Guarantor letter template uk

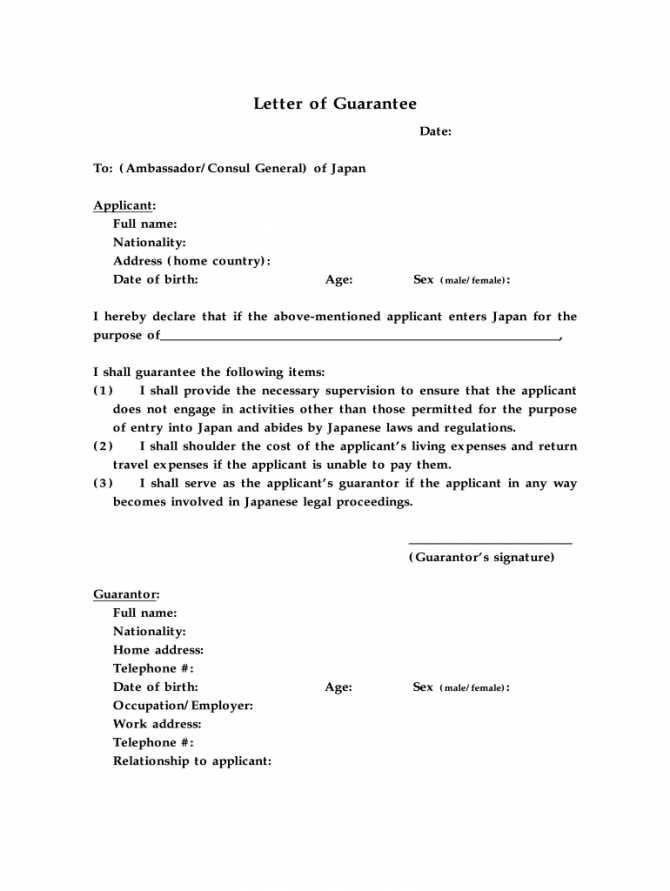

Creating a guarantor letter in the UK is straightforward, but it’s important to ensure that all necessary details are included for it to be valid. A well-structured guarantor letter serves as a commitment to pay rent or cover any damages if the tenant fails to do so. It’s often required by landlords, especially when the tenant’s financial background doesn’t meet the criteria for tenancy.

The letter should clearly identify the parties involved: the tenant, the guarantor, and the landlord. It needs to outline the terms of the guarantee, specifying the amount the guarantor will cover, and should state that the guarantor is aware of the tenant’s financial situation. If the tenant defaults on payments, the guarantor is legally obligated to step in. Make sure to include the full name, address, and contact details of both the guarantor and the tenant, as well as any supporting documentation if necessary.

In the UK, a guarantor letter is legally binding, so it’s crucial to be precise. The document must be signed by both the guarantor and the landlord, and it may require a witness. It’s a good idea to consult with a legal advisor to ensure that all necessary details are correctly included to avoid future disputes.

Here is the revised version of your list, with minimal repetition and the meaning preserved:

To create a solid guarantor letter in the UK, follow these key steps:

1. Personal Information

Include the full name, address, date of birth, and contact details of the guarantor. Make sure the guarantor’s relationship to the tenant is clear, as this helps establish credibility.

2. Agreement Statement

Clearly state the guarantor’s commitment to cover any unpaid rent or damages. Specify the terms under which the guarantor is legally responsible.

3. Length of Guarantee

Specify the period during which the guarantor is responsible, typically the duration of the tenancy agreement. If it’s a fixed-term tenancy, mention that explicitly.

4. Property Details

Provide the full address of the property being rented to ensure there is no confusion about which property the guarantee applies to.

5. Signature

Ensure the guarantor signs the letter to confirm their understanding and agreement. Include the date of signing for clarity.

- Guarantor Letter Template UK

When drafting a guarantor letter in the UK, make sure to include clear and concise details. A well-structured guarantor letter provides reassurance to landlords or lenders. Here is a simple template that covers all necessary aspects:

| Section | Details |

|---|---|

| Guarantor Information | Include full name, address, and contact details of the guarantor. |

| Tenant Information | State the name and current address of the tenant for whom the guarantor is assuming responsibility. |

| Agreement | Clearly state the nature of the guarantor’s commitment, including the terms of the tenancy or loan they are supporting. |

| Financial Responsibility | Specify the financial obligations the guarantor is willing to take on, such as unpaid rent or loan defaults. |

| Guarantor’s Signature | Provide space for the guarantor to sign and date the letter, confirming their agreement. |

Ensure the letter is clear about the financial responsibility the guarantor is assuming. This will prevent any confusion should issues arise during the tenancy or loan period.

