How to Use the Letter of Direction Template CIBC

When dealing with financial institutions, it’s often necessary to provide clear instructions to ensure the proper processing of transactions. A well-structured document is essential for guiding the bank on how to handle specific requests, ensuring that the process is smooth and free from errors.

Key Elements of a Financial Instruction Document

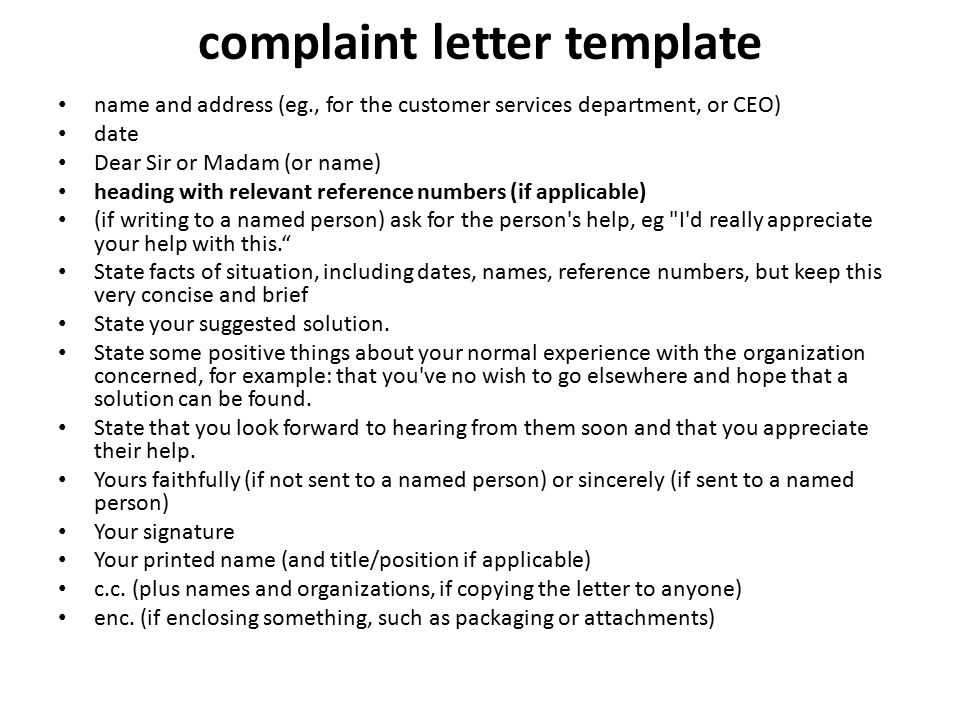

To create an effective document for instructing your bank, include the following key details:

- Recipient’s Information: Clearly mention the intended recipient of the instructions.

- Transaction Details: Specify the amount, date, and nature of the financial request.

- Authorized Signatures: Ensure the document is signed by the relevant individual or party.

Steps to Complete Your Financial Instruction Document

Follow these steps to ensure the document is completed correctly:

- Fill in the recipient’s information, including name and account details.

- State the purpose and specifics of the transaction in clear terms.

- Include your signature and any other required authorizations.

Benefits of Using a Structured Format

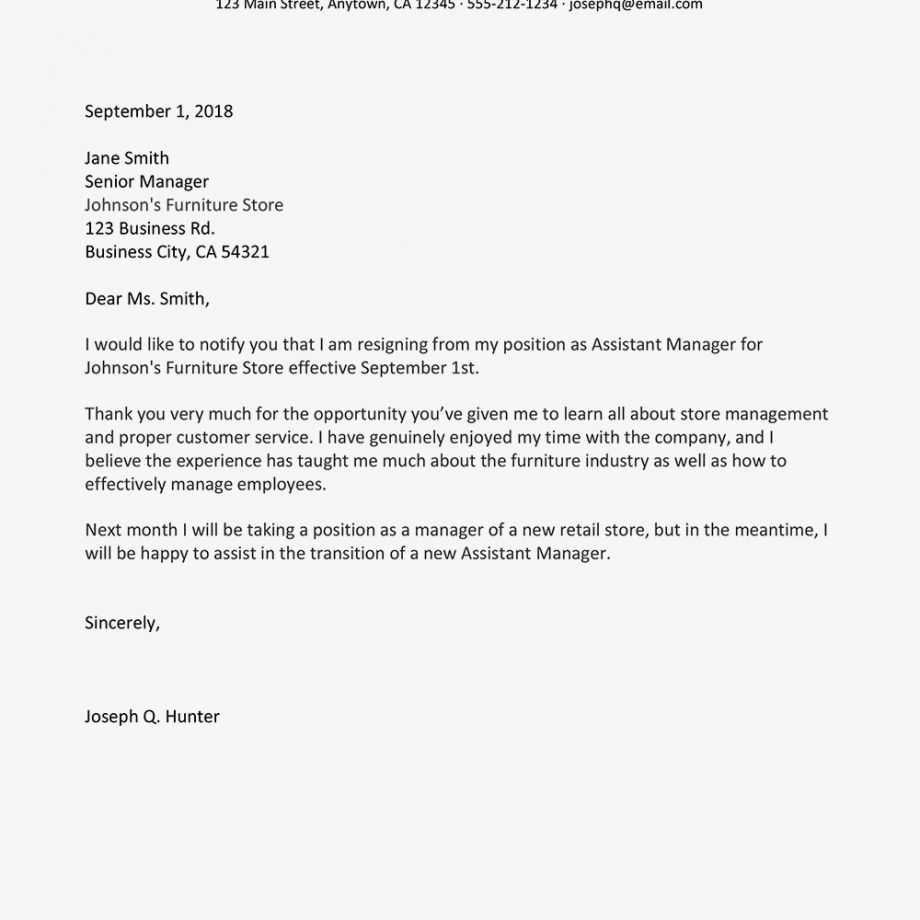

Utilizing a clear, standardized format provides numerous advantages:

- Clarity: Reduces the chance of misinterpretation.

