How to Write a Goodwill Adjustment Letter Template

When it comes to managing your financial reputation, there are times when certain negative marks on your record may not fully reflect your overall reliability. In such situations, you can reach out to creditors to ask for reconsideration of these entries. A well-crafted appeal can lead to the removal or adjustment of unfavorable information, helping to improve your credit standing.

To make this process effective, it’s essential to approach the issue with a well-structured message that clearly conveys your situation and reasoning. This document serves as a formal request, outlining the circumstances and your efforts to resolve past issues. By presenting your case in the best possible light, you increase the chances of a favorable outcome.

Understanding how to communicate professionally and persuasively is crucial in such cases. A thoughtful appeal can often make a significant difference, showing the creditor your commitment to maintaining a positive financial relationship. The key is to focus on honesty, clarity, and the steps you’ve taken to improve your financial behavior.

What is a Goodwill Adjustment Letter

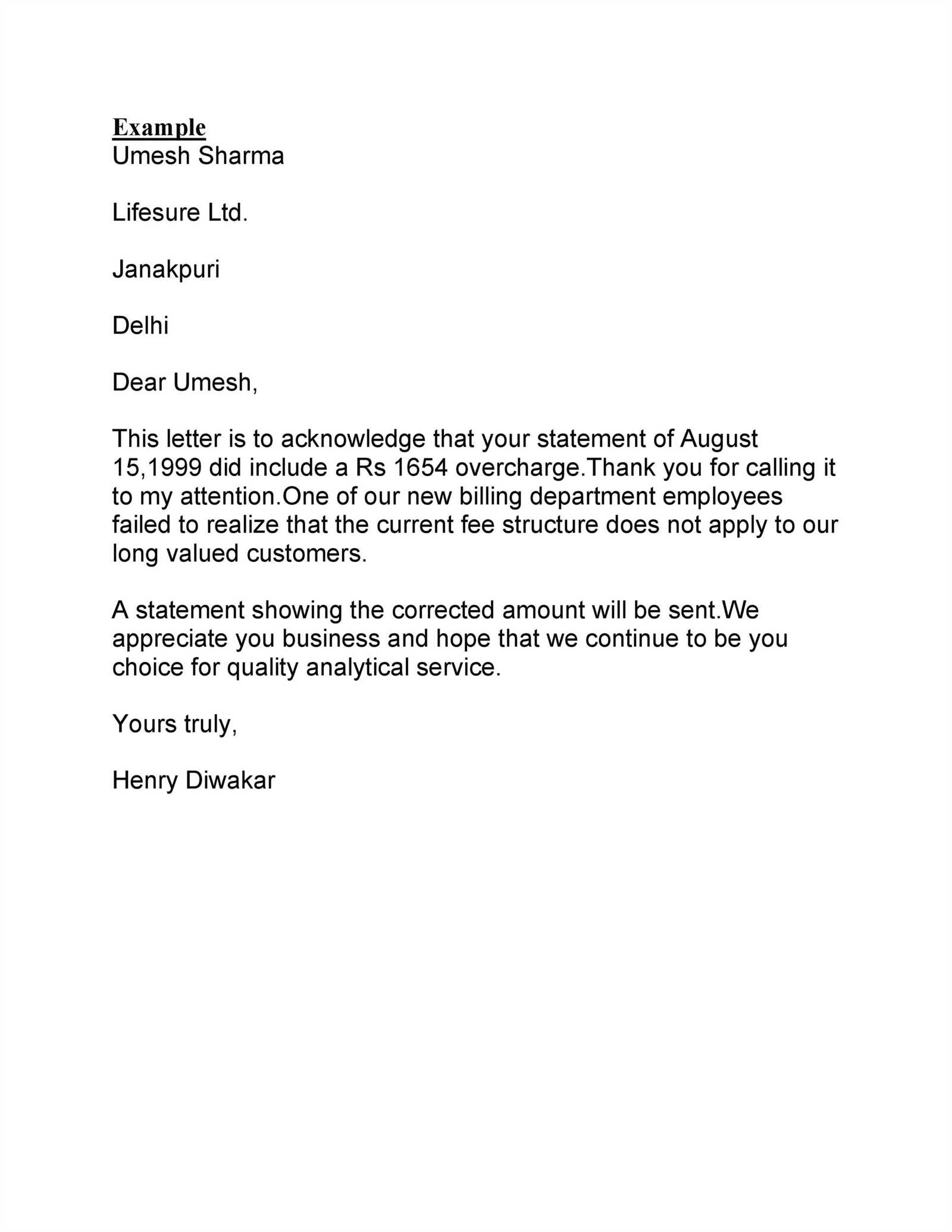

At times, individuals may find themselves with negative entries on their credit report that do not accurately reflect their current financial habits. In such cases, a formal communication can be sent to creditors or reporting agencies, requesting them to reconsider the listed information. This type of communication serves as a request to modify or remove certain marks that may be damaging to one’s credit profile.

Essentially, this written request explains the context behind the negative entry and provides reasons why it should be removed. It is an opportunity for individuals to present their case in a respectful and professional manner, highlighting any improvements they have made in managing their finances. The goal is to persuade the recipient to show understanding and offer a more favorable update to the credit record.

Understanding Its Role in Credit Repair

In the process of improving one’s financial standing, addressing negative information on a credit report is a crucial step. When an individual notices unfavorable entries that do not accurately represent their current financial behavior, taking action can make a significant difference. A formal request to the creditor or reporting agency can potentially lead to the removal or modification of these entries, which can positively impact one’s credit score.

How It Helps Repair Your Credit

By submitting a well-crafted request, you open the door to having certain negative items reconsidered or removed. This is particularly beneficial for individuals who have demonstrated significant improvement in their financial habits but are still affected by past mistakes. This approach gives creditors an opportunity to look at the bigger picture and consider the steps the individual has taken to manage their finances responsibly.

When It Becomes an Effective Tool

This method is most effective when used under the right circumstances, such as when a person has paid off past debts, made timely payments, or experienced a one-time financial hardship that has been resolved. A formal request serves as a way to appeal for fairness and understanding, making it an essential tool in the credit repair process.

