Irresponsible lending complaint letter template

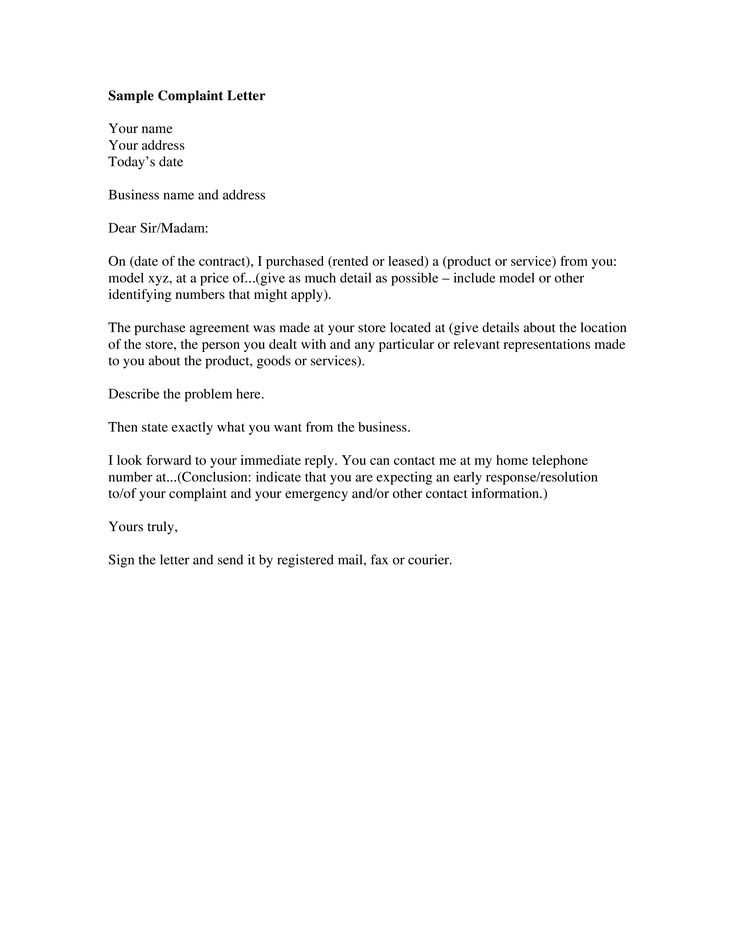

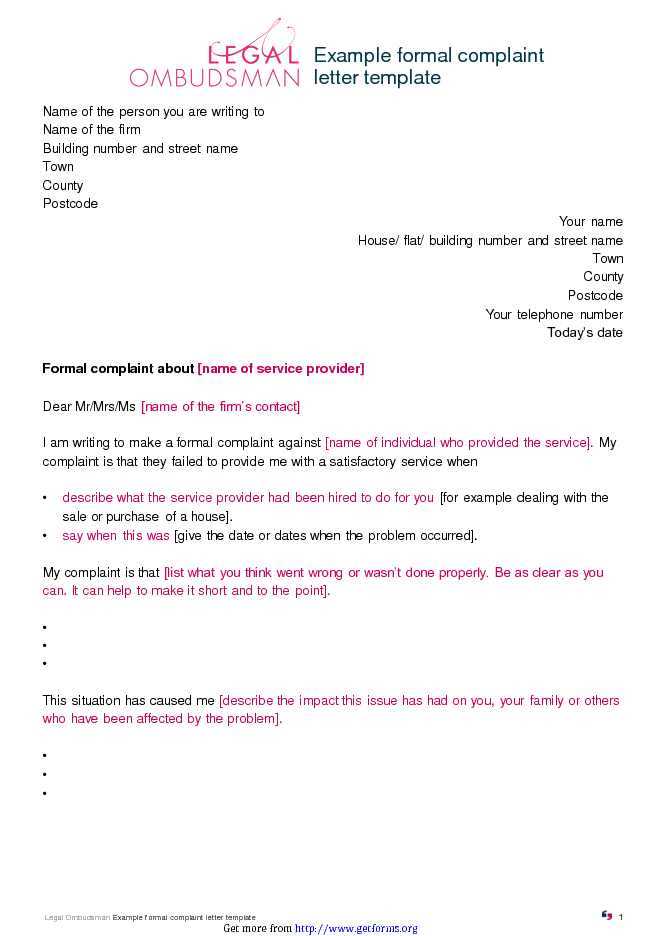

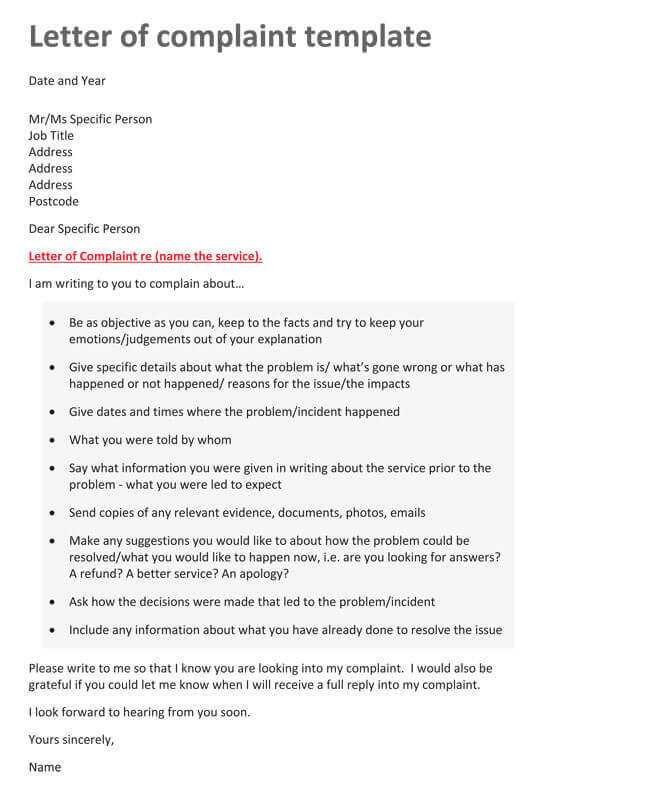

Start your letter by clearly stating the issue. Specify the loan details, such as the amount, dates, and terms, followed by a description of the irresponsible lending practices you’ve experienced. Use direct language to outline the concern and avoid unnecessary details.

Example: “I am writing to formally complain about the loan I received from [Lender’s Name] on [Date]. The terms of this loan, specifically the interest rate and repayment schedule, do not align with my financial capabilities, leading to undue hardship.”

Next, provide any evidence you have to back up your claim, such as communication logs, loan documents, or any financial assessments that demonstrate the loan was not suitable for your needs. This will help establish a factual basis for your complaint.

Example: “I have attached a copy of the loan agreement and the correspondence I had with your team, which highlight the mismatch between my financial situation and the loan terms.”

Clearly state the desired outcome. Whether you seek a revision of the loan terms or another form of resolution, outline your expectations succinctly and respectfully. Avoid vague language to ensure your request is understood.

Example: “I request a review of my loan terms and a revision to reflect a more manageable repayment schedule.”

Finish by stating your intention to take further action if necessary, such as reporting the issue to relevant authorities or seeking legal advice. This shows that you are serious and prepared to follow through with your complaint.

Example: “If this issue is not resolved within [X] days, I will consider escalating my complaint to the Financial Ombudsman Service.”

Here are the revised lines with minimal repetition:

Focus on clarity by simplifying the language. Use concise, straightforward sentences to express your points without unnecessary elaboration. This makes your complaint easier to understand and more direct.

Key adjustments for clarity:

- Replace overly complex phrases with simpler terms.

- Avoid repeating the same idea in different words.

- Streamline your sentence structure to enhance readability.

