Letter of Claim Debt Template for Successful Debt Recovery

When facing unpaid invoices or outstanding balances, it’s important to take a professional approach in requesting the funds owed to you. This process can often feel overwhelming, but having a clear and well-structured written notice can increase the chances of a successful resolution. A well-crafted document is not only a formal reminder but also a key tool in ensuring that you follow proper procedures to recover what’s due.

Creating an effective document for this purpose requires understanding the essential elements that should be included. These elements ensure that your message is clear, polite, and legally sound. Whether you’re dealing with an individual or a business, a carefully constructed communication can prevent misunderstandings and promote timely payment.

In this guide, we will explore how to write a formal request that outlines the necessary information, the tone to maintain, and the steps to take when preparing such a document. By following a straightforward approach, you can maximize your chances of resolving payment issues promptly and professionally.

What is a Formal Payment Request?

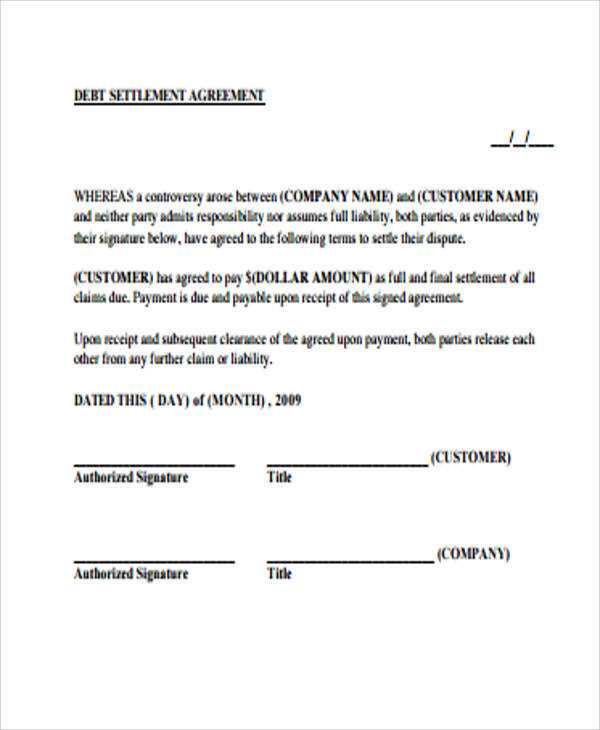

When a person or company owes money, a formal written notice serves as the first step to request payment. This document is an important tool for initiating the process of recovering outstanding amounts in a professional and legally appropriate manner. It clearly communicates the amount owed, the payment deadline, and the consequences of failing to make the payment. A well-constructed request helps both parties understand their obligations and the steps to resolve the issue.

Why Is a Formal Communication Important?

Such a communication helps set a clear expectation for the recipient. It is an official reminder, which holds both legal weight and moral significance. It’s essential for establishing a timeline for payment and demonstrating that you are serious about recovering the funds owed to you. This document is often a precursor to further legal action, making it an essential tool for anyone looking to settle financial disputes.

Key Features of an Effective Request

An effective written request should contain all the relevant details, such as the amount owed, the nature of the agreement, and the timeline for repayment. The tone must be firm but respectful to maintain professionalism. Including a reference to the original contract or agreement can also be helpful in reinforcing the legitimacy of the request. Ensuring clarity and accuracy is vital to avoid any confusion or delays.

