Goodwill Letter Template for Removing Late Payments

When it comes to managing your credit, having a positive history is crucial. However, sometimes mistakes happen, and negative marks can appear on your credit report. These marks can impact your financial future, affecting your ability to secure loans, mortgages, or even rent a home.

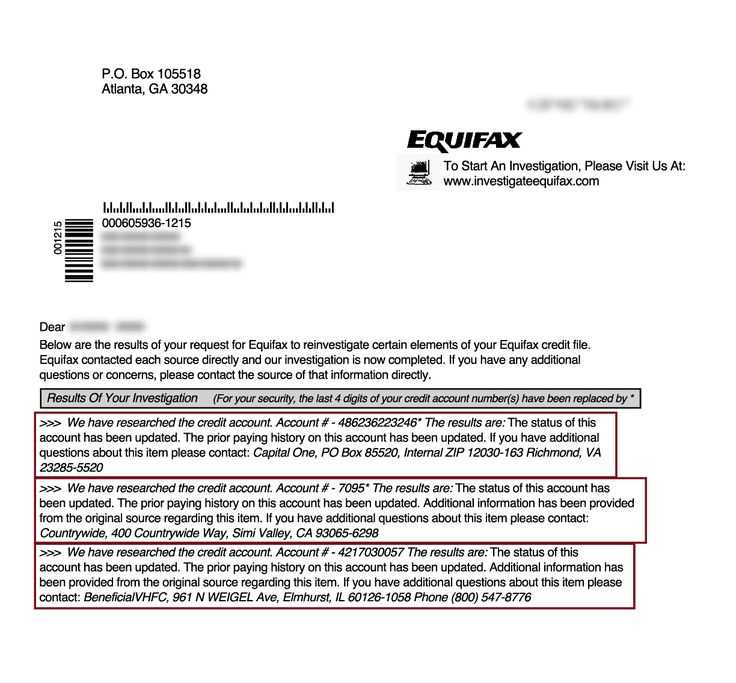

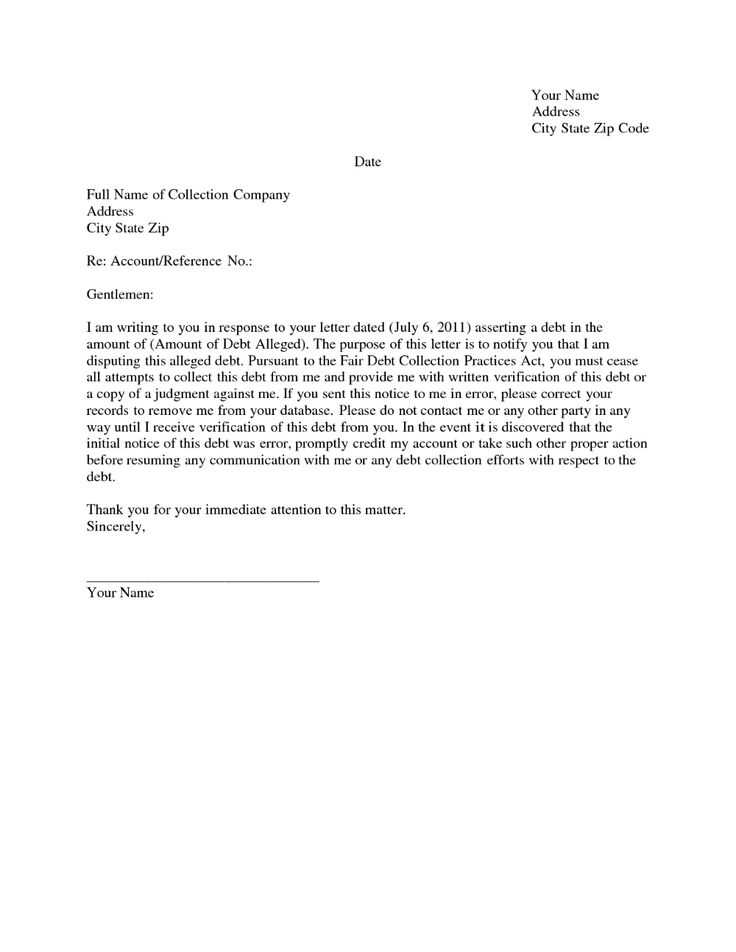

There are ways to address these blemishes, especially if they were made due to exceptional circumstances. One effective method involves reaching out to the creditor or reporting agency directly. By making a formal request, you can ask for a reconsideration of the reported information.

