Gift Letter for Mortgage Template in the UK

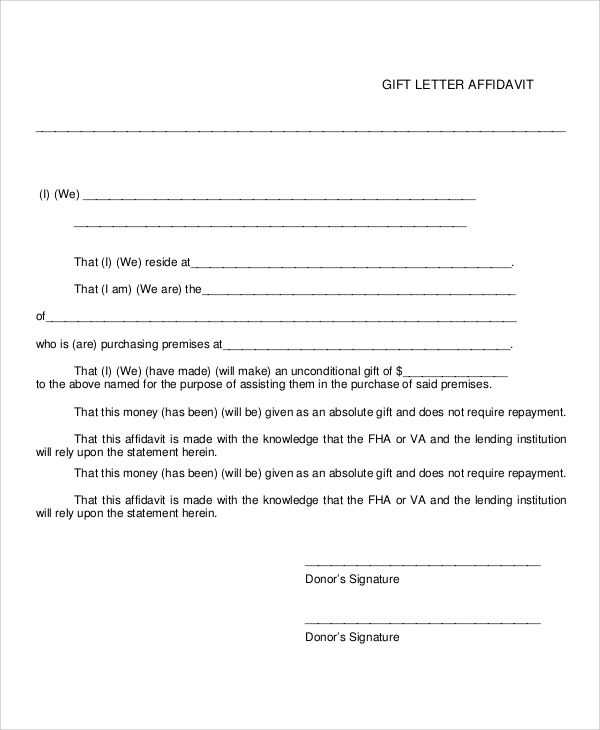

When securing a home loan, some individuals may receive assistance from family members or friends to meet the necessary financial requirements. This support is often formalized through a written statement, confirming that the funds are a gift and not a loan that needs to be repaid. Such declarations are vital for lenders to assess the legitimacy of the financial help provided.

These statements serve as official proof that the contribution is given freely without expectation of repayment. They offer clarity to both parties and help avoid any confusion that could arise during the loan approval process. Knowing how to create such documents properly is essential for those looking to secure a home loan with external financial help.

Proper documentation can simplify the approval process and ensure smooth communication between the borrower and the lender. Understanding what needs to be included in such an agreement is crucial to avoid delays or complications when applying for a loan.

When applying for a home loan, it is common for borrowers to receive financial support from family members or friends. To ensure that these contributions are clearly understood by the lender, it is essential to provide a formal statement that specifies the funds are being given without the expectation of repayment. This documentation plays a critical role in the loan process, helping to clarify the nature of the financial assistance.

Clarifying the Terms of the Contribution

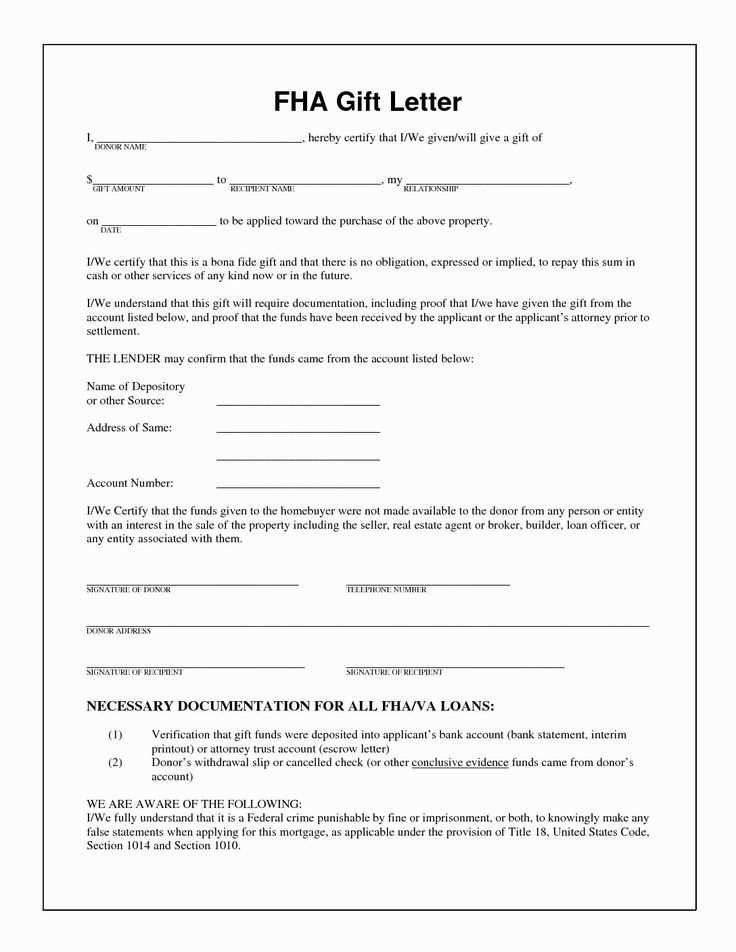

In many cases, lenders require proof that the amount offered is a true gift and not a loan. Without this confirmation, the loan could be rejected, as it might raise concerns about the borrower’s ability to repay the loan. The declaration confirms that no repayment will be expected, giving both parties peace of mind and ensuring transparency.

