Harsh collection letter template

Send a direct, clear message when using a harsh collection letter template. Address the situation promptly and firmly, making it clear that the debt is overdue and must be settled. Keep the tone professional but assertive to emphasize the seriousness of the matter.

Clearly state the amount owed and the consequences of continued non-payment. Mention potential legal actions, credit damage, or further collection steps if the payment is not received within the specified time. Using precise language removes any ambiguity, which can lead to quicker responses.

Ensure your message is concise yet detailed enough to cover the necessary information. You don’t want to overload the recipient, but you must provide all relevant details, such as the due date, payment instructions, and any applicable late fees. Strong communication in this regard often leads to faster resolutions.

Here’s a detailed plan for the article titled “Harsh Collection Letter Template” in HTML format, with each section focused on a specific aspect or task. The sections are practical and precise, avoiding broad or generic terms.

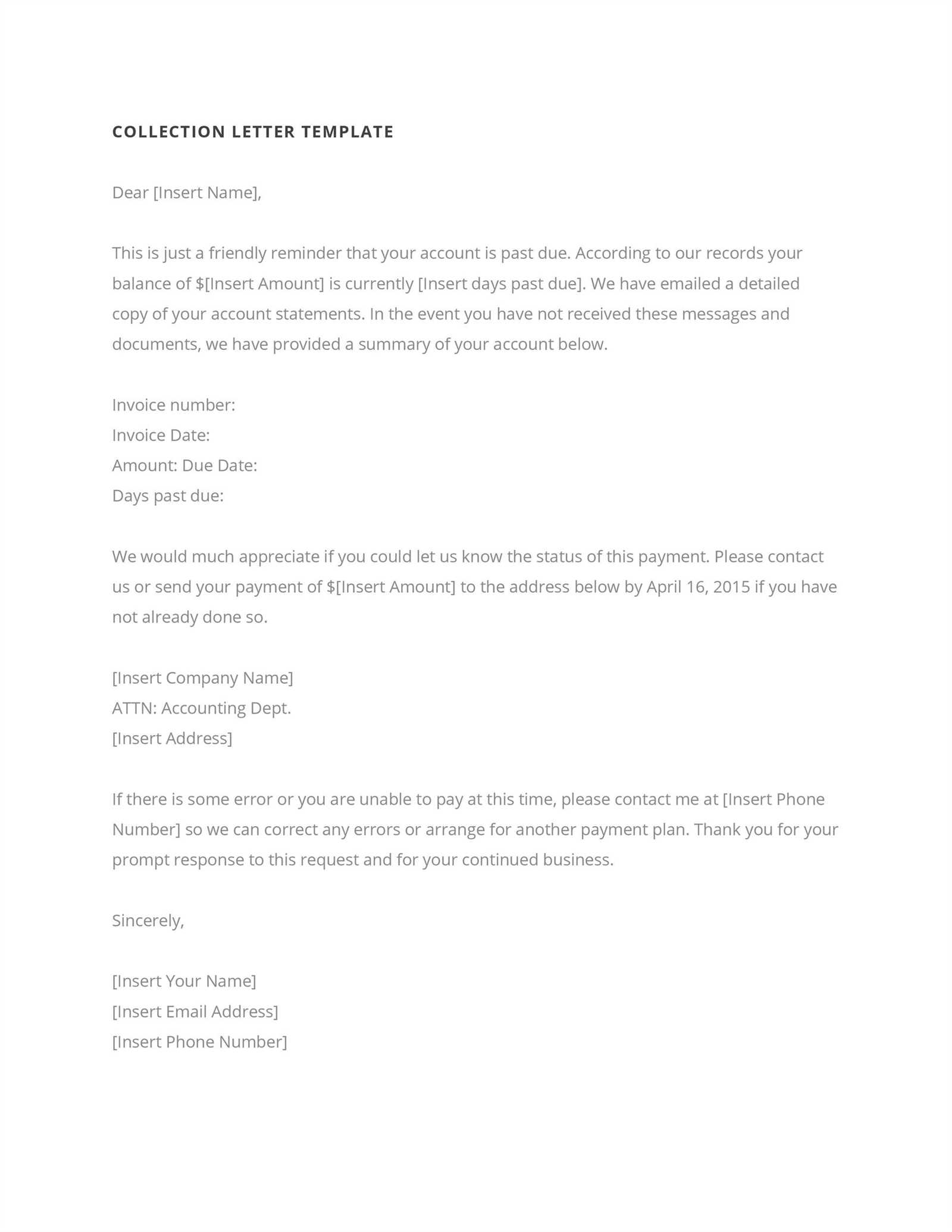

1. Introduction to Harsh Collection Letters

Begin by explaining the purpose of a harsh collection letter. It should state the urgency and importance of settling the debt, using a firm but professional tone. Make it clear that this is the final attempt to resolve the matter before further action is taken. Provide an example of a strong opening sentence that demands attention, such as: “This is your final notice regarding the outstanding balance of [amount]. If payment is not received by [date], we will proceed with legal action.” Ensure the language conveys the seriousness of the situation without being overly aggressive.

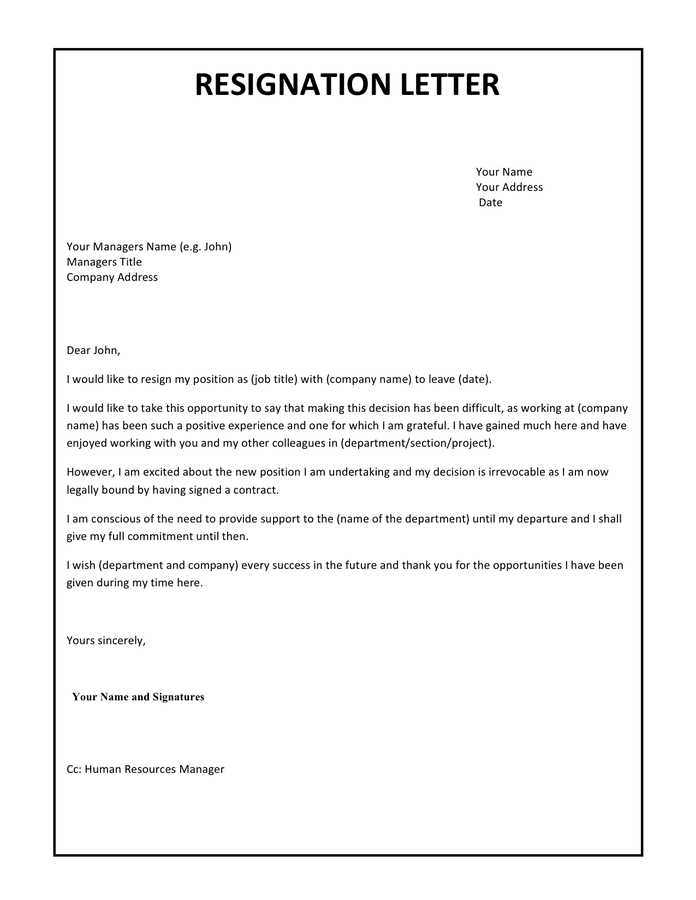

2. Structuring the Letter Effectively

