Late payment reminder letter template

A late payment reminder letter should be clear, polite, and direct. Ensure the message is focused on resolving the issue without sounding confrontational. Address the late payment professionally by specifying the due date, the amount owed, and any penalties or interest that may apply.

Start by referencing the original invoice number and payment terms. A straightforward request, coupled with a reminder of the benefits of settling the account, often encourages faster resolution. Ensure you provide clear instructions on how to make the payment to avoid confusion.

If the situation continues without response, consider adding a note about potential consequences, like service suspension, to motivate the recipient to act quickly. Always remain courteous and polite, as maintaining a good business relationship is important for future interactions.

Here’s the corrected version:

Ensure your late payment reminder is clear and to the point. Start by addressing the recipient directly, mentioning the outstanding payment, and providing clear instructions for the next steps. Avoid ambiguity in your request for payment.

Structure of the Reminder:

- Begin with a polite yet firm opening, acknowledging their business relationship.

- State the invoice number, amount due, and the original due date.

- Include a specific due date for the payment, reinforcing urgency without being too harsh.

- Offer payment methods, ensuring ease for the recipient.

- Conclude with a friendly note, encouraging communication if there are issues preventing payment.

Example Template:

Dear [Client Name],

This is a friendly reminder that payment for invoice #12345, totaling $500, was due on [Due Date]. We kindly request that payment be made by [New Due Date].

For your convenience, payments can be made via [Payment Methods]. Should you have any questions or concerns, please don’t hesitate to reach out.

We appreciate your prompt attention to this matter.

Best regards, [Your Name]

- Late Payment Reminder Letter Template

When sending a late payment reminder letter, clarity and professionalism are key. Ensure the tone is firm yet respectful, encouraging timely payment while maintaining a positive relationship with your client. Here’s an outline for an effective letter:

1. Clear Subject Line

Start with a straightforward subject line like “Reminder: Payment Due for Invoice #12345” to grab the recipient’s attention immediately.

2. Introduction and Details

In the first paragraph, politely remind them of the outstanding balance. Include the original invoice number, date, and amount due. For example: “Our records show that the payment for Invoice #12345, dated January 1, 2025, in the amount of $500, has not yet been received.”

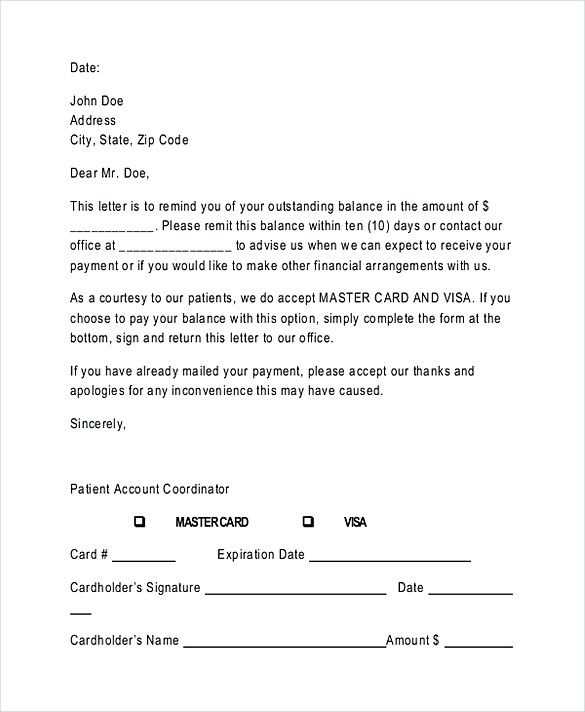

Provide any necessary payment information again in case they missed it, such as payment methods or account details.

3. Consequences and Next Steps

In the next section, outline the consequences of non-payment, such as potential late fees or service disruptions. Be clear but not aggressive. For example: “Please note that a late fee of $50 will be applied if payment is not received by February 10, 2025.”

End with a gentle but firm request for payment and provide contact information in case of questions. Include a polite closing, such as “We appreciate your prompt attention to this matter and look forward to resolving it as soon as possible.”

Clarity and precision are the foundation of a successful late payment reminder. Ensure the message clearly outlines the overdue amount, the original due date, and the payment method. Provide an explicit deadline for payment to prevent further delays and to avoid misunderstandings.

Clear Payment Details

Include the invoice number, outstanding balance, and any relevant references. This eliminates any confusion on the part of the recipient and helps them quickly locate the necessary details to process the payment.