- Efficiency: Helps ensure transactions are processed without delays.

- Accountability: Creates a verifiable record of instructions given.

Where to Obtain the Necessary Document

You can easily find the required form through most financial institutions, either online or at a physical branch. These documents are typically available in a downloadable format for ease of completion.

Understanding the Purpose of Financial Instruction Documents

When engaging with a financial institution for specific requests, it is crucial to provide a clear, concise document outlining the details of the transaction. Such documents ensure proper processing and eliminate any confusion, allowing the bank to act in accordance with the instructions given.

Key Features of a Structured Financial Document

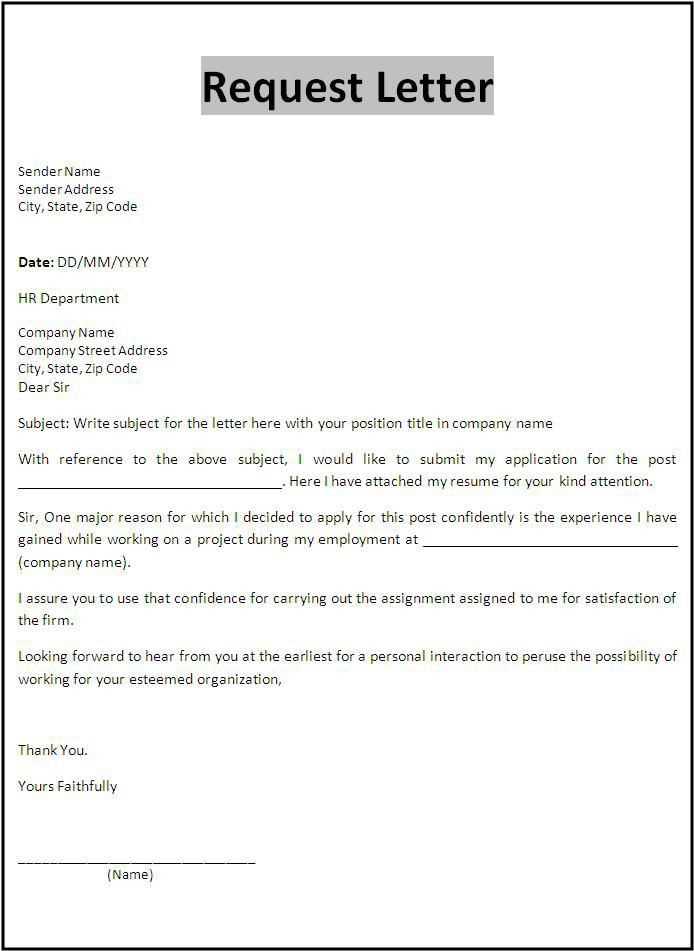

A well-organized financial instruction form contains several important elements:

- Sender and Recipient Information: Identifies both parties involved in the transaction.

- Transaction Specifics: Clearly defines the nature, amount, and timing of the financial activity.

- Authorization: Provides necessary signatures to validate the instruction.

How to Complete a Financial Instruction Form

Follow these steps to ensure your document is filled out accurately:

- Enter the full details of both the sender and the recipient.

- Provide a precise description of the transaction and any relevant dates.

- Include signatures where required for verification.

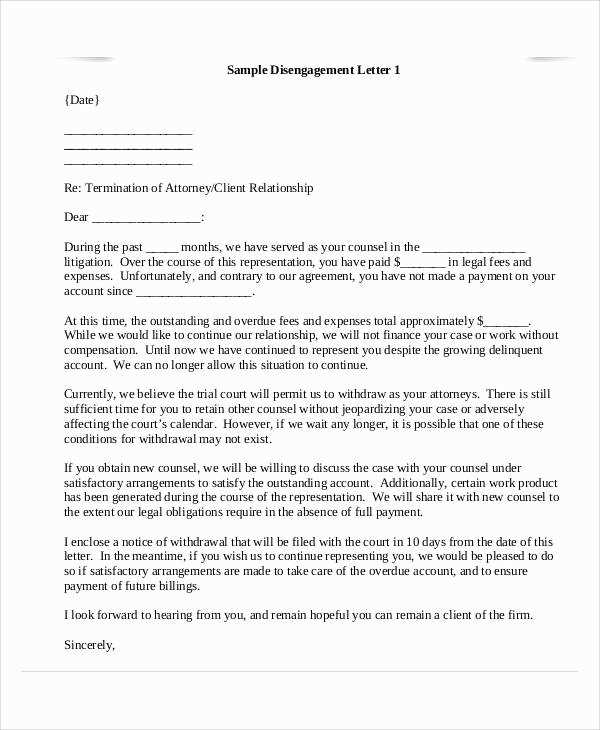

Common Errors to Avoid include providing incomplete details, missing signatures, or failing to verify the form before submission. These oversights could delay processing or result in an incorrect execution of the transaction.

Advantages of Using a Standardized Format

Using a predefined format enhances the overall process:

- Accuracy: Reduces errors and misunderstandings.

- Speed: Streamlines the approval process, ensuring faster execution.

- Legality: Helps ensure all necessary legal requirements are met.

These forms are generally available for download from the financial institution’s website, providing easy access for clients who need them.