Letter template to irs

If you need to contact the IRS for any reason, it’s important to follow a clear and professional structure. A well-written letter can ensure your message is received and addressed properly. Below is a template that you can tailor to your specific needs when corresponding with the IRS.

Start by clearly stating your reason for writing. Whether it’s an inquiry, a payment issue, or a request for clarification, make sure to mention it right away. This sets the tone for the rest of your letter and helps the IRS direct your case to the appropriate department.

Include your personal details next: your full name, taxpayer identification number (TIN), and any other relevant information like your address or the tax period in question. This ensures the IRS can easily locate your records and respond accordingly.

After stating your reason, include any supporting documents or reference numbers that may help clarify the situation. Be direct and concise with the information you provide–this reduces the chances of confusion and speeds up the resolution process.

Finally, be sure to request a specific action, whether it’s a follow-up, an adjustment, or clarification. End the letter with a polite closing and thank the IRS for their attention to your matter.

Here’s the revised version with reduced repetitions:

Address your concern directly in the letter. State the issue clearly and offer specific details. For instance, if there was an error in tax filing, explain the nature of the error and provide supporting documentation. Avoid unnecessary explanations that don’t contribute to solving the problem.

Providing Documentation

Include any relevant documents such as forms, receipts, or calculations to support your claims. Organize them in a logical manner, so the IRS can easily verify your statement. If there is a discrepancy, mention the steps you’ve already taken to resolve it.

Clear and Concise Requests

Make your request straightforward. Whether you are seeking clarification or asking for a correction, state your request in a direct manner. Avoid restating the issue multiple times. For example, “I request a review of my filing and a correction of the error found in my 2024 return.” Keep the tone polite but assertive.

- Gather the Necessary Information Before Writing

Before you start drafting your letter to the IRS, ensure you have all relevant details at hand. This includes your taxpayer identification number (TIN) or Social Security number (SSN), the tax year in question, and any notices or forms related to the issue you’re addressing. Having these documents organized will help streamline your letter-writing process.

Make sure to collect the following documents:

| Document | Purpose |

|---|---|

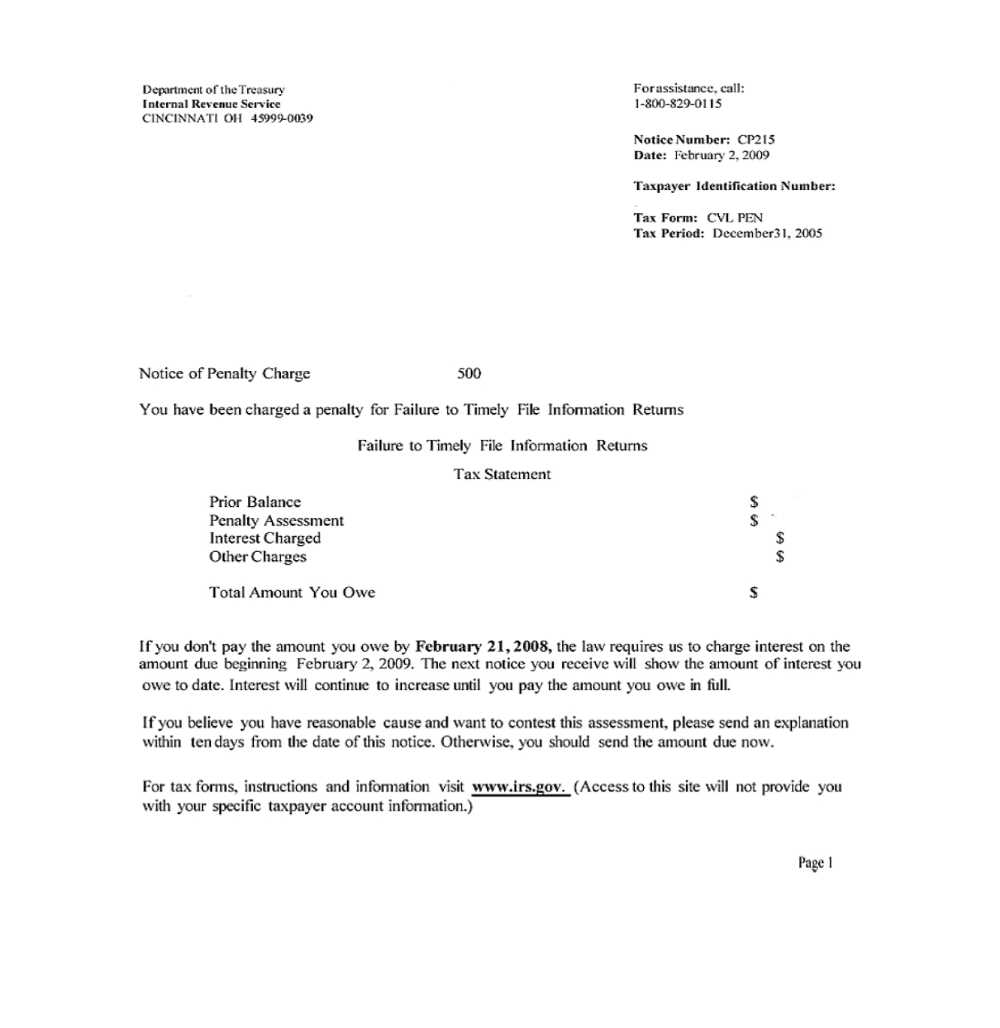

| Notice from the IRS | Provides reference for your inquiry or response |

| Previous Tax Returns | Clarifies past filings if necessary |

| W-2, 1099, or other relevant forms | Supports income or deductions related to your issue |

| Bank Statements (if applicable) | Validates financial data referenced in your communication |

Having these documents ready will ensure you provide accurate information, reducing the chance of delays in resolving your matter with the IRS.

