Insufficient Funds Letter Template for Professional Use

In various situations, individuals or businesses may encounter payment challenges, making it essential to communicate effectively with creditors or institutions. Addressing such issues professionally can help maintain good relations and avoid misunderstandings. Properly conveying the reason for the delay or inability to pay is crucial for resolving the matter efficiently.

Clear communication is key in these scenarios. A well-structured document ensures that the recipient understands the situation and the actions being taken to resolve it. This document not only explains the current issue but also serves as a commitment to address the matter in a timely manner.

Whether dealing with a financial institution or a vendor, the tone and content of the message can significantly impact the outcome. By following specific guidelines and adopting a respectful tone, one can increase the chances of reaching a mutually beneficial resolution.

Understanding Insufficient Funds Letters

When facing a financial setback, effective communication is vital for managing the situation. A well-crafted message can serve as a formal explanation of why a payment was missed and outline steps to resolve the issue. These messages are essential for maintaining professional relationships and ensuring that all parties involved are aware of the circumstances.

Key Reasons for Sending a Payment Notification

- To inform creditors about an overdue payment

- To request more time or an alternative payment arrangement

- To clarify any misunderstandings regarding the amount or due date

Common Characteristics of These Messages

- Clear and respectful tone

- A detailed explanation of the situation

- A commitment to resolve the matter promptly

Understanding the purpose of these communications is crucial for ensuring that all necessary information is conveyed in an effective manner. The goal is always to address the issue while maintaining professionalism and fostering cooperation with the recipient.

Why Write an Insufficient Funds Letter

In certain financial situations, it becomes necessary to formally inform a recipient about an inability to make a scheduled payment. This type of communication helps clarify the issue at hand and provides the opportunity to propose a resolution or alternative arrangement. The primary objective is to maintain transparency and prevent any misunderstandings that could arise due to missed payments.

Writing such a message ensures that both parties are on the same page regarding the reasons for the delay and the actions being taken to address it. It also shows a willingness to cooperate and uphold good relations, which is especially important when dealing with creditors or business partners. By approaching the matter in a professional and respectful manner, the sender can help facilitate a smooth resolution and avoid potential conflicts.

