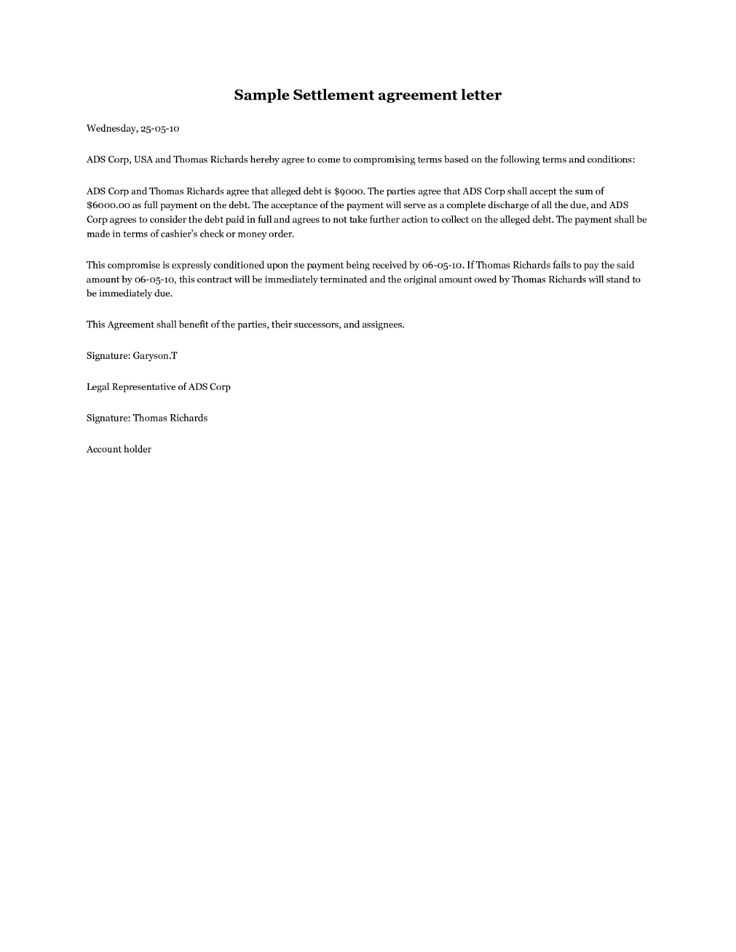

Letter of settlement template

Using a Letter of Settlement template ensures clarity and formalizes the terms of an agreement, helping both parties avoid misunderstandings. A well-crafted letter outlines all the key details and commitments clearly, making the settlement process smooth and effective. This template is ideal for individuals or businesses looking to resolve disputes or finalize settlements in a professional manner.

Start by customizing the template to include specific information relevant to your situation, such as the names of the parties involved, the date of the settlement, and the agreed terms. Ensure that the language is straightforward and precise, leaving no room for ambiguity. Include any payment amounts, deadlines, or other obligations that are part of the settlement.

Conclude the letter by reaffirming both parties’ commitment to the terms outlined. A well-executed letter of settlement can serve as a binding document that both parties can refer back to, offering legal protection and clarity in case of future disputes.

Here is the corrected version where words do not repeat more than two to three times:

To avoid redundancy in your settlement letter, focus on using varied vocabulary while keeping the message clear. Start by stating the agreement or terms explicitly, without repeating similar terms in the same sentence. This maintains clarity and improves readability. For instance, instead of using “settlement” repeatedly, use synonyms like “agreement” or “resolution” as appropriate.

Structure and Clarity

Begin with a concise statement about the dispute or agreement, followed by a clear explanation of terms. Be direct and transparent, ensuring both parties understand their commitments. If you are referring to payments, state the amount or dates without overusing the term “payment.” Alternate with terms like “compensation” or “amount due” where suitable.

Final Confirmation

Conclude with a summary that reconfirms both parties’ obligations, keeping your tone professional but friendly. Avoid repeating the same phrases like “agreement reached” multiple times; vary the phrasing to maintain engagement while staying precise and professional.

- Letter of Settlement Template

A letter of settlement serves as a formal agreement between two parties, typically used to resolve disputes or financial matters. It clearly outlines the terms under which both sides agree to conclude a matter without further action. This document is important for preventing future misunderstandings or claims related to the issue being settled.

