Letter of Direction to Bank Template for Simple Use

When dealing with financial institutions, it’s essential to provide clear instructions for various transactions. These written instructions ensure that your requests are executed correctly, preventing misunderstandings and delays. Whether you need to authorize someone else to manage your funds or request specific actions, having a well-structured document is crucial for effective communication.

Why Written Instructions Are Essential

Written guidelines provide clarity and avoid verbal miscommunications, ensuring that both parties understand the scope and details of the request. Such documents are typically required for specific tasks such as transferring funds, managing accounts, or authorizing third-party actions on your behalf.

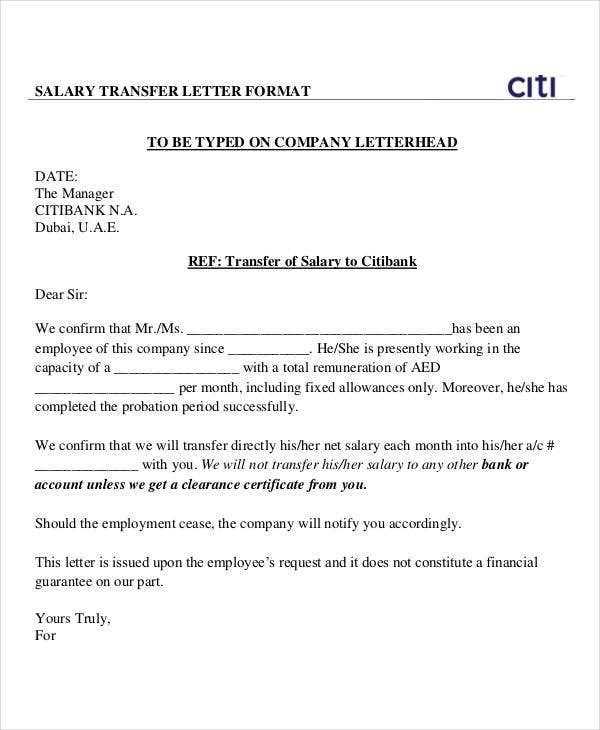

Key Information to Include

- Full Name and Account Details: This helps the institution verify your identity and locate the right account.

- Clear Instructions: State exactly what action needs to be taken, such as transferring funds or authorizing someone to access your account.

- Signature: A signed document confirms your consent and authorizes the action.

- Contact Information: In case further clarification is needed, provide your contact details.

Common Pitfalls to Avoid

It’s important to be precise when writing these documents. Ambiguity can lead to errors or delays in fulfilling your request. Double-check your personal details, the instructions themselves, and ensure that everything is legible and correctly formatted. Avoid using vague language or omitting critical information.

