Gift Letter Down Payment Template for Homebuyers

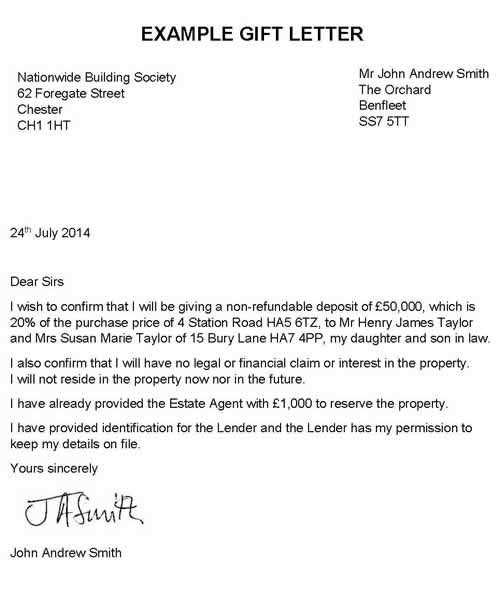

When purchasing a home, buyers often receive financial assistance from family or friends to help with the initial costs. This support must be documented correctly to meet the requirements of mortgage lenders. Proper documentation ensures that the funds are seen as a genuine gift and not a loan, which could affect the buyer’s financial standing. A clear and accurate record of this contribution can make the difference in securing approval for the home loan.

Importance of Proper Documentation

In order to maintain transparency and avoid any complications during the loan process, it’s crucial to provide the lender with the right kind of documentation. Lenders need to verify that the funds provided are indeed a gift, rather than a loan, as loans from non-lenders can impact the debt-to-income ratio. This documentation acts as an official statement, confirming the source and purpose of the funds, helping to clarify that there are no expectations for repayment.

