Letter template for debt collection

To begin the debt collection process, it is crucial to write a clear and concise letter that outlines the amount owed, the terms of the debt, and a request for payment. A well-structured letter can facilitate resolution without unnecessary delays or complications.

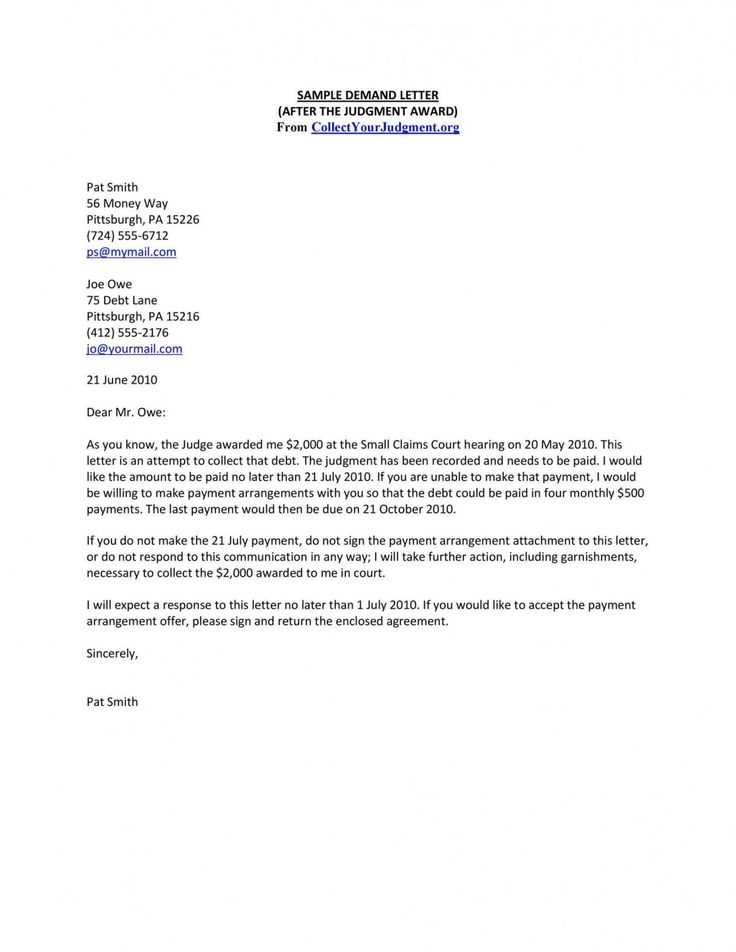

Start by clearly identifying the debtor and specifying the amount owed. Include relevant dates, such as the original due date and any missed payments, to highlight the urgency. Clearly state the method of payment and the date by which the payment should be made. Keep the tone firm yet polite to avoid alienating the debtor while conveying seriousness.

Offer options for the debtor to contact you, whether by phone, email, or postal mail. Keep your communication lines open to ensure any misunderstandings can be addressed promptly. In some cases, suggesting payment plans can lead to a quicker resolution, especially if the debtor is experiencing financial difficulty.

Finally, make it clear that further actions may be taken if the debt remains unpaid. This could include involving a collections agency or pursuing legal action. Always document your communication and retain copies of the letter for future reference.

Here is the revised version:

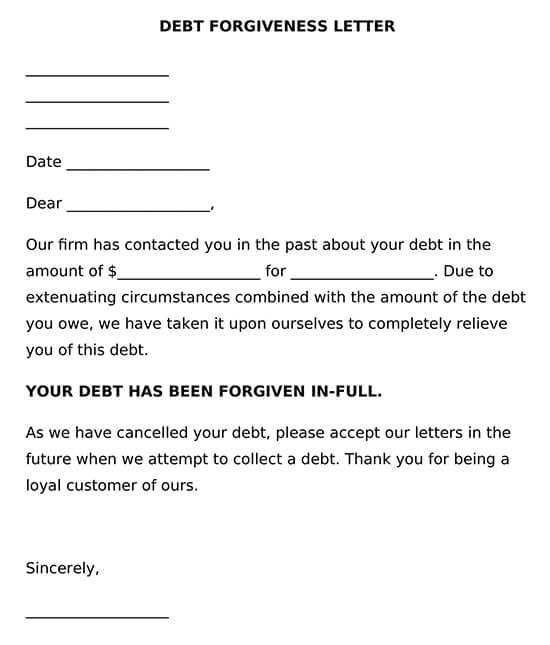

Focus on clarity and directness when drafting a letter for debt collection. Begin by stating the purpose of the letter upfront–make it clear that payment is overdue and request immediate action. Include details such as the amount owed, the due date, and any previous communication regarding the debt.

