Force placed insurance letter template

To write a force placed insurance letter, focus on clear communication. Begin by stating the purpose of the letter–informing the borrower about the necessity of acquiring force-placed insurance. Include the specific reasons why this action is being taken, such as failure to maintain the required insurance coverage or failure to provide proof of insurance. Be precise in describing the timeline for obtaining the required coverage and the consequences of not complying.

Clarify the Costs: Detail any costs that the borrower will incur for force-placed insurance. Specify whether these costs will be added to the loan balance, or if they will be charged separately. Mention the lender’s right to add these charges and explain the potential impact on the loan terms.

Provide Next Steps: Clearly outline the borrower’s options to resolve the issue. Offer a deadline for providing proof of insurance and explain the process for submitting that information. Include contact details for any questions or concerns regarding the matter.

Maintain a polite yet firm tone throughout the letter, ensuring that the borrower understands both the seriousness of the situation and the available avenues for resolution. This will promote a cooperative response while protecting the lender’s interests.

Force Placed Insurance Letter Template

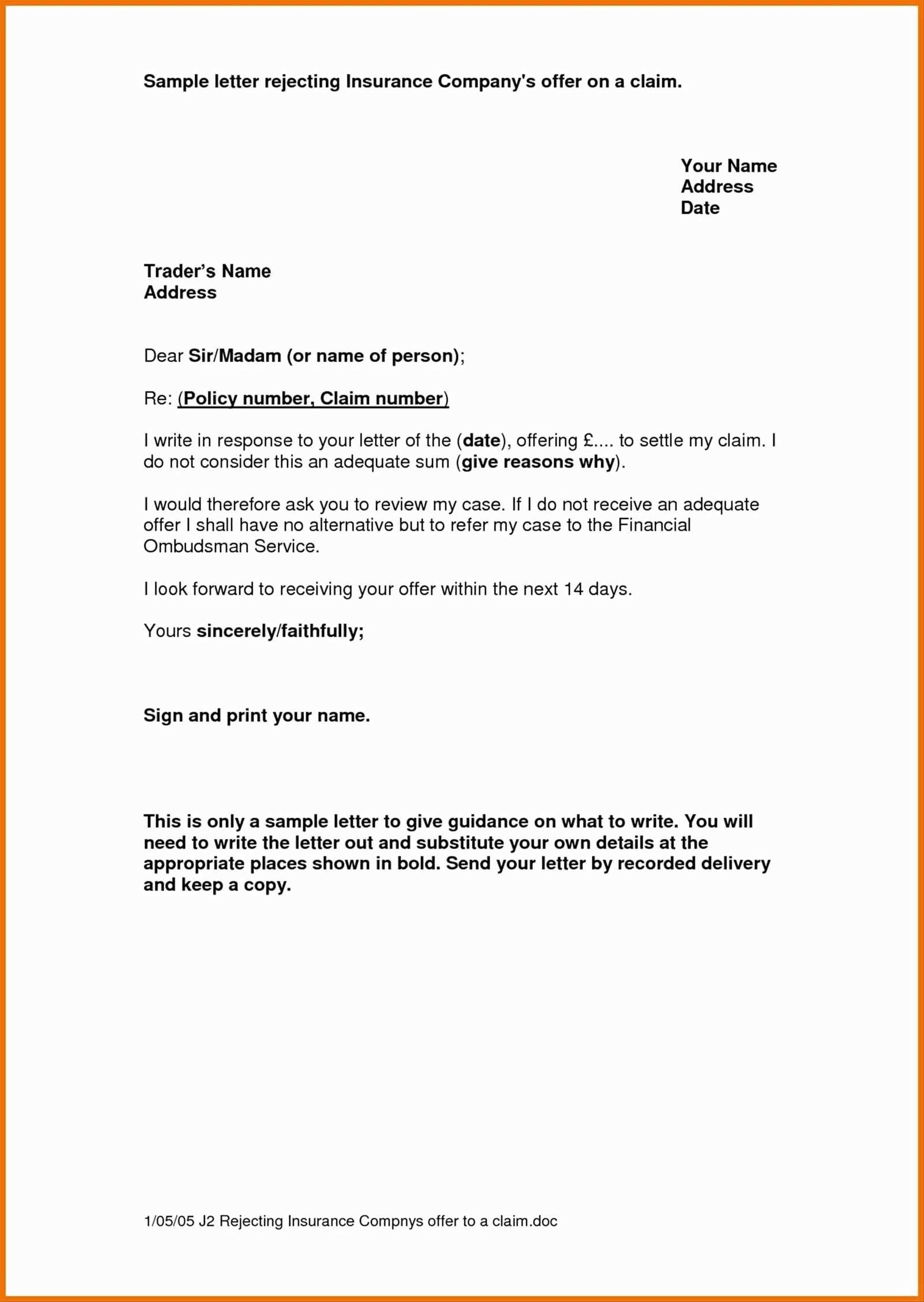

When sending a force placed insurance letter, ensure that the language is clear, direct, and legally compliant. Include details such as the borrower’s name, loan information, and a specific timeline to purchase insurance. Here is an example template that addresses the key points effectively:

