Home loan letter of explanation template

Provide clear and concise details in your letter of explanation to increase the likelihood of your home loan being approved. Be direct and specific when addressing the reason behind any discrepancies or unusual circumstances in your financial history. Focus on explaining the situation in a straightforward manner without unnecessary details.

Use a professional yet approachable tone throughout the letter. Start by identifying yourself and your loan application, then briefly explain the situation that requires clarification. If possible, offer context that helps the lender understand your financial decisions, especially if they were influenced by factors outside your control.

Ensure that your letter is organized. Begin by addressing the most critical points, followed by any supporting information or documentation that validates your explanation. Be honest and transparent, as lenders value reliability and openness. Keep the letter short but clear, avoiding any ambiguity or vague statements that could delay the approval process.

Conclude by thanking the lender for considering your explanation and reaffirming your commitment to meeting your financial obligations. This approach will not only clear up any concerns but also show your determination and responsibility.

Here’s the revised version with minimal repetition:

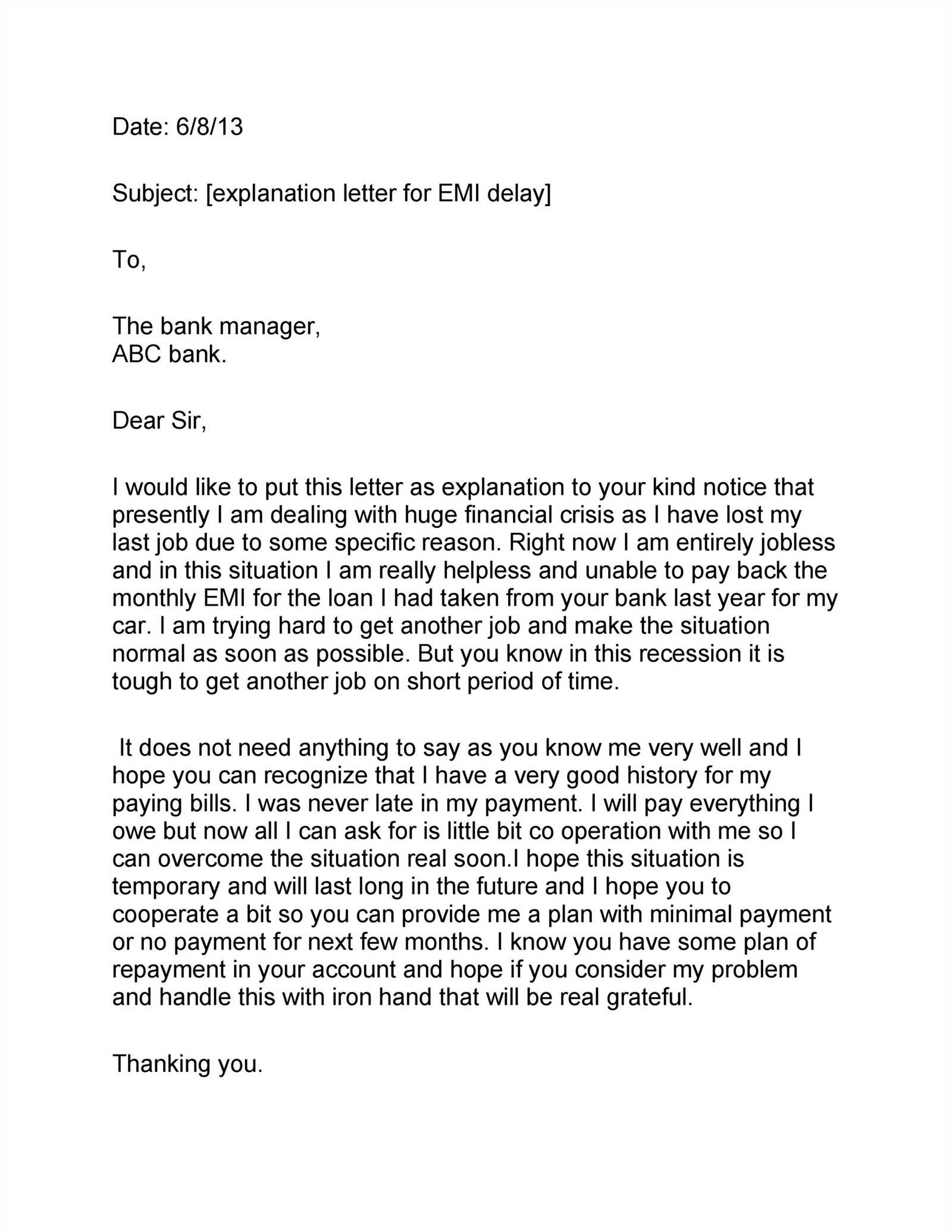

When writing a home loan letter of explanation, make sure to provide clear and concise details. Address the issue directly and avoid unnecessary elaboration. For example, if you are explaining a missed payment, state the reason and the actions taken to resolve it. Keep the tone polite and professional.