Key Information to Include

Provide specifics about the debt, such as the account number or invoice reference. Mention the payment methods available and remind the recipient of any penalties or fees for late payments. Be concise but assertive about the expectation for payment within a set period, typically 7 to 10 days.

Polite but Firm Language

Avoid aggressive language, but keep the tone firm. Acknowledge that the recipient might have overlooked the payment but make it clear that further delays will not be acceptable. Be polite, but show urgency.

Finish with a clear call to action, such as asking the recipient to contact you with questions or provide a payment plan if necessary. Include your contact details, including phone number and email, to facilitate easy communication.

In conclusion, keep your letter professional, straightforward, and focused on obtaining payment while maintaining a respectful tone. This approach ensures the matter is taken seriously and handled promptly.

Letter Template for Debt Collection

Structuring the Opening of Your Debt Collection Letter

Key Elements to Include in the Body of Your Correspondence

How to Address and Specify the Outstanding Amount

Setting a Deadline for Payment in Your Communication

Clear Language for Consequences of Non-Payment

Legal Considerations in Debt Collection Letters

Begin with a concise introduction that immediately identifies the purpose of the letter. State the debtor’s name, the nature of the debt, and the relevant account details. Use a professional, direct tone to set the right expectations for the rest of the letter.

In the body, clearly outline the outstanding balance. Specify the original amount, any interest or fees applied, and the total sum due. Make sure this section is straightforward, using figures rather than vague terms to avoid confusion.

Clearly indicate the exact amount the debtor owes. Avoid ambiguity by using clear, unmistakable wording such as “The outstanding balance on your account is $X,” followed by a breakdown of the charges or late fees incurred. This ensures transparency and makes the amount difficult to dispute.

Specify a clear deadline for payment. State the exact date by which the payment must be made, and indicate that failure to pay by this date will lead to further action. A reasonable deadline typically ranges from 7 to 30 days, depending on the situation and agreement terms.

