Insurance policy cancellation letter template

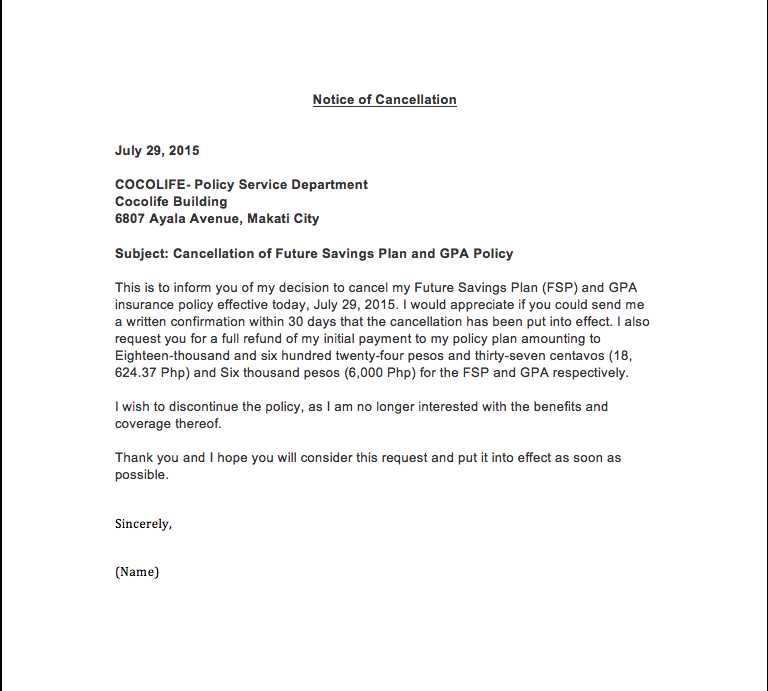

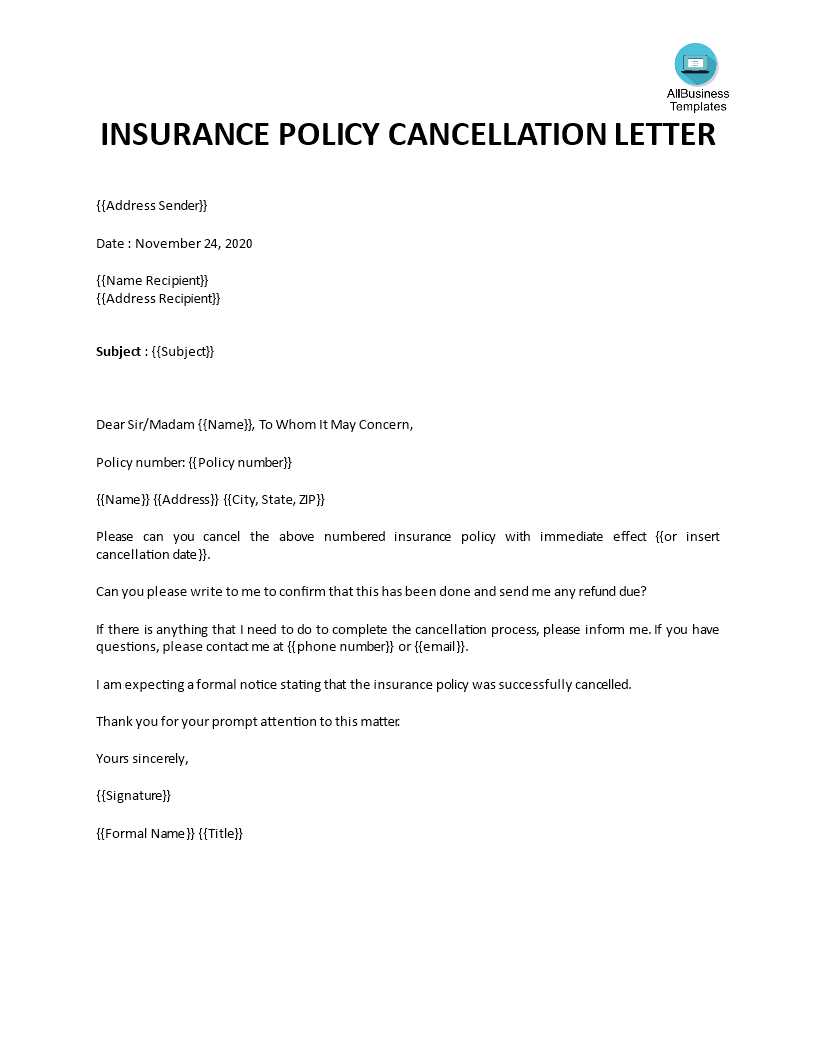

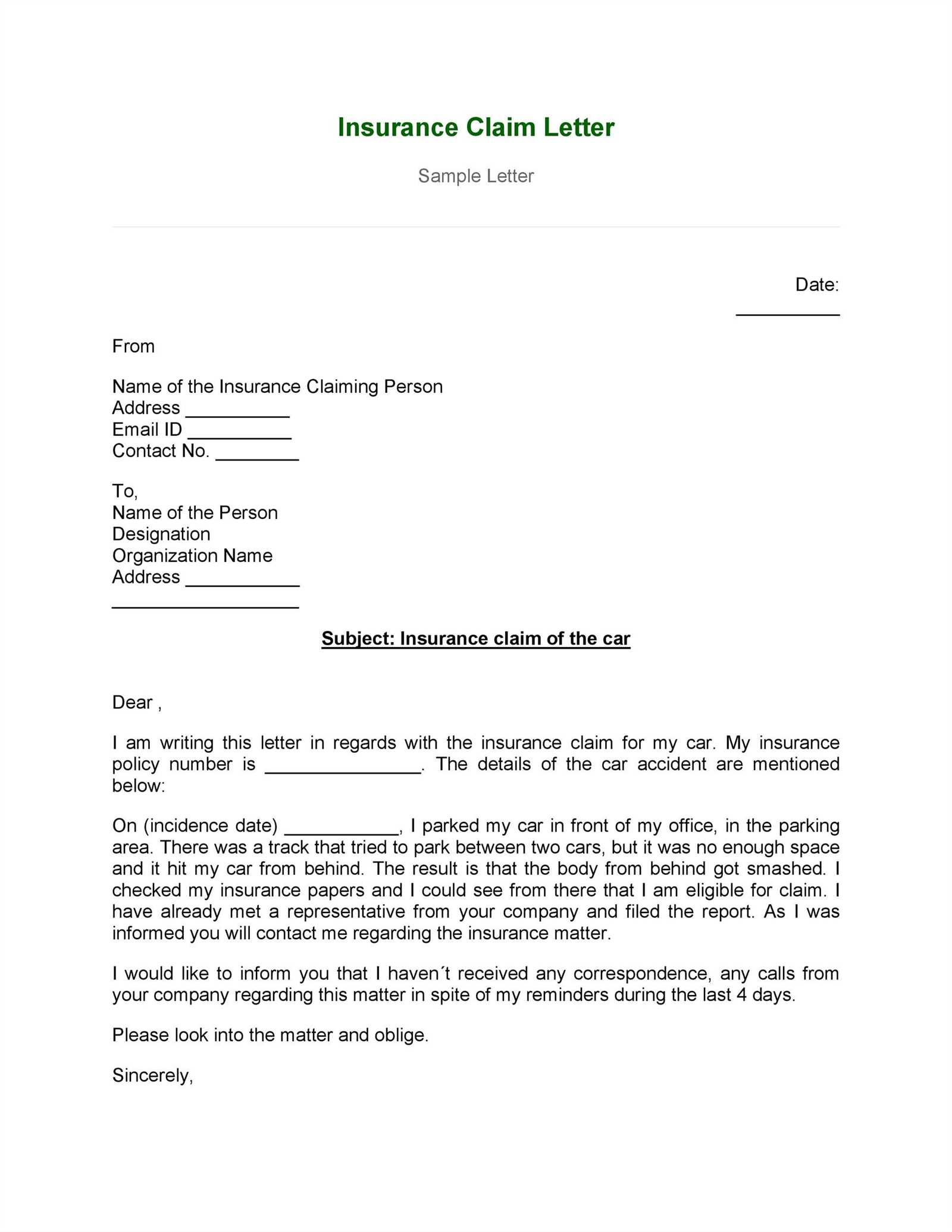

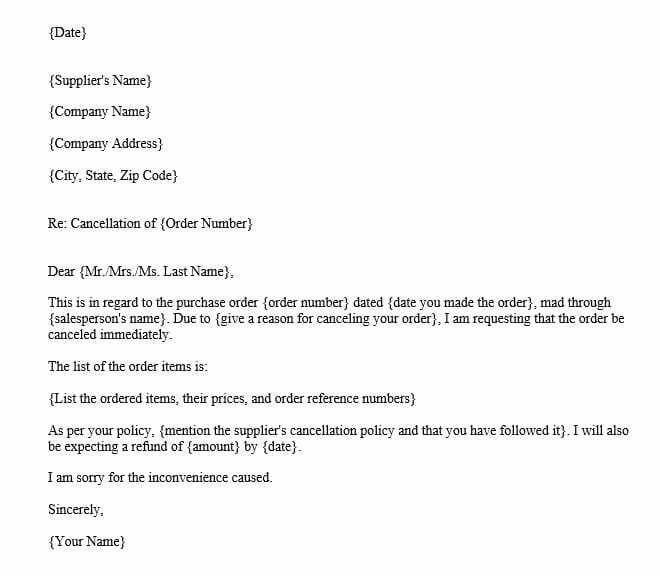

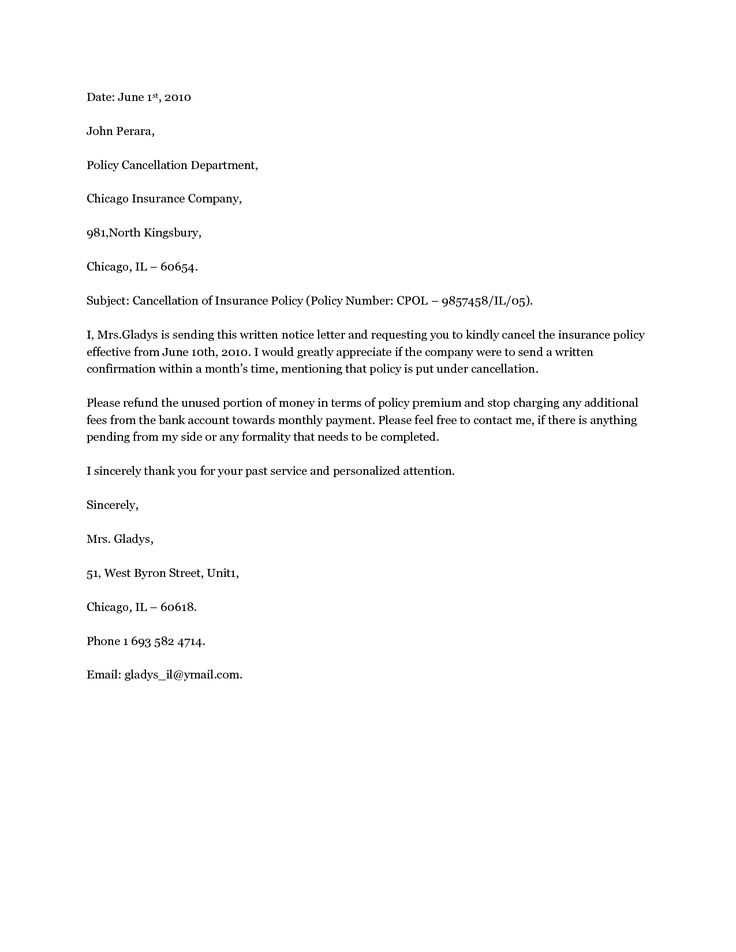

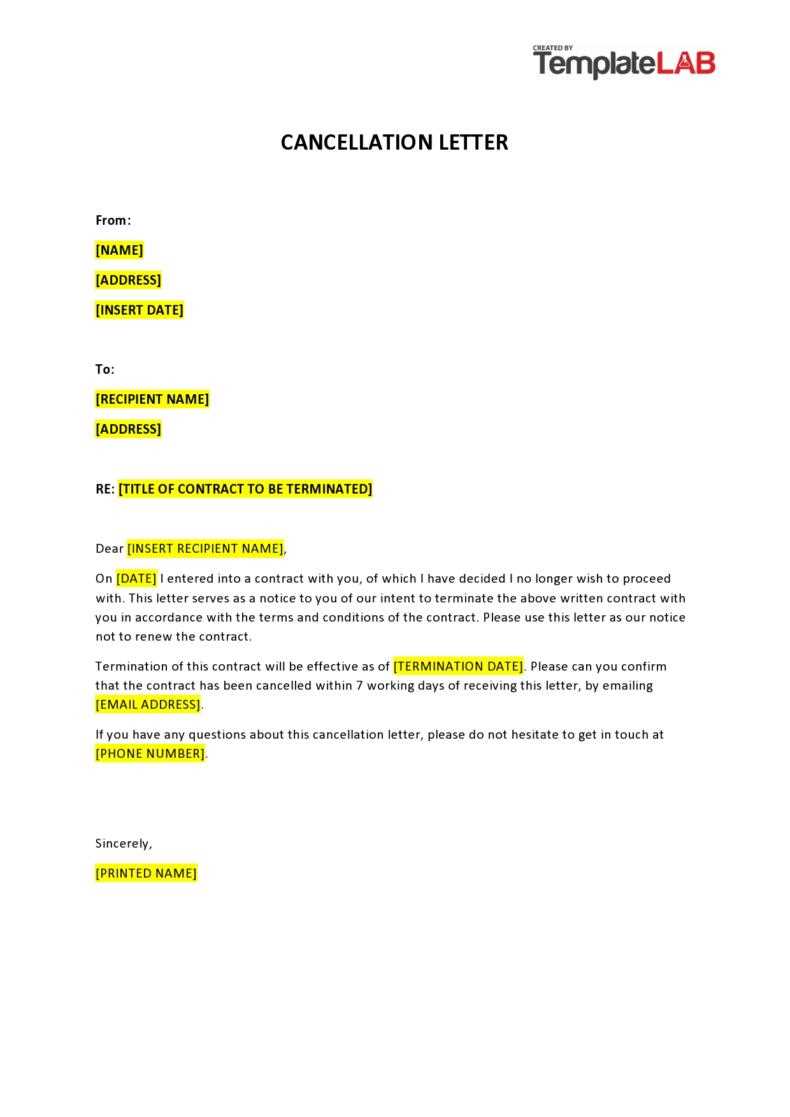

To cancel your insurance policy, start with a clear and concise letter. State your intention to cancel the policy and include key details such as your policy number and the effective date you wish the cancellation to take place. Make sure to provide your full name and contact information, as this will help the insurance company process your request smoothly.

Be direct and precise in your communication. Mention any specific terms from your policy regarding cancellation to avoid confusion. For example, note whether there are any cancellation fees or conditions tied to your request. The more straightforward your letter, the quicker it will be addressed.