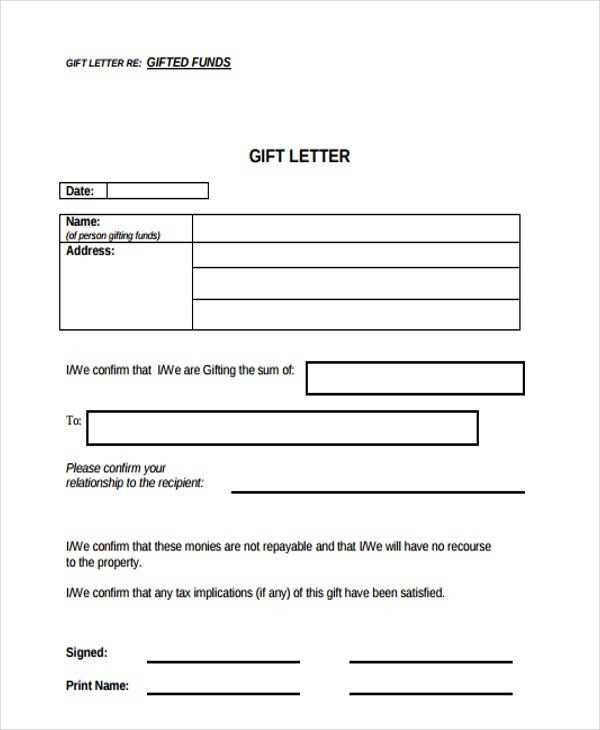

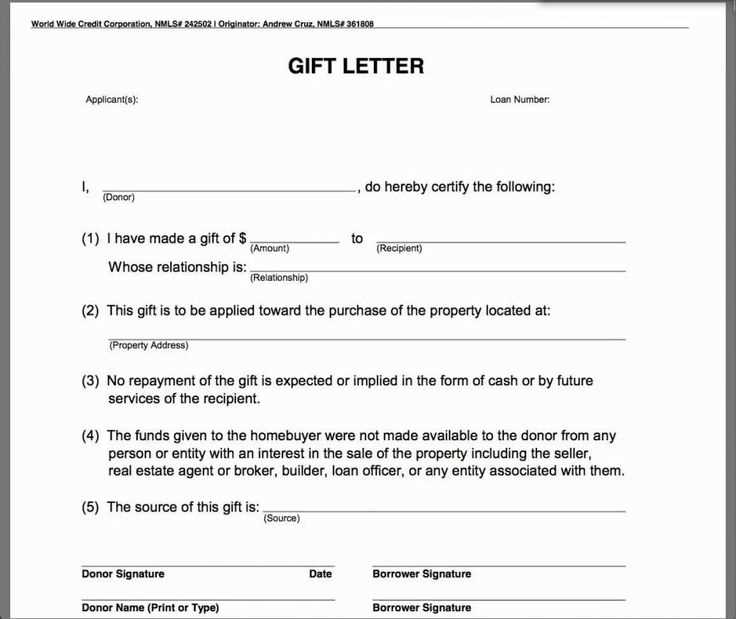

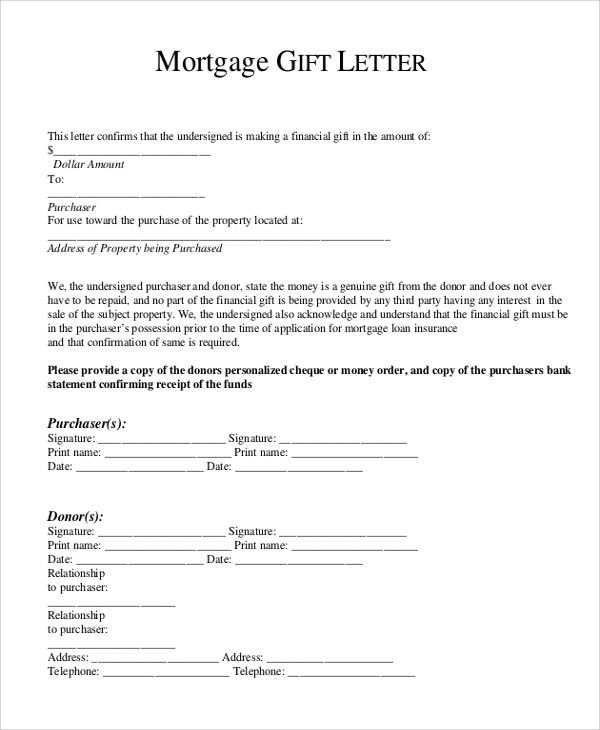

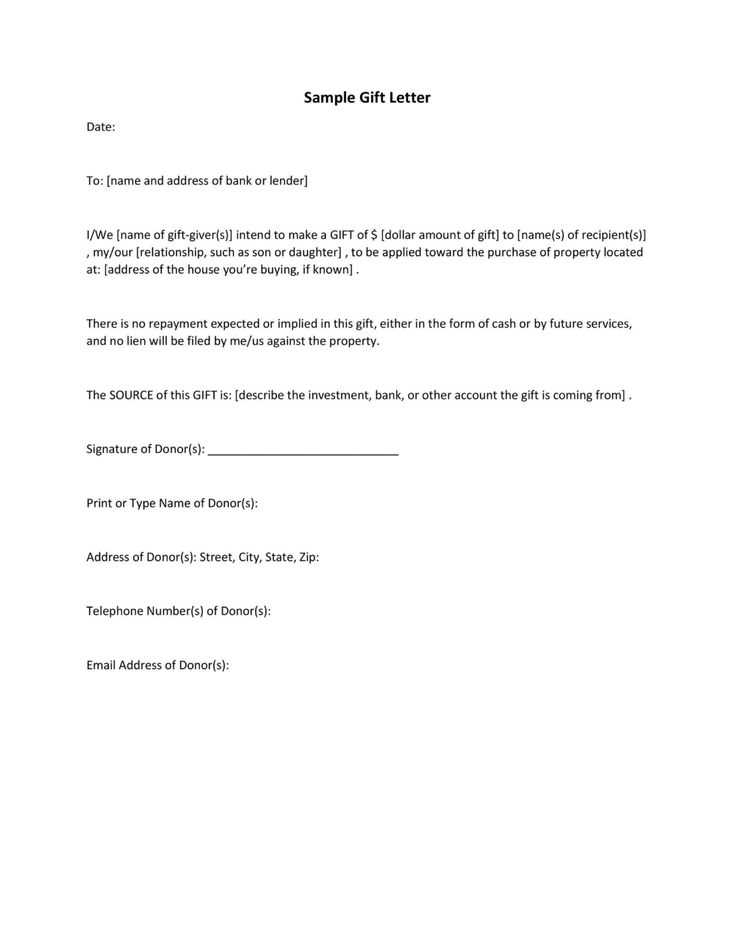

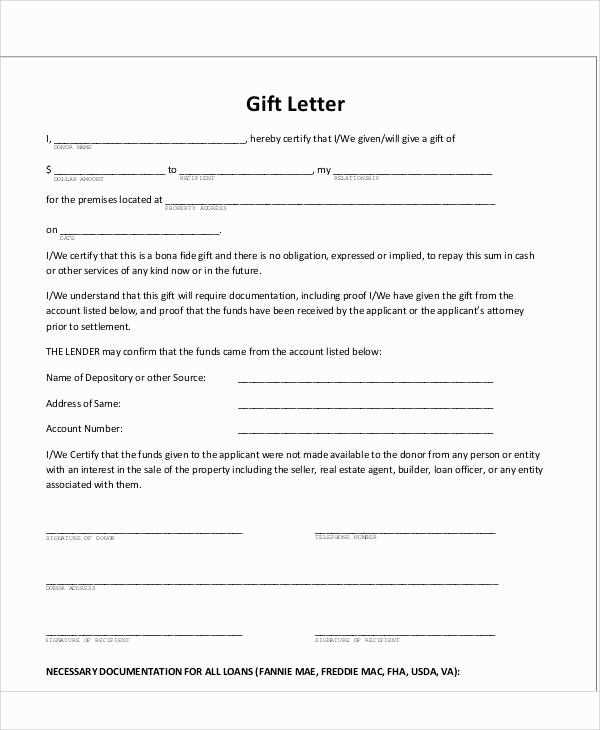

Key Components of the Document

- Donor’s Information: The person offering the financial assistance must provide their full name, relationship to the buyer, and contact details.

- Amount Given: The exact sum of money being offered should be clearly stated.

- Confirmation of No Repayment: A declaration confirming that the funds are a gift, with no expectation of repayment, is essential.

- Source of Funds: The donor may also need to provide evidence that the funds are theirs and legally available to give.

Steps to Ensure Accuracy

- Clarify the Relationship: Ensure the relationship between the donor and recipient is clear to avoid confusion.

- Provide Evidence: If necessary, supply additional documents that prove the legitimacy of the funds.

- Use a Template: Using a professionally designed format helps ensure all necessary details are included and presented clearly.

How It Affects Mortgage Approval

Mortgage lenders are cautious when assessing a borrower’s financial situation. If the funds are misrepresented or if there are doubts about their legitimacy, it could delay or prevent loan approval. On the other hand, properly documented assistance provides assurance to the lender, making the approval process smoother and faster. Clear and detailed documentation ultimately strengthens the buyer’s case and increases the chances of a successful loan application.

What is a Financial Contribution Statement?

Understanding Its Purpose in Homebuying

How to Create a Contribution Statement

Step-by-Step Process for Buyers

Information Needed for a Contribution Statement

Key Details for Accurate Documentation

Why Lenders Request Financial Assistance Documents

How It Influences Loan Approval

When purchasing a home, many buyers rely on financial support from family or friends to help cover initial costs. This assistance must be properly documented to meet the requirements of lenders. Clear documentation ensures that the contribution is recognized as a legitimate gift and not a loan, which could affect the borrower’s financial profile and debt obligations. Proper records are vital for the smooth approval of the mortgage application.

How to Create a Contribution Statement

Creating an official document to outline the financial support involves a few key steps. It is important to ensure that all necessary details are included and that the information is clearly presented. The statement should include the donor’s identity, the amount offered, a confirmation that it is a gift, and an assurance that the funds are not expected to be repaid. This makes the process easier for the buyer and ensures that the lender receives all the required details.

Why Lenders Request Financial Assistance Records

Lenders require these documents to verify that the assistance provided to the buyer is not a loan. Loans from family members or friends that are not documented could impact the borrower’s debt-to-income ratio, which is a critical factor in mortgage approval. By having a well-documented statement, the buyer assures the lender that there are no additional liabilities, which helps in the approval process.