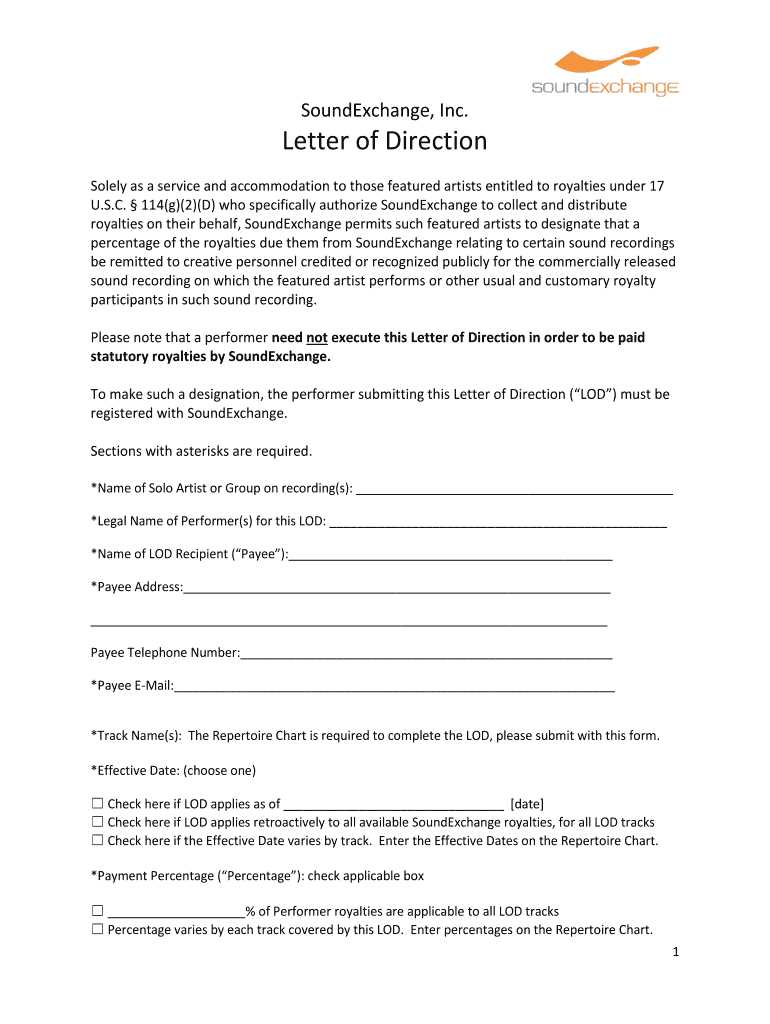

Advantages of Using Pre-designed Formats

Utilizing a pre-structured form can save time and ensure all necessary components are included. These formats guide you through the process, helping you avoid mistakes and ensure consistency in your requests. Whether you’re submitting instructions for personal use or a business transaction, a well-organized document reduces the chances of rejection and expedites processing.

What is a Letter of Direction?

