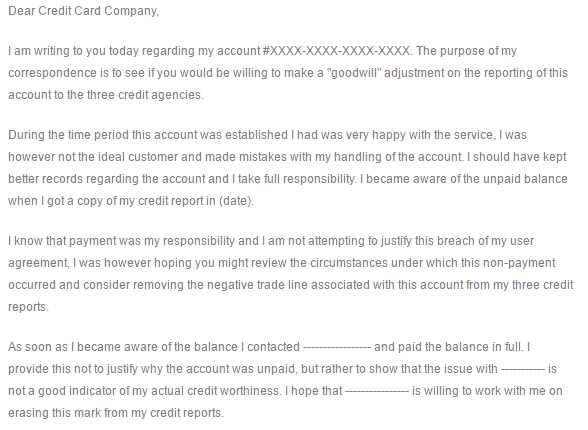

Goodwill forgiveness removal letter template

To begin the process of goodwill forgiveness removal, a well-structured letter is key. Be clear, concise, and respectful when drafting your message. Acknowledge your past actions, express regret, and present the situation in a way that highlights your commitment to improving moving forward.

Start with a direct request for the removal of the goodwill forgiveness, explaining why you believe it should be reconsidered. This is your opportunity to demonstrate that you’ve learned from the past and are committed to better financial habits. Acknowledge the impact of the decision, but focus on your readiness to improve.

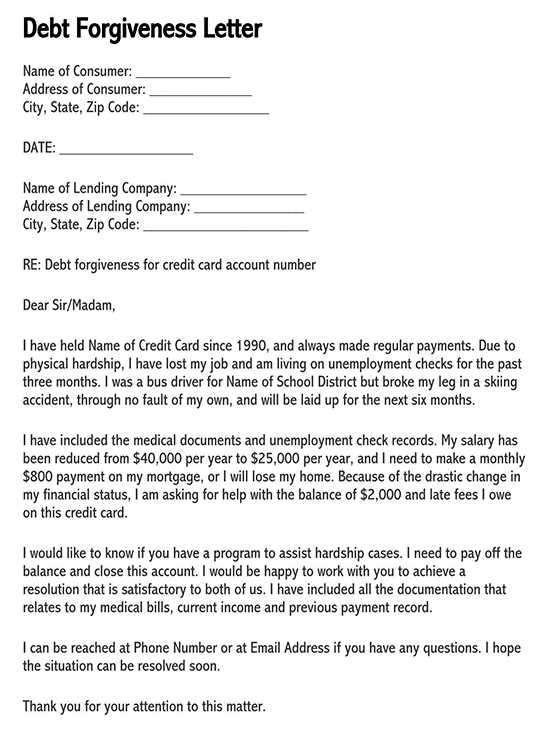

Provide context and reasoning behind your request. Explain any mitigating circumstances that led to the mistake, such as unexpected financial hardships or other valid reasons. Be transparent, but avoid over-explaining or sounding defensive. The goal is to show accountability without making excuses.

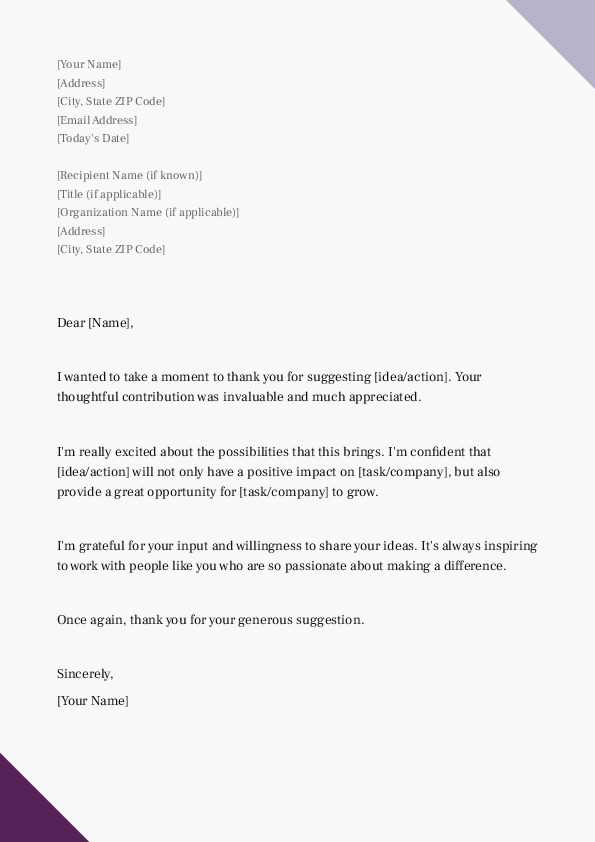

Close with gratitude and a positive tone. Thank the recipient for considering your request and express appreciation for their time and attention. Let them know you’re looking forward to a favorable response and are committed to fulfilling any future obligations without delay.

