Irs letter template

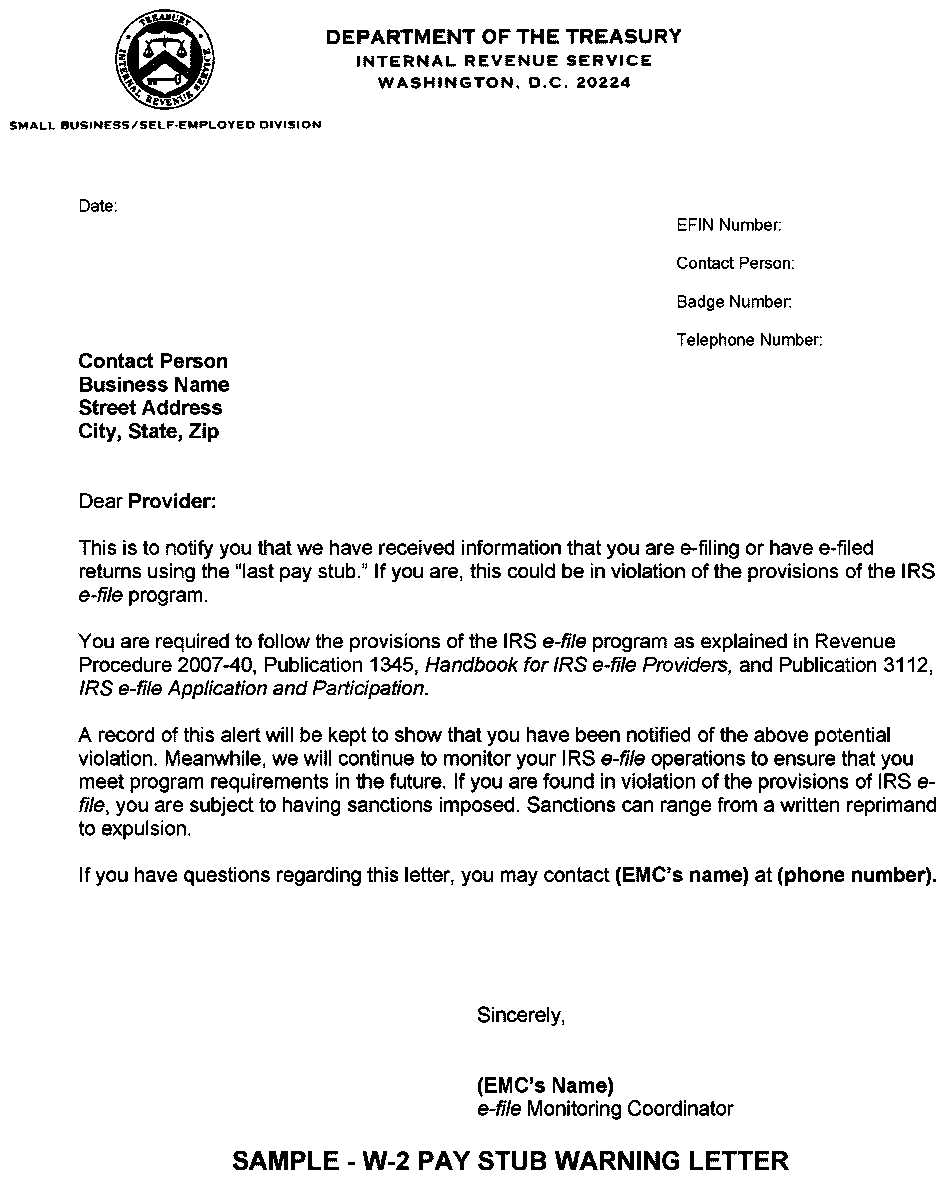

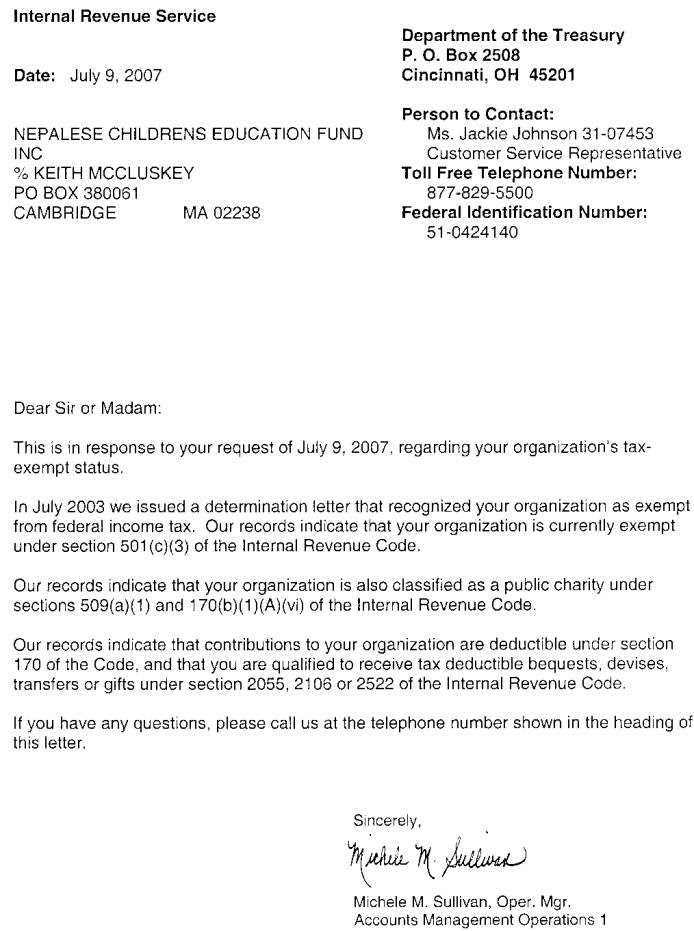

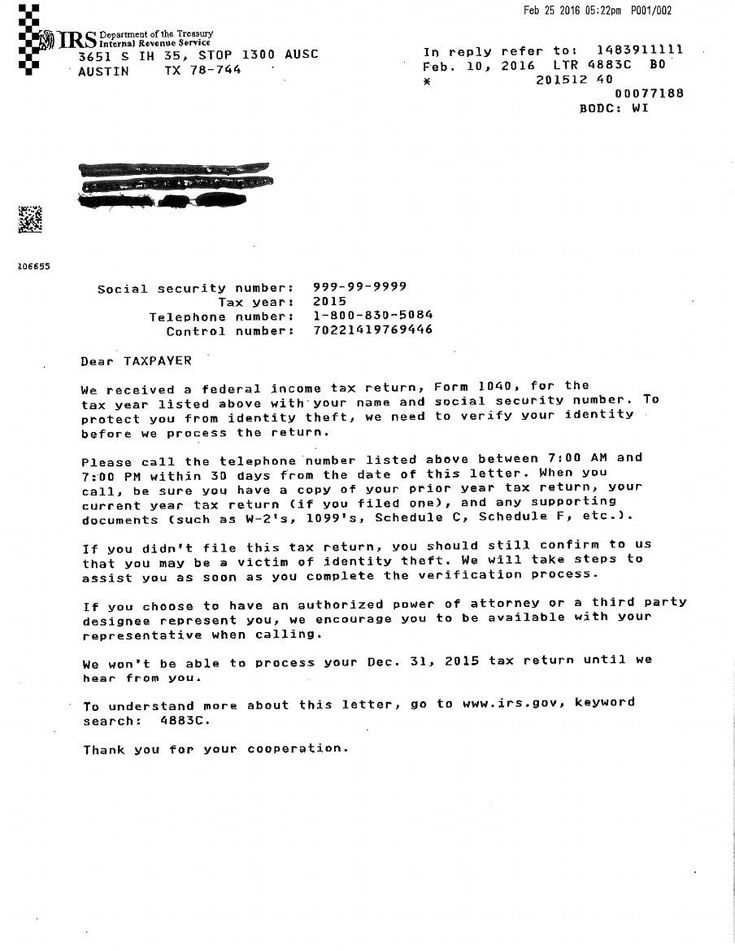

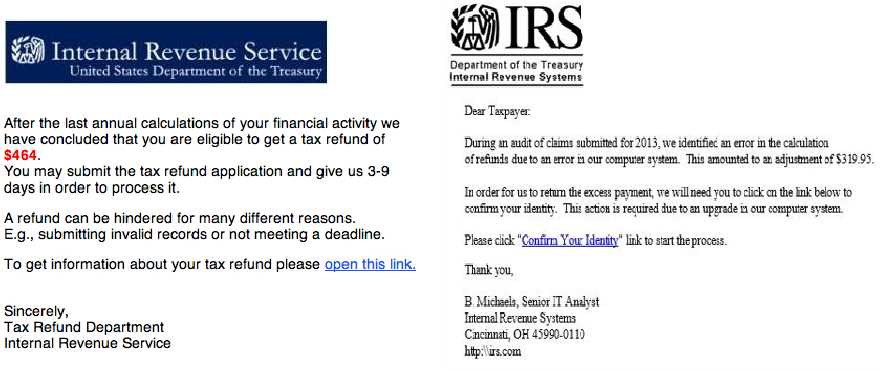

If you’ve received a letter from the IRS, responding correctly is critical to resolving any issues. A well-crafted letter to the IRS should be clear, concise, and professional. Start by addressing the specific reason you are writing and referencing the notice number from the IRS letter. This will help ensure your response is directed to the correct department and issue.