Essential Elements of a Goodwill Request

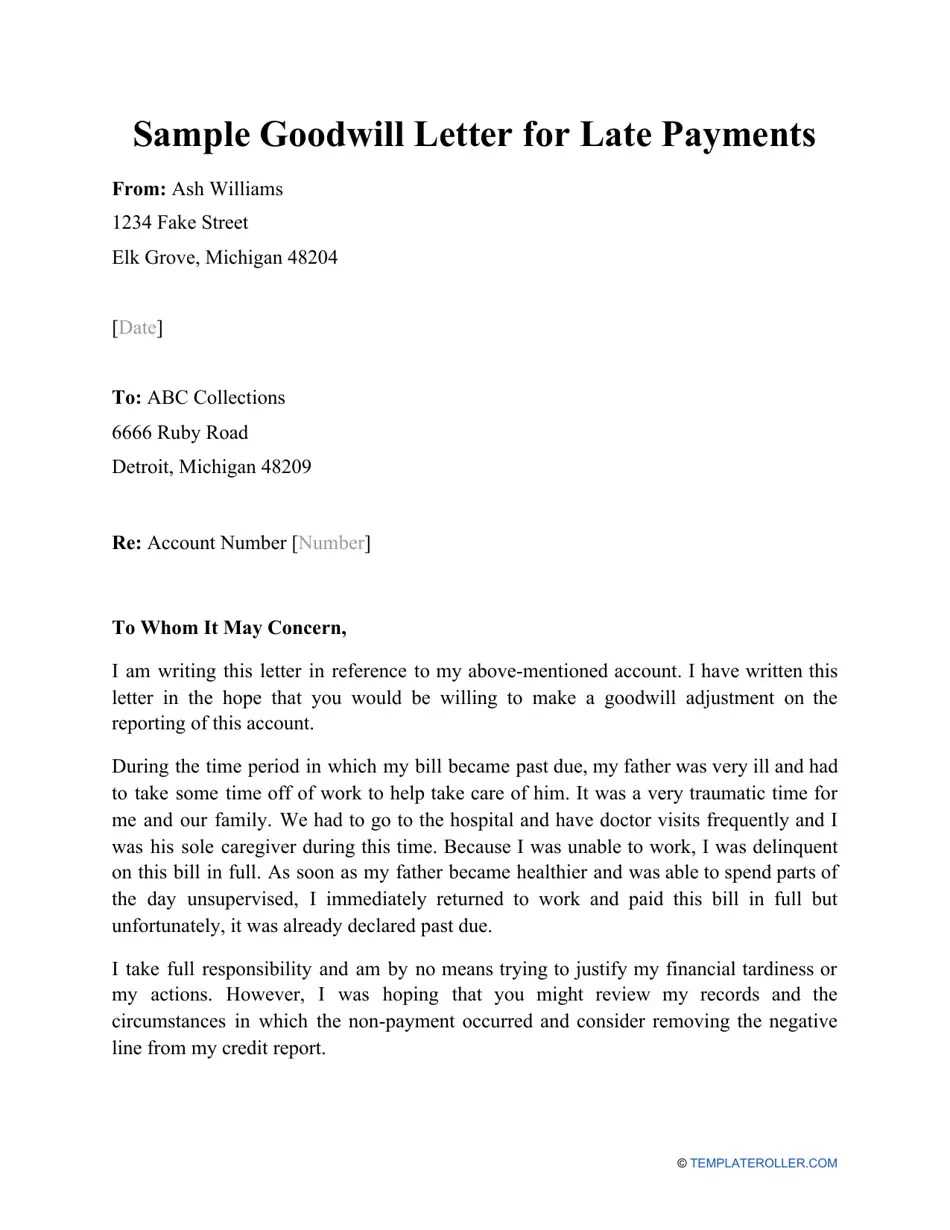

When crafting a request to modify or remove an entry from your credit report, it’s important to include specific details that make your case clear and compelling. This communication needs to be formal, concise, and focused on presenting a persuasive argument for reconsideration. By highlighting key points and explaining your situation effectively, you increase the likelihood of a positive response.

Clear and Concise Explanation

One of the most critical aspects of your request is providing a direct and honest explanation for why the negative entry should be adjusted. Clearly state any circumstances that led to the issue, such as a one-time financial difficulty or an error on the part of the creditor. By providing context, you help the recipient understand your situation better and make a case for fairness.

Professional Tone and Positive Framing

Maintaining a professional tone throughout your message is crucial. Even though you are asking for a favor, it’s important to frame your request positively and respectfully. Avoid sounding confrontational or demanding. Instead, show appreciation for the recipient’s time and consideration, which helps establish a cooperative atmosphere.

Key Components to Include for Success

To increase the chances of having a favorable outcome, it’s essential to ensure that your communication includes the right components. A well-structured request should address the main points clearly and respectfully, while also presenting a strong case for reconsideration. Including the right information helps the recipient assess your request more effectively and improve the likelihood of a positive response.

Personal Information and Account Details

Start by providing your full name, account number, and other relevant personal details to ensure that the recipient can easily locate your information. This step is critical for establishing the context of your request and ensuring that it pertains to the correct account.

Context and Explanation of the Issue

It’s important to explain the reason behind the negative mark, providing a clear narrative about the situation. Whether it was caused by a financial hardship, medical emergency, or an oversight, giving a detailed and honest explanation shows that you are proactive in addressing the issue and have taken steps to improve your financial behavior.

Request for Specific Action

Be sure to specify the exact outcome you are hoping for. Whether you are requesting a complete removal of the negative entry or simply an update to reflect your current standing, clarity about what you are asking for helps prevent misunderstandings and keeps the focus on the goal.

By including these elements in your request, you not only ensure clarity but also present yourself as organized and serious about resolving any issues on your credit report.

