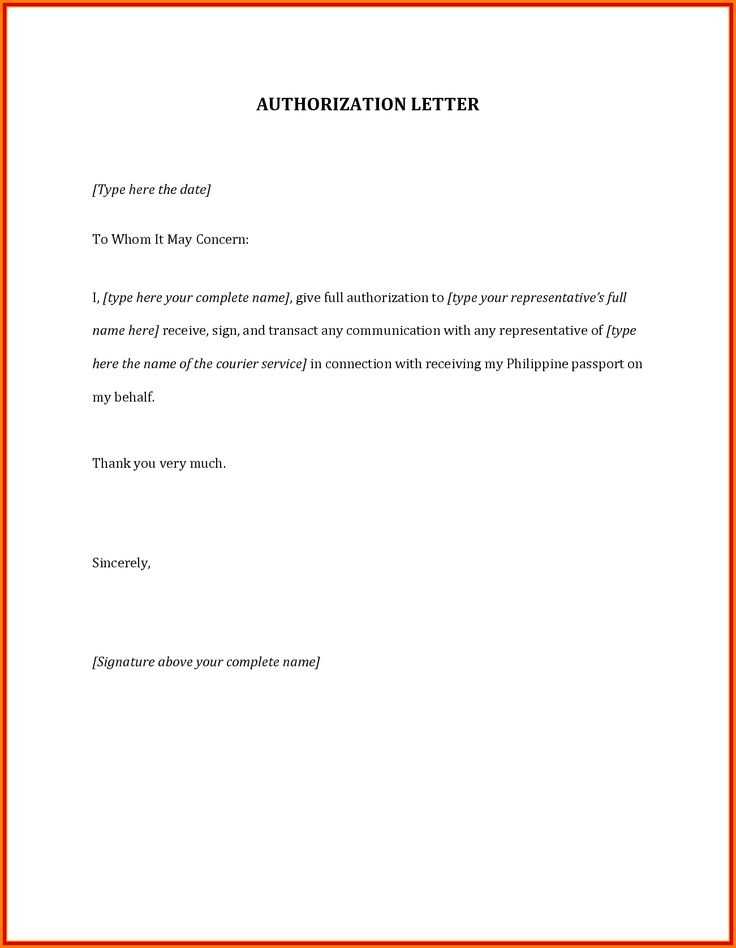

A forbearance letter serves as a formal request to delay or adjust payments for a loan or debt. It is important to craft a clear, concise letter that outlines the specific terms being requested, such as a temporary reduction or suspension of payments. The letter should present your situation transparently and provide any necessary supporting documentation to validate your need for relief.

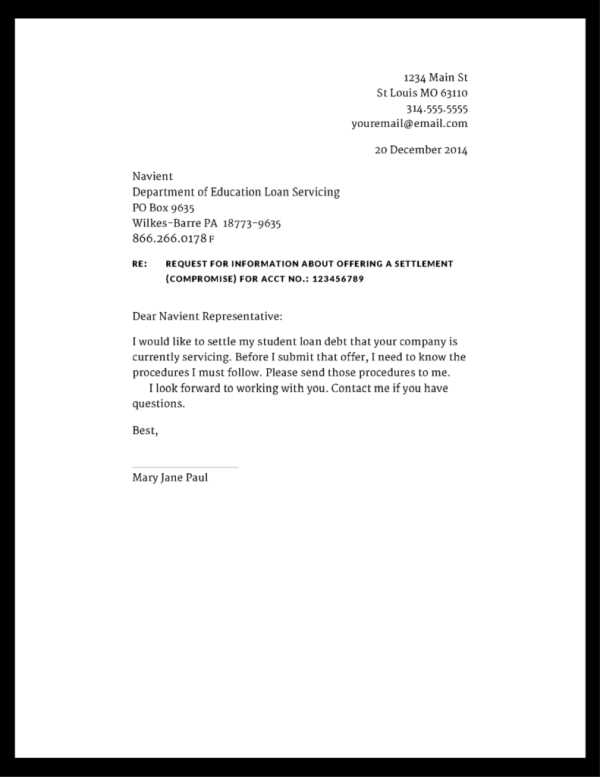

Begin by addressing the lender with respect, including their correct contact information and a reference to your loan or account number. Clearly state the reason for your request–whether due to financial hardship, medical issues, or other temporary circumstances–and specify the period during which the forbearance is sought.

Offer a solution in the letter by suggesting a repayment plan or modified terms once the forbearance period ends. It’s crucial to express your willingness to continue meeting obligations after the temporary pause and to demonstrate your intent to work with the lender towards a viable repayment solution.

Make sure to keep the tone polite and professional throughout, providing all necessary details to avoid any misunderstandings. Include contact information for further communication, and if applicable, request confirmation of the forbearance agreement in writing.

Here is the improved version with reduced repetition:

Make your letter clear and to the point. Begin by stating the reason for requesting forbearance, specifying any relevant dates, amounts, and agreements. Clearly explain the circumstances that led to financial difficulty, without unnecessary details. Focus on the actions you’ve taken to manage the situation, including payments made or financial adjustments. Address the specific forbearance terms you’re requesting, such as a pause on payments or a temporary reduction. Conclude with a polite but firm request for approval, emphasizing your intent to fulfill obligations as soon as possible.

By organizing your letter logically and eliminating redundant phrases, you create a direct and effective request. Be professional, but avoid excessive formalities that may detract from your main message. Keep the tone respectful, demonstrating your willingness to work together while outlining the specific assistance needed.

