Letter of direction estate template

To create a clear and actionable letter of direction for an estate, outline the specific instructions in a straightforward manner. Make sure the document is concise and free from ambiguity, providing all necessary information for the executor to follow. Include details such as the distribution of assets, instructions for handling debts, and any special requests regarding the estate’s management.

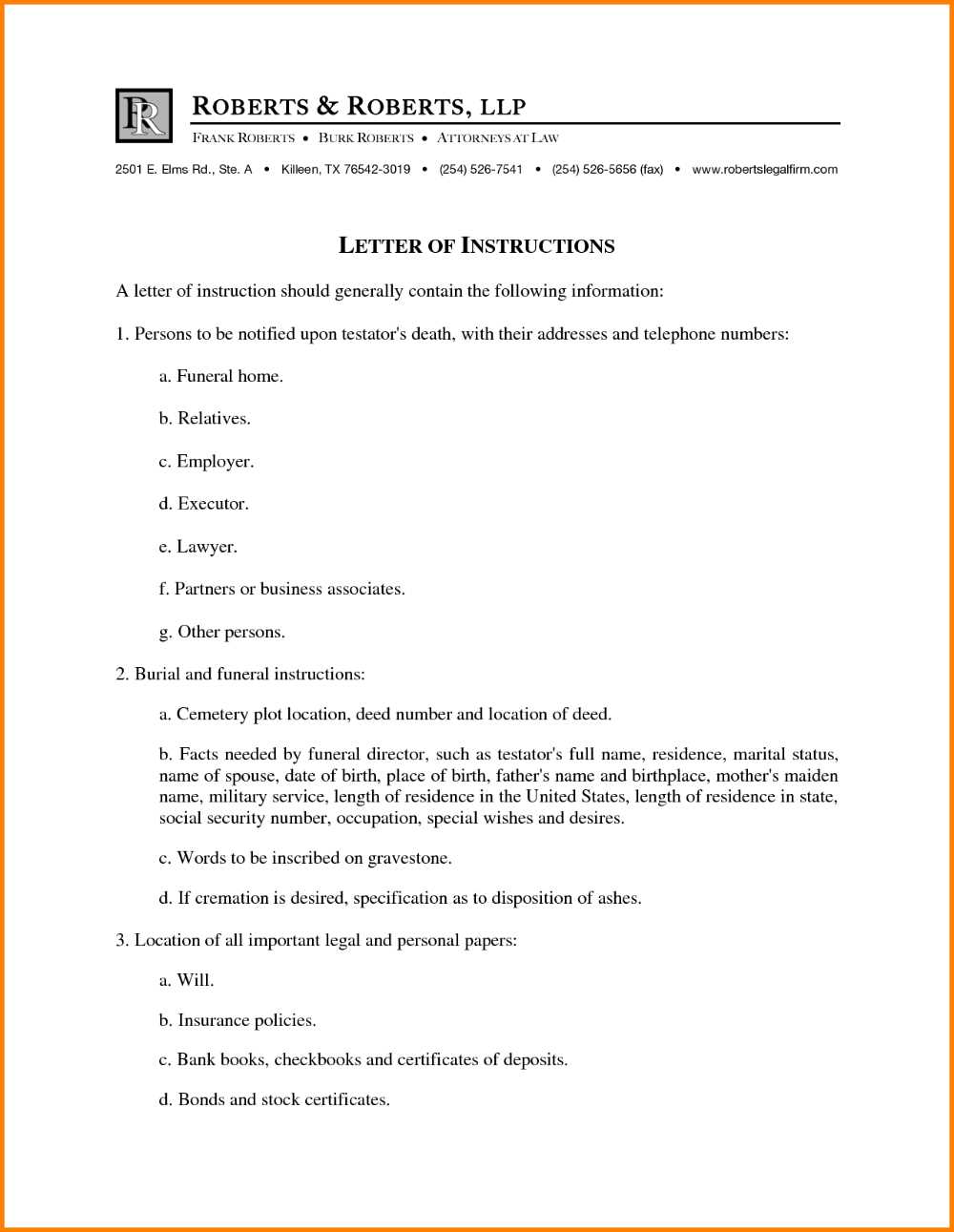

Start with a clear declaration: Indicate the purpose of the letter at the very beginning, mentioning that this is a letter of direction meant to guide the estate’s executor. Clarify that the document supplements the will and provides specific directions for administering the estate.