Helping Smooth the Loan Approval Process

Providing the proper paperwork can significantly speed up the approval process. When a lender sees that all necessary documentation is in place, they can more quickly verify that the financial support is legitimate, which may result in fewer delays and a smoother approval process overall.

| Required Information | Why It’s Important |

|---|---|

| Relationship between the donor and borrower | Helps confirm the nature of the gift and its authenticity. |

| Amount of the contribution | Clearly shows the financial support being offered. |

| Statement that no repayment is expected | Assures the lender that the funds are a gift, not a loan. |

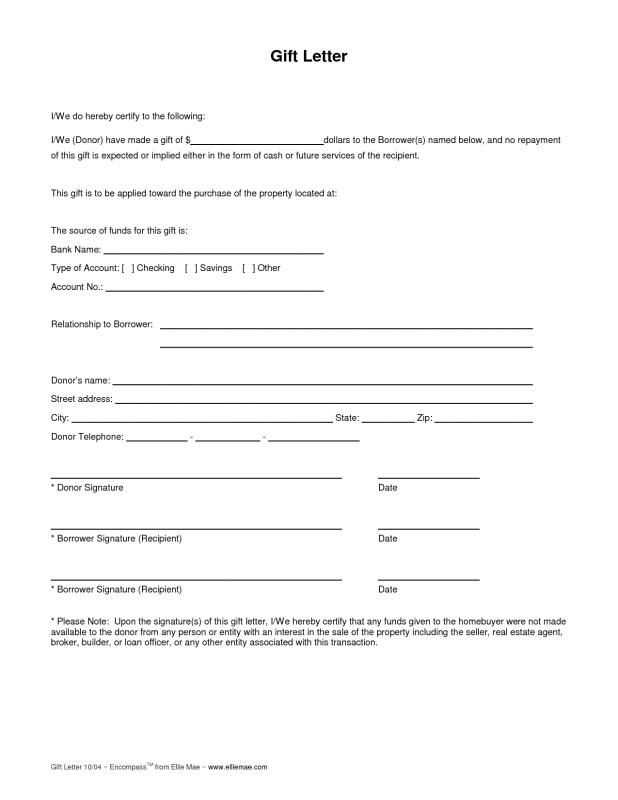

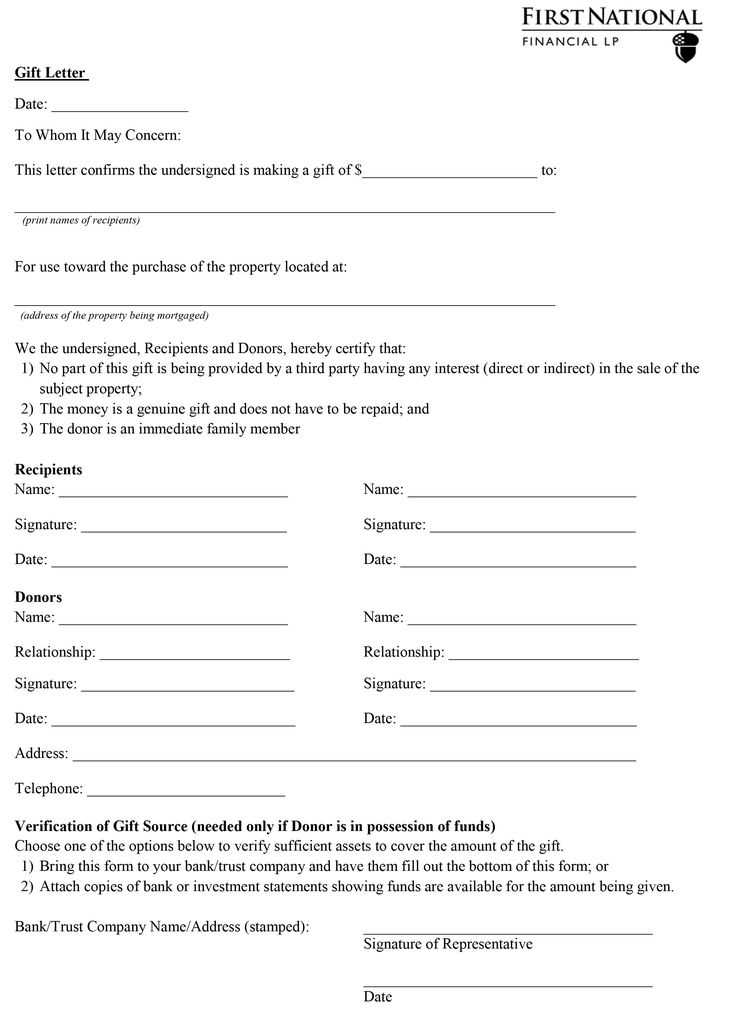

Essential Details for Financial Declarations

When submitting a document to confirm a financial contribution, it is crucial to include specific information that makes the agreement clear and legally binding. These details ensure that both the lender and the borrower have a mutual understanding of the nature of the funds and help avoid any misunderstandings during the loan application process.

