Insurance Refund Letter Template for Quick Reimbursement

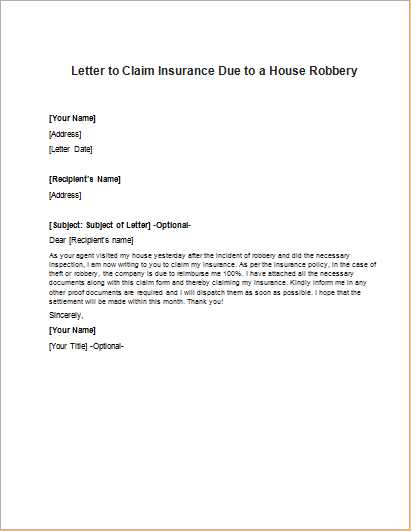

When you need to recover a previously paid amount, it’s essential to formalize your request with a clear and professional document. This communication should detail the situation and the amount expected, ensuring that the process is efficient and straightforward. Knowing how to structure such a request can make a significant difference in getting the desired outcome.

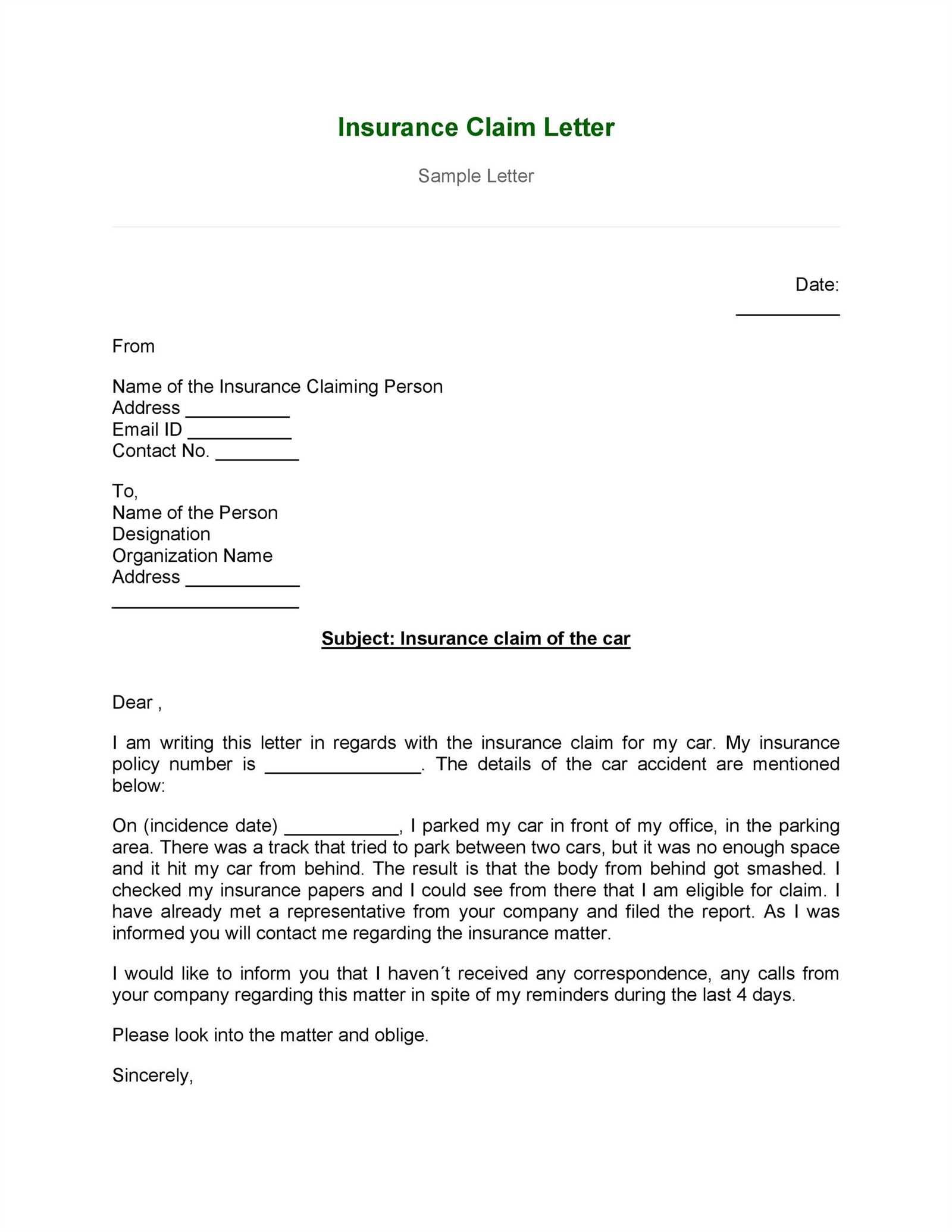

Essential Components for a Successful Request

The primary goal of any recovery request is clarity. Here are the key elements that must be included to ensure that the recipient understands the purpose of your communication:

- Recipient Information – Ensure that you address the correct department or person who handles such matters.