By focusing on these principles, you can craft a letter that clearly communicates your concerns while ensuring it’s straightforward and effective.

- Understanding the Importance of a Complaint Letter

A well-crafted complaint letter provides a clear record of your concerns, ensuring that the lender addresses the issue promptly. It sets the tone for the resolution process and highlights specific instances of irresponsible lending, which may help in negotiating a fair outcome. Address the situation directly, mentioning the exact problem with dates and supporting documents, to avoid confusion or misinterpretation.

By submitting a formal complaint, you show that you take the matter seriously. This not only strengthens your position but also signals to the lender that you are aware of your rights and expect action. A structured letter with factual details and professional language can help speed up the investigation process, as it makes it easier for the company to review and resolve the issue.

Being clear and concise in your complaint allows the lender to understand your grievance and respond more efficiently. This can lead to a quicker resolution or a more favorable outcome, as it shows a willingness to work through the issue constructively. A well-written letter could be an essential step toward preventing future problems with the lender.

Begin by including your full name, address, and contact details at the top of the letter. Clearly state the lender’s name and address as well. This establishes the connection and ensures your complaint reaches the right department.

Be specific about the loan in question: mention the loan amount, interest rate, and the exact date you signed the agreement. If possible, refer to the loan number or any specific reference number associated with the loan for quick identification.

Provide a brief summary of the issue. Focus on how the lending process was irresponsible, highlighting key actions or omissions by the lender that led to the problem. This can include issues like unclear terms, failure to assess your ability to repay, or misleading communication.

Clearly outline the impact of this irresponsible lending. State how it has affected you financially, mentally, or otherwise. Offering concrete examples helps strengthen your case and provides the lender with a better understanding of the severity of the situation.

