Gifted letter template uk

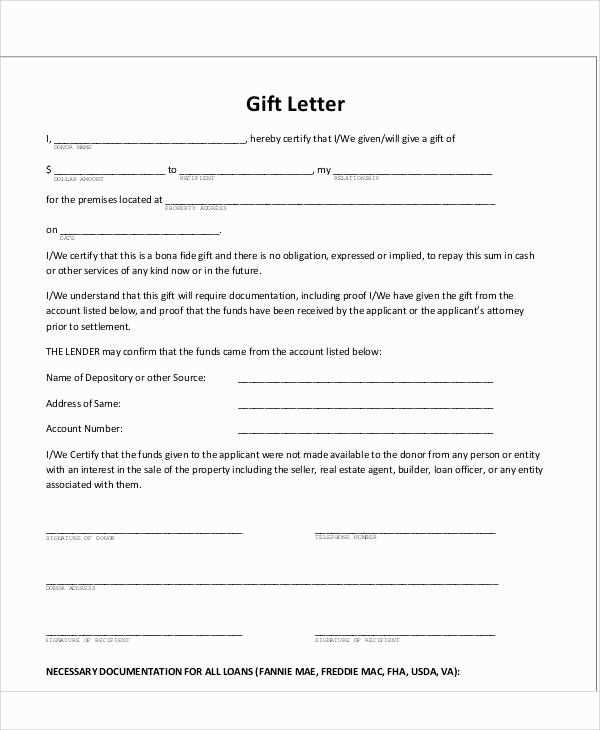

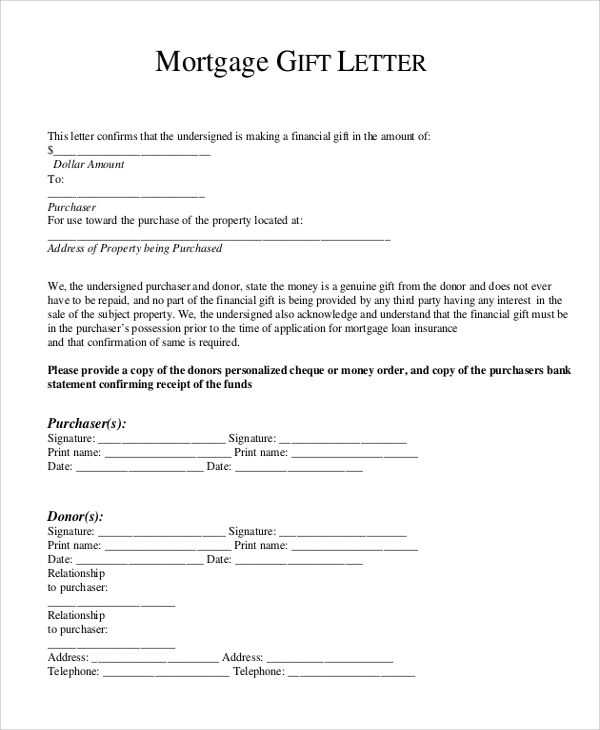

When writing a gifted letter in the UK, it’s important to ensure clarity and legality. The letter should clearly state the intention behind the gift, whether it’s monetary or another asset. Make sure to include the recipient’s name and address, as well as the value or nature of the gift.

Start with a direct statement that establishes the nature of the gift. For instance, if you’re giving money, explicitly mention the amount and clarify that no repayment is expected. For non-monetary gifts, describe the item or asset in detail.

Next, include any relevant information that would help confirm the authenticity of the gift. If the gift involves property or items of significant value, consider including receipts or any other proof of ownership. This helps avoid confusion or complications down the line.

Finally, finish the letter with a clear signature, dated and with any necessary legal formalities, such as a witness if required. Always double-check the gift tax laws in the UK to ensure compliance, as certain gifts may trigger tax obligations depending on the amount or type of asset transferred.

Here’s the revised version, with repetition reduced while preserving the meaning:

To create a more concise and clear letter, focus on removing redundant phrases and unnecessary details. Instead of repeating points, rephrase sentences to convey the message more directly. This makes the content easier to understand while keeping the key ideas intact.

Clarify and Shorten Sentences

For example, avoid using multiple sentences for a single idea. Combine related points to make the message more straightforward. Eliminate unnecessary qualifiers like “just” or “only” to maintain clarity and precision.

Be Direct and Specific

Specificity helps reduce confusion. Replace vague terms with precise descriptions. Rather than saying “I believe this is important,” say, “This is crucial.” This eliminates fluff and enhances the letter’s impact without altering its meaning.

Gifted Letter Template UK

How to Write a Letter for HMRC Compliance

What Information Should Be Included in a Gift Letter?