Start by stating the facts: “I missed the payment on [insert date] due to [reason].” Follow with what steps you’ve taken to rectify the situation: “I have since caught up on my payments and have set up automatic payments to ensure this doesn’t happen again.”

Be specific: If there are documents that support your explanation, mention them. “Attached are copies of my bank statements showing the correction.” This helps to back up your claim and shows your commitment to resolving the issue.

Avoid over-explaining: Stick to the key points and keep the explanation brief. A few clear sentences can provide all the necessary context without overloading the reader with irrelevant details.

Conclude with assurance: “I am committed to maintaining a positive payment history moving forward.” This leaves a positive impression and reinforces your dedication to meeting obligations.

- Home Loan Letter of Explanation Template

A well-written letter of explanation can significantly strengthen your home loan application. Here’s a template that will guide you through writing your own. Keep it clear and to the point.

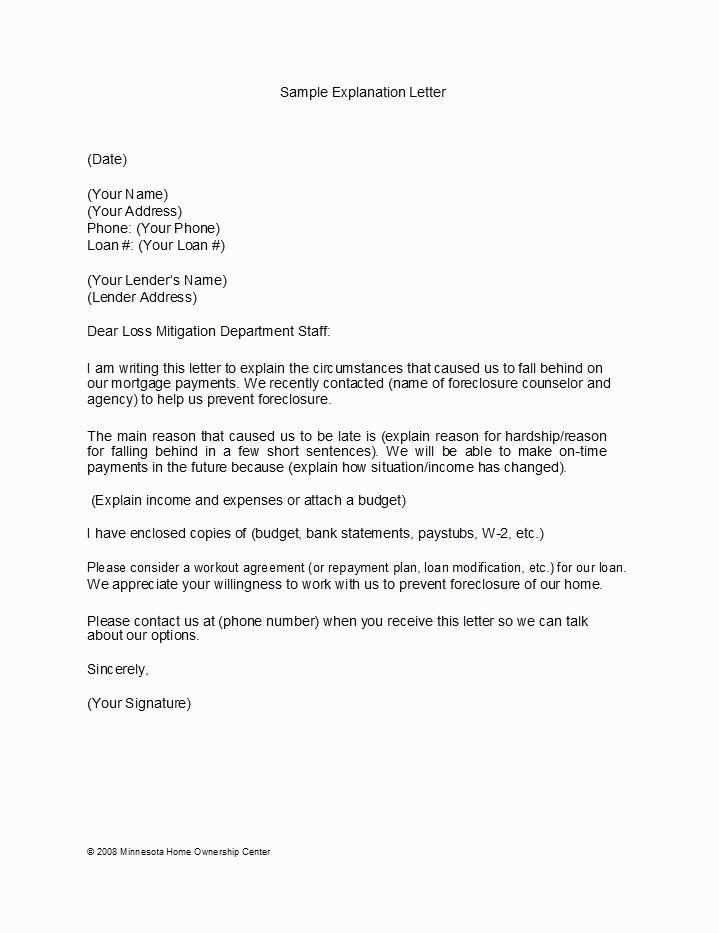

- Header Information: Include your full name, address, contact information, and the date at the top of the letter.

- Subject Line: Clearly state the purpose of the letter, such as “Letter of Explanation for Recent Credit Inquiry” or “Letter of Explanation for Bank Deposit.”

