Car Insurance Experience Letter Template for Easy Creation

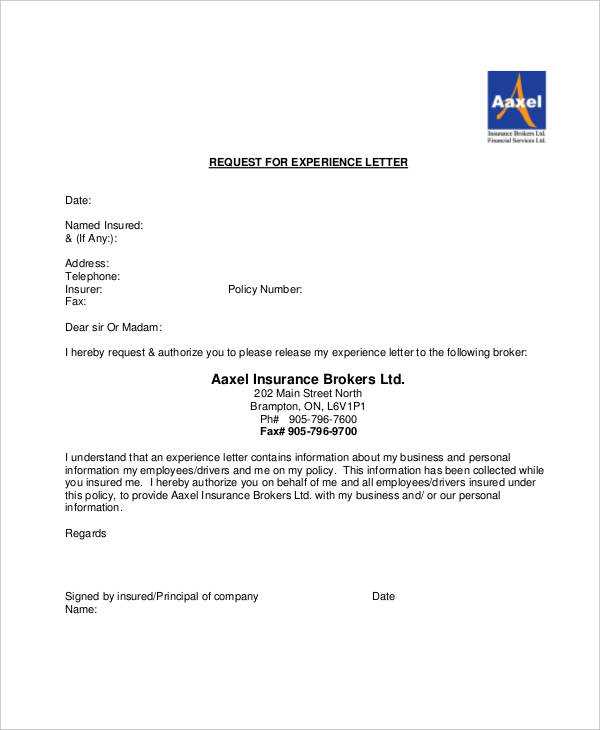

When applying for new coverage or verifying your history with a provider, having the right documentation can make all the difference. A well-crafted record summarizing past agreements or claims is an essential tool in facilitating smooth communication between the policyholder and the service provider.

In this guide, we will explore how to construct a concise yet detailed statement that highlights your past engagements with a provider. This type of document serves as proof of your reliability and ensures that all necessary details are included for the review process.

Understanding how to format and structure this correspondence will help you create an effective record that meets the expectations of both current and future providers. With the right approach, such a document can significantly streamline the approval process and demonstrate your experience in a professional manner.

