Goodwill Deletion Letter Template to Remove Negative Marks

htmlEdit

Understanding Removal Requests

What is a Credit Removal Request

How to Write a Request for Removal

Step-by-Step Guide to Drafting a Request

When to Use a Removal Request

Best Time for Sending a Request

Improving Your Credit Score with Removal

How Removing Negative Items Helps

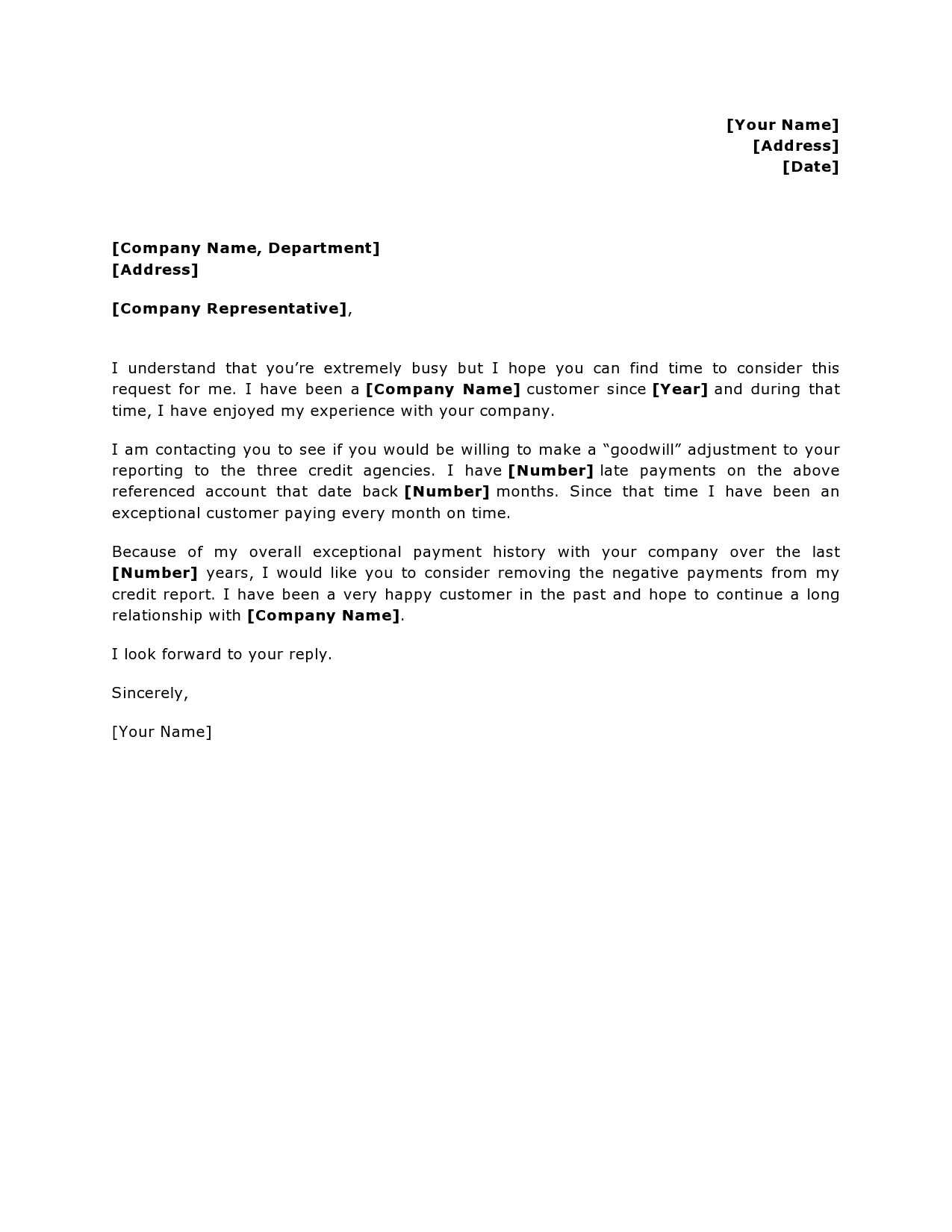

Removing negative information from your credit report can significantly improve your financial standing. Many people face situations where their credit score is impacted by mistakes or late payments that occurred in the past. A request to remove these items, under specific circumstances, is a method used by individuals to seek a better credit profile. This process involves communicating with credit bureaus or lenders to request the removal of inaccurate or outdated information.

What is a Credit Removal Request?

A credit removal request is a formal appeal made to credit bureaus or creditors to ask for the removal of negative marks from a credit report. These requests typically occur in cases where the individual believes there has been an error or when they want to ask for forgiveness for a past financial mistake. The aim is to have those items removed in order to potentially improve the individual’s credit score.