Sample Force Placed Insurance Letter

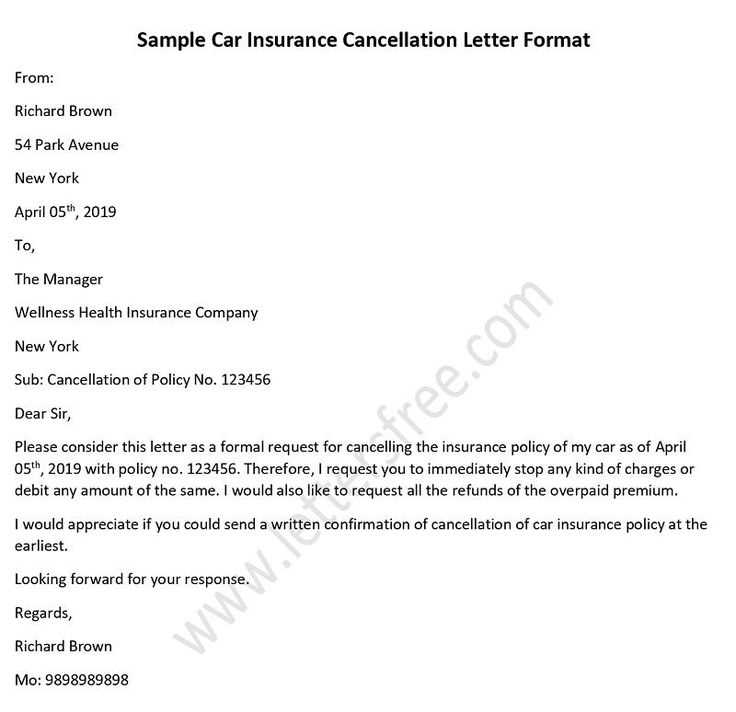

Dear [Borrower’s Name],

This letter serves as formal notification that, as of [Date], we have placed insurance coverage on your property located at [Property Address] due to the absence of required proof of insurance. According to the terms of your loan agreement, you are obligated to maintain insurance on the property. Our records indicate that no insurance policy has been provided to us for verification.

Please note, the cost of this coverage will be added to your account, and the premium amount will be reflected in your upcoming payment. You have until [Date] to provide us with valid proof of your own insurance coverage. Failure to do so will result in continued force-placed coverage at a higher rate, as outlined in your loan terms.

If you have already secured insurance or need assistance in updating our records, please contact us immediately at [Contact Information].

We urge you to address this matter promptly to avoid additional fees and complications regarding your loan.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

Understanding Force Placed Insurance

Force placed insurance is a policy that a lender purchases on behalf of a borrower when the borrower fails to maintain their own insurance coverage. Lenders typically take this step to protect their financial interest in the property. The borrower is then responsible for reimbursing the lender for the cost of the insurance policy.

How It Works

When a borrower’s homeowner’s insurance lapses, the lender has the right to purchase insurance to cover the property. This policy is often more expensive than a standard homeowner’s policy, and the borrower must pay for it. The insurance covers the property but not the borrower’s personal liability or contents, which are typically included in regular homeowner policies.

Cost Comparison

Force placed insurance premiums are generally higher than those of personal policies due to the limited coverage they offer. Borrowers should contact their lender as soon as possible to restore their own coverage to avoid the added expense of force placed insurance.

| Policy Type | Coverage | Cost |

|---|---|---|

| Personal Homeowner Insurance | Comprehensive coverage, including property and liability | Lower premiums |

| Force Placed Insurance | Property-only coverage, no liability or personal contents | Higher premiums |