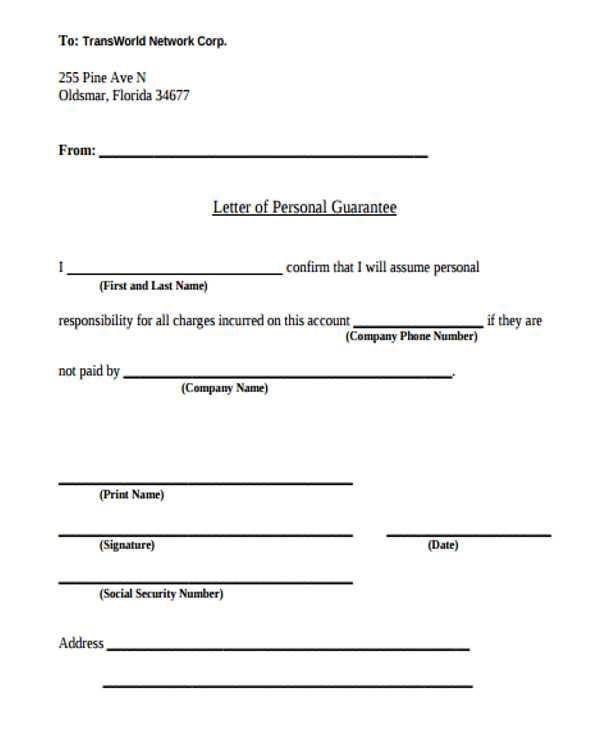

Begin with the full name and address of the guarantor, along with their contact details. Clearly state their relationship to the tenant, whether it’s a family member, friend, or colleague. Include the guarantor’s employment status and financial situation to demonstrate their ability to support the tenant if needed.

Letter Contents

- Introduction: State the purpose of the letter and confirm the guarantor’s willingness to take responsibility.

- Guarantor Details: Include the full name, address, date of birth, and employment details of the guarantor.

- Tenant Details: Include the full name and address of the tenant, as well as the rental property details (address, rental term, monthly rent).

- Commitment: The guarantor should clearly state they will cover the rent if the tenant fails to pay. Specify the terms and conditions of this commitment.

- Signature and Date: Ensure the guarantor signs and dates the letter at the end. This confirms their agreement.

Additional Considerations

- Clarify whether the guarantee is joint or individual. If it’s a joint guarantee, all guarantors should be listed and agree to the terms.

- Keep the tone professional and concise. Avoid unnecessary language or extraneous details.

- Ensure all details are accurate and up to date to prevent any misunderstandings in the future.

A guarantor letter should provide clear details to assure the landlord or institution about the responsibility and reliability of the guarantor. Here’s what needs to be included:

1. Guarantor’s Full Name and Contact Information

Provide the full legal name, address, phone number, and email address of the guarantor. This ensures the landlord or institution can easily reach them if needed.

2. Tenant’s Details

Include the full name and address of the tenant for whom the guarantor is responsible. It should be clear who the letter applies to.

3. Statement of Responsibility

The letter must explicitly state that the guarantor agrees to take financial responsibility if the tenant fails to meet their obligations. This might include rent payments or damages.

4. Duration of the Guarantee

Indicate the period during which the guarantor is liable, whether it’s for the entire lease term or specific dates.

5. Financial Information

Provide a brief outline of the guarantor’s financial stability, including employment details or income information. This reassures the landlord that the guarantor can fulfill their commitments.

6. Legal Agreement

The guarantor letter should confirm that the guarantor understands the legal implications and responsibilities involved, including any consequences of non-payment or breach of terms.

7. Signature and Date

Ensure the guarantor signs the letter and includes the date. This validates the agreement.

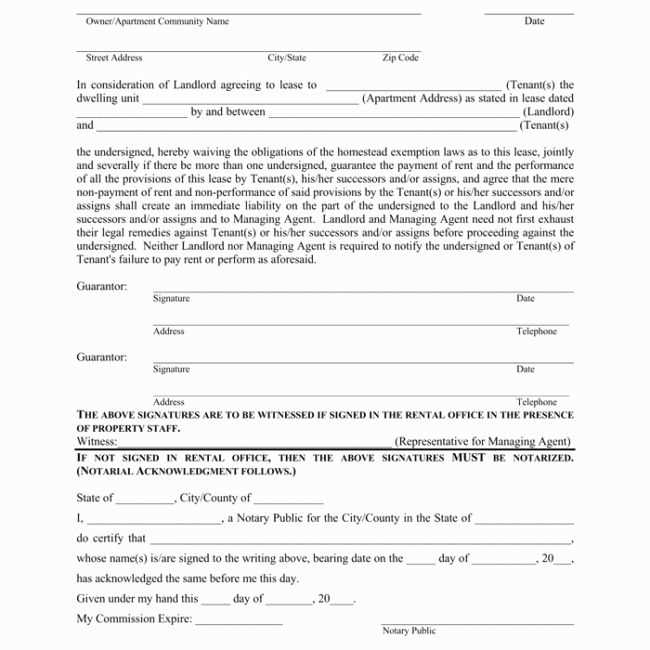

A guarantor letter in the UK must include specific details to be legally binding. It should clearly outline the responsibilities of the guarantor and include the following elements:

- Identification of Parties: The names and addresses of both the tenant and the guarantor must be clearly stated.