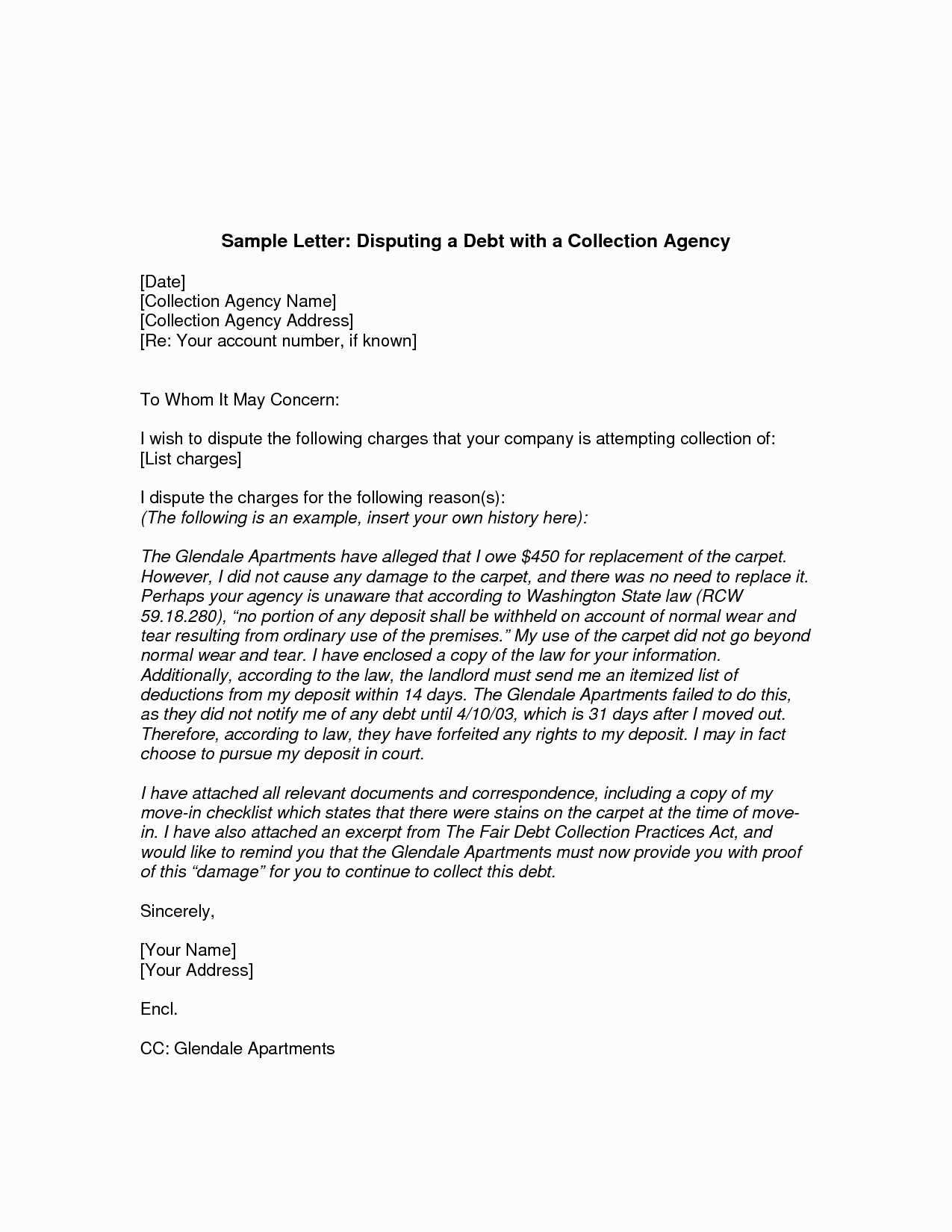

Describe the consequences of non-payment in straightforward language. Avoid overly legalistic terms, but make it clear that failure to settle the debt by the given deadline will lead to legal actions, credit reporting, or other measures. The consequences should feel real without sounding threatening.

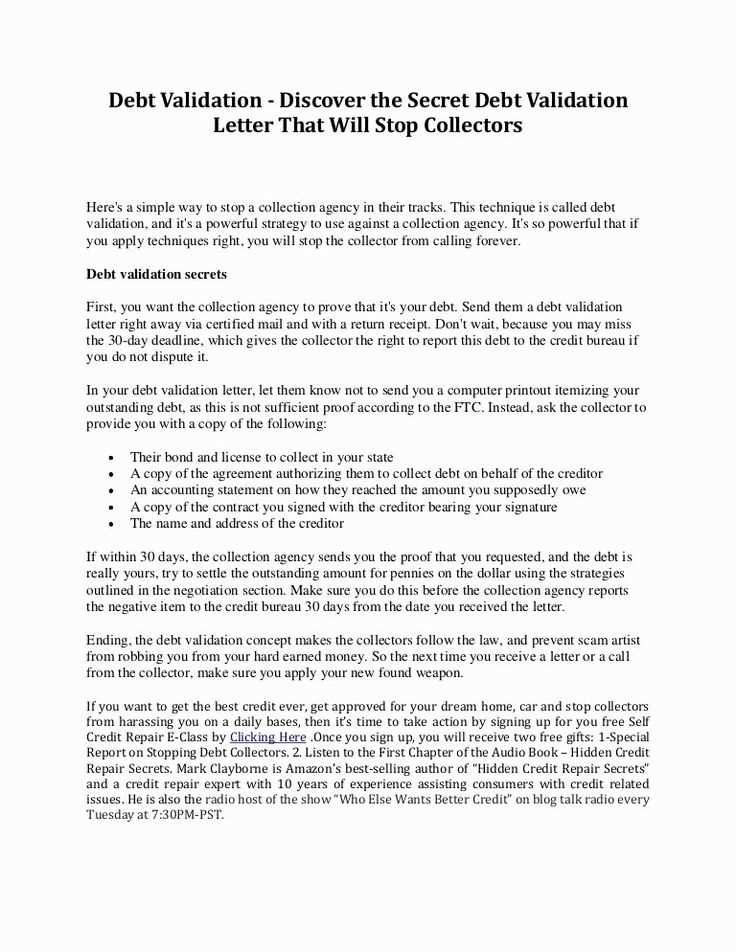

Ensure your letter complies with relevant laws governing debt collection. Mention the debtor’s right to dispute the debt within a certain time frame, and include any other legal rights or obligations that may apply. This helps maintain transparency and keeps the process within legal boundaries.