- Relationship between the contributor and borrower: This helps to confirm the legitimacy of the donation and ensures there are no conflicts of interest.

- Amount of the financial support: Clearly state the amount being provided to avoid any ambiguity or confusion regarding the contribution.

- Statement of non-repayment: A clear indication that the money is being given without any expectation of repayment is necessary to prevent it from being considered a loan.

- Date of the contribution: Including the date helps verify the timing of the support and may be relevant to the loan application process.

- Contributor’s contact information: Providing full contact details for the person offering the support adds credibility to the document.

By including these essential elements, you can ensure that the document meets the requirements set by lenders and helps facilitate the loan approval process.

Who Can Provide Funds for Loans

When applying for a loan, many individuals seek external financial help from trusted sources to strengthen their application. These sources of support often come from people who have a personal relationship with the borrower, ensuring the funds are provided with no expectation of repayment. Knowing who is eligible to offer such assistance is vital for both the borrower and the lender during the approval process.

Family Members

Typically, family members are the most common contributors, offering financial support due to their close relationship with the borrower. This can include parents, siblings, grandparents, or even extended family. Such contributions are usually seen as genuine gifts, provided with no strings attached.

Close Friends

In some cases, close friends may also step in to offer assistance when they have a strong bond with the borrower. While not as common as family support, friends with whom the borrower shares a deep relationship may also provide funds to help with the loan application process.

Steps to Create a Financial Support Document

Creating a formal document to confirm a financial contribution is a simple yet important process. This written statement ensures that the financial support is clearly understood and accepted by the lender, helping to avoid any misunderstandings. Following the proper steps to prepare the document will streamline the loan application process and provide all necessary information for approval.

To start, gather the key details such as the amount of support being offered, the relationship between the contributor and the borrower, and a clear statement indicating that no repayment is expected. These elements will help create a transparent and valid document for the loan process.

Next, ensure that the contributor’s contact details, along with the date the funds are given, are included in the document. This additional information helps verify the authenticity of the support and provides further clarity to the lender. Once the document is completed with all required details, both the contributor and borrower should review it to confirm its accuracy before submission.

Common Errors to Avoid in Documents

When preparing a formal statement to confirm financial assistance, it’s important to avoid common mistakes that can cause confusion or delay the loan approval process. Accuracy and clarity are essential to ensure the document serves its intended purpose. Below are some of the most frequent errors and how to prevent them.

- Missing Key Information: Failing to include necessary details, such as the amount of financial support or the relationship between the parties involved, can lead to complications. Make sure all relevant information is clearly stated.

- Incorrect Dates: Providing inaccurate or incomplete dates can make the document seem unreliable. Always double-check the dates to ensure they align with the transaction.

- Ambiguity in Intent: The document should explicitly state that the funds are a gift with no expectation of repayment. Lack of clarity on this point may raise questions about the nature of the contribution.

- Unverified Contact Information: Not including valid contact details for the contributor can undermine the credibility of the document. Always verify and provide accurate information.

- Failure to Review: Rushing through the process without reviewing the document can lead to overlooked mistakes. Take time to ensure everything is correct before finalizing the statement.

Avoiding these errors will ensure that your statement is clear, reliable, and accepted by the lender, helping to smooth the loan application process.

How Gifts Impact Loan Approval

Financial contributions from external sources can play a significant role in securing a loan, especially when the borrower’s savings are insufficient. Lenders typically assess the stability and reliability of these funds before approving a loan. The way in which these contributions are documented and presented can greatly influence the decision-making process. Understanding the impact of these contributions is crucial for ensuring the loan application proceeds smoothly.

When funds are provided by a close associate, such as a family member or friend, lenders usually require clear documentation to confirm that the money is indeed a gift with no expectation of repayment. If these contributions are not properly disclosed or documented, the lender may question the source of funds and whether they could affect the borrower’s ability to repay the loan. Proper documentation ensures that the financial support is viewed favorably and doesn’t hinder the approval process.

Additionally, accurately representing the nature of the contribution can help avoid delays or rejections. A well-prepared statement that outlines the terms of the support provides transparency and helps the lender assess the overall financial situation of the borrower more confidently.