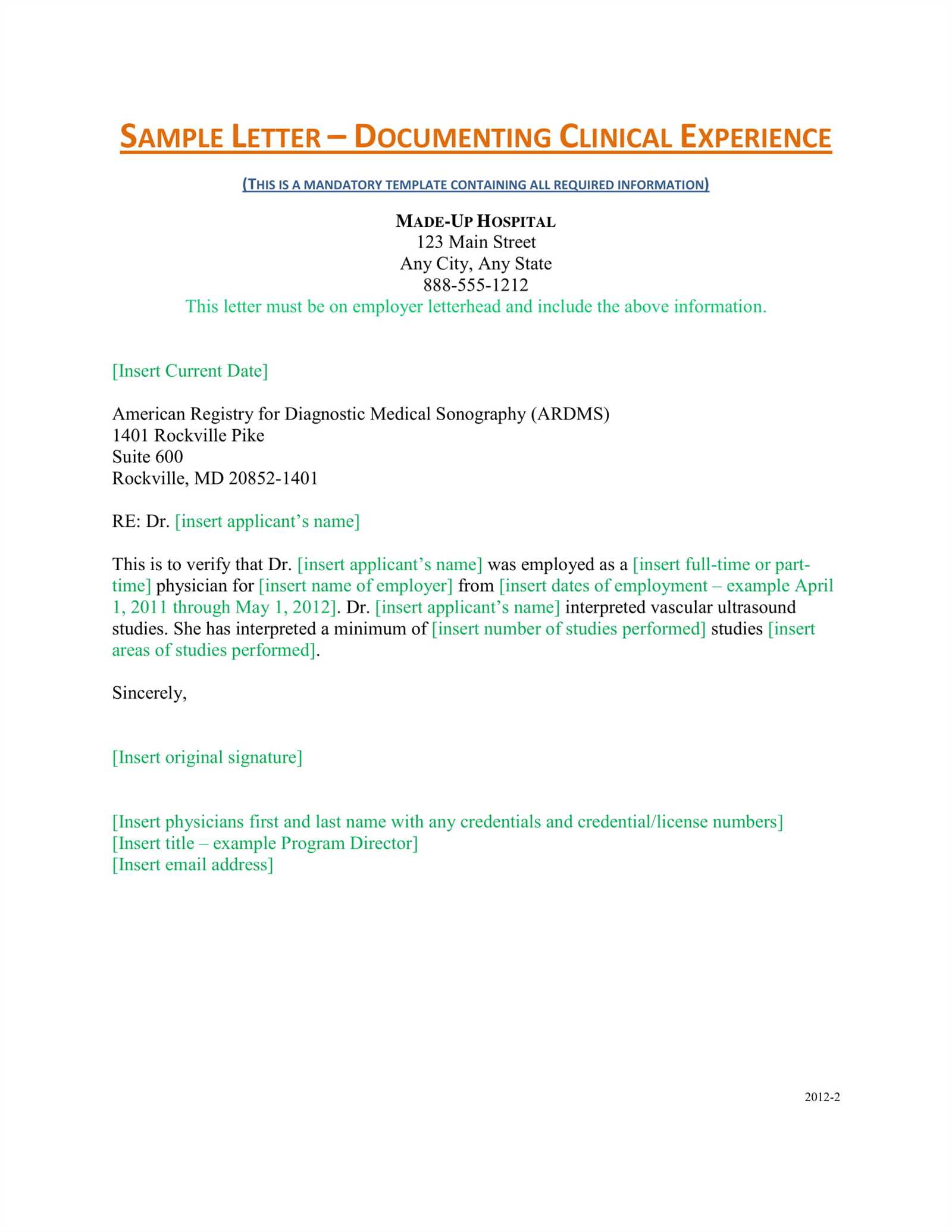

This document serves as a formal summary of your past interactions with a coverage provider, detailing key information such as policy periods, types of coverage, and any claims or incidents. It acts as an official reference, proving your history and reliability as a policyholder to new or current service providers.

Purpose and Importance

The main goal of this record is to provide clear evidence of your previous engagements. It helps establish your credibility and can be requested when transferring to a new provider or updating your existing policy. This document allows providers to quickly assess your background and decide on the terms of coverage or pricing.

Key Information Included

A typical document will include the duration of past policies, the type of coverage received, and any significant claims or incidents during the term. It may also note any gaps in coverage or instances of non-renewal, providing a comprehensive view of your history in relation to risk management.

Importance of Experience Documents for Policyholders

Having a detailed record of your past engagements with coverage providers is essential for proving your reliability and history as a policyholder. This type of documentation can help you stand out when applying for new agreements or renewing existing ones, as it provides clear evidence of your previous commitments and overall risk profile.

For providers, these records offer insight into your past behavior and claims history, allowing them to assess the level of risk associated with offering you coverage. By having an official summary, policyholders can often benefit from better terms, lower premiums, or even quicker approval processes. This document acts as a trusted reference in any future negotiations.

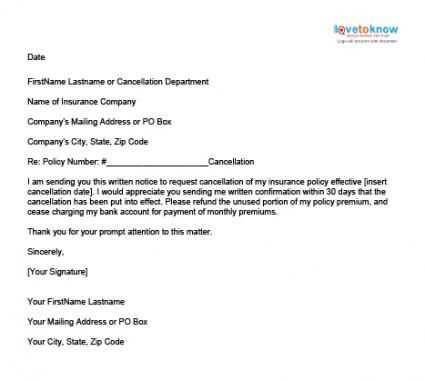

How to Create a Clear Template

Creating a well-structured document that summarizes your past agreements with a provider requires clarity and organization. A clear outline ensures all necessary details are included while maintaining a professional and easy-to-read format. Proper formatting and attention to detail are key to making the document effective for both you and the recipient.

Key Elements to Include

- Personal Information: Start by including your full name, contact details, and policy numbers.

- Coverage Details: Describe the types of coverage provided and the duration of each agreement.

- Claim History: Mention any claims made during the policy period and their outcomes, if applicable.

- Policy Expiry and Renewals: Include information on policy expiration dates and renewal processes, if relevant.

Formatting Tips

- Use a professional tone and keep the language clear and concise.

- Structure the document logically, with headings for each section.

- Use bullet points or lists to organize detailed information for easy reference.

- Ensure proper grammar and spelling for a polished result.

Key Information to Include in the Document

To create a thorough and effective document, it is essential to include all relevant details that provide a clear picture of your history with a provider. This ensures that the recipient has a complete understanding of your background and can make an informed decision regarding your future coverage. Including the right information also helps prevent any misunderstandings or omissions.

Essential Details

- Personal Identification: Full name, contact information, and any reference numbers related to previous policies.

- Policy Duration: The start and end dates for each coverage agreement.

- Types of Coverage: A brief description of the coverage provided during the policy period.

- Claims and Payouts: Information about any claims filed, including the nature of the claim and any resulting actions taken by the provider.

Additional Considerations

- Policy Renewals: Indicate whether policies were renewed and the terms of any updates.

- Coverage Gaps: Mention any periods when you were without coverage, if applicable.

Best Practices for Writing an Effective Document

When crafting a formal record summarizing your past agreements with a provider, following best practices can significantly enhance its effectiveness. The goal is to create a clear, concise, and professional document that conveys all necessary details without any confusion. By adhering to certain guidelines, you can ensure that your communication is impactful and meets the expectations of the recipient.

Clarity and Precision

Be clear and direct: Avoid unnecessary jargon or overly complex language. The recipient should easily understand the content without ambiguity. Present facts in a straightforward manner, ensuring the information is both relevant and accurate.

Consistency and Structure

Maintain a logical flow: Organize the document into sections, with headings for easy navigation. Consistency in formatting, such as the use of bullet points or numbered lists, helps the reader digest key information quickly. Keep your tone professional and ensure there is no redundancy or repetition of details.

