Letter for irs template

When addressing the IRS, clarity and conciseness are key. Begin your letter by clearly stating the purpose of your communication. If you are responding to a notice, make sure to reference the notice number and the date it was issued. This helps the IRS quickly locate your records and process your request faster.

Be direct and to the point. Explain the reason for your letter, whether it’s requesting clarification, providing additional documentation, or making a payment arrangement. The IRS appreciates straightforwardness and expects relevant information to be presented without unnecessary details.

Maintain a professional tone. Even though the situation may be stressful, using a polite and respectful tone helps maintain a positive relationship. Express your willingness to cooperate and provide any additional documents or information if needed.

Conclude your letter by reaffirming your contact details and your availability for follow-up. Include your full name, taxpayer identification number, and any other relevant identifiers. This will ensure the IRS can process your letter efficiently.

Make sure to keep a copy of the letter for your records. It’s always a good idea to track any communication sent to the IRS for future reference.

Here’s the revised version with minimized word repetition:

Write a concise introduction that briefly explains the purpose of the letter. Avoid unnecessary details, focusing only on the main issue you are addressing.

Key Information

Ensure you include your full name, Social Security Number (SSN), and the tax year involved. Be clear and precise when providing these details to avoid confusion or delays.

Action Steps

State the action you’re requesting from the IRS, such as correcting a mistake or requesting an extension. Use direct language and focus on the specific action you expect from them.

Be sure to sign the letter at the end. If applicable, attach any supporting documents that substantiate your claim. Keep the tone respectful and professional throughout.

- Letter for IRS Template

When writing a letter to the IRS, clarity and accuracy are paramount. Below is a basic template to guide you through the process of communicating effectively.

IRS Letter Template Example

Your Name

Your Address

City, State, ZIP Code

Phone Number

Email Address

Date

Internal Revenue Service

Address of the IRS Office

City, State, ZIP Code

Subject: [Reason for Contacting the IRS]

Dear Sir/Madam,

I am writing in regard to [briefly state the reason for writing: e.g., a notice received from the IRS, a request for payment plan, etc.]. My taxpayer identification number (TIN) is [Your TIN] and my Social Security Number (SSN) is [Your SSN]. I would like to clarify [or] address the issue of [state the issue clearly].

If there is any additional information required to resolve this matter, please do not hesitate to contact me at the phone number or email address provided above.

Thank you for your attention to this matter. I look forward to your prompt response.

Sincerely,

Your Name

Key Points to Include in Your IRS Letter

Ensure that you clearly identify your issue, include any relevant documentation, and follow the specific instructions provided by the IRS. Always double-check the information you include to avoid any mistakes that may delay your request.

Begin by clearly stating the purpose of your letter. Specify whether you are seeking information, clarification, or assistance with a particular tax issue.

Include your full name, address, and taxpayer identification number. This information will help the IRS locate your records quickly and address your inquiry properly.

Provide details about the tax matter you are inquiring about. Mention relevant tax years, forms, and any notices you have received. Being specific will help the IRS respond accurately.

Use a polite, formal tone. Keep your sentences direct and to the point. Avoid unnecessary details that may distract from the main issue.

State the desired outcome. Be clear about what you hope the IRS will do in response to your letter, whether it’s providing information or resolving a discrepancy.

Finally, close your letter by thanking the IRS for their time and attention. Include your contact information in case they need further details or clarification.

- Address the letter to the appropriate department or office of the IRS.

- Ensure the letter is signed and dated.

- Keep a copy for your records before sending it to the IRS.

Clearly state your full name, address, and contact information at the beginning of your letter. This ensures the IRS can easily identify and communicate with you. Include your taxpayer identification number (TIN) or Social Security number (SSN) to link your letter to your tax records. Specify the tax year or period the letter addresses, whether it’s for a specific issue or request. If applicable, mention any related IRS notices you’ve received, including the notice number and date. Be concise but specific about your request or the issue you are addressing. Provide supporting documentation if necessary, making sure it’s easy for the IRS to review. Always double-check that the information is accurate and up-to-date to avoid delays or confusion.

Always double-check your personal information. Mistakes with your name, Social Security number, or address can delay processing. Make sure these details match what the IRS has on file.

Not Including Required Documentation

Omitting necessary documents is a common issue. If you reference a form or document in your letter, attach copies to avoid delays. Incomplete submissions can lead to unnecessary follow-up and extended processing times.

Vague or Unclear Language

Be specific and concise in your communication. Avoid ambiguous terms that may confuse the IRS. Clearly explain the purpose of your letter, whether it’s a tax dispute, inquiry, or request for clarification.

Double-check your spelling and grammar. Errors in these areas can make your request harder to understand and may cause delays. Review your letter carefully before sending it.

