Guarantor template letter

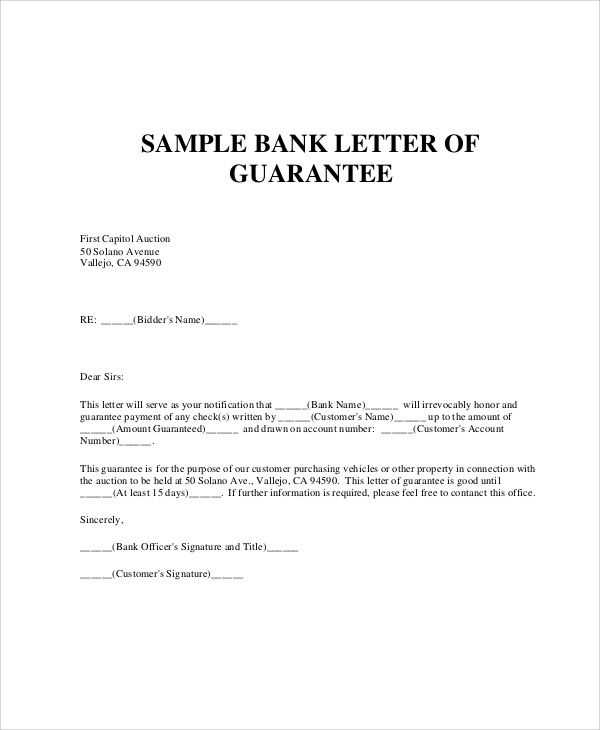

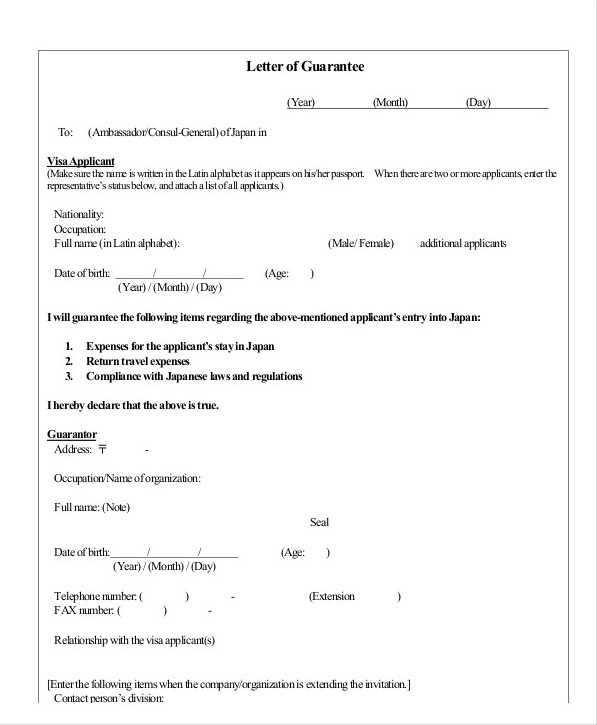

To create a guarantor letter, it’s important to start with the right structure. A well-written guarantor letter should clearly state your agreement to take responsibility for someone else’s obligations. Begin by providing the necessary details about both the applicant and yourself as the guarantor.

In the first paragraph, include your personal information, such as your full name, address, and contact information. Then, provide a brief statement of your relationship with the person you’re guaranteeing and your understanding of their situation. This will help establish your credibility as a guarantor.

Next, outline the commitment you’re making. Mention the specific responsibilities you’re agreeing to cover, whether it’s rent, a loan, or another form of financial obligation. Be sure to include any terms or conditions that apply to the guarantee.

Finally, close the letter by expressing your willingness to take on the responsibility and offer your contact details for further verification. A clear and formal tone will make the letter more professional and ensure it serves its purpose effectively.