- Introduction: Address the recipient (usually the underwriter) and briefly introduce the reason for writing. For example: “I am writing to provide an explanation regarding the recent credit inquiry listed on my credit report.”

- Details: Explain the situation in clear, concise language. If it’s a credit inquiry, detail the reason behind it, such as applying for a car loan or a temporary credit card. If it’s a deposit, mention the source and reason behind the transaction.

- Supporting Documentation: Mention any attached documents that back up your explanation, such as bank statements or letters from creditors. Be sure to provide any relevant references to these attachments.

- Conclusion: End the letter by thanking the recipient for their time and consideration. Also, express your willingness to provide further details if needed. A simple closing like: “Thank you for your attention to this matter. Please feel free to contact me if additional information is required.” is appropriate.

Keep the letter professional and ensure all details are accurate. Avoid unnecessary details that don’t directly address the issue. This letter should be short but clear enough to explain the situation effectively.

A Letter of Explanation (LOE) provides clarity on any discrepancies or issues in your financial history that may raise concerns during the loan application process. Mortgage lenders typically request an LOE when they need more context about your credit report, income, or recent financial activities. Without this letter, you may face delays, or worse, have your loan application rejected.

Clarifies Inconsistencies

If there are any recent late payments, a gap in employment, or large deposits that don’t seem typical, an LOE gives you the chance to explain these events. Addressing these concerns directly with a clear and honest explanation can help reassure the lender about your ability to repay the loan.

Improves Your Chances of Approval

Submitting a well-written letter shows that you’re proactive and transparent. It gives the lender the information they need to make an informed decision, which can enhance your chances of securing the home loan you want.

In short, a concise and direct Letter of Explanation can clear up misunderstandings and demonstrate your financial stability, making it a key part of the mortgage application process.

Begin your letter by clearly stating its purpose in the first paragraph. Be direct and avoid any unnecessary explanations. This sets the tone and helps the reader understand the context immediately.

Use short paragraphs to break up your points. Each paragraph should focus on one main idea or piece of information. This avoids confusion and allows the reader to follow your reasoning more easily.

Keep Sentences Clear and Concise

Avoid overly complex sentence structures. Stick to simple sentences that convey your message without ambiguity. If needed, use bullet points to list facts or details, which will improve readability.

Use a Logical Flow

Arrange your information in a logical sequence. Start with the most critical facts and then provide additional details or explanations as needed. Consider the reader’s perspective, and organize your points from the most important to the least important.

| Section | Content Focus |

|---|---|

| Introduction | State the reason for the letter clearly |

| Main Body | Provide the necessary details, organized logically |

| Conclusion | Summarize key points and offer any follow-up actions |

End your letter with a call to action or a clear next step. This helps the reader understand what is expected after reading your letter.