Here’s an improved version, where words do not repeat more than two or three times, and the meaning is preserved:

Begin by addressing the issue directly. Explain your situation clearly, without unnecessary details. State the reason for your request, highlighting the specific mistake or issue. If the error was minor or unintentional, emphasize that you’ve taken steps to prevent it from happening again. Apologize for any inconvenience caused but keep it brief and to the point.

Be polite but firm in your approach. Avoid long explanations or justifications. Keep the tone respectful and professional, focusing on what you need–removal of the mark or forgiveness of the mistake. Provide any supporting evidence that could help your case, such as records, emails, or correspondence that show your compliance or correction of the error.

End the letter by thanking the recipient for their time and consideration. Reaffirm your request and express hope for a positive resolution. Keep it concise, respectful, and clear, ensuring that each sentence adds value to your case.

Goodwill Forgiveness Removal Letter Template: A Step-by-Step Guide

Goodwill forgiveness allows you to request the removal of a late payment or negative mark from your credit report, often when it was a one-time mistake or due to exceptional circumstances. This process can play a significant role in repairing your credit. To make the most out of your goodwill request, follow this simple yet impactful guide.

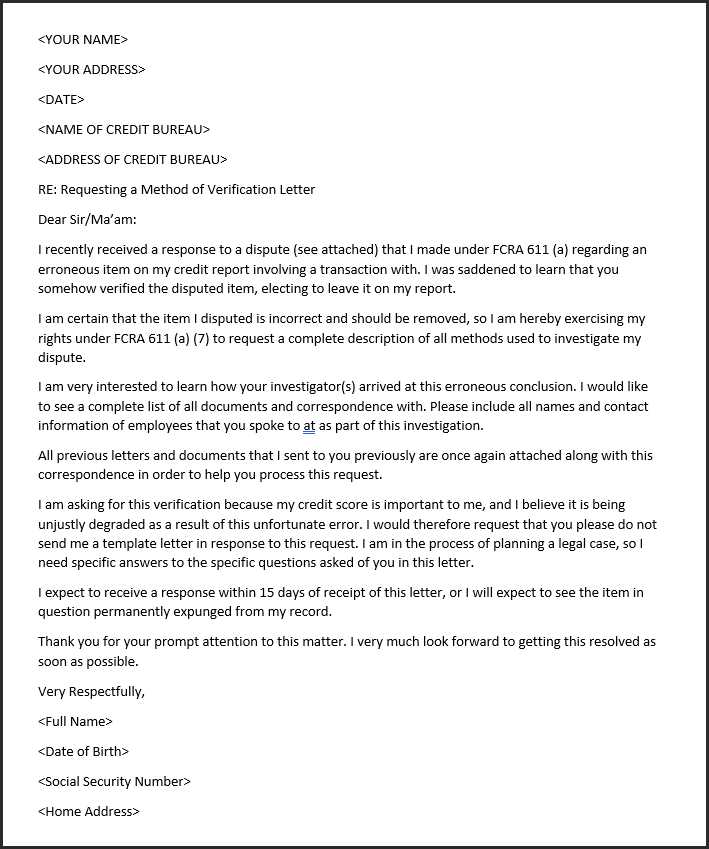

Key Details to Include in a Goodwill Removal Request: Clearly state your request to have the negative item removed. Start with your full name, address, and account details for easy identification. Explain the situation that led to the negative mark. Be honest, and make sure you acknowledge any mistakes, while also showing how you’ve since improved your payment habits.