Each IRS department requires a specific approach when addressing them. Knowing which department handles your issue can help streamline the process. Follow these guidelines to ensure your correspondence is directed to the right place.

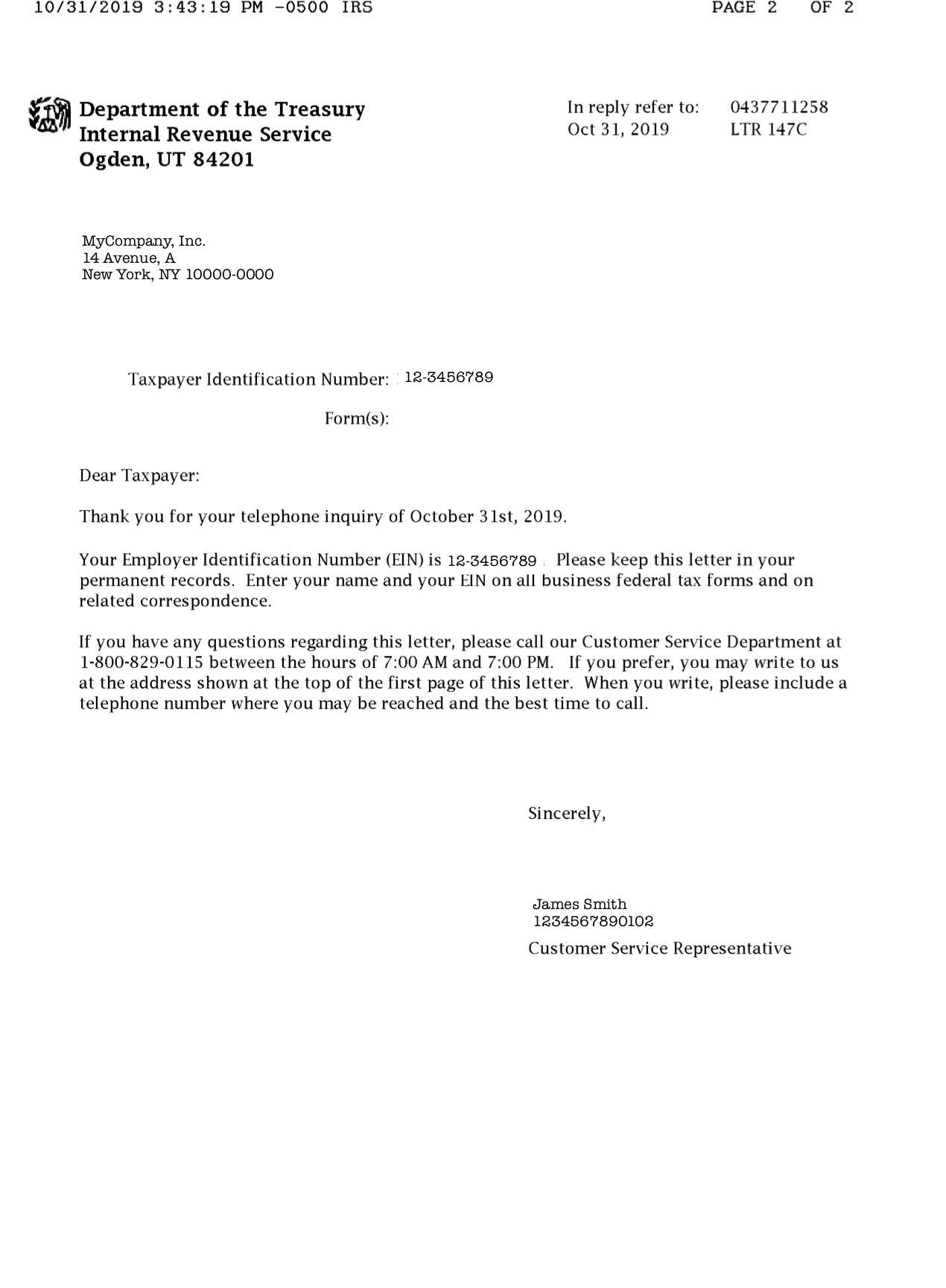

1. Correspondence with the IRS Customer Service

For general inquiries or account issues, address your letter to the IRS Customer Service. Use the address provided on your tax notice or the IRS website. Always include your taxpayer identification number (TIN), social security number (SSN), or employer identification number (EIN) to ensure proper processing of your request.

2. Addressing the IRS Collections Department

If you’re dealing with unpaid taxes or notices of levy, direct your letter to the IRS Collections Department. The address will be on any collection notice you’ve received. Include details such as your case or reference number for quicker resolution.