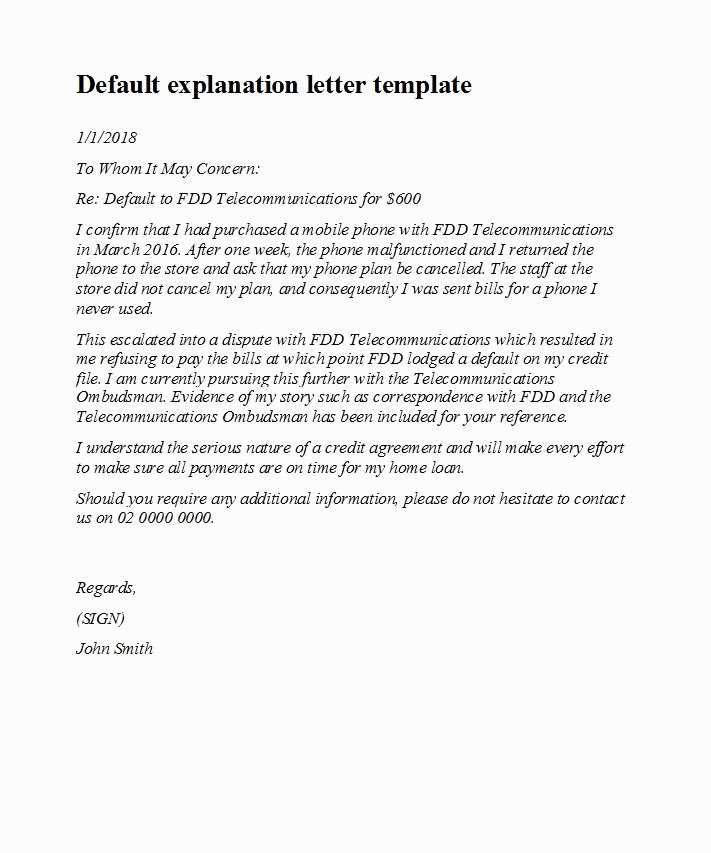

Clearly state the reason for the credit issue. Whether it was due to a medical emergency, job loss, or financial mismanagement, provide a straightforward explanation of the situation.

Be transparent about the timeline of the problem. Include specific dates or periods when the issue occurred and any actions taken to resolve it. If you’ve made improvements, such as catching up on payments, mention these steps.

Offer context on any mitigating factors. If there were external events or circumstances beyond your control, describe them in detail. This could include issues like divorce or unexpected family responsibilities that impacted your financial stability.

If applicable, include evidence of your efforts to restore your credit. Provide documents such as payment history, communication with creditors, or credit counseling records to show you’re actively working to improve your financial situation.

Finally, reassure the lender of your current financial stability. Highlight any positive changes in income, budgeting, or financial management strategies that demonstrate you are now in a better position to handle your obligations.

Clearly explain the reason for any gaps in your employment or income history. Be concise and honest, providing the necessary context. If you took time off for personal reasons, family care, or pursuing education, mention it briefly and emphasize how it aligns with your current financial stability. If you experienced a period of unemployment due to industry changes or job market conditions, highlight any skills or experience gained during this time, such as freelancing, part-time work, or volunteer efforts. This shows your proactive approach despite the gap.

Avoid unnecessary details. Focus on the positive aspects of the situation, such as how it led to career growth or a new, stable position. If applicable, reference any relevant documentation like job search records, certificates, or courses completed during the gap. This will provide further assurance that you are financially responsible and committed to long-term stability.

Always tie the explanation back to your current situation. Assure the lender that your income is now steady and that you can meet your loan obligations without issue. Be clear, direct, and professional in your explanation to maintain credibility and trust. Keep the tone confident but not overly defensive, showing your awareness of the gap but also your readiness to move forward.

One common mistake is providing unclear or vague reasons. Always be specific about the situation you’re explaining. If there was a late payment, provide the exact reason for it, such as a personal emergency or a clerical error, and mention any steps you’ve taken to prevent it from happening again.

Avoid making the letter overly lengthy or complex. Lenders appreciate concise and to-the-point explanations. Stick to the facts and avoid adding unnecessary details that might cloud the main issue.

Another mistake is failing to take responsibility when it’s necessary. If the issue was due to an oversight on your part, be honest about it. Lenders value transparency, and acknowledging mistakes can demonstrate accountability.

Don’t forget to include relevant supporting documents. If you’re explaining a financial situation, attach proof where applicable. This could include medical bills, bank statements, or communication records that validate your explanation.

Be cautious with your tone. A defensive or combative tone can give the wrong impression. Keep the language respectful and professional, showing that you understand the seriousness of the situation and are committed to resolving it.

Lastly, avoid submitting a generic letter. Customize the explanation to your specific circumstances. A personalized approach reflects effort and helps your case stand out in a positive light.

