Late Payment Removal Letter Template

When negative marks appear on your financial record due to overdue obligations, it can significantly affect your creditworthiness. However, it is possible to appeal these entries and potentially have them erased. The process typically involves reaching out to the creditor with a formal request that addresses the issue and seeks its correction. This section outlines the steps involved in such a process, including what information should be included and the key factors to consider.

Why Initiate a Credit Correction Request

Appealing negative entries can help restore your credit rating and open up better financial opportunities. Many lenders consider the presence of overdue debts when making approval decisions. By eliminating or revising these marks, you increase your chances of qualifying for loans or lower interest rates. A successful appeal can improve your financial standing and provide you with more favorable terms in future agreements.

Important Details to Provide

- Personal information: Include full name, address, and account details for verification.

- Explanation of the situation: Clearly describe the circumstances that led to the error or delay in fulfilling the obligation.

- Supporting documents: Attach relevant documents that validate your case, such as payment receipts or communication records.

Steps for Submitting Your Request

Once you have drafted your appeal, follow these steps to ensure it is sent properly:

- Gather all necessary documents, including your account details and supporting proof.

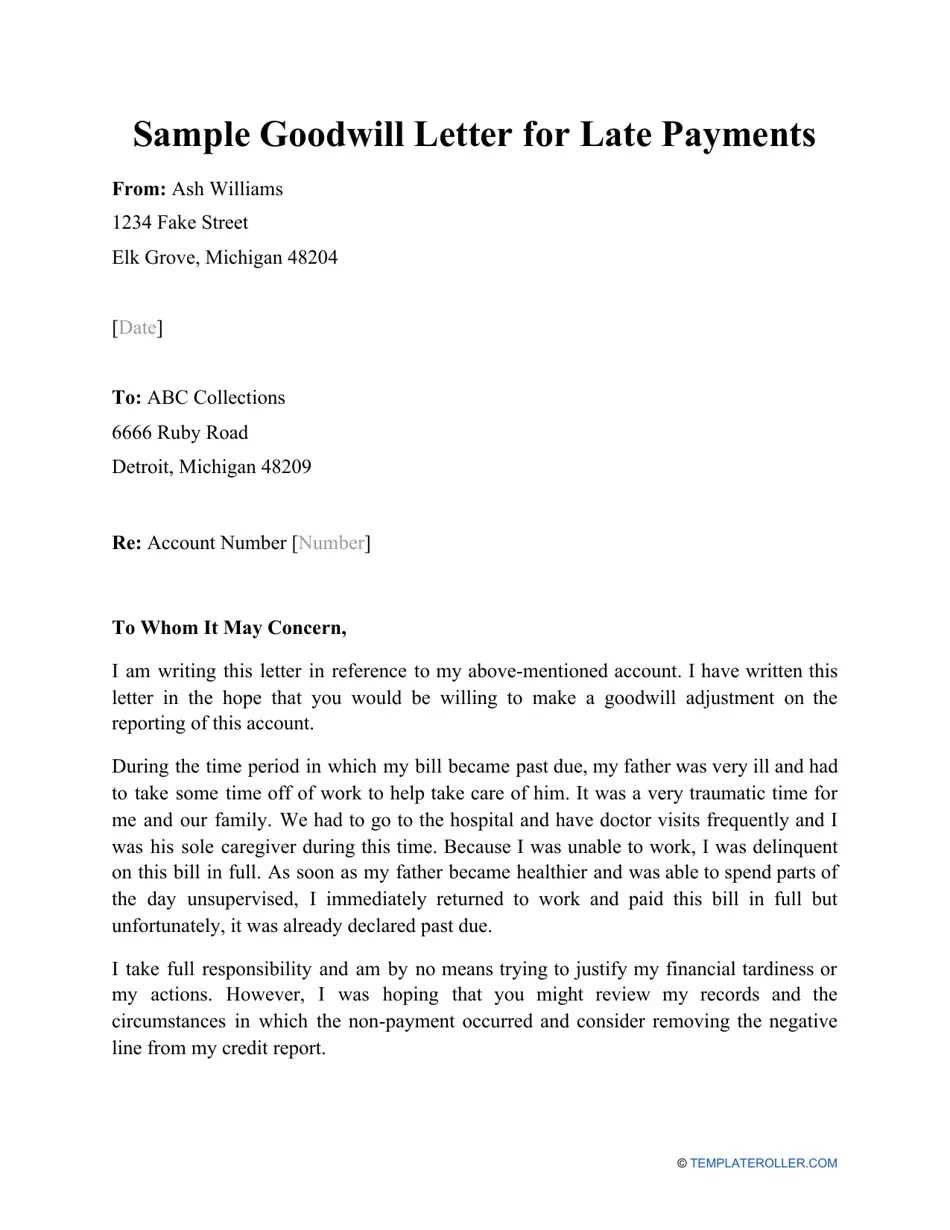

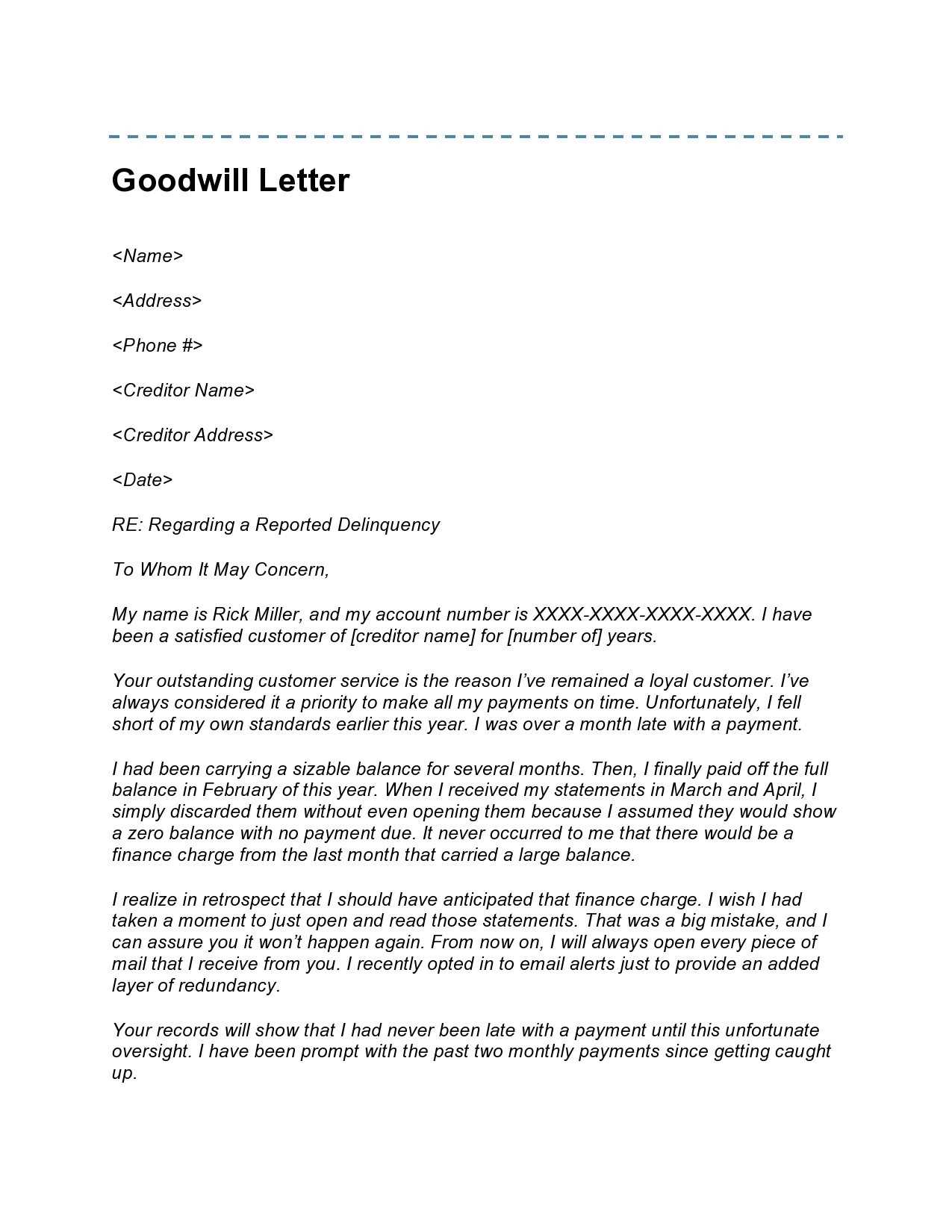

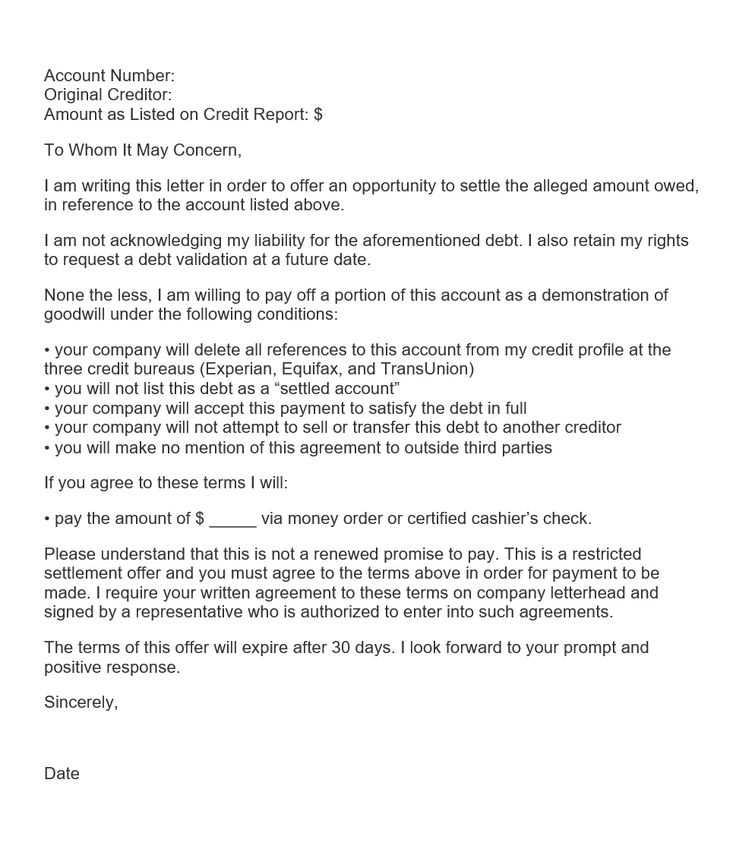

- Write a clear, concise appeal explaining the situation and your request for correction.