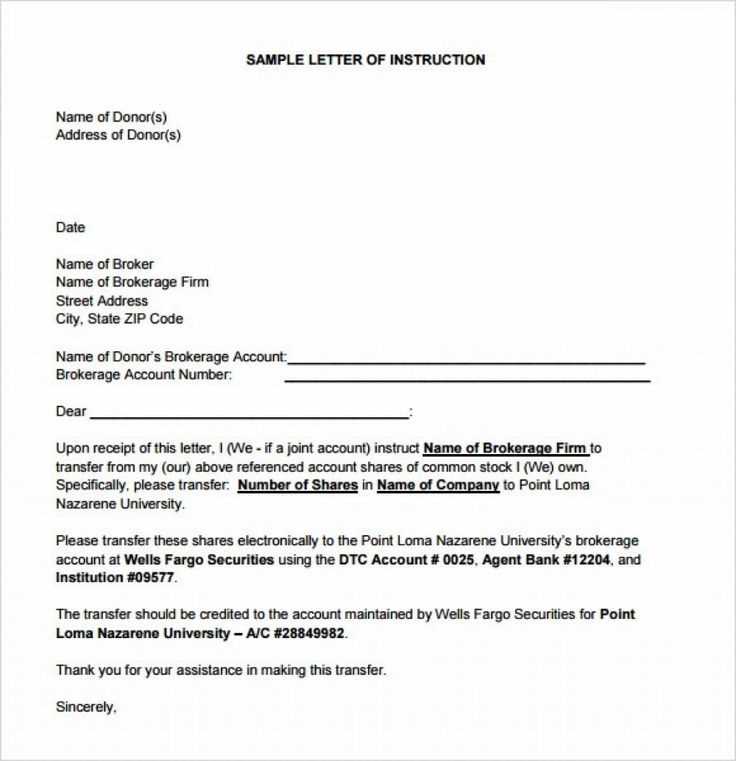

Be precise with asset distribution: List each asset individually, along with the beneficiary who should receive it. Make sure to include any relevant account numbers, property addresses, or identification details for clarity. This section should also include instructions on how to handle any debts or liabilities attached to the estate.

Include any personal wishes: If there are specific requests about the funeral, the care of pets, or other personal matters, include them in this document. While not legally binding, these requests offer important guidance to the executor and loved ones.

Ensure the letter is signed and dated by the person providing the directions, and have it witnessed if necessary. Keep a copy with the will and distribute it to trusted individuals involved in the estate’s management.

Here’s the revised version with word repetition minimized:

To reduce word repetition, focus on using synonyms and restructuring sentences. When drafting a letter of direction for an estate, ensure each section conveys the necessary information without redundancy. Avoid repeating phrases like “as previously stated” or “in addition to” unless absolutely necessary.

Streamlining Language for Clarity

For example, instead of using the phrase “I hereby direct,” you can simplify it to “I direct” or “I instruct.” The goal is to maintain the clarity and purpose of the letter while eliminating unnecessary wording. When referring to specific actions or assets, try to avoid excessive qualifiers like “in the event that” or “with regard to.” Opt for direct, clear statements to communicate instructions more efficiently.

Focusing on Specific Details

In a section discussing asset distribution, instead of repeatedly mentioning “the estate,” use variations like “the property,” “the assets,” or “the holdings.” This keeps the language dynamic and avoids repetitiveness without losing context. Use clear, actionable language to convey instructions, ensuring recipients understand their responsibilities without excessive elaboration.

By refining the language, you can create a more concise and professional document, which will be easier for all parties to understand and act upon promptly.