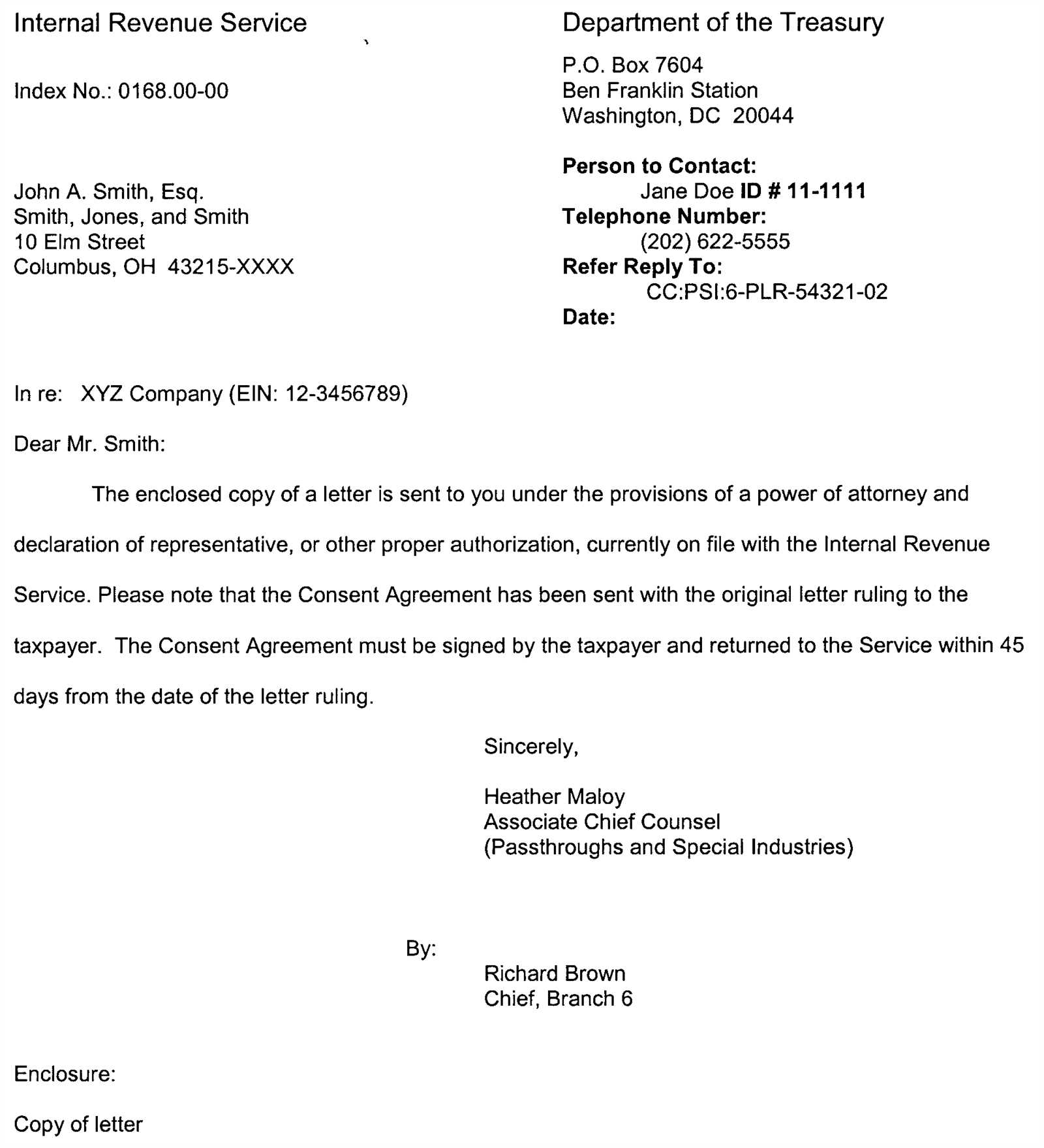

3. Contacting the IRS Appeals Office

For disputes over IRS decisions, address your letter to the Appeals Office. The correct address is typically listed on the correspondence sent to you regarding the appeal. Make sure to provide all necessary documentation to support your case.

4. IRS Audit Department

If your case involves an audit, send your letter to the audit office indicated in your audit notice. Include copies of requested documents, as well as a clear explanation of your situation. Ensure that your contact details are easy to find for any follow-up inquiries.

The IRS response times can vary, depending on the nature of your request. On average, expect to wait about 30 to 60 days for a reply, but it can take longer in busy periods. Tax season, for example, might cause delays due to the high volume of inquiries.

Response Times for Different Types of Requests

- Individual Taxpayer Inquiries: These generally take 30 to 45 days.

