Income Letter Template for Different Purposes

When preparing formal communication for proof of earnings, it is important to present the information clearly and effectively. A well-structured document can ensure that both the sender and recipient understand the financial details being shared. This format is widely used for a variety of situations such as loan applications, rental agreements, and employment verifications.

Key Components of a Financial Proof Document

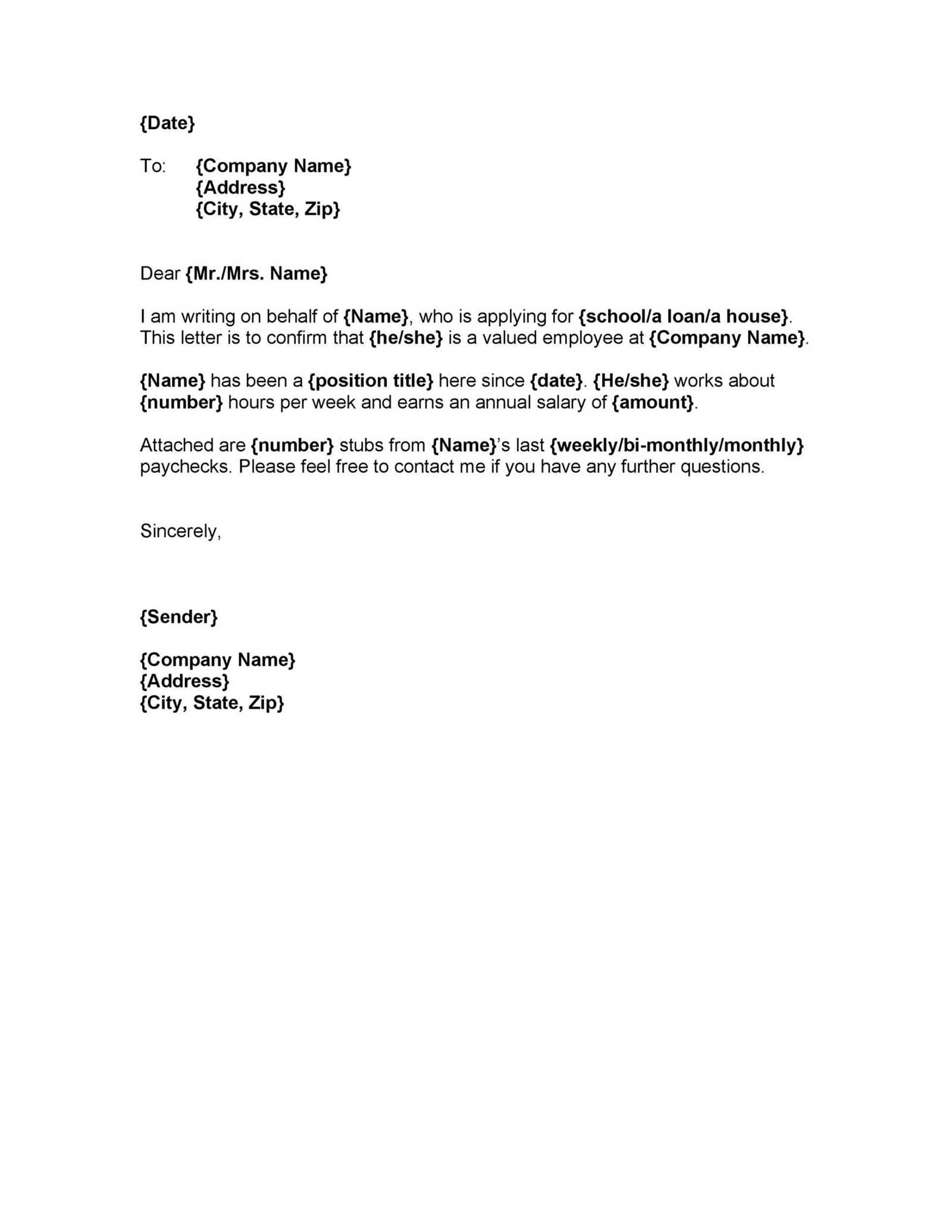

To create an effective and professional document, certain elements must be included to ensure clarity and completeness. The primary sections generally contain the following:

- Sender’s Information: Include the full name, address, and contact details.