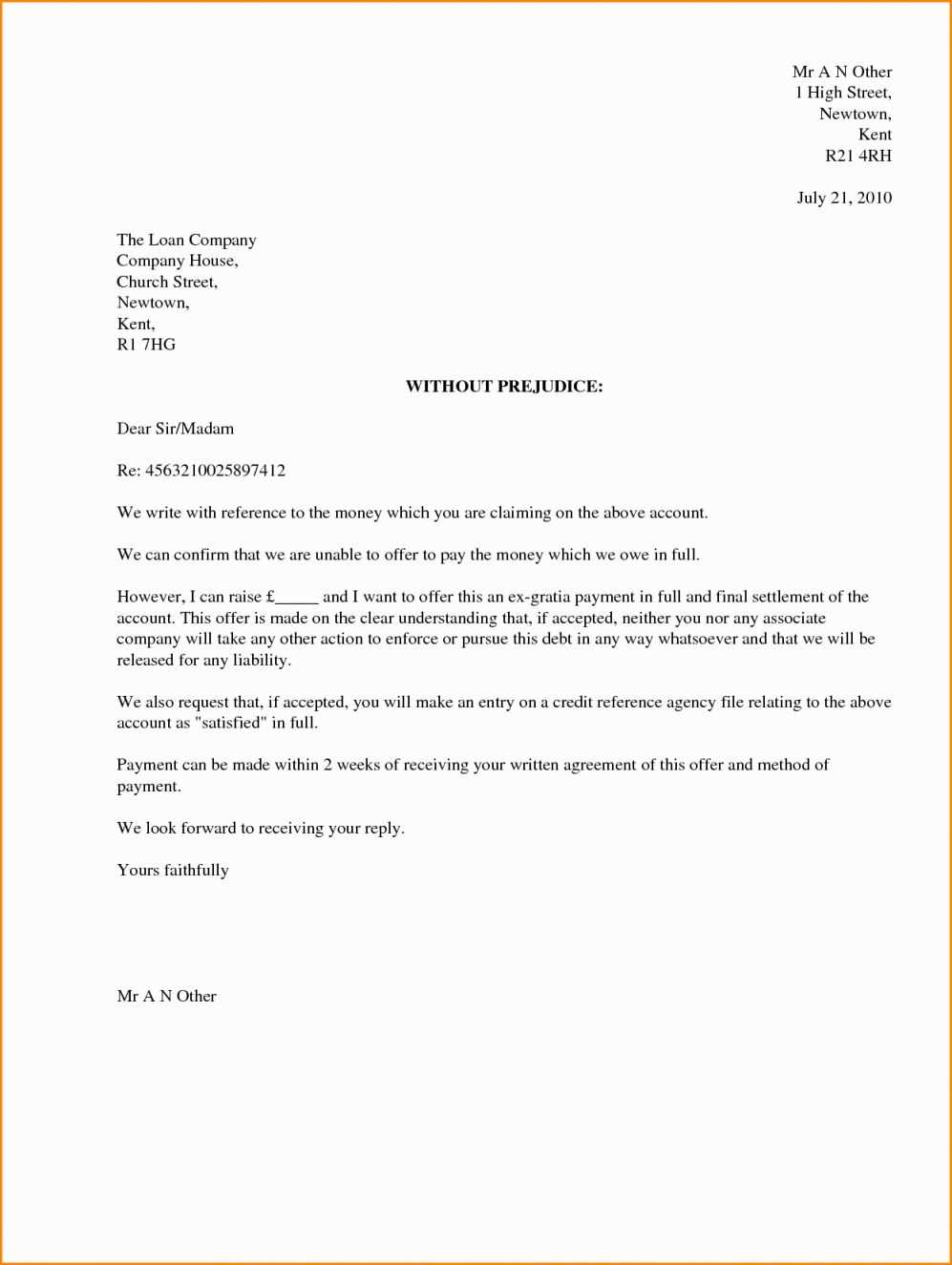

Start with a clear heading identifying the document’s purpose, such as “Settlement Agreement” or “Letter of Settlement.” Include the names and addresses of the parties involved, specifying the date the agreement is made. You should also include a section that describes the issue being resolved, whether it involves a debt, contractual obligation, or other dispute.