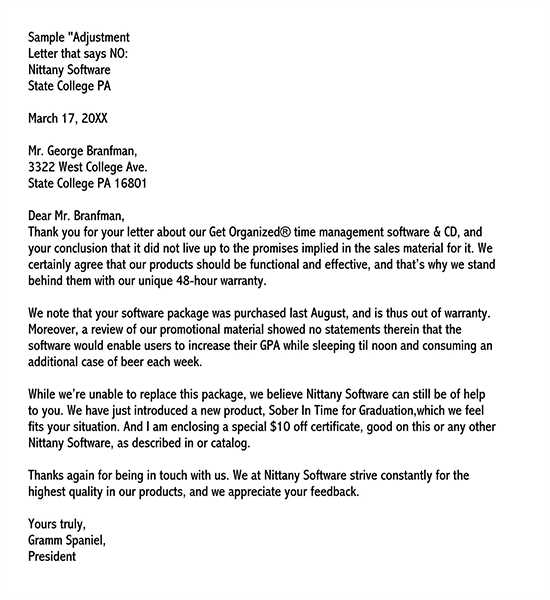

Tips for Writing an Effective Letter

Crafting a compelling and respectful request is key to increasing the likelihood of a successful outcome. The tone, structure, and clarity of your message can make a significant difference in how your appeal is received. By following a few best practices, you can ensure your communication is both professional and persuasive.

| Tip | Explanation |

|---|---|

| Be Direct and Clear | State your request upfront and make it easy for the recipient to understand what you’re asking for. Avoid unnecessary details or lengthy explanations. |

| Maintain a Polite and Respectful Tone | Even though you’re requesting a favor, always be courteous and professional in your language. A positive approach increases the chances of a favorable response. |

| Provide Supporting Information | Include any relevant details that strengthen your case, such as dates of payments made, steps taken to improve your financial behavior, or other factors that may influence the decision. |

| Keep It Concise | Avoid making your message too lengthy. Focus on the key points and ensure your request is easy to follow. |

| Proofread Before Sending | Check your communication for grammar, spelling, and clarity before sending. A well-written request reflects positively on you and your intentions. |

By incorporating these tips into your request, you present yourself as a responsible and organized individual, increasing the likelihood that your appeal will be considered favorably.

Best Practices for Clear Communication

Effective communication is essential when making a request to modify or remove an entry from your credit history. Ensuring that your message is clear and easy to understand not only improves the chances of success but also helps to establish trust and professionalism. Following a few key practices can make a big difference in how your message is received.

- Be Brief and to the Point: Avoid unnecessary elaboration. Stick to the core issue and clearly state your request.

- Use Simple and Direct Language: Keep the language straightforward. Avoid jargon or overly complex terms that might confuse the reader.

- Stay Organized: Present your points in a logical order. Use paragraphs and bullet points to break up information and make it easier to follow.

- Avoid Emotional Language: While it’s important to provide context, refrain from using overly emotional or accusatory tones. Stick to the facts.

- Focus on the Positive: Highlight the steps you’ve taken to improve your financial situation and any positive changes that have occurred since the issue arose.

By adhering to these practices, you ensure that your communication is both effective and professional, increasing the likelihood of a positive outcome for your request.