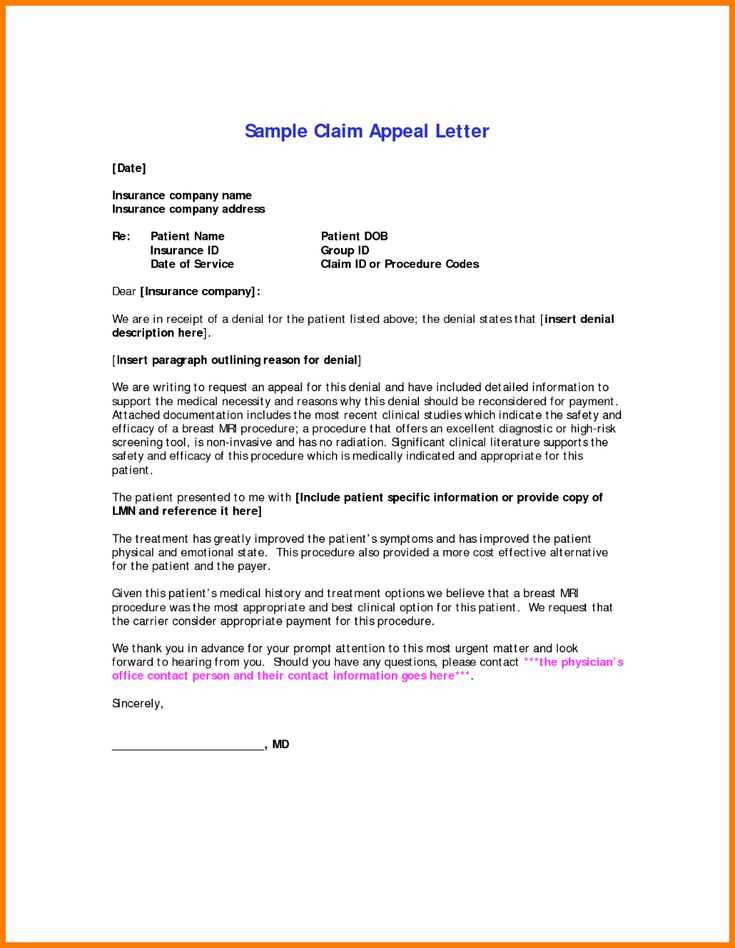

Key Elements to Include in a Letter

Clearly state the purpose of the letter at the beginning. Ensure the recipient understands why they are receiving it. Specify the type of coverage being provided and the time frame. Include detailed information about the premiums and any applicable charges.

Specific Details on Coverage

Outline the specific insurance coverage included in the policy. Provide clear information on what is covered and any exclusions. This helps avoid misunderstandings later on. Be transparent about what the recipient can expect from the policy.

Call to Action

Finish the letter with clear instructions. Ask the recipient to take specific steps, whether it’s paying premiums, providing additional information, or acknowledging the letter. Make it easy for them to understand what needs to be done next.

How to Address the Recipient

Use a direct and respectful tone when addressing the recipient in a force-placed insurance letter. Always begin with a clear salutation to establish a professional approach.

- For individuals: Use “Dear [Recipient’s Name]” if you know the person’s name. This creates a personalized connection.

- For a company: Use “Dear [Company Name]” or “To Whom It May Concern” when the recipient’s identity is unclear.

- If addressing a specific department: Use “Dear [Department Name], [Company Name].” For example, “Dear Claims Department, ABC Insurance.”

Avoid overly formal or generic terms that may feel detached. Be concise and clear in your salutation to maintain professionalism and respect for the recipient.

Legal Considerations in Force Placed Insurance

Ensure compliance with state and federal laws before placing insurance on a property. Lenders must follow specific regulations to avoid legal risks. Always notify the borrower in writing before enforcing force-placed insurance. Failure to do so can result in legal challenges, including fines or penalties.

State-Specific Laws

Each state has unique regulations regarding force-placed insurance. Check the laws in your jurisdiction to avoid non-compliance. Some states require specific timing for notification, while others limit the amount a lender can charge for such coverage. Ensure that your insurance premiums align with these restrictions.

Consumer Protection Laws

Under the Homeowners Protection Act (HPA), lenders are required to provide clear terms for insurance placement. Violating these provisions can lead to lawsuits and customer complaints. Always communicate the reason for placing the insurance, as well as the coverage details, to protect borrowers’ rights and prevent disputes.

Common Mistakes to Avoid

Ensure clarity in the language used. Ambiguous terms or unclear instructions lead to misunderstandings and disputes. Avoid generic phrases like “appropriate coverage” or “adequate protection.” Be specific about the policy type, coverage amount, and timeline.

1. Inaccurate Policy Details

Verify all policy information before issuing a letter. Mistakes such as incorrect policy numbers, coverage limits, or incorrect dates can delay the process and cause confusion. Double-check these details to prevent errors.

2. Lack of Timeliness

Sending the letter too late or too early can be problematic. Make sure the notice is sent in a timely manner, in line with contractual obligations, to avoid legal complications. It’s crucial that the letter meets the required deadlines.

Lastly, don’t overlook any required signatures or documentation. Missing signatures or attachments can delay the insurance placement process. Always ensure every part of the letter is complete before submission.

Next Steps After Sending the Letter

Once the force-placed insurance letter has been sent, follow these actions to ensure timely resolution and avoid delays:

Monitor for Response

Check for any response from the recipient. They may provide a payment, proof of existing insurance, or request clarification. Keep track of communication to prevent any miscommunication.

Confirm Coverage

- Verify that the insurance policy meets the necessary requirements outlined in the letter.

- Ensure that the insurance company has processed the coverage correctly.

Follow Up If Needed

If no response is received within the specified timeframe, send a polite reminder. Be clear about the consequences of non-compliance, such as the continuation of force-placed insurance.

Maintain Documentation

- Keep copies of the letter, any responses, and relevant communication for your records.

- Document any actions taken to resolve the matter.

Review the Situation Regularly

Monitor the situation regularly until the issue is resolved. If necessary, consult with a legal or insurance expert to explore further steps.