- Recipient’s Information: Include the details of the individual or institution receiving the document.

- Details of Financial Status: Clearly state the amount being confirmed and the source of the income.

- Verification or Signature: A declaration or signature to validate the authenticity of the information provided.

Formatting Tips for Professional Appearance

For the document to look polished and credible, formatting plays a vital role. Here are a few tips to ensure your document is appropriately structured:

- Keep the font simple and professional, such as Arial or Times New Roman.

- Use consistent spacing and margins to ensure the text is clear and easy to read.

- Make sure the document is well-organized, with each section clearly separated and labeled.

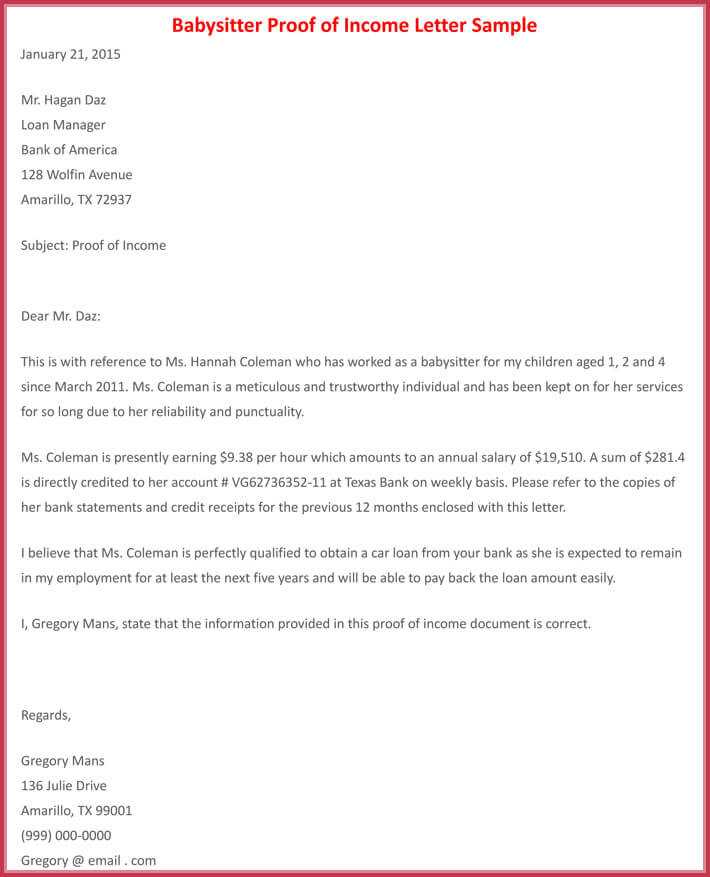

When to Use This Format

Such documents are used in several scenarios, such as when verifying employment income for a bank loan, confirming earnings for a rental application, or providing proof of financial status for official purposes. By following the recommended structure, you can easily adapt the format to suit any of these situations.

Benefits of Using a Pre-Formatted Financial Verification Document

By utilizing a ready-made structure, you can save time and ensure accuracy. Having a standard format helps prevent errors and ensures that all necessary information is included. It also streamlines the process for both the sender and the recipient, making the verification smoother and more efficient.

Understanding Professional Financial Documentation and Its Structure

Creating a document to verify financial status involves organizing key details in a clear and effective manner. This type of paperwork is essential in numerous professional and personal situations where confirmation of earnings or financial stability is required. Proper formatting and inclusion of critical information ensure its credibility and acceptance.