Letter of Direction Estate Template

Creating the Basic Structure of the Document

Legal Requirements for Drafting a Direction Letter

Incorporating Specific Instructions for Asset Allocation

How to Address Possible Disputes in Estate Administration

Including Relevant Legal and Financial Information

Final Steps: Reviewing and Notarizing the Document

The first step in creating a direction letter is to establish a clear and organized structure. Begin with the full legal name and contact details of the testator. Ensure you include a date to avoid any confusion about the document’s validity. Specify the person or entity responsible for administering the estate, referred to as the executor or trustee.

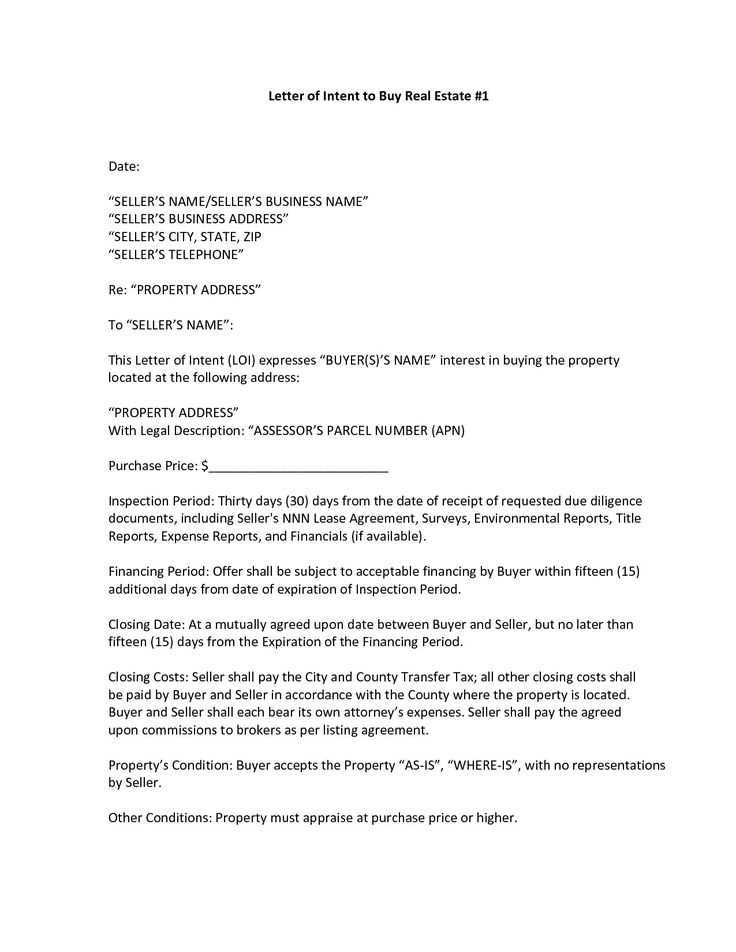

Follow the legal requirements for such documents. A direction letter must comply with local inheritance laws, which vary depending on jurisdiction. Ensure that the letter addresses who will inherit assets, how these assets will be distributed, and any other specific instructions related to property or family heirlooms.

Clearly list all assets to be allocated, specifying who receives each item or amount. This section should also include any conditions that apply, such as the recipient being of a certain age or meeting certain criteria. Accuracy in the description of the assets, including their value and location, helps prevent future confusion.

Estate disputes are common, especially when instructions are unclear. Include a clause outlining how disputes will be resolved. Whether through mediation or arbitration, this will set a clear course of action if disagreements arise during the distribution process.

Incorporate necessary legal and financial information that may assist the executor in fulfilling their role. This includes details of any outstanding debts, taxes, and liabilities that need to be addressed. Ensure your legal advisors review these details to ensure accuracy and compliance with regulations.

Finally, once the document is complete, review the letter for clarity and completeness. Ensure all necessary signatures are included, and the document is notarized. This final step will solidify the legal standing of the direction letter and confirm its authenticity for all parties involved.