Common Mistakes to Avoid When Writing a Gift Letter

Understanding Gift Letter Requirements for Property Transfers

How to Address the Donor and Recipient in Your Gift Letter

Steps to Submit Your Gift Letter to HMRC

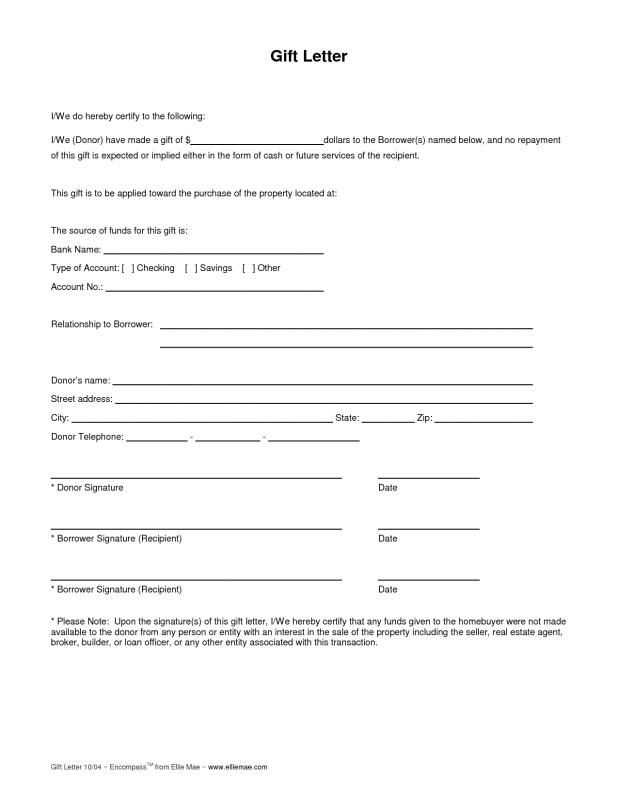

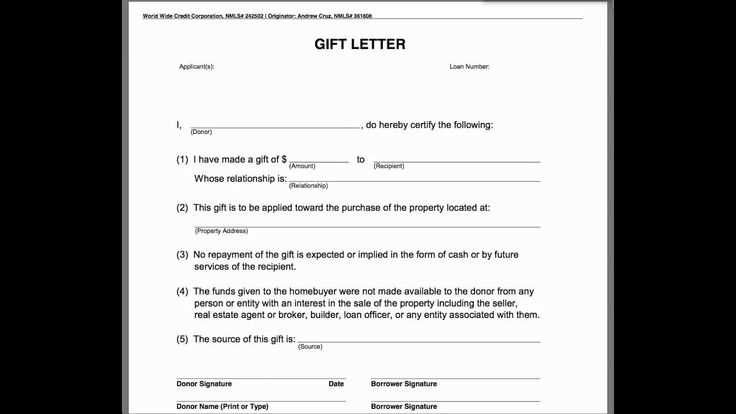

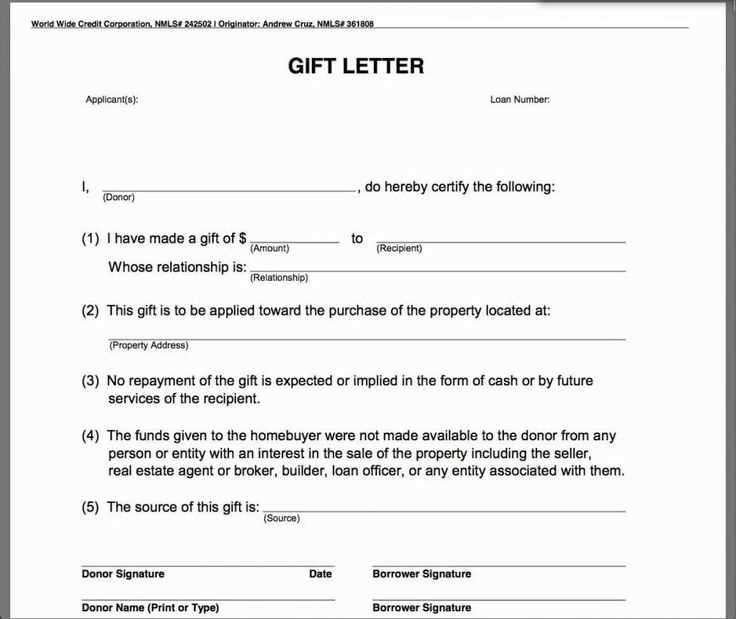

Start with clear and precise information. The gift letter should clearly outline that the donor is giving a monetary or property gift without any expectation of repayment. Ensure you mention the full names and addresses of both the donor and the recipient. Include the relationship between the two parties to confirm that the gift is legitimate and not a loan. It’s important to state the value of the gift and confirm that it is being given voluntarily, with no conditions attached.

What Information Should Be Included?

Include the date of the gift, the value of the gift, and any specific details related to the item or funds being transferred. For property gifts, mention the property address and confirm that there are no strings attached. Be sure to state the donor’s intent to give the gift without any future claims or repayment requirements.

Common Mistakes to Avoid

Avoid vague language. Be specific about the nature and value of the gift. Do not omit details about the relationship between the donor and recipient. Failing to mention whether the gift is a loan or a true gift can create complications with HMRC. Ensure the letter is signed and dated by both parties to validate the transaction.

To ensure compliance with HMRC, submit the letter along with any required supporting documentation, such as bank statements or proof of the gift’s transfer. Double-check that the details are accurate and complete before submitting the gift letter to HMRC.