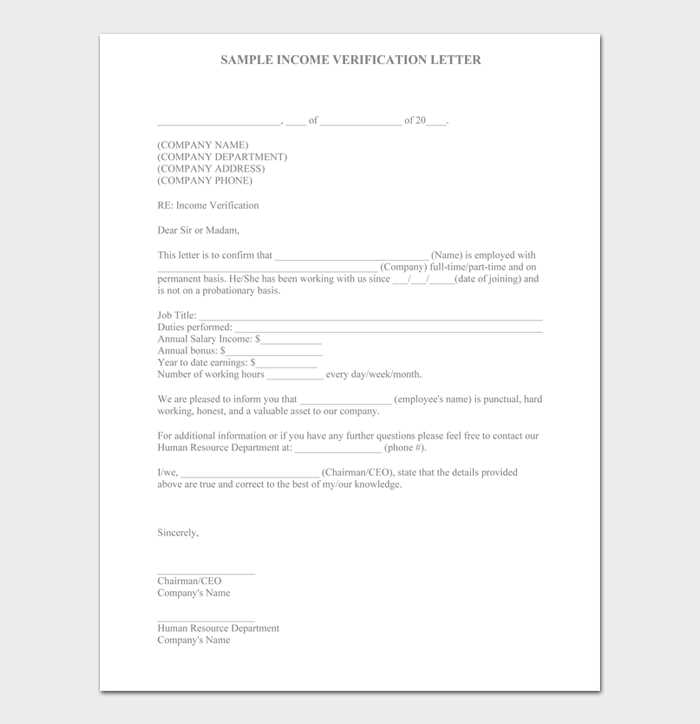

Essential Steps for Crafting a Financial Verification Document

To ensure the document meets the necessary standards, follow these key steps:

- Start by gathering all required details, such as the sender’s full name, position, and the source of income.

- Organize the information in a logical order, ensuring each section flows smoothly.

- Include a formal closing with a signature or verification statement to confirm the authenticity of the content.

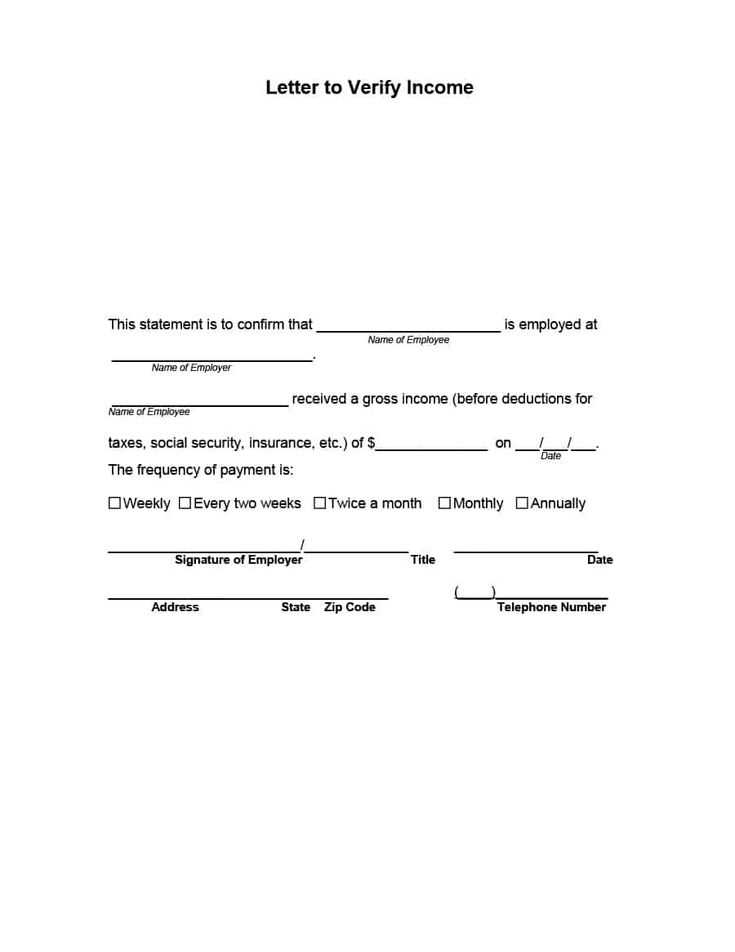

What Information Should Be Included

Critical details must be carefully incorporated to provide a complete picture. These typically include:

- Personal and Contact Information: Full name, address, and relevant contact details of the sender and recipient.

- Verification of Financial Status: A clear description of earnings, sources, and supporting details like dates and amounts.

- Official Statement: A signed declaration or confirmation that verifies the document’s accuracy and legitimacy.

By structuring the document properly and including these key elements, you can ensure that it serves its purpose in any situation where financial verification is needed.