Importance of Using a Bank Document

How to Create a Letter of Direction

Key Details to Include in the Document

Common Errors to Avoid

Advantages of Using a Bank Template

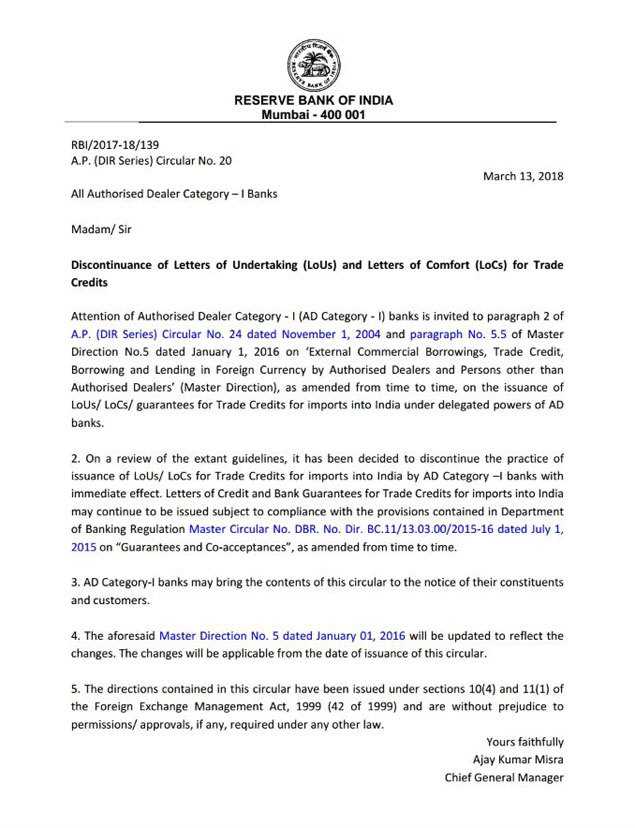

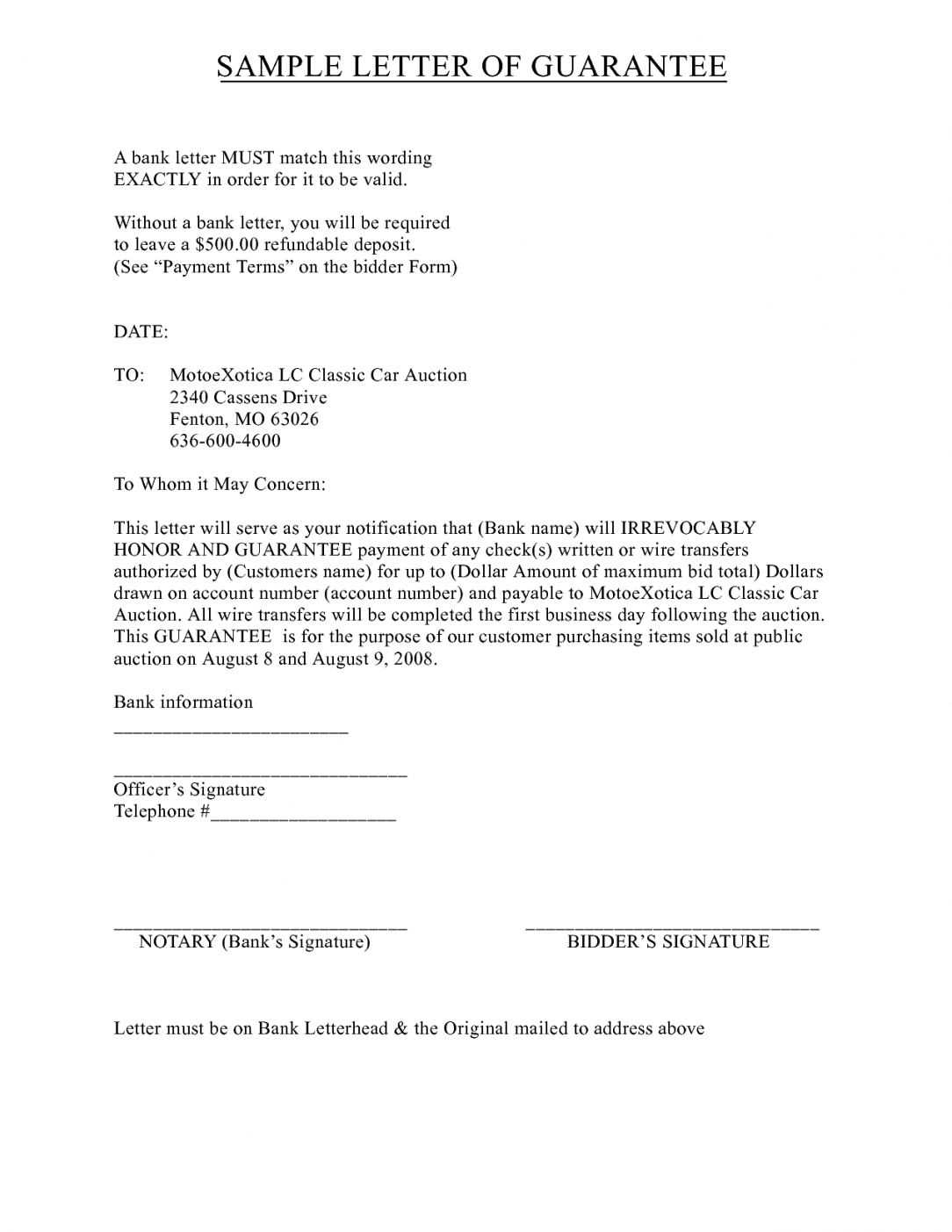

When interacting with financial institutions, providing written instructions is essential for clear communication. These documents are used to request specific actions related to accounts or transactions, ensuring that the financial institution performs the desired tasks accurately. Without proper instructions, the likelihood of mistakes increases, leading to delays or incorrect processing.

Such documents play a crucial role in establishing a clear understanding between the account holder and the institution. Whether it’s for authorizing transfers, giving permission for access, or providing operational guidance, these written forms make sure that the requested action is executed in the right way. Proper documentation also provides a record for both parties in case of disputes or inquiries.