- Business Taxpayer Inquiries: These may take 45 to 60 days, depending on complexity.

- Amended Returns: These can take up to 16 weeks or more.

- Tax Liens or Levies: The IRS may respond within 30 days, but sometimes delays occur if further information is needed.

How to Follow Up

- Check the IRS website or your account status to see if your issue has been resolved or if there are any updates.

- If you haven’t received a response within the estimated time frame, you can contact the IRS directly by calling their help line at 1-800-829-1040.

- Be prepared to provide specific information such as your taxpayer identification number, the type of inquiry, and the date you submitted your request.

- If the IRS is still unable to respond within a reasonable period, consider filing a formal complaint or seeking assistance from a tax professional.

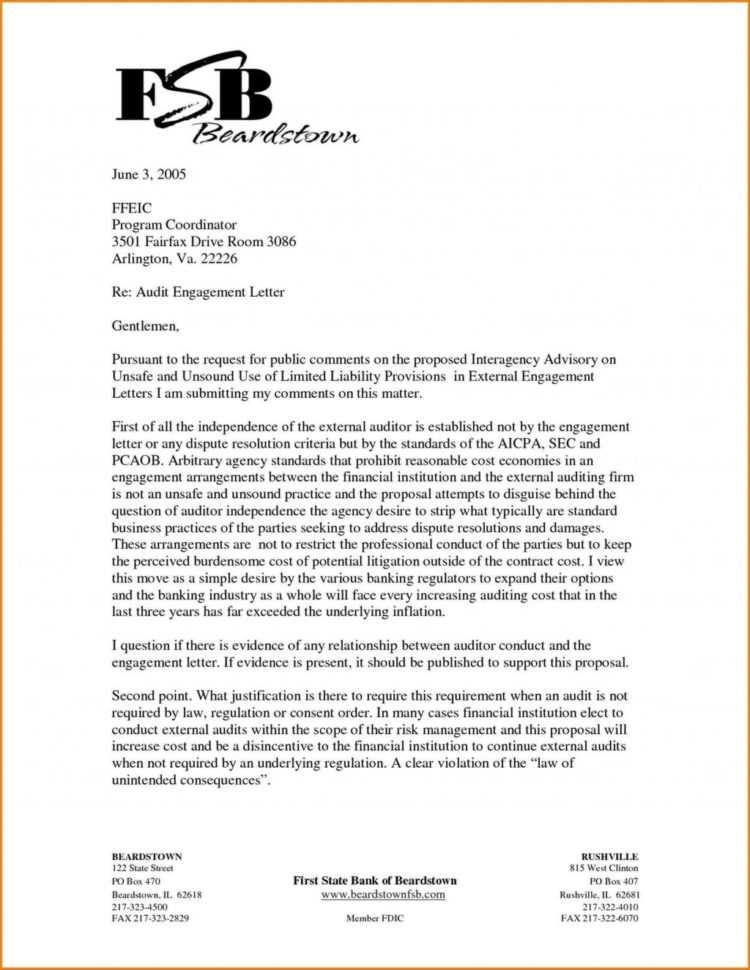

Ensure your letter follows a simple and clean structure. Use clear paragraphs to separate ideas. Each section should cover one main point, making it easier for the reader to understand your message quickly.

Choose the Right Font and Spacing

Use a legible font like Times New Roman or Arial in size 12. Set your line spacing to 1.5 or double to improve readability. Keep margins at 1 inch on all sides to maintain a professional appearance.

Be Direct and Concise

Avoid long sentences and unnecessary details. Stick to the core points to prevent confusion. Use short paragraphs with clear headings or bullet points when explaining multiple items or requests.

Always review your letter for any errors. Clear formatting, combined with concise writing, makes your letter easier to read and ensures that your message is communicated effectively.

Start by ensuring that the information provided in your letter is clear and concise. Address the IRS by the correct title and include all necessary personal details like your full name, address, and taxpayer identification number (TIN). Clearly state the purpose of your letter, whether it’s a request, an explanation, or a correction. Keep the tone formal yet respectful.

Include any reference numbers such as those found on IRS correspondence you’ve received. This will help the IRS locate your records quickly and avoid delays. Be sure to also mention any documents you’ve attached or referenced to support your claims or questions.

| Required Information | Details |

|---|---|

| Name | Your full legal name as it appears on your tax documents. |

| Taxpayer Identification Number (TIN) | Your TIN (e.g., Social Security Number or Employer Identification Number). |

| Reference Numbers | Any IRS reference numbers from past correspondence. |

| Supporting Documents | Attach any necessary forms, statements, or other supporting evidence. |

End your letter with a polite request for confirmation or further guidance from the IRS. Always include your contact information to make it easier for them to reach you if needed.