Next, clearly state the agreed-upon settlement terms. This might include monetary compensation, a timeline for payments, or actions each party must take to finalize the agreement. Specify the payment amount, schedule, and method, as well as any deadlines for performance. If applicable, include any concessions or conditions that might influence the settlement.

Ensure both parties understand their obligations by listing specific actions or steps they must take. Detail any legal provisions or relevant clauses that may apply, such as confidentiality agreements or non-disclosure terms. Be specific about the scope and limitations of the settlement, ensuring there are no ambiguous terms.

End with a section confirming that both parties agree to the terms. This may include signatures, dates, and a statement that both parties understand and accept the settlement agreement. If necessary, include a clause about the legal validity of the document in the event of future disputes.

Begin with your contact information at the top, aligned to the left. Include your name, address, phone number, and email. Follow this with the date, then the recipient’s details (name, address, and any other relevant information).

Afterward, use a formal salutation like Dear [Recipient’s Name],. In the opening paragraph, state the purpose of the letter clearly, outlining the settlement agreement you’re addressing.

In the body, be precise. Detail the terms of the settlement–whether it’s financial, an agreement on actions, or another resolution. Use clear, direct language to describe what both parties are agreeing to, including amounts, deadlines, and any necessary conditions. Ensure all information is accurate to avoid confusion.

Conclude with a statement that invites the recipient to reach out for further clarification if needed. Keep your tone polite but firm, indicating that the matter can be settled amicably.

End with a formal closing, such as Sincerely,, followed by your name and signature.

Clearly identify the parties involved, including full names and addresses. This ensures that all parties are correctly represented in the agreement.

Include the date of the settlement letter. This establishes when the agreement takes effect, which is important for tracking timelines and deadlines.

Provide a detailed description of the terms of the settlement, such as the payment amount, schedule, and any conditions tied to the agreement. Clearly outlining these specifics helps avoid misunderstandings.

State any legal obligations or actions that each party must undertake following the settlement. This may involve compliance with certain regulations or following up on specific tasks.

Clarify any confidentiality clauses that apply. If either party is required to maintain privacy about the terms or existence of the settlement, include this in clear language.

Specify the method of dispute resolution in case either party fails to comply with the terms. For instance, mediation or arbitration could be listed as potential solutions.

Ensure that the letter is signed by all parties involved, along with their titles or roles, to validate the agreement.

A settlement letter is typically used when resolving disputes, such as in legal, financial, or insurance matters. It provides a written agreement between parties to finalize terms, avoiding further litigation or negotiations.