Forbearance Letter Template: A Practical Guide

How to Start Writing a Forbearance Letter

Key Information to Include in Your Request

How to Address Your Loan Servicer in the Letter

What Tone and Language to Use in a Forbearance Request

Common Mistakes to Avoid When Writing the Letter

Next Steps After Submitting Your Request

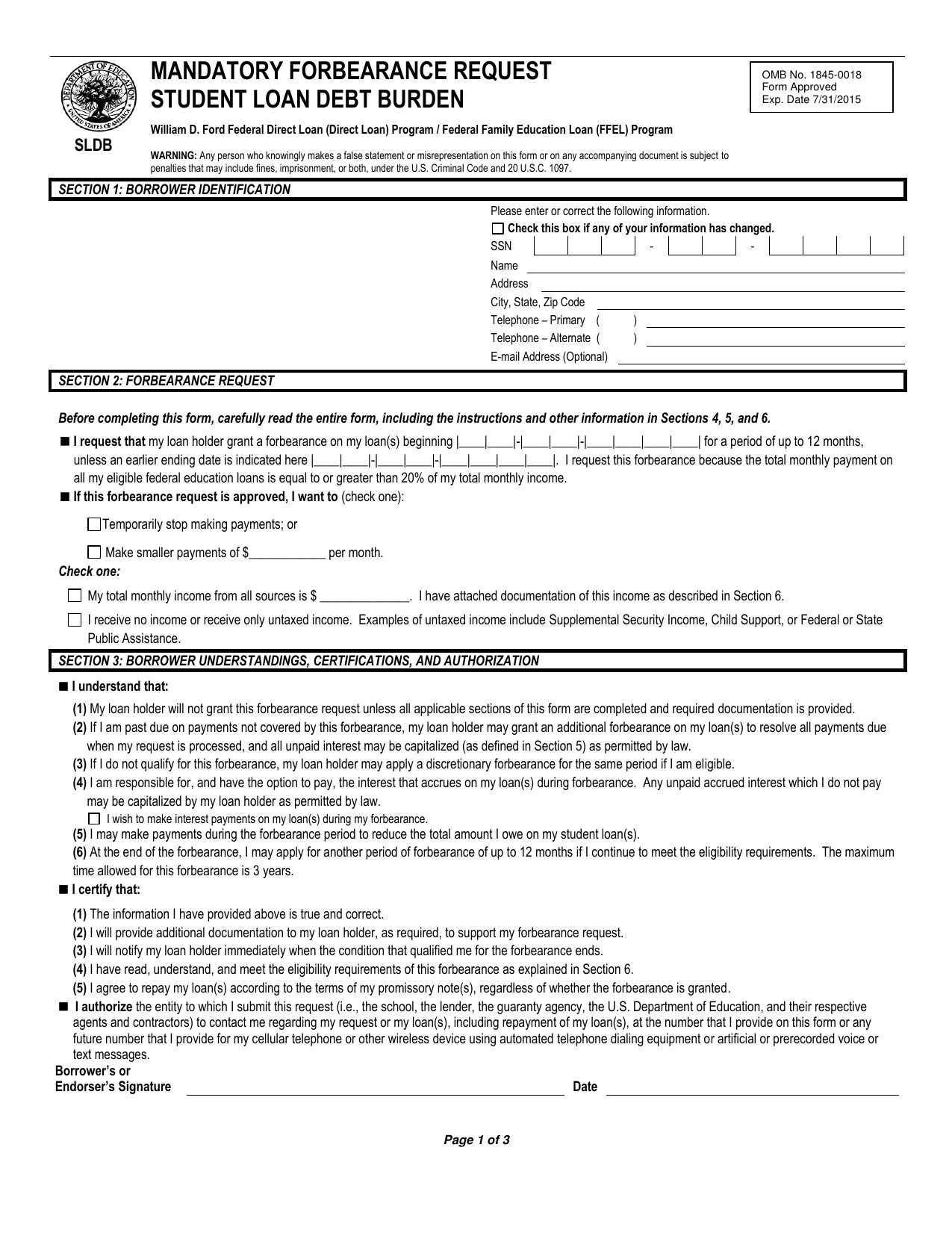

Begin by clearly stating your need for forbearance, providing context for your request. Mention the loan type, account number, and the reason you’re requesting forbearance. Be honest and transparent, as this helps build trust with your loan servicer. You may also want to explain any financial difficulties or hardships you are experiencing.

Key Information to Include in Your Request

Include your full name, address, and contact information. Specify the amount of time you need for the forbearance, whether it’s a few months or a more extended period. It’s also helpful to mention whether you plan to make partial payments or if you’re requesting complete suspension of payments. Provide any relevant documentation that supports your situation, like medical records or employment notices, if applicable.

How to Address Your Loan Servicer in the Letter

Address the letter to the specific department or individual handling your account. Use the proper title (e.g., “Dear Loan Servicer”) and ensure you have the correct contact details. If you’re unsure who to address it to, check your loan documents or contact customer service to confirm the appropriate recipient.

Maintain a respectful tone throughout your request. Use formal but clear language, and keep the letter concise. Avoid using overly casual language or sounding apologetic. The goal is to appear professional and demonstrate your commitment to resolving the situation.

Common Mistakes to Avoid When Writing the Letter

Don’t be vague in your request. Clearly define the terms you’re asking for. Avoid oversharing personal information–stick to what’s necessary to explain your financial situation. Also, ensure that the tone is not overly demanding or emotional; this can reduce the effectiveness of your request.

After submitting your request, follow up if you don’t receive a response within a reasonable time frame. Keep a record of all communications and any agreements made. If approved, make sure you understand the terms and conditions of the forbearance and how they will impact your loan repayment schedule in the future.