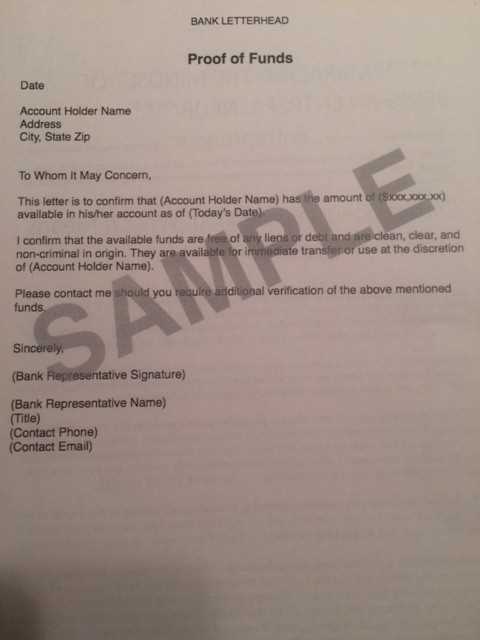

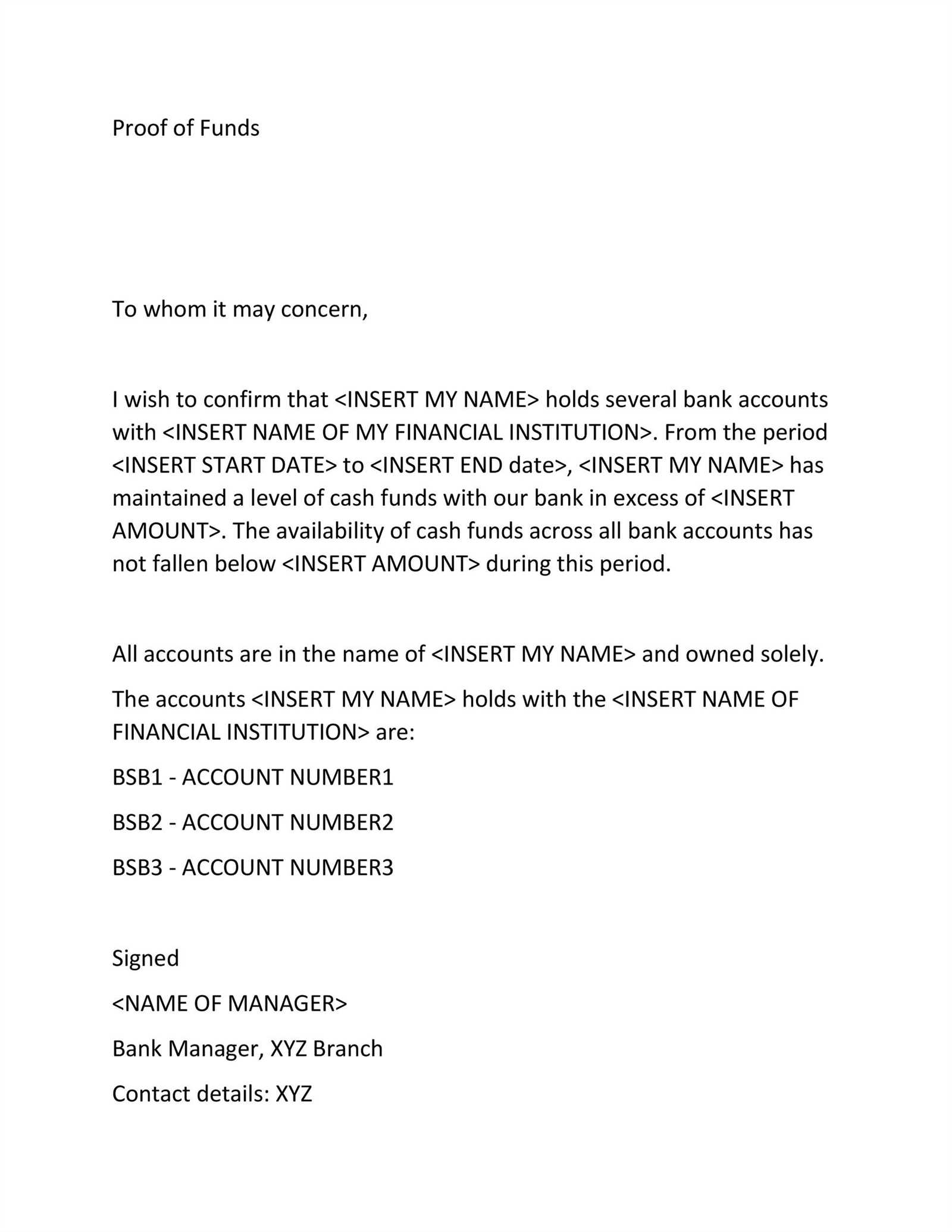

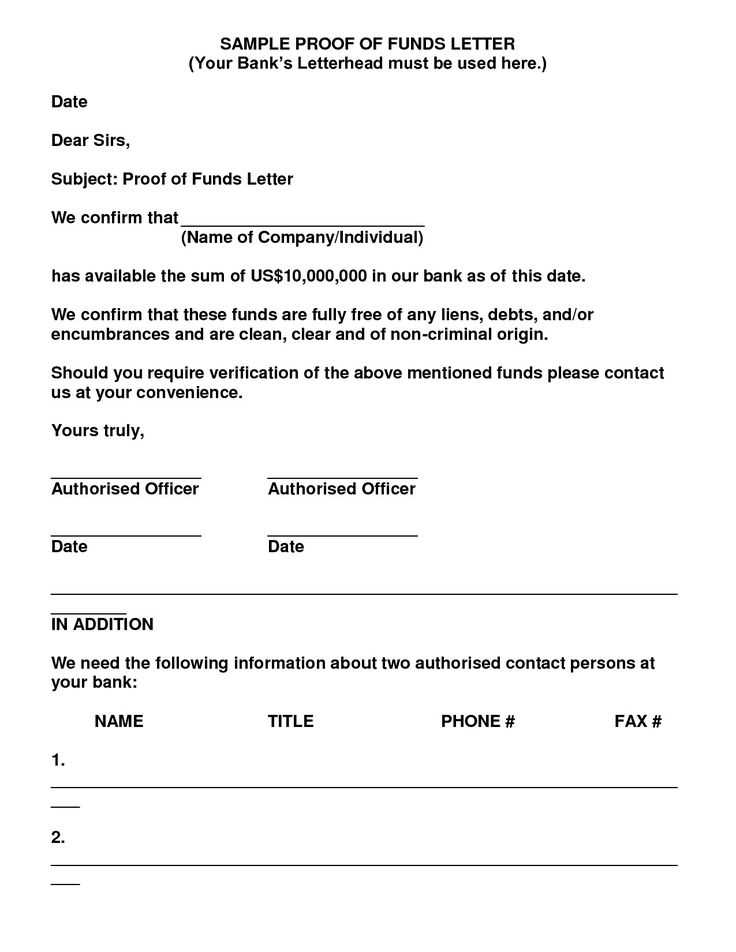

Key Elements of the Letter

When drafting a communication regarding a delayed or missed payment, certain components are essential to ensure clarity and professionalism. Including all relevant details helps prevent confusion and shows commitment to resolving the issue promptly. The following elements should be present in any effective correspondence of this nature.

- Clear Explanation: Provide a concise description of the issue and the reason for the delay.

- Acknowledgment of Responsibility: Show that you recognize the obligation and express a willingness to resolve it.

- Suggested Solutions: Offer potential solutions or propose a new payment schedule to demonstrate intent to settle the matter.

- Apology or Explanation: Depending on the situation, an apology or further explanation might be necessary to maintain trust.

- Contact Information: Ensure the recipient has a way to reach you for follow-up or further discussions.

Incorporating these key components ensures that the message is not only clear but also sets the stage for a positive outcome. By addressing the situation professionally, both parties can focus on finding a resolution without unnecessary tension or confusion.

Common Mistakes to Avoid

When addressing payment delays or similar financial issues, it’s important to be mindful of common errors that could affect the tone and effectiveness of your communication. These mistakes can undermine your efforts to resolve the matter and may lead to further complications. Understanding what to avoid can help ensure that your message is received in the right light and fosters a cooperative atmosphere.

Vague or Incomplete Information

Failing to provide clear and specific details about the situation can cause confusion. Ensure that your message includes the necessary facts, such as the payment due, the reason for the delay, and any proposed actions to resolve the issue. Without these details, the recipient may have difficulty understanding the situation or knowing what steps to take next.

Negative or Confrontational Tone