- Address the communication to the right department or individual at the creditor’s organization.

- Send the letter through a reliable delivery method that allows you to track its receipt.

What to Expect After Sending Your Appeal

Once submitted, the creditor will typically review the information provided and decide whether to adjust the entry. This process may take some time, depending on the institution’s policies. It is important to remain patient and follow up if necessary. In some cases, the creditor may request additional information before making a decision. If the appeal is successful, the negative entry will be removed or amended, improving your credit profile.

Understanding Credit Report Corrections and How to Appeal

In the process of managing your financial record, there may be instances where inaccurate or outdated information affects your standing. Correcting these details can lead to a more favorable credit score and improve your chances of securing better terms for future financial transactions. This section provides insights into why it’s crucial to address such discrepancies, how to effectively request changes, and key considerations for ensuring the success of your appeal.

Why You Should Initiate an Appeal

Correcting incorrect entries on your credit profile can significantly improve your financial prospects. Negative entries can lower your credit score, making it harder to obtain loans or secure favorable interest rates. By submitting a formal appeal to have these inaccuracies corrected, you can enhance your chances of approval for future financial opportunities and potentially save money in the long term.

How to Write an Effective Request

Crafting a persuasive and clear appeal is key to ensuring that your case is considered seriously. Focus on presenting all relevant facts, such as account details and any supporting evidence that explains the reason for the issue. Be concise yet thorough in your explanation, and ensure that the request is directed to the appropriate department or individual responsible for addressing such matters.

Be sure to include your full name, contact information, and relevant account identifiers in your communication. Additionally, be polite and professional, as this increases the likelihood of a favorable response. Avoiding overly emotional language and staying focused on the facts will help strengthen your request.

Common Mistakes to Avoid

While submitting your appeal, there are several common mistakes that can hinder its success. These include:

- Providing insufficient evidence to support your claim

- Failing to address the correct department or individual

- Being unclear about the desired outcome or what you want the creditor to do

- Sending the request in an informal or unprofessional tone

Avoiding these pitfalls can improve the chances of having the negative mark amended or removed from your record.

Best Practices for Submitting Your Appeal

Once your request is ready, follow these best practices to maximize its effectiveness:

- Send the request via a trackable method to confirm receipt

- Follow up within a reasonable timeframe if you do not receive a response

- Keep copies of all correspondence for your records

By adhering to these practices, you can ensure that your appeal is handled promptly and correctly.

What to Do After Submission

After submitting your appeal, it’s important to remain patient. The creditor will typically review your request and provide a response within a few weeks. If the request is denied, you may still have the option to escalate the matter or seek assistance from a credit repair agency. Stay proactive by checking your credit report regularly to confirm any changes.