In your letter, provide all requested information, including your taxpayer identification number, and any supporting documents that back up your position. Avoid unnecessary details, but make sure to explain any discrepancies or mistakes as clearly as possible. If you’re requesting more time to resolve the issue, state this explicitly and provide a reasonable timeframe.

Tips: Be sure to keep a copy of the letter for your records. If you’re mailing it, use certified mail for proof of delivery. Also, consider consulting with a tax professional if you’re unsure about how to respond. A well-written letter can make all the difference in how quickly your issue is addressed.

Here’s the corrected version:

To address the issue at hand, follow this approach when responding to an IRS letter:

1. Acknowledge the issue

Start your response by clearly identifying the matter the IRS addressed in their letter. If it’s regarding an error in your filing, specify what needs to be corrected. If additional documentation is required, confirm that you’ll provide it.

2. Provide necessary details

- Include your full name, Social Security Number (SSN), and the tax year in question.

- Ensure all supporting documents are legible and well-organized.

3. Outline the correction

If you are correcting an error, briefly explain what went wrong and how you’ve rectified it. If you’ve made a payment or filed an amended return, confirm these actions in your response.

4. Be clear and concise

Avoid unnecessary details. Stick to the facts and ensure your explanation is easy to follow.

5. Close professionally

Thank the IRS for their attention to the matter. Be sure to include your contact information in case further clarification is needed.

- IRS Letter Template Guide

When writing a letter to the IRS, it’s important to be clear, direct, and concise. The letter should include all necessary details to ensure the IRS understands your situation without the need for follow-up. Here’s a simple template for reference:

IRS Letter Template

Subject: [Your Issue/Request]

Dear Sir or Madam,

I am writing regarding [state the reason for your letter, e.g., “a discrepancy in my tax filing for 2023”]. My full name is [Your Name], and my taxpayer identification number is [Your TIN]. I am writing to [explain the purpose of your letter].

Provide specific details about your issue or request, including any supporting facts, documents, or reference numbers. For example:

For the 2023 tax year, I believe there was an error in the processing of my tax return. I filed my return on [date], and the IRS notice I received on [date] indicates [describe the discrepancy]. Attached are copies of the documents I submitted and any additional information that may clarify the situation.

If applicable, state what you are requesting, e.g., “I respectfully request a review of my case and a correction of the discrepancy.” Be sure to express your desire for a timely resolution.

Thank you for your attention to this matter. I look forward to your prompt response. Should you need further information or clarification, please feel free to contact me at [your phone number or email address].

Sincerely,

[Your Name]

[Your Address]

[Your Contact Information]

Important Tips for IRS Letters

Always keep a copy of the letter for your records. Be polite and professional, even if you’re frustrated. Ensure that any documents referenced are clearly labeled and easy to read. If sending sensitive information, consider using certified mail for delivery confirmation.

Begin with a clear heading that includes your name, address, and the IRS address as the recipient. This ensures the letter is directed to the right department. Include your taxpayer identification number (TIN) or Social Security Number (SSN) for proper identification.

Address the Issue Directly

Clearly state the purpose of your letter. Whether it’s a request for clarification, response to a notice, or payment arrangement, be concise and direct. Describe the situation or issue without unnecessary details, focusing on key facts. Provide any necessary background to make your case clear but stay to the point.

Offer Supporting Information

Include relevant documents or reference numbers to support your claims. For example, if you’re disputing a charge, provide documentation that backs your position. Attach copies of tax forms, payment receipts, or other relevant records that substantiate your case.

End the letter with a polite closing, such as “Sincerely” or “Best regards,” and your full name. Be sure to sign the letter to confirm its authenticity.

Key Elements to Include in a Letter to the IRS

Be clear and concise when addressing the IRS. Start by including your full name, address, and Social Security Number (SSN) or Employer Identification Number (EIN) for identification. Make sure this information is accurate to avoid delays in processing your letter.

Specific Issue or Request

Clearly state the reason for your letter. Whether it’s disputing a tax assessment, requesting an extension, or seeking clarification, be specific about the issue. Include any relevant tax years and forms associated with the situation to make it easier for the IRS to identify your case.

Supporting Documentation

Attach copies of any documents that support your claim. This could include tax returns, receipts, bank statements, or previous correspondence with the IRS. Make sure all documents are legible and relevant to the matter at hand.

If you’re requesting a payment plan or settlement, be sure to mention your financial situation. Offering supporting details about your income, expenses, or other liabilities can strengthen your request.

