Insurance letter of authority template

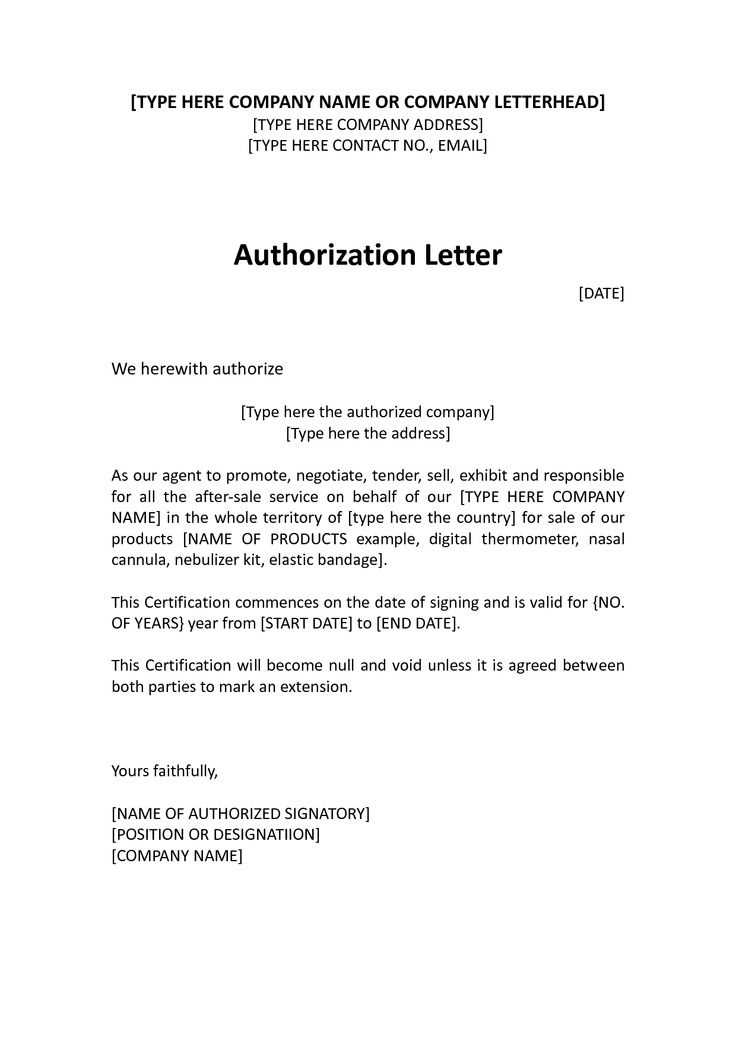

To create an effective insurance letter of authority, ensure it clearly identifies both the policyholder and the authorized representative. This document gives the representative the legal power to act on behalf of the policyholder, often for claims processing or policy management. Without this letter, the insurer may not recognize the representative’s right to make decisions or receive information about the policy.

The letter should begin with the policyholder’s details, including full name, address, and policy number. Clearly state the specific actions the representative is authorized to perform. If the letter covers a range of actions, such as filing claims or making changes to coverage, list each activity to avoid ambiguity. Always include the time frame for the authorization, whether it’s for a single transaction or an extended period.

Ensure that both parties sign the document and, if required, notarize it to meet legal requirements. Without signatures, the document lacks binding authority. The letter should also include the insurer’s name and contact information to facilitate verification. Lastly, consider keeping a copy of the letter for future reference or when submitting claims.