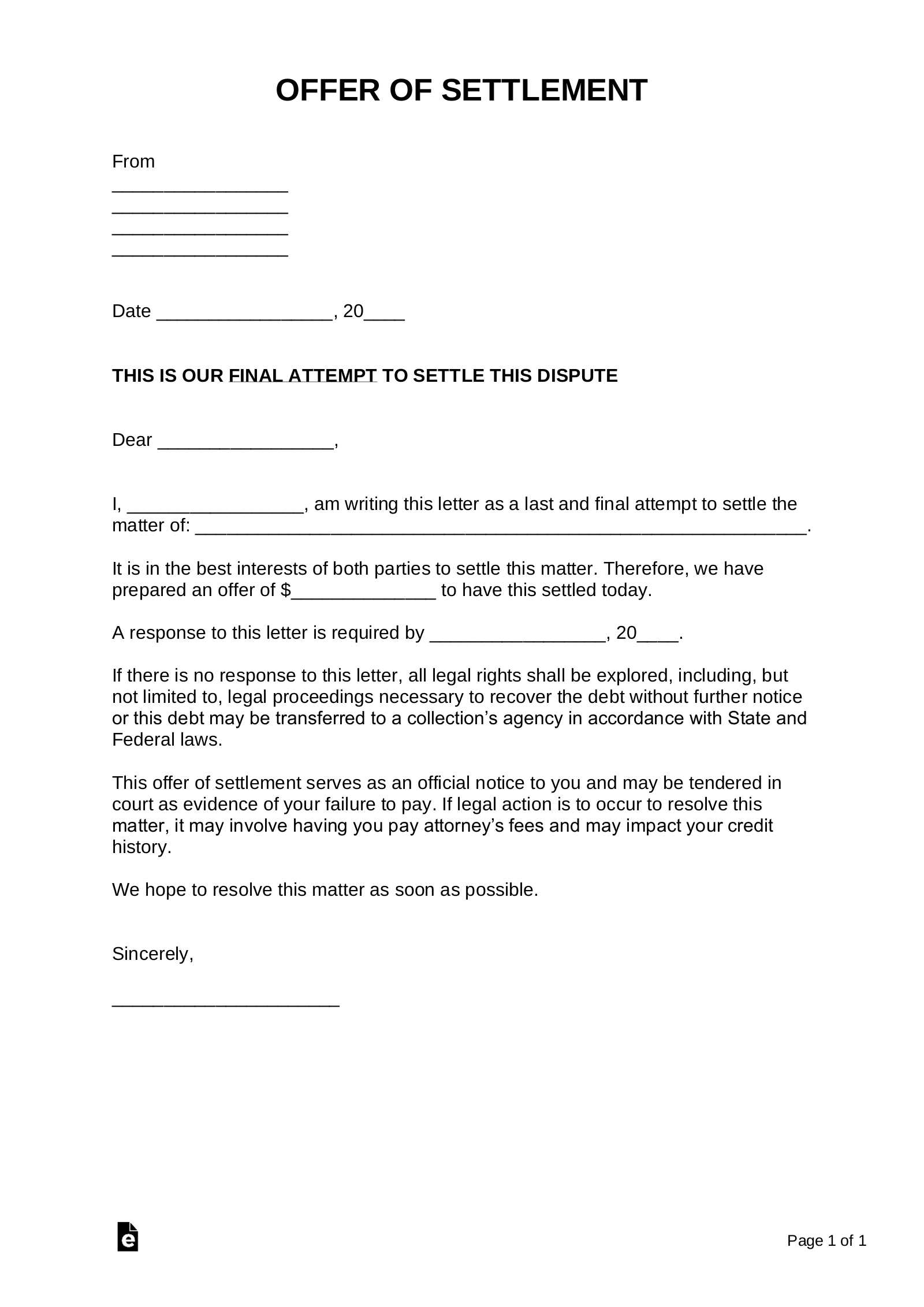

1. Legal Disputes

Use a settlement letter when negotiating the terms of a lawsuit settlement. This letter confirms the agreed-upon terms, such as the payment amount, deadlines, and other conditions to prevent the case from going to trial. It’s a formal way to document the resolution and ensure both parties follow through.

2. Insurance Claims

If an insurance claim is under dispute, a settlement letter can be used to settle the claim amount or other aspects of the case. It serves as proof that both parties agreed on the compensation and terms for resolving the claim.