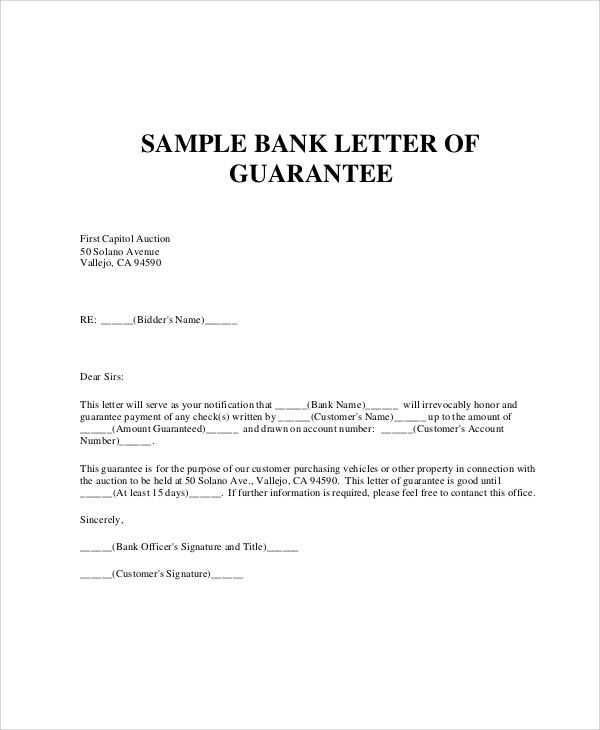

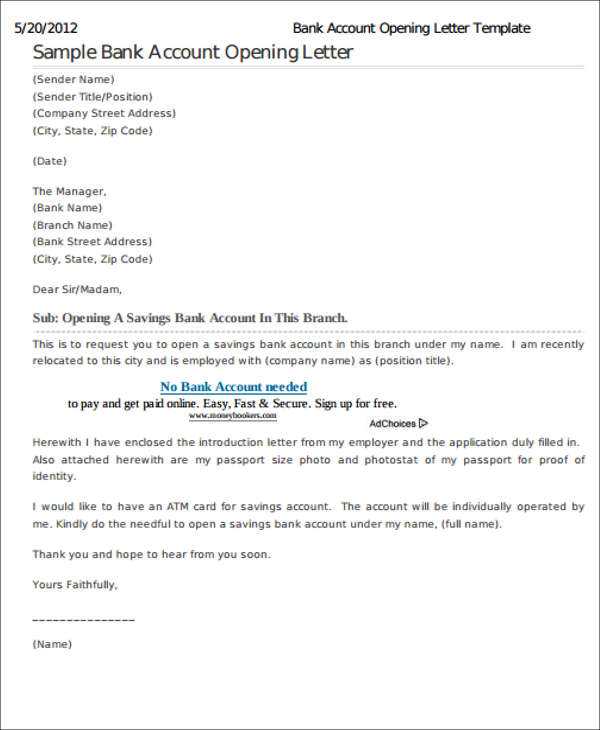

Creating an effective document requires attention to detail. Begin by outlining your request clearly and concisely, providing all the necessary details. The format should be professional and easy to understand, avoiding any complex jargon. Depending on the action, the document might need additional requirements, such as signatures or account verification information.

Key components to include are: full personal details, including your name and account number, a clear description of the requested action, and any necessary dates or amounts. Ensure the request is specific and detailed, leaving no room for confusion. It’s also important to state who will carry out the action or benefit from the instruction, if applicable. Finally, make sure to sign the document to validate it.

Avoid vague language and ensure all details are accurate and easy to read. Errors, even small ones, can lead to delays or misinterpretation of your request. It’s important to double-check all personal information, as well as the instructions themselves. Additionally, ensure the document is legible and properly formatted, which can prevent unnecessary back-and-forth with the institution.

Using pre-designed forms can significantly simplify the process. These forms are structured to ensure that all necessary elements are included and that the instructions are clear. They guide you step-by-step, reducing the risk of forgetting important details or making mistakes. Templates also ensure that the document meets the institution’s requirements, speeding up processing times and making communication more efficient.