- Agreement to Guarantee: The letter should explicitly confirm the guarantor’s commitment to cover the rent or other liabilities in case the tenant defaults.

- Financial Details: The letter must include the financial terms, specifying the amount the guarantor will be responsible for.

- Duration of Guarantee: The guarantee period should be mentioned, indicating if it covers the entire lease or specific periods.

- Signature: The guarantor must sign the letter. In some cases, a witness might be required to sign as well.

Key Legal Considerations

- Written Agreement: For the guarantee to be enforceable, it must be in writing, either on paper or electronically.

- Clarity: All terms should be clear, leaving no room for ambiguity, especially regarding the guarantor’s liability.

- Joint and Several Liability: The guarantor is typically liable for the full amount, not just a portion, in case of default.

Failure to include these details may render the letter invalid or unenforceable in court. It’s advisable for both tenants and guarantors to carefully review the terms before signing any guarantee agreements.

Avoid vague or unclear language. Be specific about your relationship with the tenant, the terms of the guarantee, and the financial commitment you are making. This clarity will help prevent any misunderstandings.

Do not fail to include key details. Ensure you mention the tenant’s full name, address, and any relevant dates, such as the start and end of the rental agreement. Omitting these specifics can make the letter incomplete or legally questionable.

Incorrect formatting can create confusion. Follow a logical structure in your letter, such as starting with your personal details, followed by the tenant’s information, and then stating the guarantee terms. Use paragraphs to break up the content for readability.

Avoid making unrealistic commitments. Only promise what you are comfortable with, whether it’s covering rent or damages. Guaranteeing amounts you cannot afford could lead to financial strain or legal complications.

Do not neglect to sign the letter. An unsigned letter may not be valid or enforceable. Be sure to sign the document at the end, and if required, have it witnessed or notarized for added credibility.

Refrain from using complex legal jargon. While it’s important to be clear and precise, using overly technical terms can confuse the reader. Use plain, understandable language to communicate your points.

| Mistake | Explanation | Solution |

|---|---|---|

| Vague Language | Unclear terms can lead to misunderstandings. | Be specific about the guarantee, terms, and amounts. |

| Omitting Key Details | Lack of important information can make the letter invalid. | Ensure all necessary details are included, such as names and dates. |

| Poor Formatting | Disorganized content makes the letter difficult to read. | Follow a clear structure and separate sections with paragraphs. |

| Unrealistic Commitments | Promising too much can lead to financial or legal issues. | Only guarantee amounts you can comfortably afford. |

| Failure to Sign | Unsigned letters are often not legally binding. | Always sign your letter and follow any other formalities. |

| Using Legal Jargon | Complex language can confuse or mislead the reader. | Use simple and clear language for better understanding. |