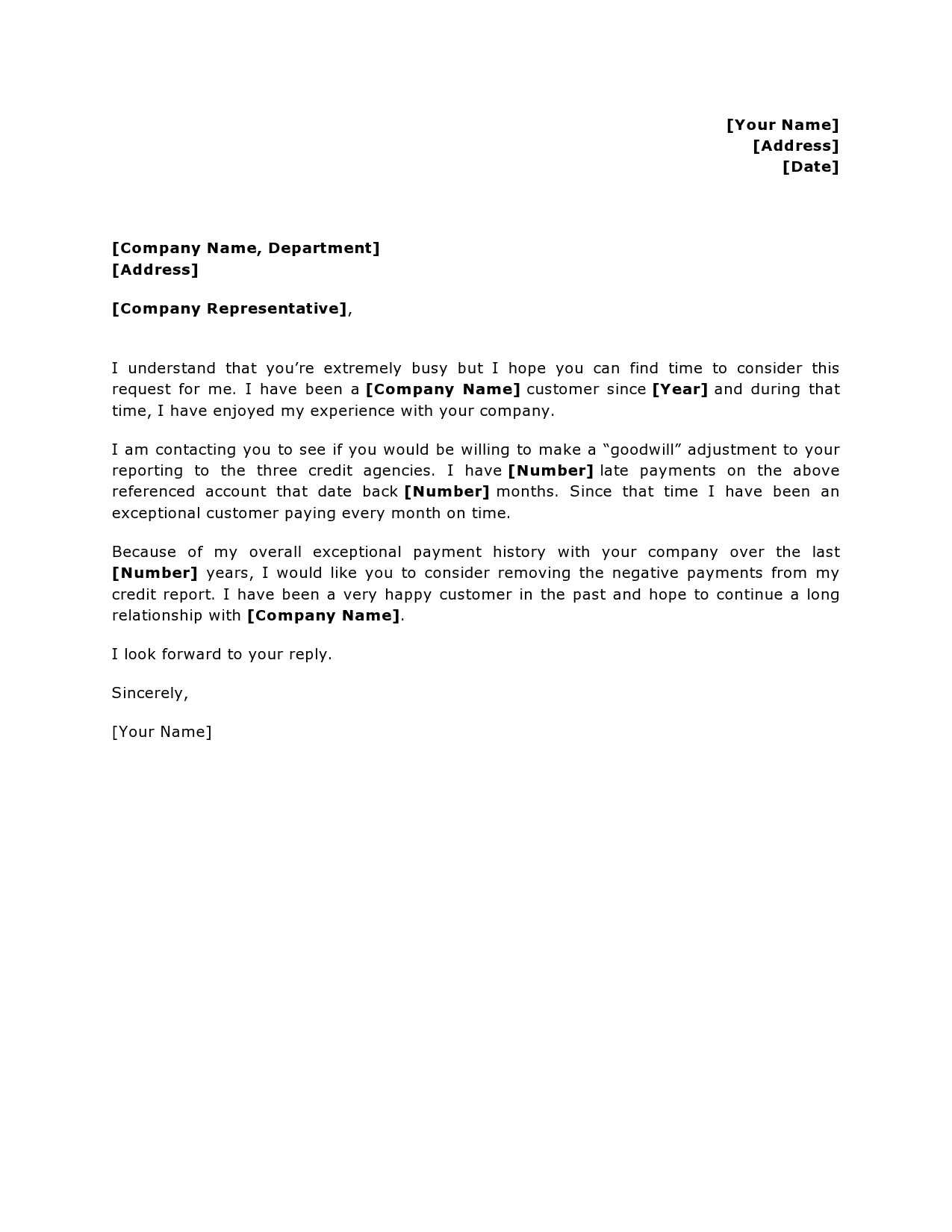

How to Customize Your Goodwill Letter for Maximum Effectiveness: Personalize the letter to reflect your unique situation. Mention how long you’ve been with the creditor and provide any proof of your improved financial behavior, such as on-time payments since the incident. Show appreciation for their previous support, and request the forgiveness as a favor based on your past positive relationship.

Common Pitfalls to Avoid When Writing a Goodwill Request: Avoid using a generic template that doesn’t reflect your individual situation. Don’t be too aggressive or demand the removal; a polite, respectful tone goes a long way. Keep your letter concise and focused–avoid unnecessary details that might detract from your main request.

When to Send Your Forgiveness Letter: Timing is Crucial: Timing matters. Send the letter when your account is in good standing, preferably after you’ve made several consecutive on-time payments. Avoid sending your request during a time when you’ve recently missed a payment or are facing other negative marks on your credit report.

What to Do After Sending the Goodwill Letter: Next Actions: After sending the letter, be patient. Creditors may take several weeks to respond. If you don’t hear back within a month, follow up with a polite reminder. If they deny your request, ask if there’s anything else you can do to resolve the issue, or consider other ways to repair your credit.

Thus, it sounds more varied, while keeping the meaning intact.

When requesting the removal of negative marks on your credit report or seeking goodwill forgiveness, be clear and respectful in your communication. Use precise language to explain why you believe your situation deserves special consideration. Mention any positive history you have with the creditor to strengthen your case.

Instead of using overly complex phrases, focus on sincerity. Express your desire to resolve the issue and highlight any circumstances that led to the mishap. Ensure your tone is polite and professional, avoiding any demands or entitlement, while showing appreciation for their time and consideration.

Providing specific details, such as the date of the missed payment and any corrective actions you’ve taken, can help make your request more compelling. Keeping your letter concise yet informative allows the recipient to quickly understand your situation without unnecessary fluff.

Finally, make sure your letter ends with a positive note, thanking the creditor in advance for reviewing your request. Being gracious, even if they deny your request, leaves the door open for future communication.