Goodwill letter template to remove closed account

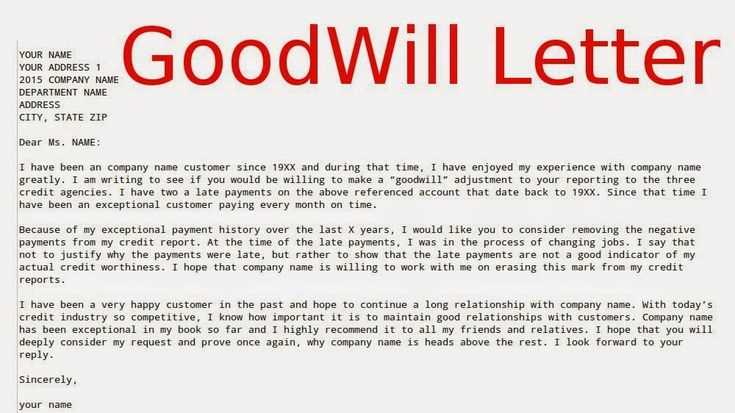

Requesting the removal of a closed account from your credit report requires a clear and polite approach. Begin by addressing the credit bureau or lender directly, stating your request succinctly and professionally. A goodwill letter is your opportunity to ask for a correction or a change, even if the account is marked as closed and the activity is accurate. It’s important to acknowledge any mistakes you made and show a commitment to improving your financial situation moving forward.

In your letter, express understanding of the impact a closed account can have on your credit score, but highlight any extenuating circumstances that contributed to the situation. Be specific about your reasons for requesting the removal, whether due to an error, a misunderstanding, or because the account was paid off but still reflects negatively. Keep the tone respectful and appreciative, recognizing the lender’s discretion in granting your request.

Include all relevant details such as your account number, dates, and any correspondence with the creditor. It’s also helpful to mention any positive financial steps you have taken since the account was closed. This can include improved payment habits, new accounts in good standing, or any other actions that demonstrate your commitment to better financial health.

Here’s the revised version:

Begin your goodwill letter by directly addressing the creditor or the credit bureau. Acknowledge the closed account and express your desire to resolve any negative impacts it may have caused to your credit report.

Clearly state that the account was closed in good standing or explain any circumstances that led to the closure. Offer an explanation of why the account was not settled or reported accurately, if applicable. Be honest but concise in this section.

Request the removal of the account from your credit report as a goodwill gesture. Emphasize your positive payment history with them, if relevant, and the steps you have taken to maintain a better credit behavior. Highlight that this will greatly help you moving forward.

Conclude by expressing your appreciation for their consideration and understanding, and provide your contact details in case they need further information to process your request. Keep your tone polite and respectful throughout the letter.

Goodwill Letter Template for Removing a Closed Account

Understanding the Purpose of a Goodwill Letter

How to Address the Creditor or Lender Correctly

Key Elements to Include in Your Letter

Choosing the Right Tone and Language for Your Request

Steps to Take After Sending the Letter

Common Mistakes to Avoid When Writing a Goodwill Letter

A goodwill letter can help remove a closed account from your credit report, particularly if the account was closed in good standing or due to a one-time issue. To make your letter effective, start by addressing the creditor directly, and state your intent clearly: you’re requesting the removal of the closed account from your credit file for goodwill purposes.

How to Address the Creditor or Lender Correctly

Use the full name of the creditor or lender and their title. If possible, find the name of the person handling such requests (such as the customer service manager or credit department head). This personal touch helps ensure the letter is directed to the right person and makes your request more likely to be considered.