- Details of the Payment – Provide specifics such as date, amount, and the reason for the payment.

- Reason for Request – Clearly explain why the payment should be returned or adjusted.

- Desired Outcome – Specify the amount you are requesting and the preferred method of reimbursement.

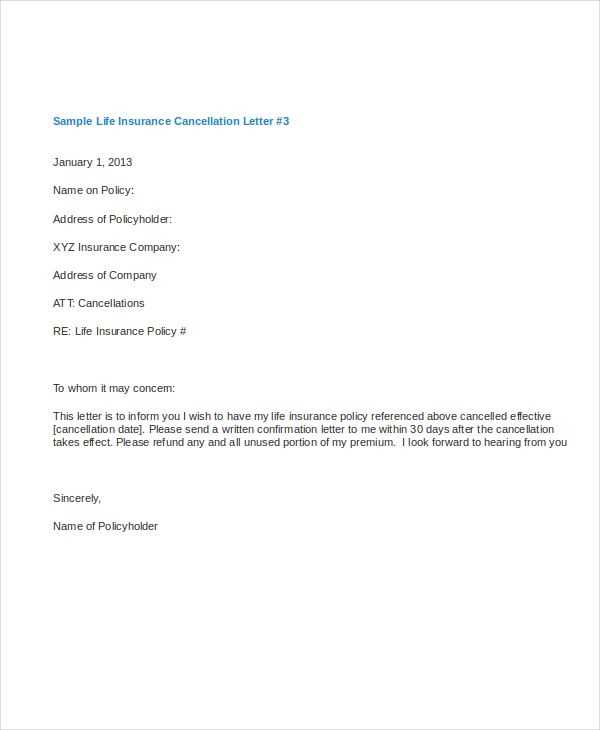

Common Errors to Avoid

Even a small mistake in your written request can delay the process or cause confusion. Avoid these common pitfalls:

- Incomplete Information – Not providing all the necessary details can lead to delays.

- Ambiguous Language – Ensure your request is direct and to the point, avoiding unnecessary complexity.

- Failure to Follow Up – After submitting your request, be proactive in ensuring it is processed.

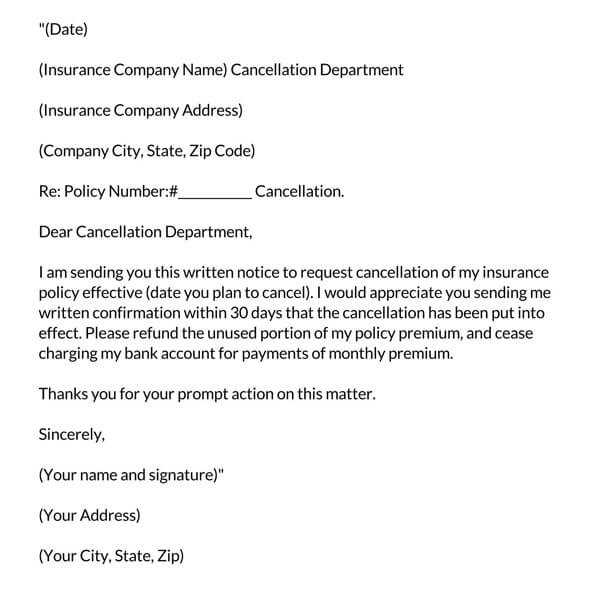

Submitting Your Request Efficiently

Once your document is finalized, consider the best method for submission. Some organizations prefer online forms or email, while others might require physical documents. Always confirm the preferred communication channel to avoid unnecessary delays.

Timeframes for Payment Recovery

The time it takes to process a request depends on the organization and the complexity of the issue. Typically, expect a response within a few weeks, though it may vary. In some cases, follow-up may be necessary to ensure that your claim is being processed.

