Insurance No Loss Letter Template for Easy Claim Filing

When you need to file a claim with your insurer and there has been no incident that requires compensation, it’s essential to provide a clear written statement. This formal declaration ensures your case is understood and handled appropriately. The key is providing the right details, such as confirming no actual damages or issues that might typically result in a payout. By doing so, you help streamline the claims process and demonstrate transparency in your communication.

Essential Information to Include

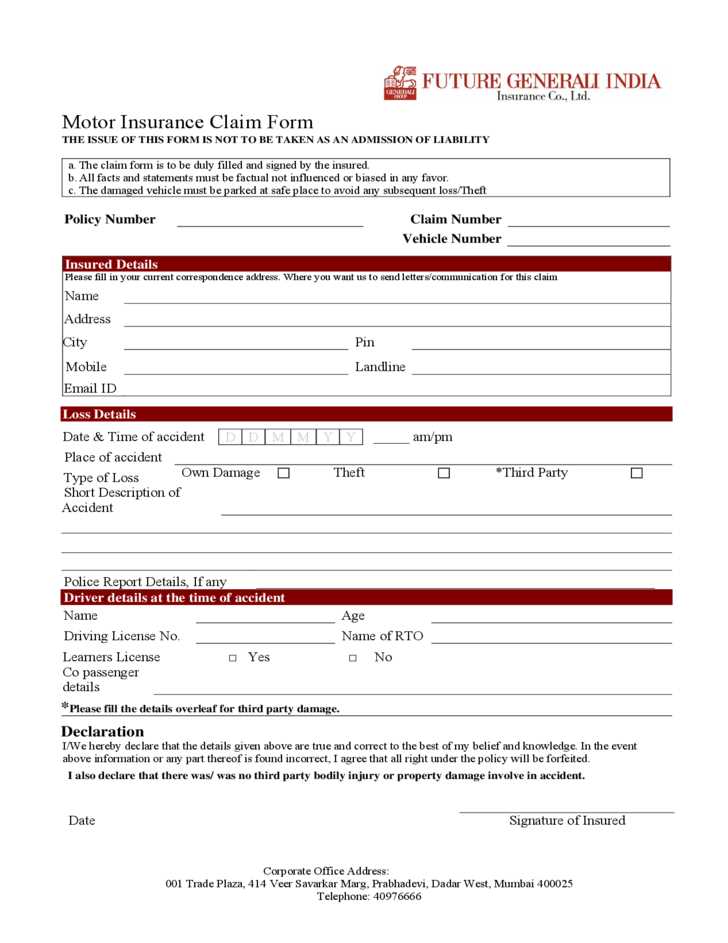

It’s important that your communication is precise and includes all relevant details. This helps prevent delays and confusion. The main elements to cover in your statement are:

- Policy Information: Clearly state the policy number and relevant dates to identify your coverage.

- Clarification of the Situation: Describe the event or circumstances, emphasizing that no compensation is needed.

- Contact Information: Provide your current contact details for further communication.