Outline the key sections of a harsh collection letter. Start with a clear subject line that catches attention. Next, use a concise introduction to state the outstanding debt, followed by a detailed breakdown of the charges. Use bullet points for clarity. The letter should end with a clear demand for payment, along with a deadline. If necessary, include a warning about further consequences, such as reporting to credit agencies or initiating legal proceedings. Each section must be brief and direct, avoiding unnecessary explanations.

3. Tone and Language Choices

Focus on how tone affects the letter’s effectiveness. The language should be direct, firm, and no-nonsense, without being hostile. Avoid overly emotional language and stick to facts. Use action-oriented verbs to maintain control, such as “pay,” “settle,” or “resolve.” Also, ensure the letter doesn’t sound too formal, as this can make it feel impersonal. Balance firmness with professionalism to prevent alienating the recipient while still demanding action.

4. Final Reminders and Legal Warnings

Include a section that briefly outlines potential legal consequences, should the debt remain unpaid. This could mention escalating the matter to collections or pursuing legal action in court. Be clear that these steps will take place unless payment is received by the specified date. It’s important to be firm without threatening unnecessarily. For instance, “Failure to resolve this matter will lead to the transfer of your account to a collections agency.” Keep it straightforward and factual.

Harsh Collection Letter Template

Understanding the Purpose

Key Components to Include

Legal Considerations When Writing

Tone and Language: Striking the Right Balance

Common Mistakes to Avoid

Steps to Take After Sending

A harsh collection letter is designed to demand payment with a firm, direct approach. The primary goal is to encourage the recipient to settle their debt quickly without leaving room for negotiation. This letter should include clear information about the outstanding amount, the deadline for payment, and consequences if the debt is not settled promptly.