In this article, we will guide you through the process of drafting a respectful and clear request to help improve your financial profile. You will learn how to approach creditors, the essential elements to include, and when to send such a request to increase your chances of success.

When it comes to managing your credit, having a positive history is crucial. However, sometimes mistakes happen, and negative marks can appear on your credit report. These marks can impact your financial future, affecting your ability to secure loans, mortgages, or even rent a home.

There are ways to address these blemishes, especially if they were made due to exceptional circumstances. One effective method involves reaching out to the creditor or reporting agency directly. By making a formal request, you can ask for a reconsideration of the reported information.

In this article, we will guide you through the process of drafting a respectful and clear request to help improve your financial profile. You will learn how to approach creditors, the essential elements to include, and when to send such a request to increase your chances of success.

Explaining the Concept and Purpose

When managing financial obligations, unexpected circumstances may cause issues with your credit record. These issues can affect your ability to secure loans or other financial opportunities. In some cases, it may be possible to address these problems by reaching out to the company or institution involved.

Purpose of Making a Formal Request

The main objective of this approach is to ask for a reconsideration of certain entries that may have been recorded inaccurately or unfairly. Through this request, individuals aim to improve their credit standing by seeking understanding and flexibility from creditors or reporting agencies.

Why It Can Be Effective

When you reach out to the reporting agency or creditor with a well-structured appeal, it allows the possibility of correcting or updating records. While not all requests are successful, a respectful and clear approach increases the likelihood of a favorable outcome.

Benefits of Sending a Request

Reaching out to a creditor or reporting agency can have significant advantages, especially when seeking to improve your credit history. By making a formal appeal, you open the door to potential adjustments that can positively impact your financial profile.

Improving Your Credit Score

One of the primary benefits of submitting such a request is the potential to boost your credit score. If the issue is resolved in your favor, the adjustment can reflect positively on your credit report, improving your financial standing and making it easier to secure loans or favorable interest rates in the future.

Restoring Trust with Creditors

Another benefit is the opportunity to strengthen your relationship with creditors. By showing initiative and a willingness to address mistakes, you may gain their understanding and trust, which could be useful for future interactions or negotiations.

How It Can Improve Your Credit

Taking the initiative to request an update on your credit record can lead to a range of improvements in your financial situation. By addressing past mistakes or misunderstandings, you can increase the accuracy of your credit report, which may have a positive effect on your credit score.

Potential Impact on Your Credit Score

When your request is considered favorably, the changes made to your credit record can have several positive outcomes:

- Higher Credit Score: By removing errors or negative marks, your credit score could increase, opening the door to better loan conditions.

- Improved Creditworthiness: A higher score demonstrates to lenders that you are a more reliable borrower.

- Better Financial Opportunities: With an improved score, you may qualify for lower interest rates, making it easier to finance large purchases or investments.

Long-Term Benefits for Your Financial Health

Aside from the immediate impact on your score, addressing inaccuracies or disputes with creditors can help you build a stronger, more trustworthy financial profile in the long run. With an updated report, you may find it easier to qualify for credit in the future.