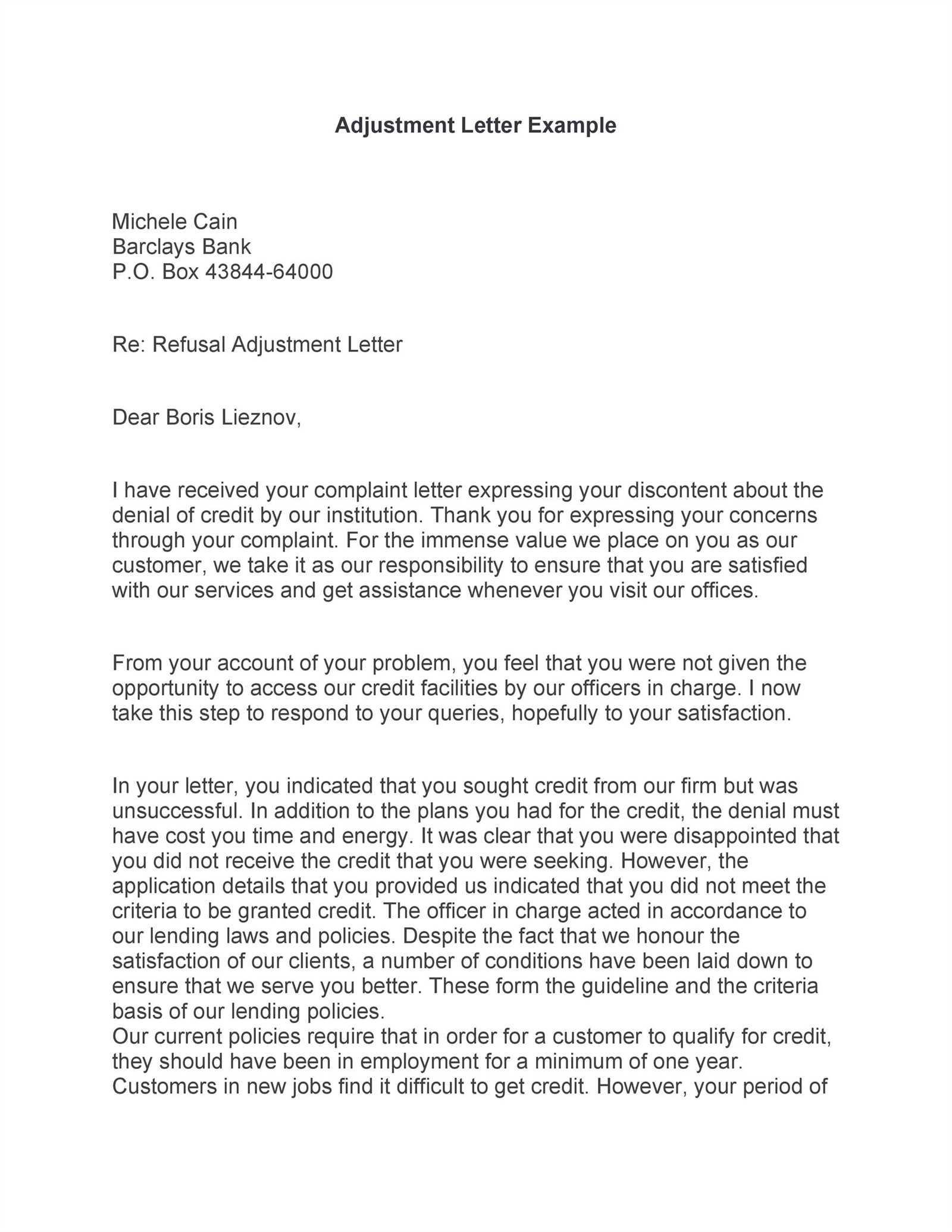

Common Mistakes to Avoid

When requesting a modification to your credit report or a reconsideration of an entry, it’s important to approach the process carefully. Mistakes in your communication can hinder your chances of success and may even damage your credibility. Being aware of common errors can help you avoid setbacks and increase the likelihood of a favorable response.

Poorly Structured Requests

- Lack of clarity: Failing to clearly state your request can lead to confusion and delay in processing.

- Excessive detail: Overloading your request with unnecessary information can make it difficult for the recipient to focus on the key points.

- Unfocused language: Using vague or ambiguous language without a clear call to action reduces the effectiveness of your appeal.

Emotional or Negative Tone

- Blaming others: Avoid pointing fingers or blaming the company. This approach often backfires and can make your request seem unprofessional.

- Overly apologetic tone: While acknowledging any mistakes is important, an overly apologetic tone can make you appear uncertain and less likely to succeed.

- Threatening language: Using threats or ultimatums can be counterproductive. Stay respectful and professional in your approach.

By recognizing and avoiding these common mistakes, you ensure that your communication remains professional, clear, and persuasive, giving you a better chance of success in your appeal.

Errors that Could Hurt Your Request

When reaching out to request changes to your credit history or an exception, certain mistakes can significantly reduce your chances of success. Understanding the types of errors that can harm your appeal is crucial to crafting a compelling and effective message. These missteps can not only weaken your case but also make your request seem less credible.

- Inaccurate Information: Providing incorrect or outdated details, such as the wrong dates or amounts, can undermine your credibility and weaken your position.

- Lack of Documentation: Failing to provide sufficient supporting evidence or relevant records that support your claim can make it difficult for the recipient to validate your request.

- Ignoring Company Policies: Not understanding or respecting the policies and procedures of the organization you’re communicating with can lead to rejection. Make sure you are familiar with their guidelines before submitting your appeal.

- Being Too Demanding: Asking for immediate action or making unreasonable demands can create a negative impression. Be respectful and realistic with your expectations.

- Failure to Follow Up: Not following up after submitting your request could lead to delays or the request being overlooked. A polite reminder shows your commitment to resolving the issue.

Avoiding these errors helps ensure your communication remains professional, effective, and increases the likelihood of a positive outcome.