Double-check the mailing address for the insurance company’s cancellations department. Some companies may also accept cancellation requests via email, but ensure your letter is directed to the appropriate place to avoid delays.

Here’s the corrected version:

Make sure to address the recipient clearly in the letter, starting with a polite but firm request for policy cancellation. State your full name, policy number, and the date on which you’d like the cancellation to take effect. Ensure that you specify whether you expect a refund for any unused premium or if you wish to cancel immediately without a refund. Mention the reason for cancellation briefly, but avoid unnecessary details. Always request written confirmation of the cancellation, as this will serve as proof in case of any disputes later.

Ensure your contact information is included, and sign the letter at the end. It’s also a good idea to send the letter via a trackable mailing service to confirm receipt by the insurer.

Insurance Policy Cancellation Letter Template

How to Start Your Request for Cancellation

Essential Information to Include in the Letter

Writing a Clear Reason for Termination

Steps to Take After Sending the Letter

How to Manage Responses from the Insurance Provider

How to Ensure Successful Policy Cancellation

Begin by addressing the letter directly to your insurance provider. Include your full name, policy number, and contact details at the top. These details help the provider quickly locate your account and process your request.

Clearly state your intention to cancel the policy. Specify the date you wish the cancellation to take effect. This helps avoid confusion about when the coverage should end.

List the essential information, including your policy number, coverage type, and personal identification details. Include your full address and the date you are submitting the cancellation request. This ensures that the provider can match your request to the correct account without delay.

When stating your reason for cancellation, keep it concise and direct. Whether it’s due to finding a better offer or no longer needing the coverage, a straightforward explanation reduces the chances of miscommunication.

After sending the letter, confirm receipt with your insurance company. Follow up with them if you do not receive a response within a reasonable time frame. Keeping track of your communication ensures you stay on top of the cancellation process.

If the insurance provider responds with questions or offers to retain your business, respond promptly. Clarify your decision to proceed with the cancellation if needed. In some cases, the provider may offer incentives to keep you as a customer, but it’s important to stand by your decision if you are firm on canceling.

To ensure the policy cancellation is successful, follow up until you receive written confirmation that your coverage has ended. This protects you from any unexpected charges or misunderstandings.