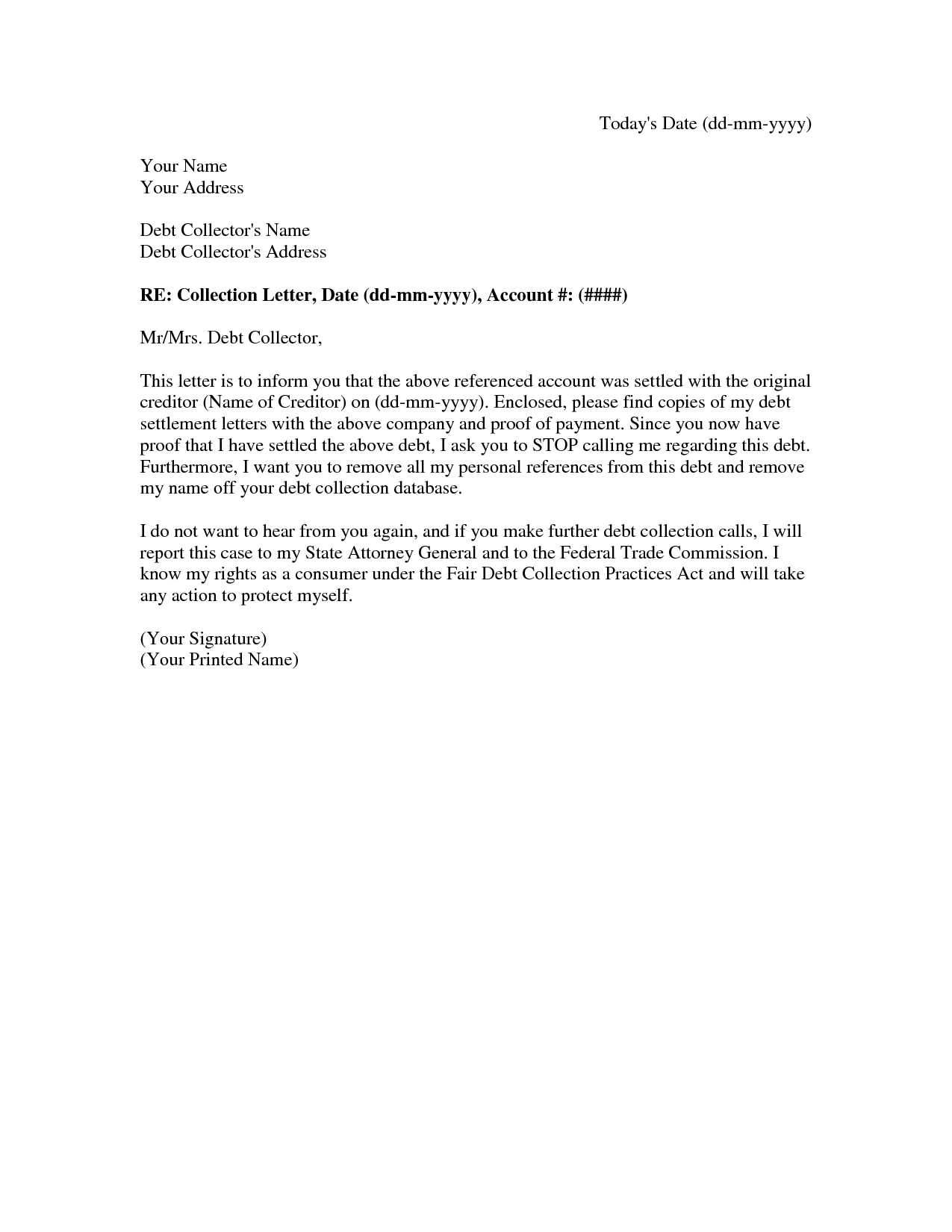

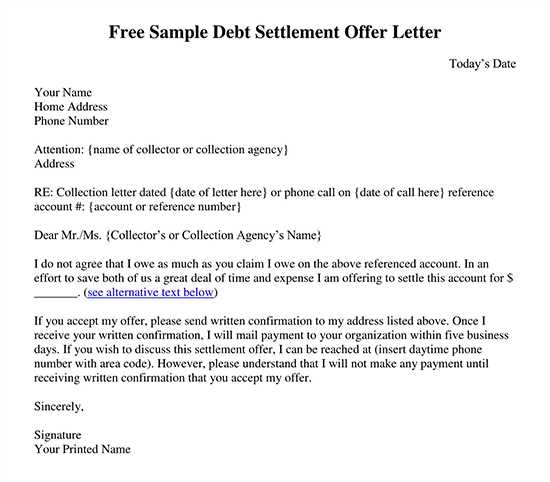

3. Debt Settlements

In financial matters, a settlement letter is often used to finalize the terms of paying off debt for less than the full amount owed. It includes the settlement offer, payment terms, and any conditions to prevent further collection actions or reporting to credit agencies.

Whether resolving a legal case or finalizing a financial matter, using a settlement letter helps both sides confirm their agreement in writing, reducing the risk of misunderstandings or disputes down the line.

To ensure your settlement letter is legally valid, make sure it meets the following requirements:

1. Clear and Precise Terms

Specify the details of the agreement without ambiguity. This includes the settlement amount, payment schedule, and any other obligations of the parties involved. Be specific about deadlines, conditions for payment, and the consequences of failure to comply. Both parties should understand their responsibilities completely.