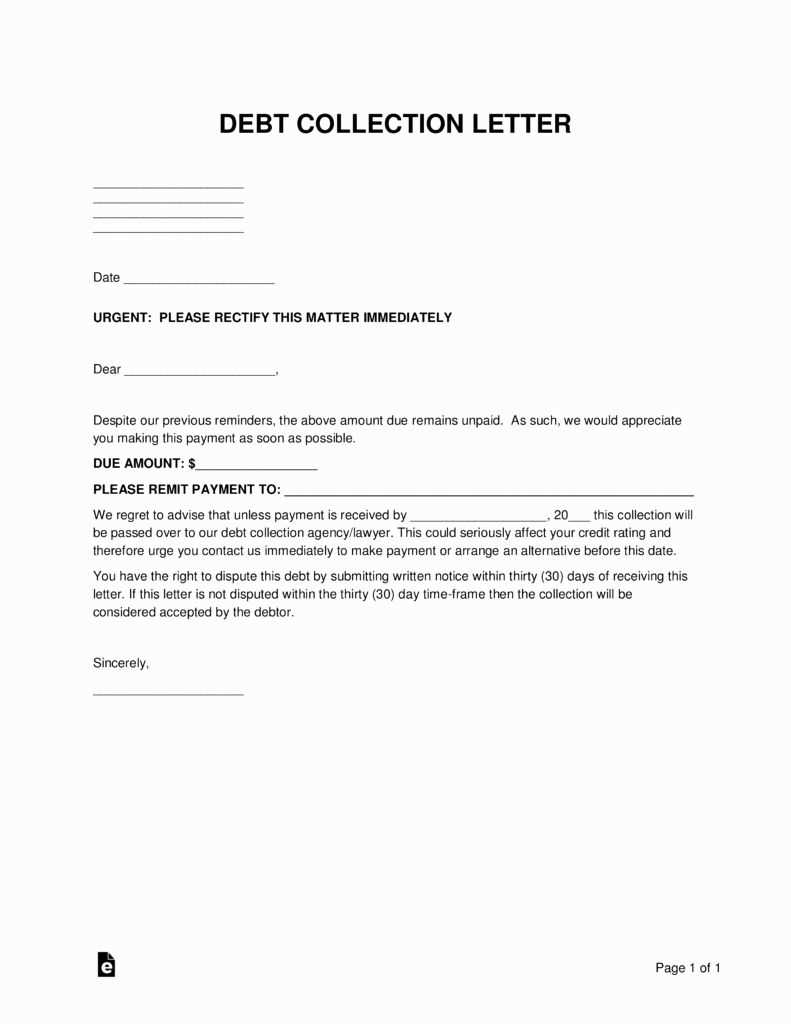

Why Use a Debt Collection Letter

Sending a formal request for payment is an essential step in recovering outstanding amounts. It not only serves as a reminder to the recipient but also helps protect your legal rights. By using a professionally written communication, you set a clear expectation for payment and demonstrate your commitment to resolving the financial issue. This formal process is often the first step before taking more serious legal action, making it crucial for both individuals and businesses.

- Clarity of Expectations: A formal document ensures that both parties understand the amount owed and the timeline for repayment.

- Professionalism: Using an official written notice reflects seriousness and helps maintain a professional relationship.

- Legal Protection: It acts as evidence if further action is required, providing a record of your attempts to resolve the issue.

- Encourages Timely Payment: The official nature of the notice often prompts the recipient to act quickly to avoid potential legal consequences.

By using a formal communication, you enhance your ability to recover funds efficiently while ensuring that all actions are legally sound. This approach can often resolve the issue without needing to escalate to more drastic measures, saving time and resources for both parties involved.

Essential Components for a Payment Request

When drafting a formal request for payment, including the right elements is essential for ensuring clarity and professionalism. The content should be clear, concise, and comprehensive, outlining both the request for payment and the potential consequences of non-payment. A properly structured communication makes it easier for the recipient to understand their obligations, while also strengthening your position if further legal action is required.

Important Information to Include

The document should start by identifying the parties involved, clearly stating the amount owed and any relevant agreements or contracts. It’s crucial to specify a deadline for payment to avoid ambiguity. You may also want to highlight any interest or fees that may accrue if the payment is not made on time. These details ensure that the recipient has all the information necessary to resolve the issue quickly.

Maintaining a Professional Tone

The tone of the communication is key in maintaining professionalism and encouraging cooperation. While it’s important to be firm in your request, the language should remain respectful and objective. Avoid aggressive or confrontational language, as it can escalate the situation and reduce the likelihood of a successful outcome.

Steps to Draft Your Request

Creating an effective written request involves several key steps that ensure all necessary information is included and the message is clear. A well-structured communication is vital in prompting action from the recipient, as it outlines the specifics of the amount owed and any necessary deadlines. By following a step-by-step approach, you can ensure that your document is both professional and effective.

Start by addressing the recipient properly, ensuring that their name or company details are accurate. Clearly state the purpose of the document and reference any previous agreements or contracts related to the payment. It’s also important to provide a concise summary of the amount owed, including any interest or additional charges if applicable. Finally, specify the deadline for payment and the consequences of failing to meet that deadline. This creates a sense of urgency while maintaining a professional tone.

