Letter of explanation mortgage template

Provide a clear, honest explanation for any financial discrepancies that may appear in your mortgage application. Use a straightforward approach, highlighting the facts behind any missed payments, gaps in employment, or other issues that could raise concerns with lenders. This letter serves to clarify your situation and show your commitment to responsible financial management moving forward.

A well-structured letter of explanation should include the specific reason for the issue, dates, and steps you have taken to rectify it. For example, if you had a period of unemployment, mention how long it lasted and what you did to find new employment. If you faced medical hardships, briefly explain the situation and the actions you’ve taken to stabilize your finances.

Keep the tone professional and transparent. Lenders will appreciate your ability to explain any negative marks on your credit or income history. A concise explanation with a positive outlook can help them feel confident about your application, especially when they see you have addressed any challenges head-on.

Here is the revised version without excessive repetition:

Begin your letter by clearly stating the purpose of your mortgage application. Express your intent directly and provide a succinct overview of your financial situation. Avoid redundancy in describing your financial status or repeating the same information. Stick to key points that highlight your capacity to repay the loan.

Provide Specific Details

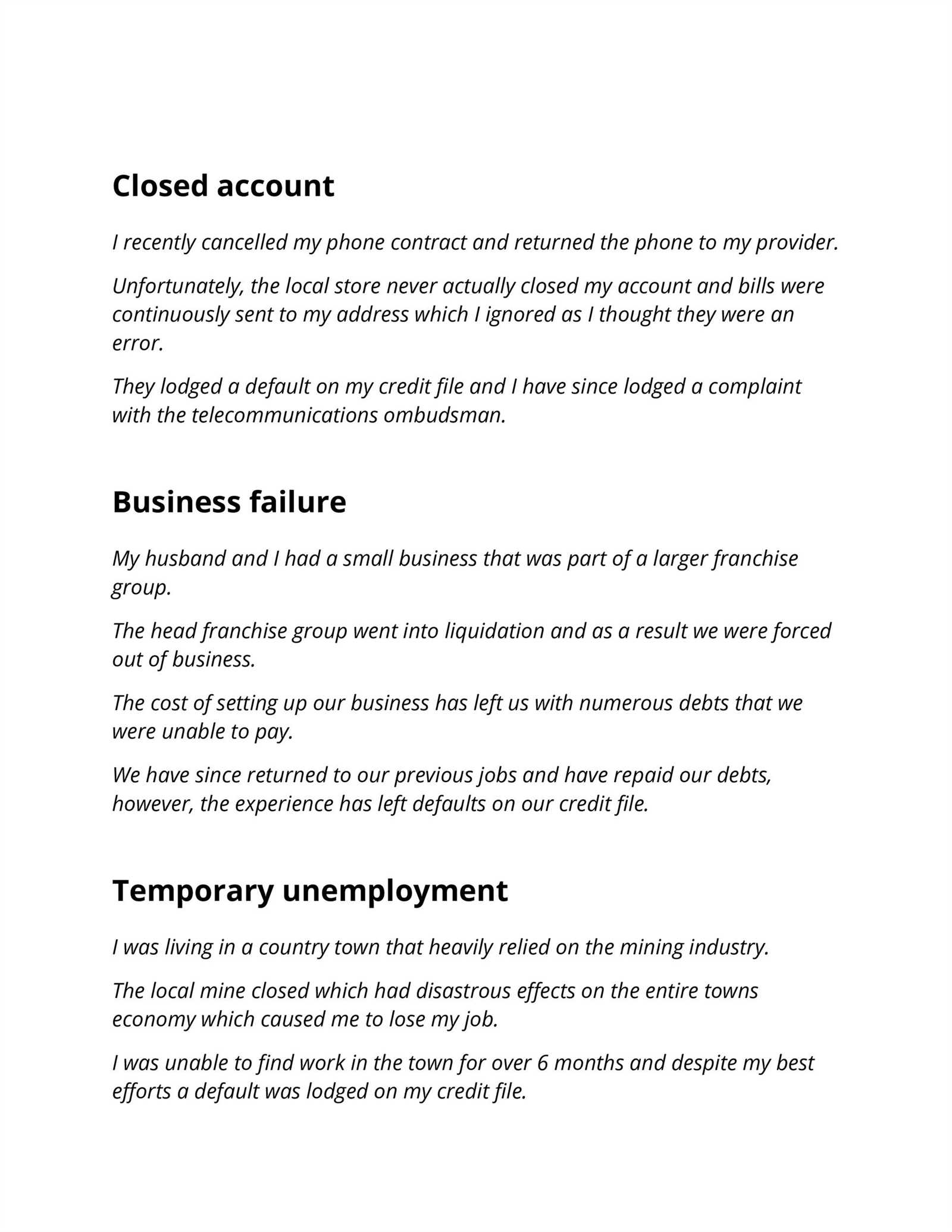

Instead of generalizations, include specific figures and facts. If explaining a financial setback, include dates and amounts. For example, instead of stating “I had some financial difficulties,” specify “I experienced a temporary job loss in 2023 that impacted my income by $X.” This gives a clear picture and reduces unnecessary wordiness.

Stay Focused on Key Points

Keep your focus on the critical elements: your income, debts, and any changes in your financial situation. If addressing credit issues, be clear about the steps you’ve taken to resolve them. Offer enough detail to assure the lender of your stability without over-explaining or repeating the same points in different ways.