Professional Tone

Maintain a polite yet firm tone throughout the letter. Acknowledge that mistakes can happen, but remind the recipient of their responsibility to pay. Offering a simple solution or payment option may increase the likelihood of prompt payment.

Begin by addressing the recipient by name, ensuring a friendly tone right from the start. Acknowledge the payment due date and reference the outstanding invoice or agreement. Be clear about the amount owed and specify the original due date without being confrontational.

Clear and Direct Language

Use straightforward, polite language. State that the payment is now overdue and that you would appreciate prompt settlement. Avoid unnecessary jargon or complicated phrasing that might cause confusion.

Offer Assistance if Necessary

If appropriate, offer assistance in case the recipient has encountered issues with the payment. This shows understanding while reinforcing the expectation for payment. Maintain professionalism throughout, ensuring the message remains respectful and courteous.

| Step | Example |

|---|---|

| Greeting | Dear [Recipient’s Name], |

| State the Issue | This is a reminder that your payment for Invoice [#1234], due on [Date], is now overdue. |

| Polite Request | We kindly request that you settle the outstanding amount of [Amount] as soon as possible. |

| Offer Assistance | If you have any questions or need assistance, please do not hesitate to contact us. |

| Closing | Thank you for your prompt attention to this matter. Best regards, [Your Name] |

Send the first reminder letter immediately after the payment due date has passed. The longer you wait, the more likely it is that the client may forget or ignore the payment request. A prompt reminder shows that you are serious about payment deadlines.

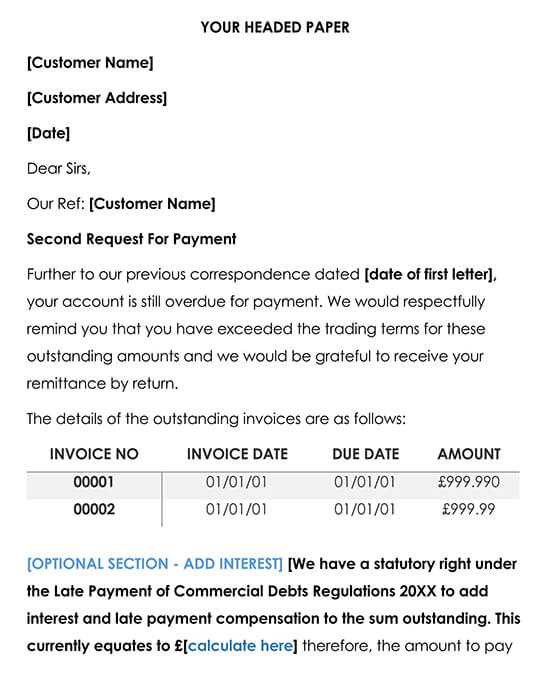

If the first reminder is ignored, send a second letter within 7 to 10 days. By this point, it is clear that the client is either unwilling or unable to pay. A gentle but firm reminder at this stage can help avoid further delays.