End by specifying the outcome you seek. Whether it’s a refund, loan modification, or another form of compensation, being clear about your desired resolution sets a clear expectation for the lender’s response.

| Detail | Example |

|---|---|

| Loan Amount | $10,000 |

| Interest Rate | 15% |

| Loan Number | 123456789 |

| Issue Summary | Lender failed to verify income before granting the loan. |

| Desired Resolution | Refund of fees and loan modification. |

Begin with a clear and concise header that includes your contact details and the recipient’s information. This provides an immediate reference for both parties.

State the date when the letter is being sent. This will help track the timeline of your complaint.

In the opening paragraph, clearly state the reason for your complaint. Focus on the issue at hand without including unnecessary details.

Follow with a brief explanation of what led to the issue. Keep this section factual and straightforward. Avoid emotions or exaggerated claims.

Next, describe the impact the irresponsible lending had on you. Include any relevant financial details or consequences.

In the next section, propose a clear resolution or action that you expect. This sets expectations and shows what you are seeking as an outcome.

End with a polite but firm closing. Express your hope for a prompt resolution and provide your contact information for follow-up.

- Ensure your letter is professional and free of grammatical errors.

- Use bullet points to highlight key issues for better readability.

- Keep your tone firm but polite, avoiding emotional language.

Lastly, sign the letter. If sending via email, include a digital signature or your typed name for authenticity.

One of the most common mistakes in a complaint letter is being vague. Clearly outline the issue, including specific details such as dates, amounts, and any relevant communication or documents. This helps establish your case and shows that you are serious about resolving the issue.

Avoiding Emotional Language

While it’s natural to feel frustrated, avoid letting emotion take over the tone of your letter. Stay polite, direct, and professional. Using angry or accusatory language can undermine your credibility and may result in your complaint being dismissed.

Excluding Key Information

Ensure you include all necessary details, such as your account number, loan agreement, and any prior correspondence. Missing these key elements can delay the process or cause your complaint to be rejected. Always double-check before sending.

Finally, do not forget to specify the resolution you are seeking. Whether it’s a refund, adjustment, or other compensation, make sure your request is clear. Avoid general requests and focus on a specific outcome to help the lender address your concerns directly.

Begin by keeping your tone polite but firm. Use clear, concise language that avoids ambiguity. State your complaint with precision, focusing on the key issues without overstating the situation. Avoid sounding overly emotional or accusatory. This will help ensure your letter is taken seriously and remains professional.

Be direct in explaining the problem and its impact, but maintain respect for the reader. Use formal language without being cold or impersonal. Phrases like “I would appreciate your prompt attention to this matter” express your concerns while maintaining a courteous approach.

Avoid using aggressive or confrontational words, as they may hinder a constructive response. Instead, focus on facts and how the situation has affected you. The goal is to prompt a solution, not to create further conflict.

Remember that the tone can influence the outcome. A balanced approach that combines clarity, respect, and assertiveness can lead to a more favorable resolution.

Once you have sent your complaint letter, keep a record of the communication. This includes saving any emails or letters you’ve sent, along with proof of delivery or receipt. If you’ve used an online platform, take screenshots or print confirmation pages.

Monitor for a Response

Allow the lender adequate time to respond. Typically, responses should come within 14 to 30 days. Keep track of the dates and follow up if you haven’t received a reply within the expected timeframe. A polite follow-up can often prompt a quicker response.

Evaluate the Response

Once the lender responds, carefully review their answer. If they offer a resolution, assess whether it meets your expectations and is in line with your original complaint. If they dismiss your complaint or provide an unsatisfactory response, you may need to escalate the issue.

If you find the response inadequate, consider contacting a financial ombudsman or regulatory body in your region. These organizations can investigate the issue further and potentially resolve it if the lender fails to act fairly.

Stay proactive and document every step of the process. This information will be crucial if you need to take further action.

To address an irresponsible lending complaint, focus on providing clear details about the loan terms and how they did not meet the expected standards. Start with the specific issue you faced, whether it was unreasonably high interest rates, unclear repayment terms, or any misleading marketing practices. Mention any communication you had with the lender, and point out any discrepancies or mistakes made during the process.

Clarify Loan Terms and Conditions

Clearly outline the terms that you were offered, such as interest rates, loan duration, and any fees involved. If the lender provided you with terms that were not fully transparent, highlight this. Refer to any documents you received and include dates and details of your agreement.

Provide Evidence of Misleading Practices

If the lender used tactics that seemed misleading or if they failed to provide the necessary information, point this out. Attach any relevant emails, letters, or phone call recordings that demonstrate the lack of clarity or improper conduct. Be as specific as possible to strengthen your case.