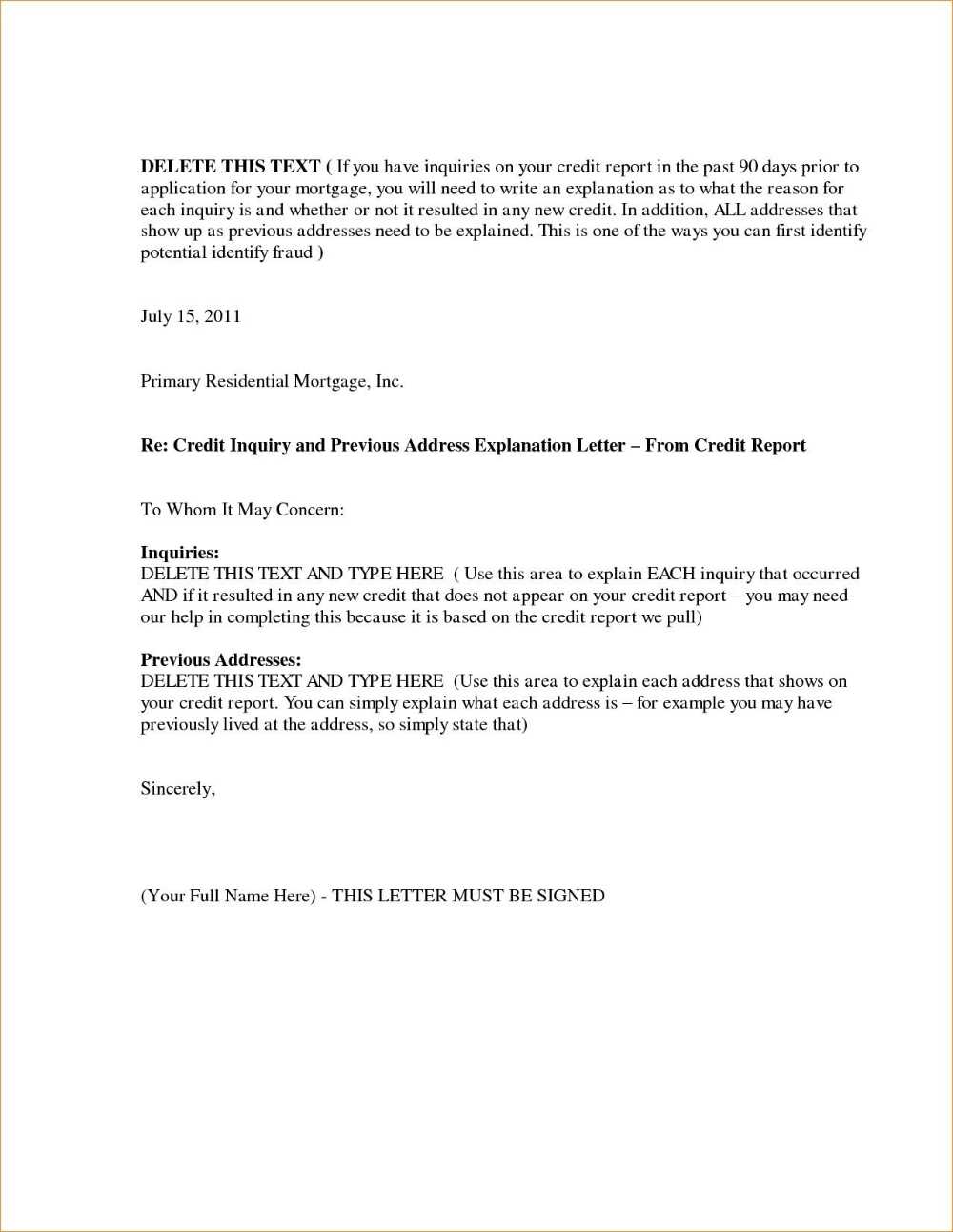

Letter of Explanation Mortgage Template

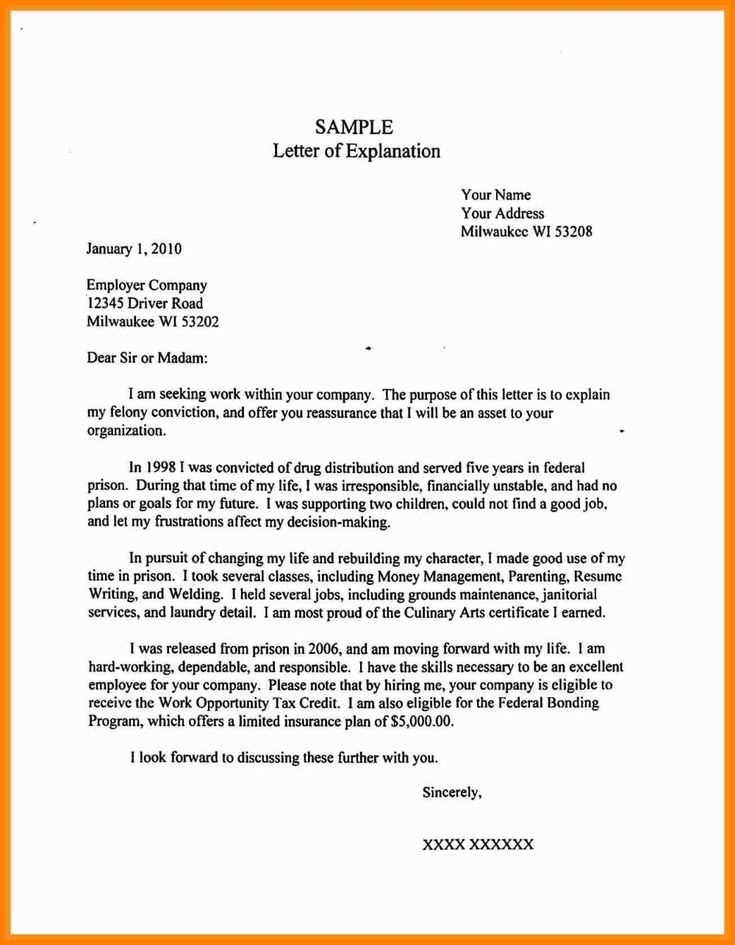

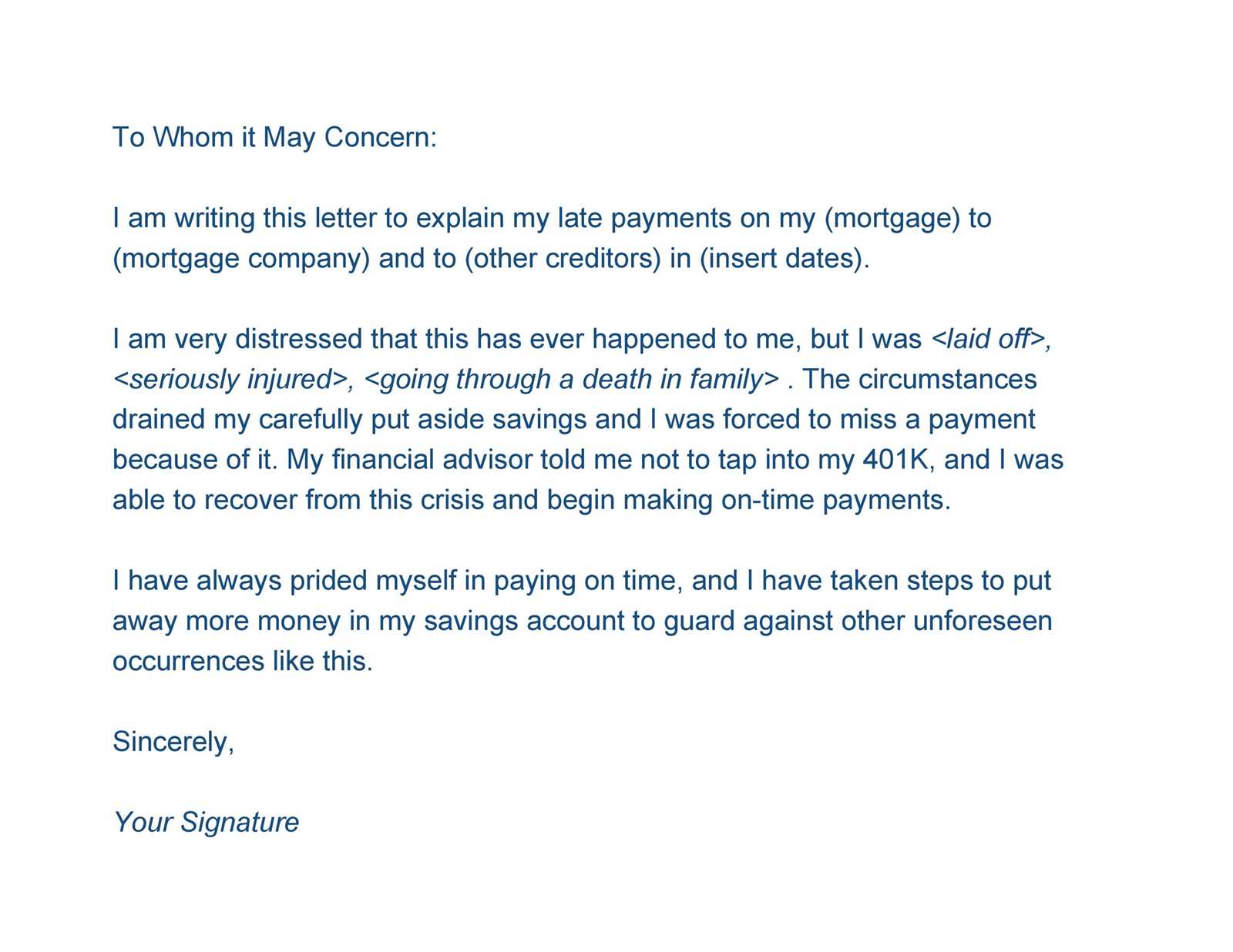

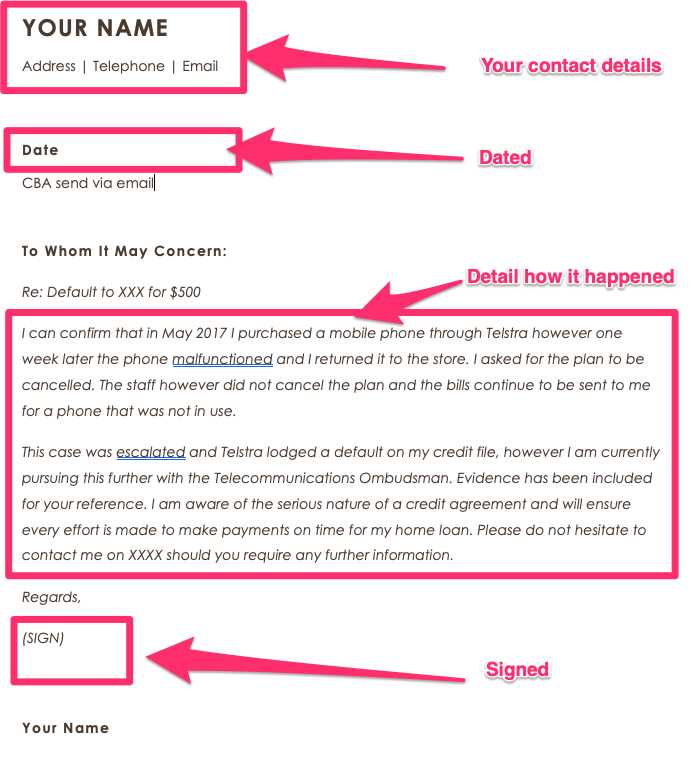

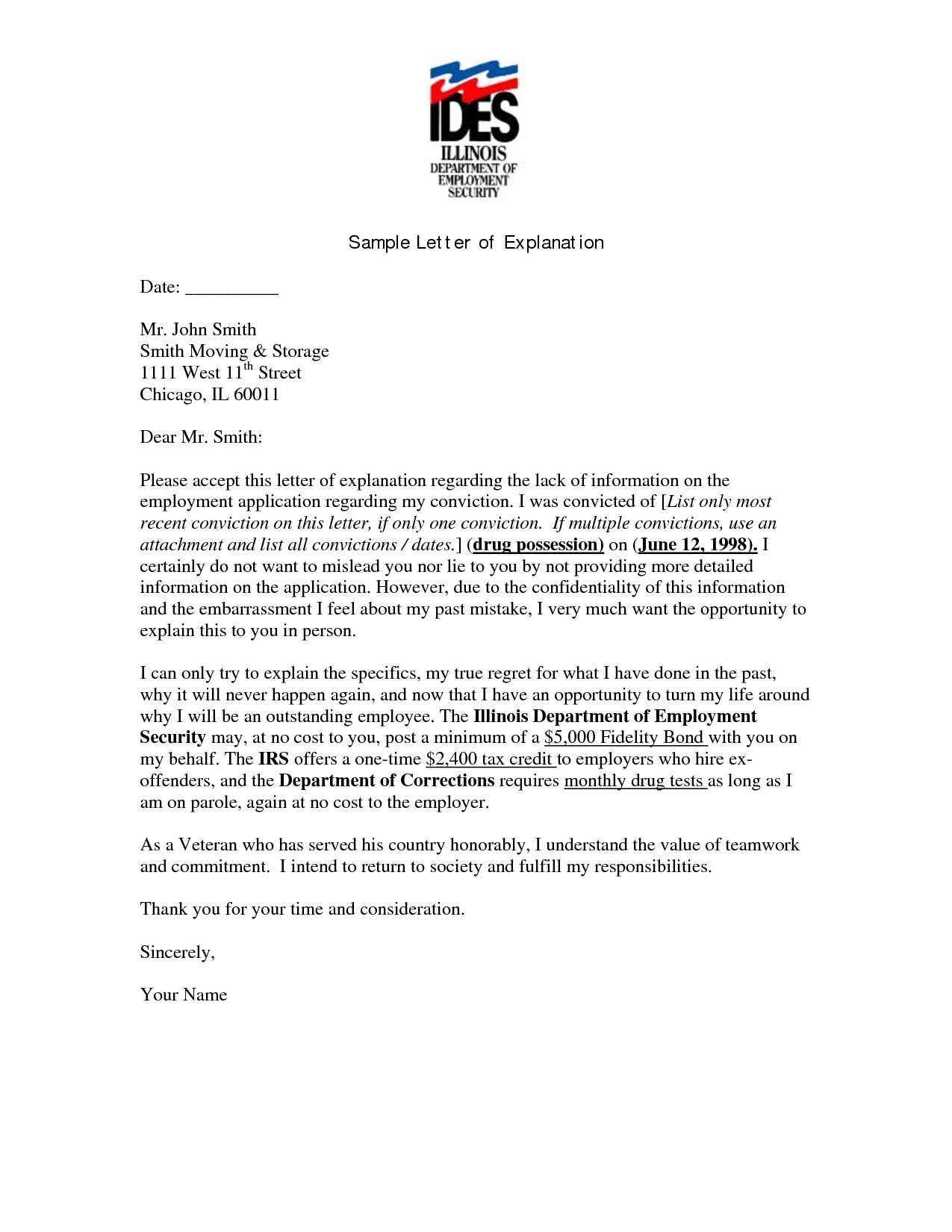

Begin by clearly stating the purpose of the letter. Mention the specific reason for writing, such as clarifying late payments or explaining credit history issues. Be direct and concise to avoid confusion.

Include key components that lenders expect to see. Start with your full name, address, and the loan application number. Follow with a detailed explanation of the issue, such as late payments, and outline the circumstances that led to the problem.

If you have late payments or credit issues, address them honestly. Acknowledge any missed payments, then explain the cause–whether it was a job loss, medical emergency, or another challenge. Be specific and provide supporting documents if possible. Emphasize any corrective actions you’ve taken, such as settling outstanding debts or improving your credit score.

When customizing the letter for different lenders, tailor your message to their specific requirements. Some lenders may want more detail about your financial situation, while others may prefer a concise explanation. Adjust the tone and length of your letter accordingly.

Avoid common mistakes like being vague, making excuses, or using a defensive tone. Stay factual and professional throughout the letter. Don’t over-explain or offer irrelevant details that detract from the main point.

Format the letter neatly, with a clear structure. Use a business letter format, with your contact information at the top, followed by the date and the lender’s information. Ensure the letter is free from spelling or grammatical errors. A well-presented letter demonstrates professionalism and attention to detail.