Frequent Mistakes When Requesting Payment

When drafting a formal request for payment, certain errors can undermine the effectiveness of your communication. These mistakes can lead to confusion, delays, or even legal complications. It’s important to be aware of common pitfalls and avoid them to ensure a smooth and successful recovery process. Here are some of the most frequent issues people encounter when writing such documents.

Incomplete or Ambiguous Information

One of the most common errors is failing to provide all the necessary details. If the amount owed is unclear or if there’s no mention of the due date, the recipient may be uncertain about their obligations. This can delay the resolution process and complicate matters further.

Overly Aggressive or Unprofessional Tone

Using harsh or confrontational language can backfire. While it’s important to be firm, maintaining a professional and respectful tone is crucial to ensuring that the recipient is more likely to cooperate. Aggressive language may escalate the situation, leading to a breakdown in communication.

| Error | Impact |

|---|---|

| Missing Payment Details | Confusion about the amount or terms can cause delays. |

| Vague Deadline | Without a clear deadline, the recipient may procrastinate. |

| Inconsistent Information | Discrepancies can raise doubts about the legitimacy of the request. |

| Aggressive Tone | Can damage the professional relationship and hinder payment. |

By being aware of these common mistakes and ensuring that your request is clear, professional, and complete, you significantly increase the chances of a prompt resolution.