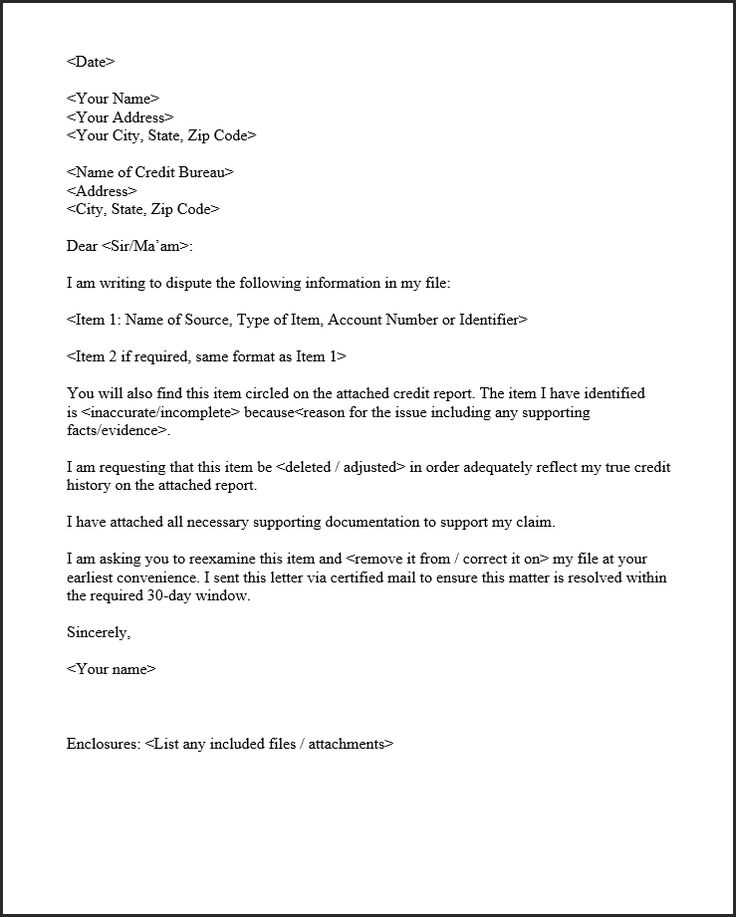

Key Elements to Include in Your Letter

Include your full name, address, account number, and the specific reason why you’re requesting the removal. Be concise but thorough. Mention any positive history you had with the creditor (e.g., timely payments, long account relationship). Explain the situation that led to the closed account, particularly if it was a result of a one-time error or hardship. Offer to provide any supporting documentation, like a financial hardship statement, if relevant.

In your request, emphasize that the removal of the account is important for your credit score and financial wellbeing. Acknowledge any mistakes but keep the tone polite and professional. Request the goodwill removal and express your appreciation for their consideration.

Choosing the Right Tone and Language for Your Request

Maintain a polite, respectful tone throughout the letter. Avoid sounding demanding or too emotional. A calm, clear, and straightforward approach works best. Express understanding of the creditor’s policies but highlight how removing the account would help you. Keep your language formal, and avoid slang or casual expressions.

Steps to Take After Sending the Letter

After sending your goodwill letter, give the creditor some time to respond. If you don’t hear back in 30 days, follow up with a polite email or phone call to inquire about the status of your request. If the request is denied, consider asking for clarification or making a more specific appeal.

Common Mistakes to Avoid When Writing a Goodwill Letter

Avoid being overly aggressive in your tone or making unrealistic demands. Don’t forget to double-check for any errors in your account details or the creditor’s name. It’s also important not to send the same letter multiple times, as this could appear unprofessional. Lastly, don’t ignore any negative marks on your credit that you haven’t addressed–focus on the specific account you want removed.

Meaning and Structure Remain Intact, but Redundancies Are Minimized.

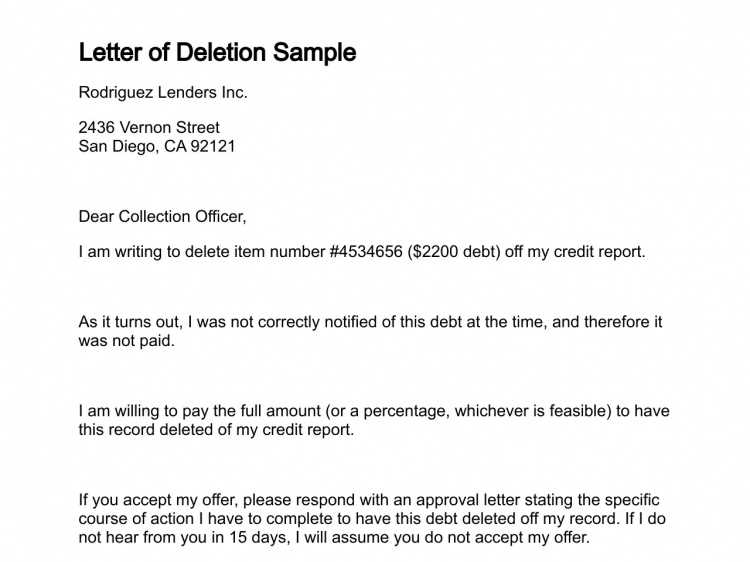

Begin by clearly identifying the purpose of your letter: requesting the removal of a closed account from your credit report. Make sure to address the letter to the appropriate party–either the credit bureau or the lender. State the account was closed by the company and explain that you are seeking a goodwill adjustment. Keep the tone polite yet direct, and avoid over-explaining.

Maintain a Positive Tone

Use a respectful and understanding tone throughout the letter. Acknowledge that the closed account may be accurate but kindly request that, as a gesture of goodwill, it be removed from your report. Briefly mention your positive payment history or any extenuating circumstances that led to the account closure.

Provide Supporting Details

Be sure to include any relevant account details, such as account number, closure date, and any reference numbers. Provide a clear and concise explanation for your request, such as the impact on your credit score and how removal could benefit your financial situation. Avoid unnecessary details or excessive background information.