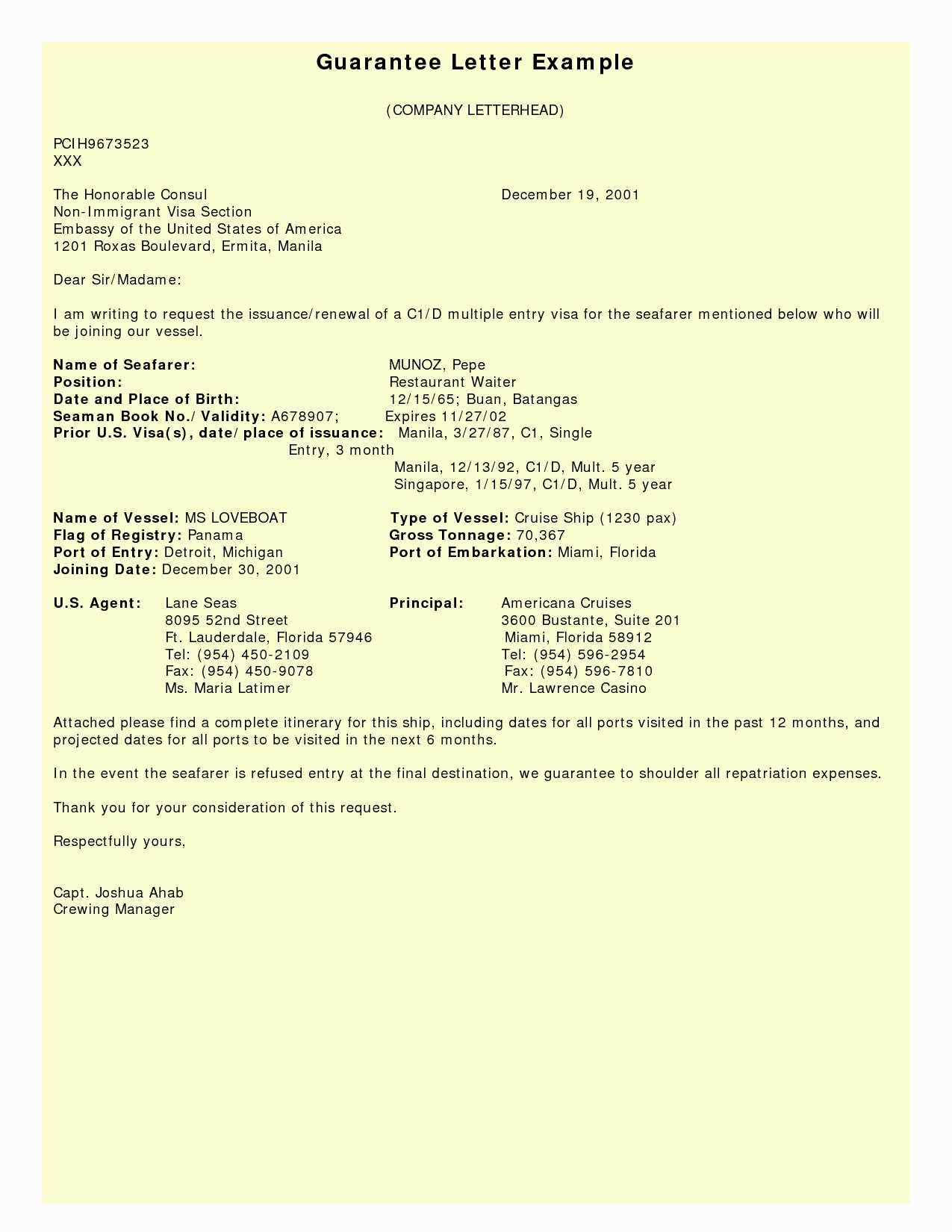

Begin by adapting the tone and details based on the specific situation. For example, if the guarantor letter is intended for a rental agreement, include clear information about the tenant’s background and your relationship with them. Mention how long you have known the individual and their financial stability. For job-related scenarios, emphasize your confidence in the person’s ability to meet the employment terms and responsibilities. Highlight their work ethic and dependability.

When the letter is required for a loan or credit application, provide a detailed description of the applicant’s character and financial situation. Include any relevant information about their history of meeting financial obligations. Specify the amount of the loan and your role in guaranteeing the repayment if necessary.

Adjust the language depending on the formality of the request. For more casual situations, like a small personal loan, you may choose a less formal tone but still ensure all important facts are presented. In formal scenarios, such as a housing or employment guarantee, keep the tone professional and precise. Always check that the letter contains all required details for the particular scenario and verify your own commitment clearly in the text.

After submitting a guarantor letter, follow these steps to ensure everything is in order:

- Confirm receipt: Contact the recipient to ensure the letter has been received and is under review.

- Provide additional documents: If requested, submit any supporting materials such as proof of income or identification.

- Wait for feedback: Give the recipient time to assess your letter and make a decision regarding your guarantor status.

- Stay in communication: Maintain an open line with the party requesting the letter, and address any concerns or additional questions promptly.

- Review the contract: If your letter is accepted, carefully go through the terms of the agreement, ensuring you understand your responsibilities as a guarantor.

- Keep a record: Save a copy of the letter and all related correspondence for your records.

Let me know if you’d like any further adjustments!

A guarantor letter for renting or a loan is a formal document that confirms a third party will cover the financial obligations in case the tenant or borrower fails to meet them. Ensure the letter includes key details such as the guarantor’s full name, contact information, relationship to the tenant or borrower, and the specific financial responsibility they are taking on. This adds clarity and assures all parties involved.

Key Elements to Include in a Guarantor Letter

Start by clearly identifying the parties involved: the tenant or borrower, and the guarantor. Include their names, addresses, and contact information. Clearly state the financial responsibility being assumed by the guarantor, such as covering missed rent payments or loan repayments. Specify the duration of the guarantee and any terms under which the agreement may be terminated. Finally, provide a space for the guarantor’s signature and date to confirm their commitment.

What to Avoid in the Guarantor Letter

Avoid vague language that doesn’t specify the guarantor’s responsibilities or the conditions of the agreement. Ensure all terms are clearly defined, so no misunderstandings arise later. Also, do not omit legal requirements or details that may be needed in a court of law should the situation arise.

Let me know if you’d like any further adjustments!