Key Components to Include

The letter must include specific details: the amount owed, the due date, and any interest or fees applied. Include the original invoice number, along with any payment instructions or bank details. Make it clear that this is a final notice and state the next steps if payment is not received, such as legal action or reporting to credit agencies. Avoid including excessive explanations–stick to the facts.

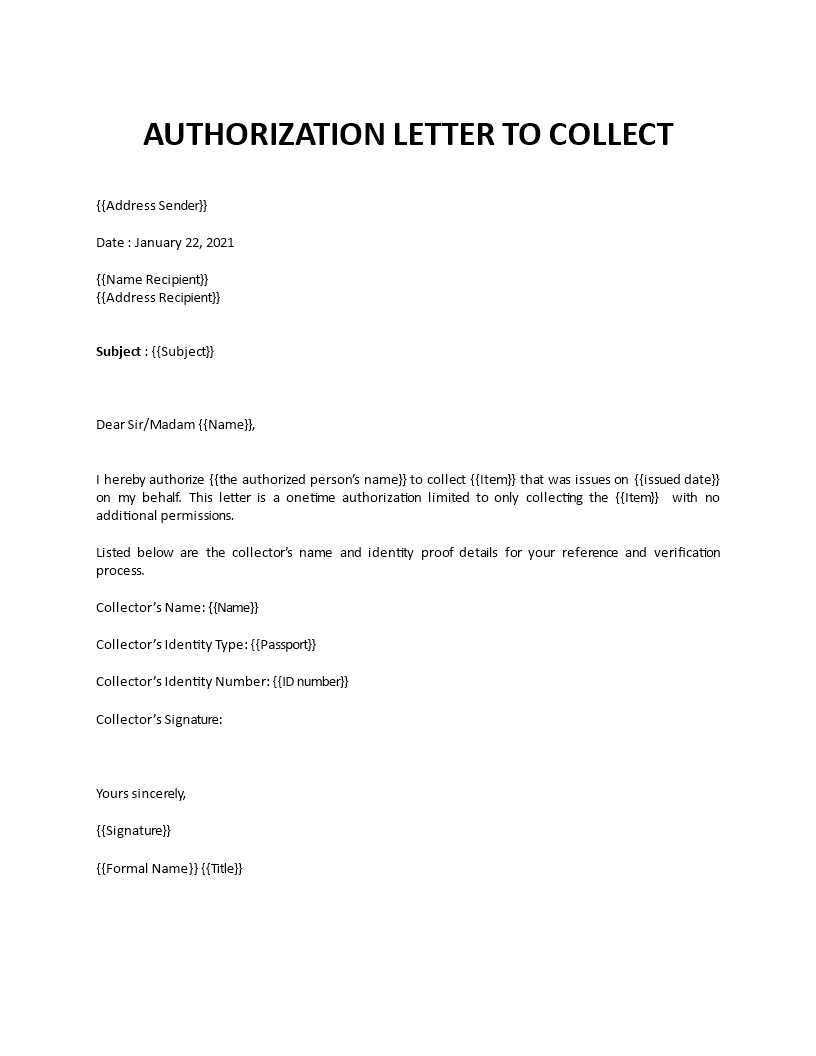

Legal Considerations When Writing

Ensure the letter adheres to legal guidelines. Do not threaten violence or use aggressive language, as this could lead to legal ramifications. Always verify the debt before taking action. Include a statement informing the debtor of their right to dispute the debt within a set period. Following the Fair Debt Collection Practices Act (FDCPA) is crucial to avoid violating regulations.

The tone of the letter should be firm but not hostile. Using strong, assertive language without crossing into intimidation is key. Be clear about the seriousness of the matter, but avoid sounding vindictive or overly harsh. Maintain professionalism throughout to prevent escalating the situation.

Common Mistakes to Avoid

Do not use vague language or leave too much room for interpretation. The recipient should have no doubt about the seriousness of the situation. Avoid lengthy sentences or too many legal terms–keep the letter simple and to the point. Do not ignore the debtor’s rights or fail to offer a clear path to resolution.

Steps to Take After Sending

After sending the letter, monitor the payment closely. If payment is not received by the deadline, follow up with a phone call or additional communication. Consider involving a collections agency or legal assistance if the matter is not resolved within the timeframe provided.