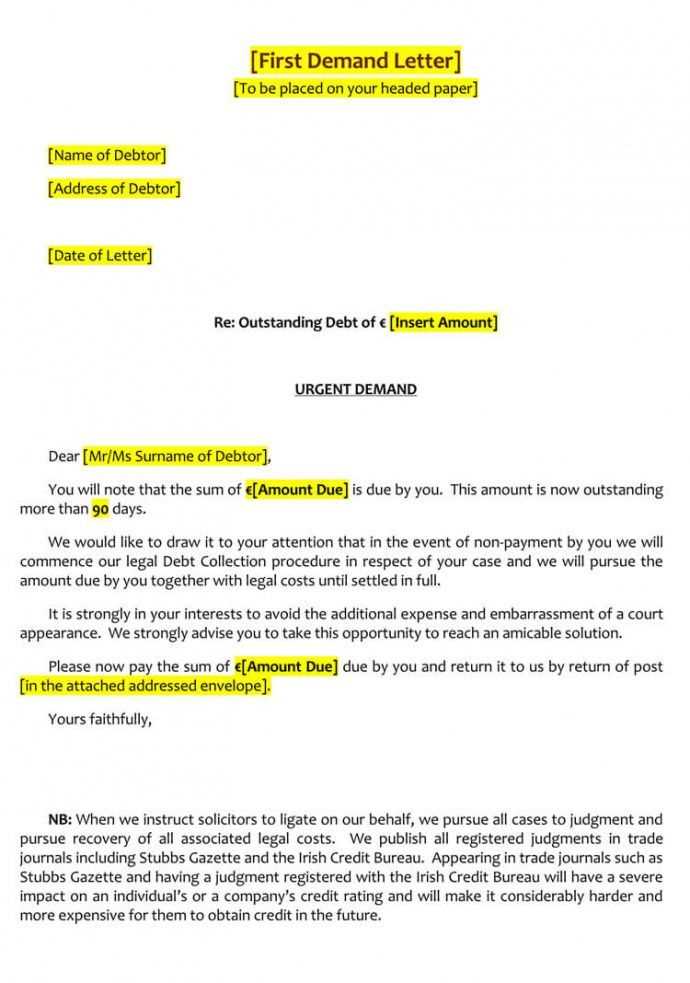

If payment remains outstanding for 30 days or more, consider sending a more formal third reminder letter. This letter should express the urgency of the matter and provide a clear outline of any late fees or legal actions that may follow if the payment is not received.

Adjust the tone and language based on how overdue the payment is, but always aim to maintain professionalism, even in the final stages of communication.

Adjust the tone of your payment reminder to suit the nature of your relationship with the client and the urgency of the situation. A personalized approach helps maintain professionalism while also addressing the matter at hand clearly. Consider using a friendly yet firm tone for first-time reminders, while adopting a more formal tone for overdue accounts. Tailoring the tone ensures that the reminder feels appropriate and motivates prompt action.

Here’s a breakdown of tone variations based on the situation:

| Situation | Recommended Tone | Key Phrases |

|---|---|---|

| First Reminder | Friendly, polite | “We kindly request,” “Thank you for your prompt attention.” |

| Second Reminder | Firm, professional | “We urge you to settle,” “Please ensure payment is made without further delay.” |

| Final Reminder | Direct, firm | “Immediate action required,” “Failure to make payment may result in further steps.” |

For clients with whom you have an ongoing relationship, use a more personalized tone. Acknowledge past transactions and maintain a friendly demeanor, even when reminding them of a past due payment. Adjusting the tone based on your familiarity with the client can help prevent any unnecessary strain in your professional relationship.

Ensure your payment reminder letters comply with applicable laws to avoid potential legal issues. Always confirm the payment terms are clear and in writing from the start of your agreement.

- Be mindful of local regulations regarding the tone and content of reminder letters. Some jurisdictions restrict aggressive language or threats of legal action unless you are prepared to follow through.

- Include specific details about the overdue payment, such as the invoice number, the amount due, and any applicable late fees. This helps establish clarity and reduces the risk of disputes.

- Ensure the timeline for payment is reasonable. Extending deadlines or offering payment plans may prevent legal complications while still encouraging timely settlement.

- Verify that the terms of late fees are clearly outlined in the initial agreement. Charging excessive or unwarranted late fees could be seen as predatory and result in legal penalties.

By being transparent and consistent in your reminders, you reduce the chances of legal action and maintain a professional relationship with your clients.

If the payment is still overdue after sending a reminder, take immediate action. First, send a second reminder with a clear deadline for payment. Make sure to include details of the original invoice and any late fees that may apply. This will serve as a firm but polite request for immediate resolution.

Follow Up With a Personal Call

If there is no response to your second reminder, consider calling the customer. A personal conversation can often resolve the issue more quickly. During the call, confirm that they received the reminder and ask if there are any issues preventing payment. Be firm but understanding to maintain a positive relationship while resolving the issue.

Consider Legal Action

If payment remains outstanding despite repeated attempts to contact the customer, it may be time to explore legal options. Start by sending a formal letter of demand, clearly outlining the outstanding amount and any interest or fees accrued. If the situation does not improve, consult a lawyer or debt recovery service to discuss further steps.

Late Payment Reminder Strategies

Sending a late payment reminder is crucial for maintaining smooth business operations. Here’s how to approach it effectively:

- Be Direct – State the exact amount overdue and the due date. Avoid any ambiguity to prevent confusion.

- Be Polite – Keep the tone respectful. Acknowledge that there may have been an oversight.

- Set Clear Consequences – Politely inform the recipient of the consequences of continued non-payment, such as late fees or service interruptions.

- Offer Payment Options – Provide clear instructions on how the payment can be made. Include all necessary payment details.

- Give a Deadline – Specify a new deadline to create urgency. Use clear, firm language to motivate quick action.

Template Key Points

- Reference the original invoice number and date for easy identification.

- Provide a gentle reminder of the terms agreed upon in the contract.

- Include your contact information for any clarifications the recipient might need.