Close with a polite but firm request for resolution. Mention any deadlines if applicable and provide contact information should the IRS need further details. Sign the letter and keep a copy for your records.

Accuracy is key. Make sure all personal and financial details are correct, including your name, Social Security number, and tax identification number. A small mistake can delay processing or lead to a misunderstanding.

1. Failing to Include the Correct Forms

Before sending any communication, ensure you’re attaching the right forms. IRS letters typically request specific documents. Omitting them can lead to unnecessary back-and-forth or a rejection of your request.

2. Not Using a Professional Tone

Avoid using informal language or making emotional statements. Stay polite and professional in your writing. Clear, respectful communication helps expedite the process and reduces confusion.

Stay organized by referencing any related IRS notices or tax years in question. This helps the IRS process your request more efficiently.

Use a clear and concise format to ensure the IRS understands your message without confusion. Begin with your contact information at the top, including your name, address, and taxpayer identification number, followed by the date. This helps the IRS quickly identify your case.

Next, include a subject line that directly explains the purpose of the letter. For instance, “Request for Payment Plan Adjustment” or “Clarification on 2023 Tax Filing.” A specific subject helps the recipient understand your request right away.

In the body, organize the letter into short, easily readable paragraphs. State your issue or request clearly in the first paragraph. Provide supporting details in the next section, and be sure to reference any IRS notices or documents relevant to your case. If applicable, include numbers, dates, and specific instructions. Avoid unnecessary jargon or long explanations.

Ensure your tone remains respectful and professional. If you’re addressing a mistake or misunderstanding, stick to the facts and avoid speculation or emotions. It’s also helpful to end the letter with a clear request or action you hope the IRS will take.

Before sending, double-check that the IRS mailing address is correct, and always keep a copy for your records.

Make sure your letter is clear and concise. State the reason for your communication right away and avoid unnecessary details.

- Use Professional Language: Avoid slang or overly casual tone. Keep the language formal, but easy to understand.

- Include Your Taxpayer Identification Number (TIN): This helps the IRS associate your letter with your specific tax account. Include it in the subject line and at the top of the letter.

- Double-Check Accuracy: Verify all personal information, tax details, and dates. Mistakes could delay processing or lead to follow-up actions.

- Organize Documents: If you’re attaching supporting documents, organize them in the order referenced in your letter. Make it easy for the IRS to follow your case.

- Use Certified Mail: Send your letter via certified mail to ensure proof of delivery. Keep the receipt for your records.

- Be Polite and Direct: IRS staff handle numerous cases daily. A respectful and clear letter is more likely to receive a prompt response.

- Follow Up: If you haven’t received a response within the expected time frame, reach out for an update. Keep a record of all communication.

After sending your letter to the IRS, track the status and initiate follow-up actions to ensure timely resolution. Begin by waiting for at least 30 days to give the IRS enough time to process your letter.

1. Check for a Response

Before following up, confirm that the IRS has received and processed your letter. You can do this by reviewing any confirmation notices, or by checking the IRS online tools, like “Where’s My Refund?” if applicable. Make sure the response is expected based on your communication type.

2. Contact the IRS for Updates

If you haven’t received a response within 30 days, it’s time to reach out. Call the IRS at their toll-free number or visit a local IRS office. Have the following information ready:

| Information Needed | Details |

|---|---|

| Taxpayer Identification Number (TIN) | Your SSN or EIN (if applicable) |

| Tax Year | Provide the specific tax year relevant to your case |

| Details of the Correspondence | Include the date you sent the letter and its subject |

| IRS Correspondence Reference | Include any reference numbers if mentioned in prior letters |

Have these details on hand to ensure the IRS can locate your case quickly. If you’re unable to resolve the issue through a phone call, request a written response or ask for an escalation to a supervisor.

3. Follow Up with a Written Inquiry

If your call does not provide clarity or resolve the matter, send a follow-up letter. In this letter, reiterate the original request, include any new information or documentation, and specify that you are seeking an update on the status. Keep your letter professional and to the point, including all relevant details as mentioned above.

Consistent follow-up ensures that your case doesn’t go unnoticed and speeds up the resolution process. Keep records of all your communications with the IRS for future reference.

Focus on clarity and accuracy when preparing your response. Begin with your name, address, and taxpayer identification number (TIN) at the top of the letter to ensure the IRS can identify you quickly. Include a concise reference to the letter you received, such as the notice number and date, followed by a clear explanation of your response. Address any questions or discrepancies directly, providing the necessary supporting documentation, such as tax records or proof of payment. If requesting an extension or additional time, specify the reason and suggest an appropriate timeline for resolution. End with a polite closing, offering contact information for further clarification. Make sure to keep a copy of the letter for your records.