While it’s essential to address the issue, using a harsh or aggressive tone can damage your relationship with the recipient. Avoid blame or harsh language, and instead focus on a constructive approach that shows a willingness to work together toward a solution. Maintaining professionalism and respect will increase the chances of a positive outcome.

How to Format Your Letter

Proper formatting is essential when crafting a formal communication about a delayed payment. A well-organized message ensures clarity and helps convey professionalism. By following specific guidelines for structure, you can make sure your message is easy to read and effective in addressing the issue at hand.

Start with a Professional Header

Begin your message with a formal header that includes the recipient’s name, your contact details, and the date. This sets a professional tone and makes the correspondence feel official. Ensure that all relevant information is clearly presented so the recipient knows how to respond.

Use Clear and Organized Paragraphs

Structure your message into short, well-organized paragraphs. Each paragraph should focus on a single idea, such as explaining the reason for the delay, apologizing if necessary, and proposing a solution. This makes your communication easier to follow and ensures that key points are not lost in lengthy or convoluted text.

Tips for a Professional Tone

When addressing financial matters, maintaining a professional tone is essential for effective communication. The right tone can foster cooperation and help resolve the issue amicably. By following some simple guidelines, you can ensure that your message is both respectful and clear, avoiding any negative impact on the relationship with the recipient.

Key Principles for a Professional Tone

| Do’s | Don’ts |

|---|---|

| Use polite and formal language | Avoid aggressive or blaming language |

| Be concise and to the point | Do not over-explain or ramble |

| Maintain a respectful and understanding approach | Avoid sounding defensive or confrontational |

Choosing the Right Words

Selecting the right words can significantly impact how your message is received. Words such as “appreciate,” “understand,” and “resolve” convey a positive and cooperative attitude. On the other hand, harsh terms like “failure” or “problem” can create unnecessary tension. Always aim for a tone that demonstrates a willingness to work towards a solution while maintaining respect.