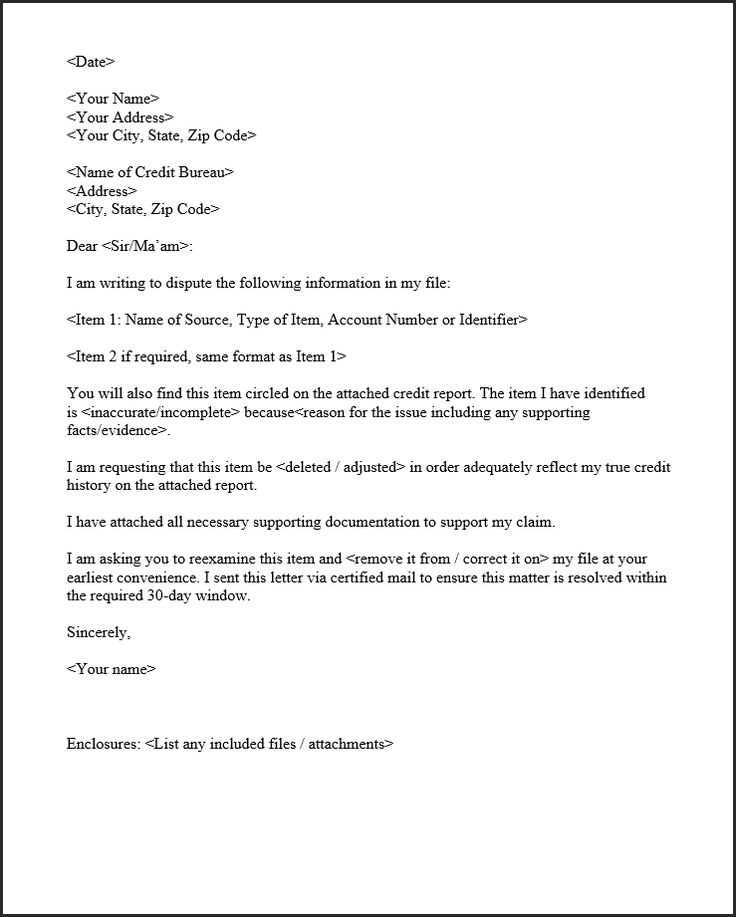

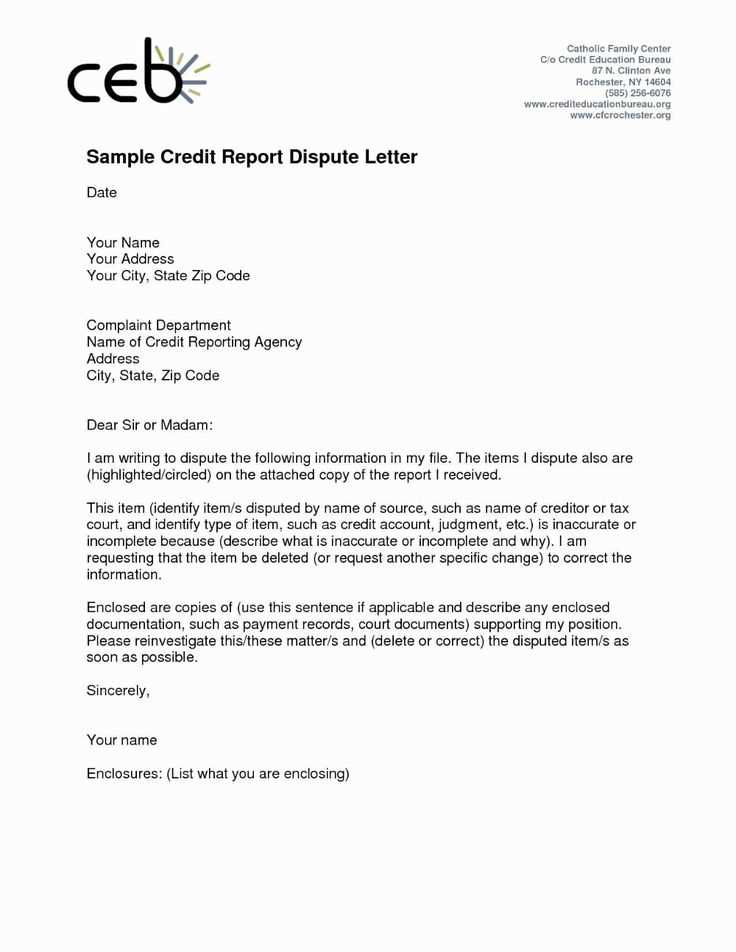

How to Write a Request for Removal

To draft a successful removal request, it’s important to be clear and concise. Start by addressing the appropriate party, whether it’s a credit bureau or a lender. Clearly explain the reason for your request, providing any supporting evidence that proves your case. Remain professional in tone, and express gratitude for their consideration. Always include relevant details such as account numbers, dates, and specific issues you wish to be resolved.

Following these steps can help you improve your credit score by eliminating unfavorable marks that could be limiting your financial opportunities. Removing negative items not only boosts your score but can also increase your chances of securing favorable loans or credit terms in the future.