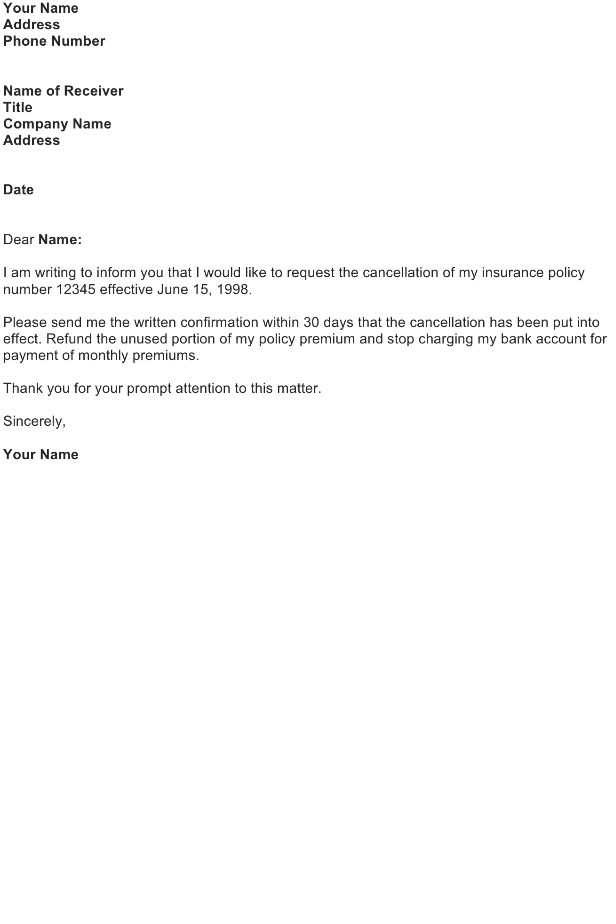

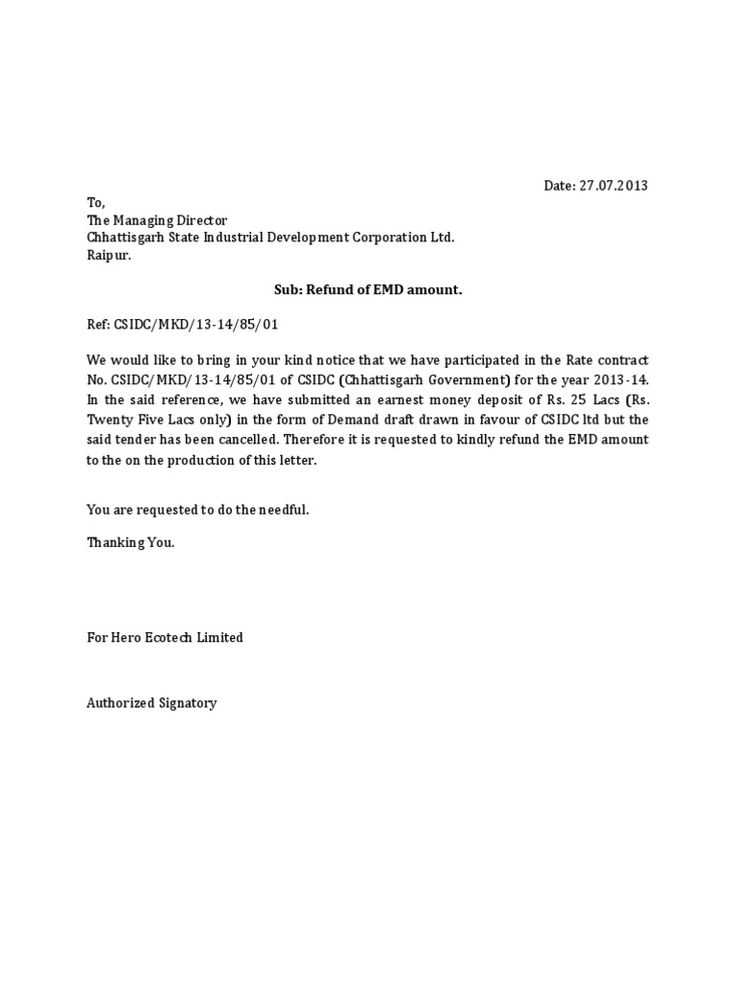

How to Write a Payment Recovery Request

Writing a formal request for the return of a previously paid amount involves clearly stating your case and providing all necessary information to ensure the process is smooth and efficient. By following a proper structure, you can increase the chances of receiving a positive response. The key is to be clear, concise, and professional in your communication.

Key Elements of a Payment Recovery Request

To make sure your claim is processed promptly, it’s important to include the following elements in your document:

- Contact Information – Include your name, address, and any relevant account or reference number.

- Details of the Payment – Clearly state the amount, date of payment, and the purpose of the payment.

- Reason for Recovery – Explain why you believe the amount should be returned or adjusted, providing any supporting evidence if necessary.

- Desired Outcome – Specify the amount to be refunded and your preferred method of reimbursement.

Common Mistakes to Avoid in Requests

To ensure your request is not delayed or rejected, avoid the following errors:

- Vague Language – Be as clear as possible when stating the reason for your request and the expected outcome.

- Missing Details – Always include all relevant information, such as account numbers and payment dates, to prevent any confusion.

- Overlooking Follow-Up – After submitting your request, make sure to follow up to check the status of your claim.

Best Practices for Submitting Claims

Once your request is ready, submit it through the appropriate channel, whether it’s via email, online form, or physical mail. Double-check that you’re sending it to the correct department or person to avoid delays.

Understanding the policies of the organization handling your claim is essential. Familiarize yourself with their guidelines and expected timelines to avoid unnecessary frustration.

Lastly, customizing your request according to the specific situation can make a difference in how quickly it’s processed. Tailor your communication to reflect the unique aspects of your case.