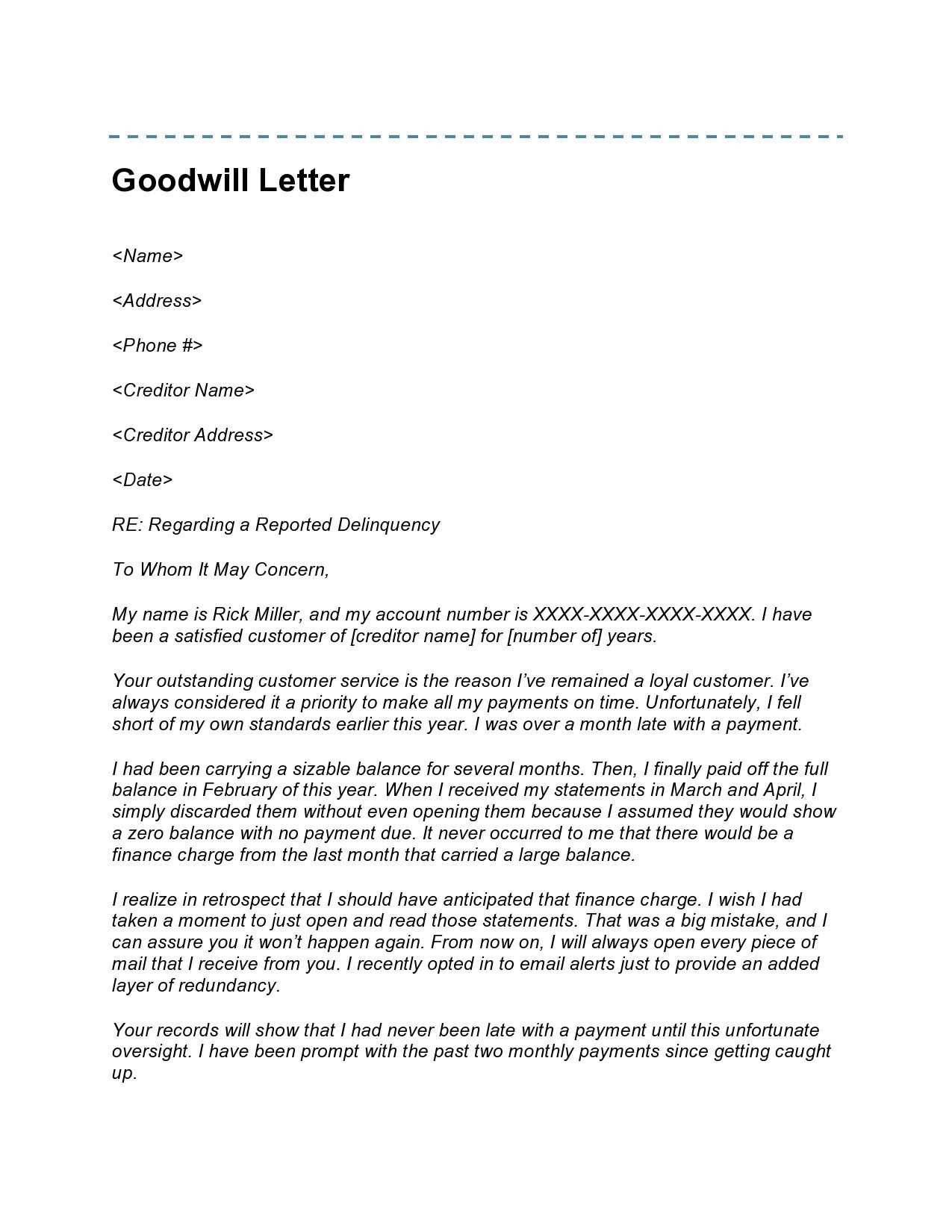

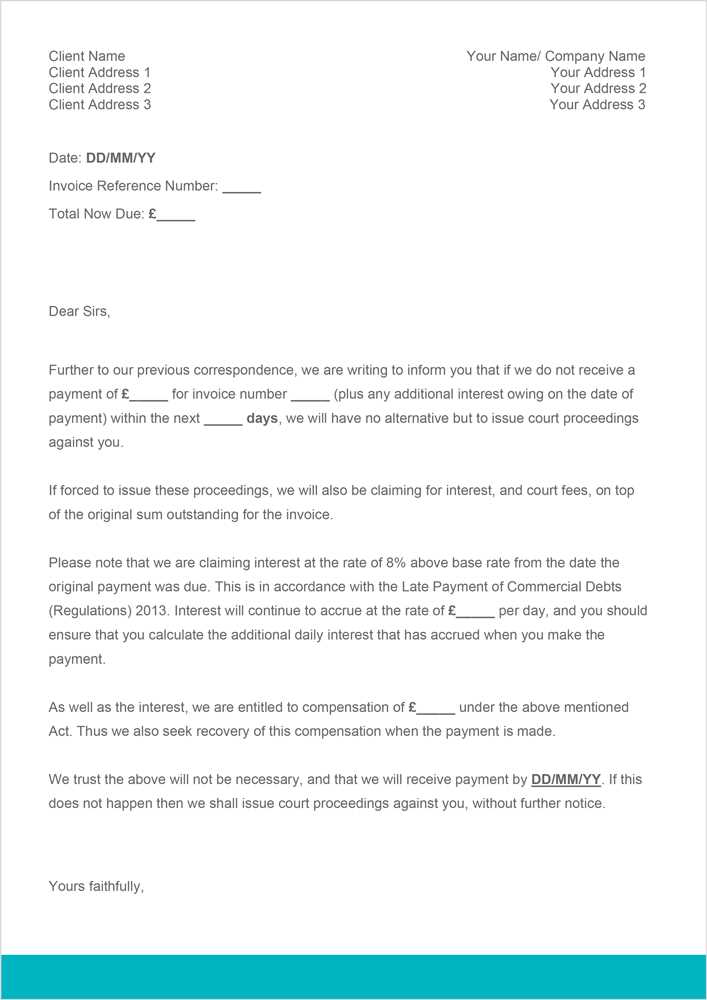

How to Write a Successful Request

Crafting an effective appeal to a creditor or reporting agency requires careful thought and attention to detail. A well-written request can significantly improve your chances of having the issue reconsidered, but it must be clear, respectful, and to the point. Below are the key steps to ensure your request has the best chance of success.

Key Elements of a Strong Request

To create a compelling appeal, include the following critical components:

- Polite and Professional Tone: Always maintain respect and professionalism in your message. A polite request is more likely to be taken seriously.

- Clear Explanation: Briefly describe the reason for the discrepancy. If it was due to extenuating circumstances, explain them without being overly emotional.

- Commitment to Responsible Behavior: Emphasize your commitment to staying on track with future obligations. This reassures the creditor that the issue is unlikely to recur.

- Supporting Documentation: If applicable, provide any relevant documents or evidence that can support your case.

Steps to Follow When Writing Your Appeal

- Start with a clear subject line, indicating the purpose of your request.

- Introduce yourself and mention your account details (such as your account number or reference number).

- Explain the reason for the discrepancy in a concise and factual manner.

- Request a reconsideration or removal of the negative mark based on your explanation.

- Thank the recipient for their time and consideration, and provide contact information for follow-up.

By following these steps and keeping the tone respectful and professional, you improve the chances of a favorable outcome for your request.

Essential Tips for Crafting Your Message

Writing a persuasive and effective request involves more than just explaining the issue. The key to success is ensuring that your message is clear, concise, and respectful. A well-crafted appeal can help you stand out and increase your chances of a positive outcome.

Keep It Short and Focused

Your appeal should get straight to the point. Avoid long-winded explanations or unnecessary details. Focus on the main issue and make your request clear from the start. A direct approach will show the recipient that you value their time.

Be Honest and Transparent

Honesty is critical when making a request for reconsideration. Explain the situation clearly and without exaggeration. If the issue was caused by a one-time mistake or an unavoidable circumstance, be upfront about it. Transparency helps build trust with the creditor or reporting agency.

By following these simple tips, you can increase the effectiveness of your request and improve your chances of having your credit report updated or corrected.