Here’s the corrected version without repetitions:

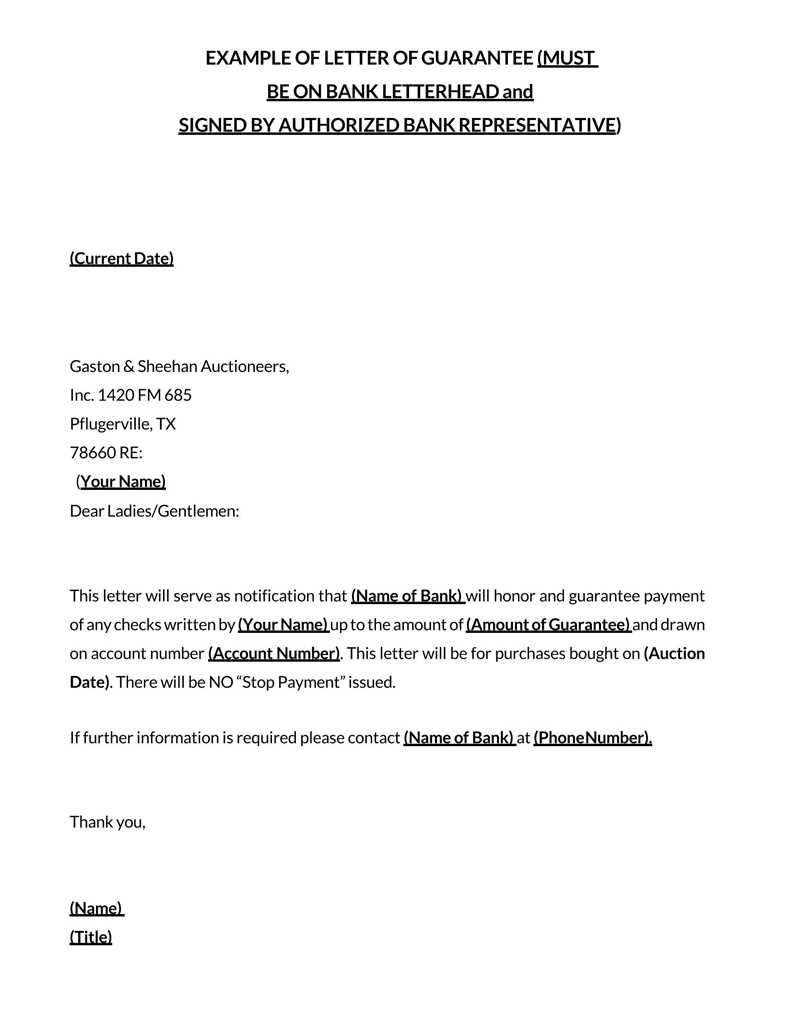

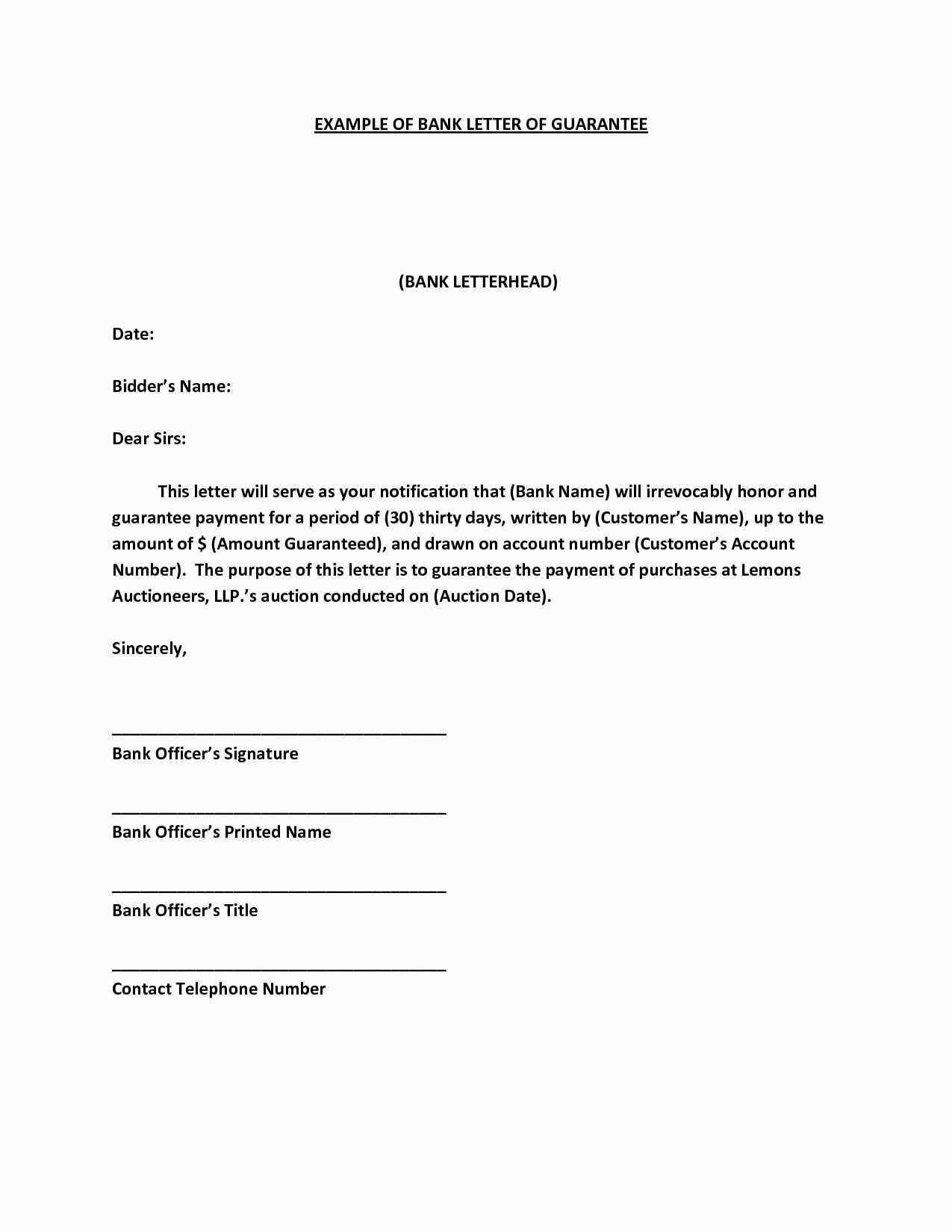

Make sure the guarantor’s letter is clear and concise. Begin with an explicit statement confirming the role of the guarantor. Avoid unnecessary information, focusing on key details, such as the amount of the guarantee and the duration for which the guarantee is valid. Be specific about what obligations are being guaranteed and any terms associated with them.

Clearly define the responsibilities of the guarantor, including any consequences in case of default. Make sure the letter includes the necessary personal information of both the guarantor and the person they are guaranteeing for, such as names, addresses, and contact details. Double-check the accuracy of all information to prevent confusion or errors.

Conclude by ensuring that the guarantor’s signature is clearly visible, with a space for the date. A witness may be required to verify the authenticity of the letter, depending on local regulations. Make sure to follow any legal guidelines specific to your location to ensure the document is legally binding.

Structure and Layout

Common Errors in Writing a Guarantor Letter and How to Avoid Them

When Is a Guarantor Letter Required? Practical Scenarios

Legal Consequences of Signing a Guarantor Letter

The structure of a guarantor letter should be clear and concise. Begin with the date and the recipient’s details at the top, followed by a formal salutation. State your relationship with the person you’re guaranteeing and clearly outline the financial or contractual responsibility you are accepting. Include specific terms and conditions of the guarantee, such as the amount or duration, and conclude with your signature.

A common error is vague language, which can lead to misunderstandings about the terms of the guarantee. Always be precise about the terms and responsibilities involved. Another mistake is neglecting to state the conditions under which the guarantee is valid. Make sure to specify these details to avoid ambiguity.

Guarantor letters are typically required in scenarios such as renting a property, securing loans, or entering into business agreements. If you are asked to guarantee someone’s performance or obligations, ensure you understand the scope of your responsibility before agreeing.

Signing a guarantor letter without fully understanding its terms can result in serious financial consequences. If the primary party defaults on their obligations, you may be held legally responsible. It’s essential to review the terms carefully, and in some cases, consulting with a lawyer might be wise to ensure that you’re not exposing yourself to unnecessary risk.