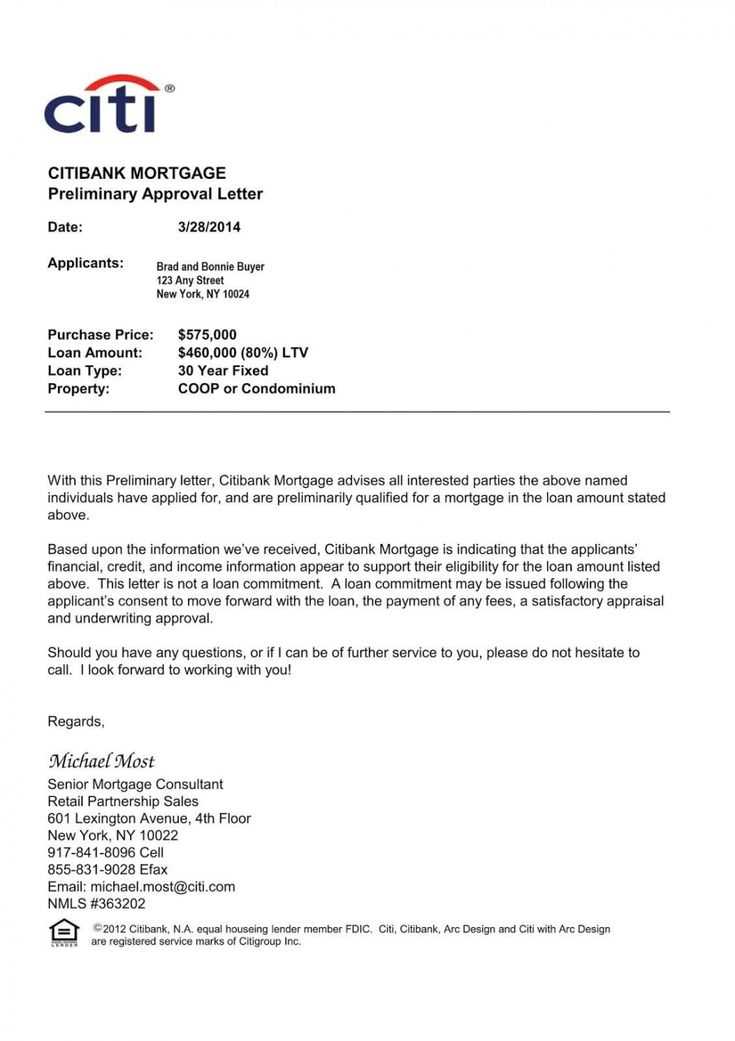

Adjust your letter to meet each lender’s specific preferences and requirements. Begin by reviewing their guidelines to ensure your document aligns with their expectations.

- Understand Lender Requirements: Each lender may have unique preferences for the information included in the letter. Some might request detailed explanations, while others may prefer brevity. Review their instructions carefully.

- Personalize the Content: Customize the letter by adding specific details that resonate with the lender. For example, highlight your financial stability or any extenuating circumstances that may influence their decision.

- Adjust Tone and Length: Some lenders prefer a formal, concise tone, while others might be more flexible. Match the tone based on your knowledge of the lender’s communication style.

- Tailor Financial Information: If the lender focuses on particular aspects of your financial background (such as income, employment history, or credit score), emphasize those areas. Include any supporting documents that reinforce your claims.

- Include Relevant Details: Some lenders may require information about past loan repayment history, explanations for late payments, or details about the property you plan to purchase. Make sure to address all points they find important.

- Follow Formatting Guidelines: Ensure the letter is formatted according to the lender’s specifications. This may include font style, size, and document layout. Adhering to their format shows attention to detail and professionalism.

After tailoring the letter, review it for clarity and accuracy before submitting it to each lender. This will ensure your application stands out as clear, thoughtful, and responsive to their requirements.

When drafting a home loan letter of explanation, focus on clarity and conciseness. Ensure that each section addresses the lender’s concerns directly. If you’re explaining a financial situation, provide specific details such as dates, amounts, and reasons for any irregularities. Keep the tone professional yet approachable to avoid misunderstandings.

For example, if you have a gap in employment, outline the reason for the break, the steps taken to secure new employment, and the date you began your new job. If there was a recent missed payment, describe the cause (e.g., medical emergency) and outline the actions you’ve taken to resolve it, such as repayment or reestablishing credit.

Be transparent, but avoid excessive detail. Only include what is necessary for the lender to assess your application. If you are unsure whether to include something, it’s better to provide too much information than not enough. However, stay on topic and focus solely on the aspects that directly affect your loan eligibility.

Key points to include:

- Dates of relevant events – When the situation occurred and any follow-up actions.

- Specific amounts – Any financial figures related to the explanation.

- Steps taken to address the issue – What you did to resolve any financial or personal difficulties.

By sticking to the facts and keeping the letter focused, you increase your chances of a favorable review. A well-written explanation letter shows the lender that you are proactive, organized, and committed to managing your financial responsibilities.