Key Information to Include in Your Request

When drafting an appeal to a creditor or reporting agency, it’s important to include all relevant details to help them understand your situation clearly. Providing the right information ensures your message is taken seriously and processed efficiently.

Here are the essential pieces of information to include in your request:

| Information | Description |

|---|---|

| Your Account Information | Include your account number, reference ID, or any other identifying details that can help the creditor or agency locate your account quickly. |

| Explanation of the Situation | Provide a brief, clear explanation of the circumstances that led to the issue. If there were extenuating factors, describe them honestly. |

| Request for Action | Clearly state your request, whether it’s the removal of the entry or a reconsideration based on your situation. |

| Supporting Documents | If applicable, include any evidence that supports your case, such as payment receipts, medical records, or other relevant documents. |

By including these critical details, you ensure that your request is complete and provides all the necessary context for a fair review. This can help increase the chances of a favorable outcome.

What Creditors Need to See

When submitting a request for reconsideration, it’s important to understand what creditors or reporting agencies look for in your communication. They need to see specific information that helps them assess the situation and decide whether they should make any adjustments to your credit record.

Here are the key elements creditors need to evaluate your appeal:

- Clear and Concise Explanation: Creditors want to know exactly what happened. A straightforward explanation of why the issue occurred and what circumstances led to it will be helpful in making your case.

- Account Details: Always provide accurate account information, such as your account number, reference ID, and any other relevant identifiers. This ensures your request is directed to the correct person or department.

- Evidence of Resolution: If the issue was caused by a specific situation, such as medical emergencies or financial hardship, provide documentation that supports your claim. This could include medical records, bank statements, or any other relevant proof.

- Commitment to Future Responsibility: Demonstrating that you have taken steps to prevent future issues is important. Creditors want to know that the problem won’t be repeated, so highlighting your efforts to stay on track is key.

By including these crucial elements, you increase the likelihood of your request being reviewed favorably and the possibility of positive adjustments to your credit record.