Proofreading and Review

Check for errors: Proofread the document carefully to eliminate any spelling or grammatical mistakes. A polished, error-free document presents you as a meticulous and reliable individual. Ask a third party to review the content if possible to ensure clarity and precision.

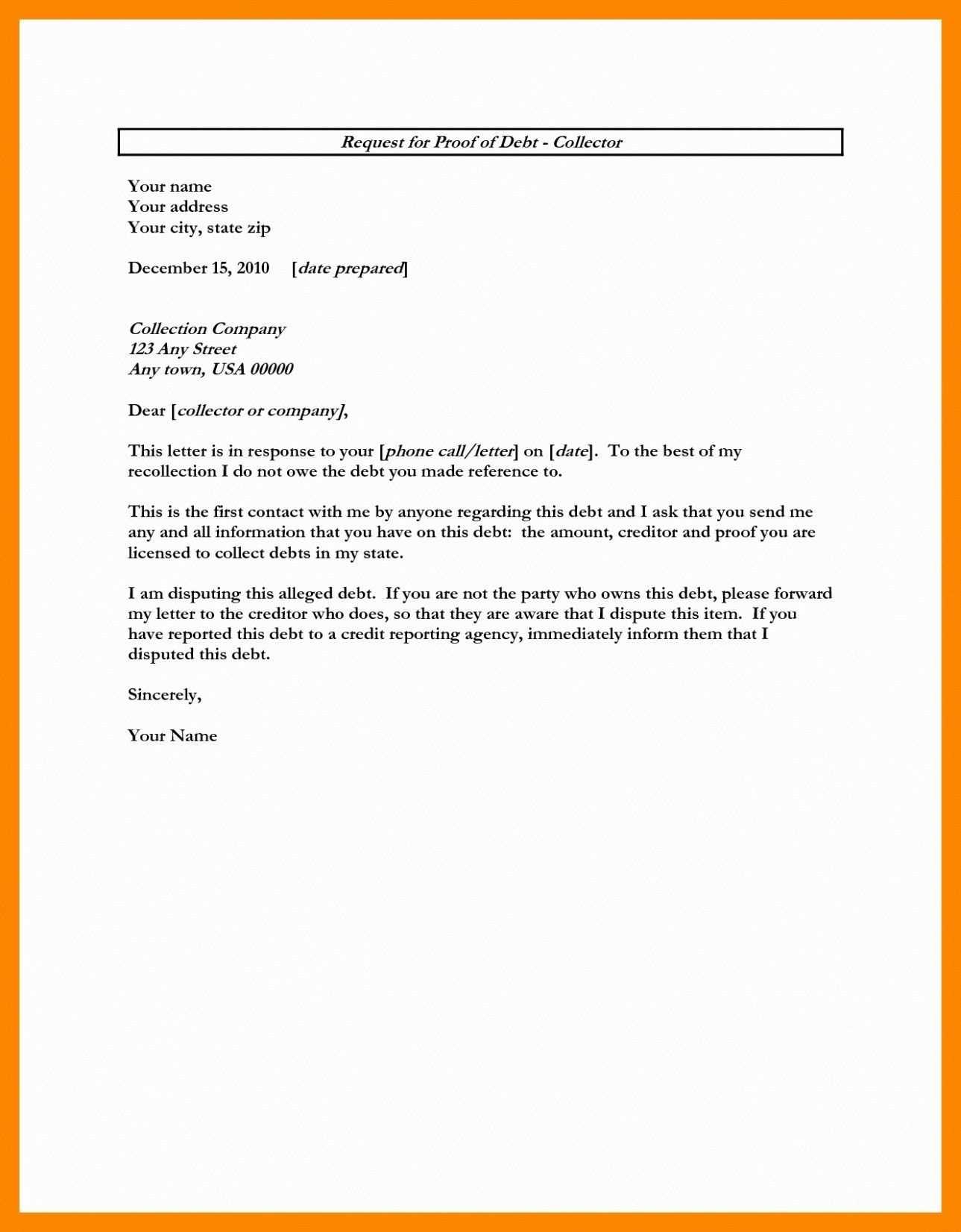

Common Mistakes to Avoid in the Document

When preparing a formal record summarizing your previous engagements with a provider, it’s crucial to avoid certain mistakes that could undermine the document’s effectiveness. Small errors or omissions can lead to confusion or delay in processing, so attention to detail is essential. By being aware of common pitfalls, you can ensure that your document remains clear, accurate, and professional.

Overlooking Essential Details

Failing to include key information: One of the most common errors is omitting vital details such as policy numbers, dates, or claim histories. Always ensure that all relevant information is clearly stated to avoid leaving gaps that may require follow-up communication.

Unclear Language and Formatting

Using ambiguous language: Vague descriptions or overly complex sentences can confuse the reader. Stick to straightforward, simple language to present the facts. Additionally, inconsistent formatting, such as irregular use of headings or unclear organization, can make the document harder to follow.

Neglecting to proofread: Typos, grammatical errors, or incorrect facts can create a negative impression. Always review the document before submitting it to ensure accuracy and professionalism.