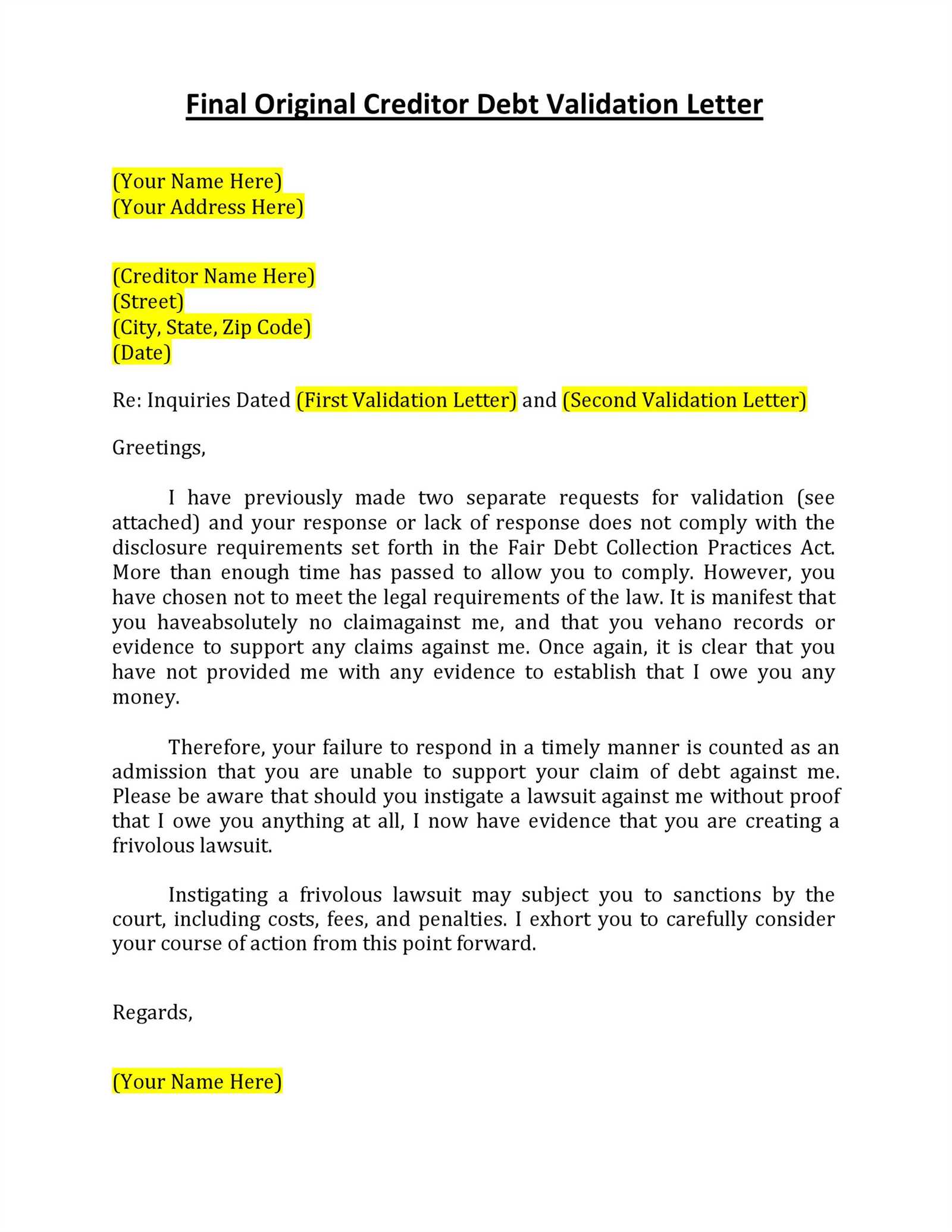

How to Reply to a Claim

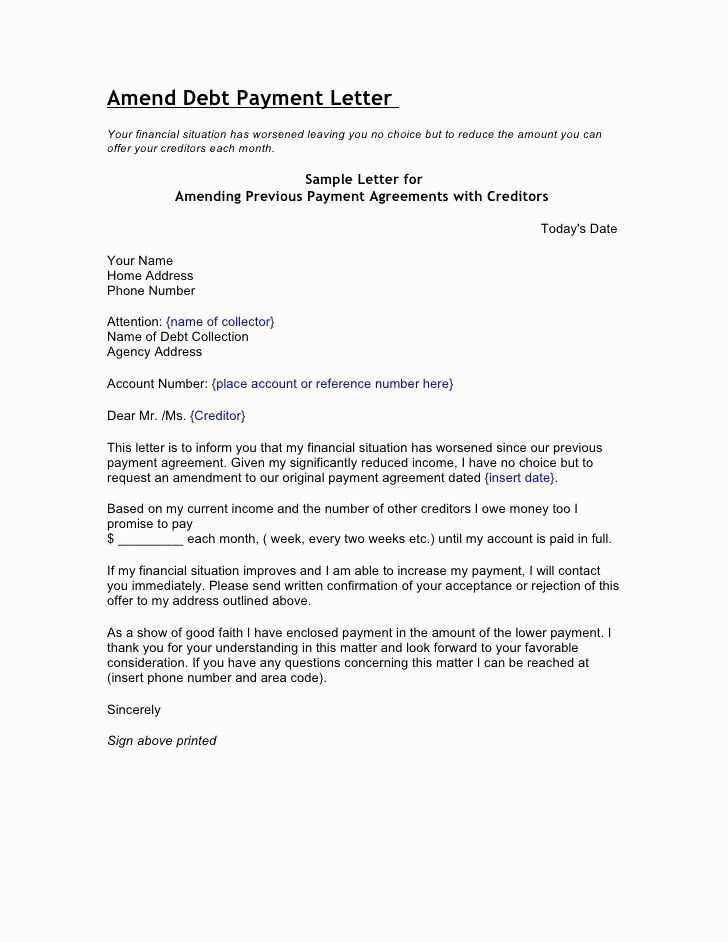

When you receive a formal request for payment, it’s important to respond appropriately and professionally. A timely and well-crafted reply can help resolve the situation amicably and avoid further complications. Whether you plan to dispute the claim, request more time, or arrange a payment plan, addressing the issue clearly is essential for maintaining a constructive dialogue.

Steps to Formulate Your Response

Begin by carefully reviewing the details of the request. Make sure you fully understand the amount owed, the terms outlined, and any deadlines specified. If you agree with the terms, a simple acknowledgment of the debt and a commitment to resolve it within the set timeframe can be sufficient. If there are discrepancies, you should politely outline any issues or concerns and provide evidence supporting your position. Clear communication is key to avoiding misunderstandings.

Maintain a Professional and Respectful Tone

Even if you disagree with the request, always maintain a respectful and professional tone. Disputing the claim in an aggressive or hostile manner could escalate the situation. Instead, remain calm and factual in your response. Offering a solution, such as a request for additional time or a payment arrangement, can show your willingness to cooperate while also protecting your interests.