2. Include Signatures

Both parties should sign the letter. This can be a handwritten signature or an electronic one, depending on the jurisdiction. The presence of signatures confirms that both parties agree to the terms, and it serves as proof of mutual consent.

3. Include a “No Further Claims” Clause

To make the settlement enforceable, include a clause stating that neither party will make further claims related to the dispute after the settlement is completed. This will prevent any future legal issues arising from the same matter.

4. Legal Review

Consult with a lawyer to review the settlement letter. They can confirm that the terms align with legal requirements and help prevent future complications. A legal review is particularly important if the settlement involves significant amounts or complex terms.

5. Ensure Mutual Understanding

Ensure that both parties fully understand the terms before signing. This may involve discussing the settlement in detail or consulting with legal advisors. Clear understanding helps avoid misunderstandings that could invalidate the agreement later.

To create a settlement agreement tailored to your situation, follow these steps:

- Update the Parties Involved: Replace placeholders with the full names and legal addresses of all parties. Specify whether the agreement involves individuals, corporations, or other entities.

- Detail the Dispute: Clearly state the nature of the dispute. Include relevant facts, dates, and events that led to the settlement, ensuring accuracy and specificity.

- Specify Terms of Settlement: Outline the financial compensation or other terms being agreed upon. Include payment deadlines, methods, and any conditions attached to the settlement.

- Include Confidentiality Clauses: If necessary, add confidentiality provisions to protect sensitive information shared during the process.

- Settle Dispute Resolution Mechanisms: Include clauses for how any future disagreements will be handled, whether through mediation, arbitration, or litigation.

- Confirm Signatories: Ensure the agreement includes spaces for signatures from all relevant parties, as well as witnesses or legal representatives if applicable.

- Review Legal Compliance: Make sure the agreement complies with local, state, or federal laws that apply to the type of dispute and settlement.

Keep language clear and precise. Ambiguity can cause confusion and lead to disputes. Avoid vague terms or overly complex legal jargon that may leave room for misinterpretation. Use straightforward language that both parties can easily understand.

Clearly state all terms of the agreement. Leaving out specific details, such as payment schedules, amounts, and deadlines, may cause issues later. Be thorough in outlining the agreed-upon actions, including any release of claims and other obligations.

Do not forget to include the date. Without a clear date, the agreement may be difficult to enforce. Ensure the settlement letter contains both the date of drafting and the effective date of the agreement, if different.

Ensure signatures are properly obtained. An unsigned settlement letter holds no legal weight. Make sure both parties sign and, if necessary, have the signatures witnessed or notarized to avoid future disputes.

Do not overlook any applicable laws or regulations. Failing to reference relevant laws may invalidate certain terms of the agreement. Verify that the letter complies with the governing jurisdiction and any applicable rules.

Avoid making promises you cannot fulfill. If a settlement requires the payment of a certain amount, ensure that you can follow through before committing. Setting unrealistic expectations can harm both parties involved.

Here is a checklist of items to double-check in your settlement letter:

| Item | Tip |

|---|---|

| Clear Language | Avoid ambiguity and complex terms. |

| Terms and Conditions | Outline all payment schedules, deadlines, and obligations. |

| Signature | Ensure both parties sign, and consider having it witnessed or notarized. |

| Legal Compliance | Check that the letter adheres to applicable laws and regulations. |

| Realistic Commitments | Do not promise terms you cannot deliver on. |

Now the same word appears no more than two to three times, maintaining meaning and text accuracy.

To ensure clarity and readability, avoid overusing the same word in your settlement letter. If a specific term repeats too often, it can disrupt the flow and sound unnatural. Use synonyms or rephrase sentences to introduce variety without changing the meaning.

Why Word Variety Matters

Repetitive wording can make your letter sound monotonous and may even confuse the reader. The goal is to communicate effectively, making it easier for the recipient to understand the terms of the settlement.

How to Manage Word Repetition

- Identify key terms that are essential to the message.

- Use synonyms or different phrases that convey the same meaning.

- Rephrase sentences to avoid repetition and maintain the letter’s professional tone.

- Read the letter aloud to catch any overused words and adjust them accordingly.

By applying these strategies, you ensure that your settlement letter remains clear, concise, and professional, all while avoiding unnecessary repetition.