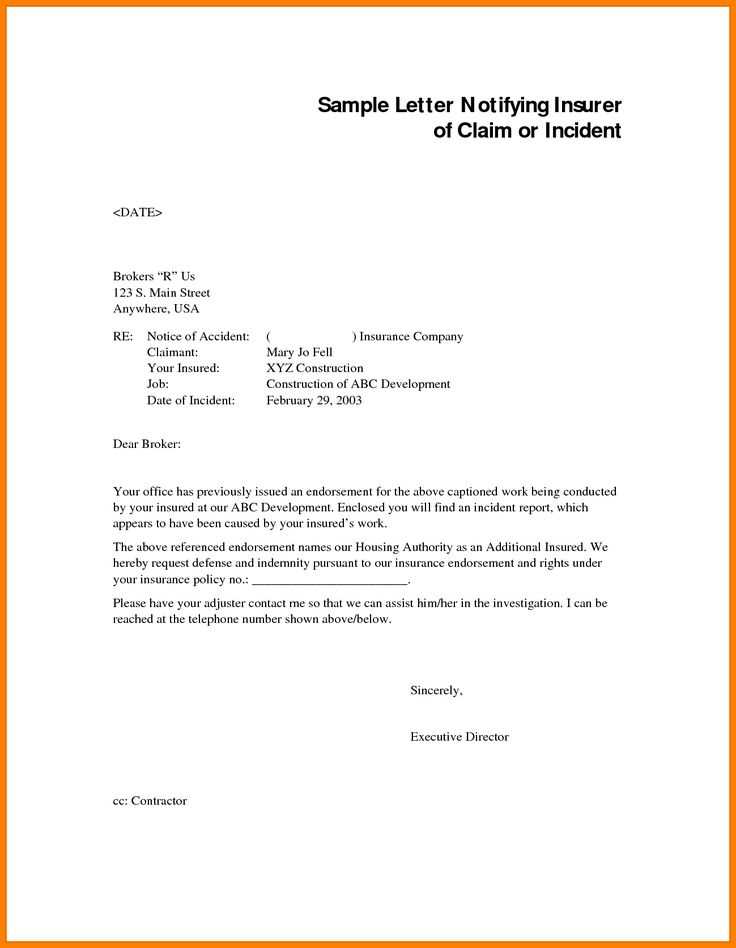

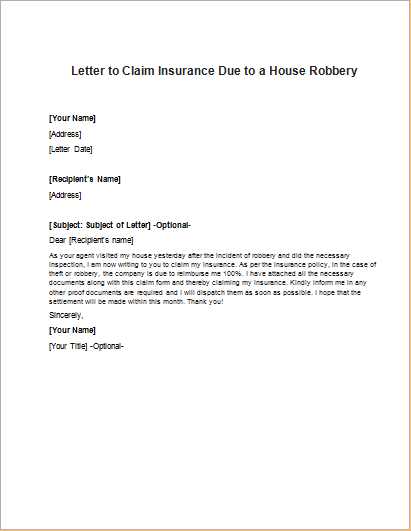

Steps for Drafting the Document

Start by addressing the document to the correct department or individual within the insurance company. Follow a professional format, ensuring the content is organized and easy to read. Once all the necessary details are included, sign the document to authenticate the statement.

Common Errors to Avoid

While drafting your statement, it’s crucial to avoid certain pitfalls. Here are some common mistakes to watch out for:

- Being too vague: Lack of specifics can cause delays.

- Failure to double-check contact details: Incorrect information can hinder response time.

- Omitting key policy details: Without these, the insurer may not be able to locate your file quickly.

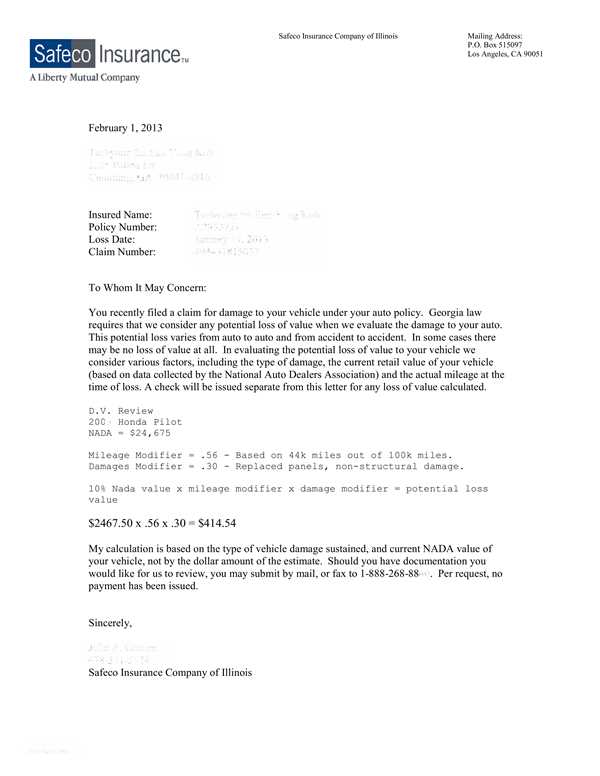

Why This Document is Crucial for a Smooth Process

Submitting this form is essential not just for clarity but also to demonstrate that you’ve complied with necessary formalities. A well-written declaration can speed up the resolution process and ensure that your case is handled with accuracy. It serves as an important tool for both the claimant and the insurance company, confirming that no claim is needed under the given circumstances.

Understanding the No Incident Declaration and Its Process

When you submit a claim with an insurer, but no actual damage or qualifying event has occurred, it’s necessary to provide a formal statement. This document serves as a clear indication to the company that no compensation is needed and confirms the absence of an incident that would typically trigger a claim. Crafting this communication accurately can help ensure the claims process runs smoothly and efficiently.

What to Include in Your Document

To ensure your communication is clear and comprehensive, include the following essential components:

- Claim Reference: Include your policy number, claim number (if applicable), and any other identifiers for easy access to your file.

- Details of the Situation: Briefly explain the circumstances or event in question, highlighting that no claim is necessary due to the absence of damage or qualifying issues.

- Personal Information: Include your contact details so the insurer can easily reach you if needed.

Step-by-Step Guide to Writing It

Start by addressing the correct recipient within the insurance company. Follow a formal structure, keeping the language clear and concise. Make sure to include all the required information such as policy numbers, contact details, and a clear explanation that no incident occurred. Conclude by signing the document to authenticate it and ensure it’s processed properly.

It’s essential to avoid common errors such as leaving out necessary information or submitting incomplete details, which may lead to delays or confusion. Once complete, submit the document via the specified method, whether by email, online submission, or postal mail, ensuring it reaches the appropriate department in a timely manner.

Why This Document Matters for Claims

Providing this declaration is vital for maintaining transparency with your insurer. It verifies that no compensatory claim is required, helping to avoid unnecessary follow-ups or potential complications. By clearly stating the facts, you help ensure your records are accurate and that the insurer can resolve any other claims swiftly and effectively.