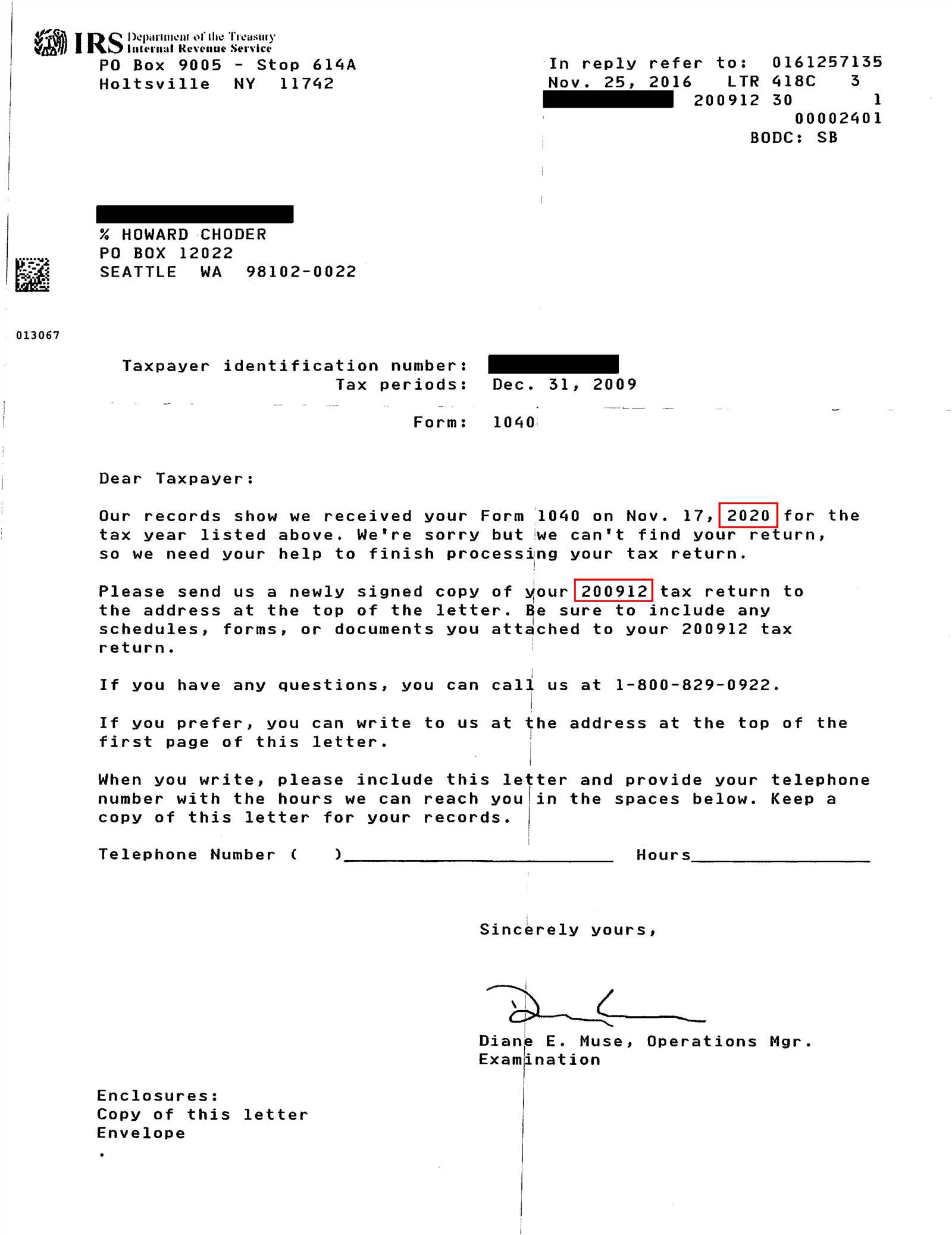

Include your full name, address, and taxpayer identification number (TIN) at the top of your letter. These details help the IRS identify your case quickly and accurately.

1. Clear Reason for Writing

State the purpose of your letter immediately. Whether you are requesting an extension, contesting a notice, or providing additional documentation, clarity is key. For example, begin with: “I am writing to address my account regarding the notice dated [date].” This will help the IRS understand your issue right away.

2. Relevant Dates and Details

Provide all necessary dates and reference numbers. If you are responding to a specific IRS letter, include the letter’s reference number and the date you received it. If your letter concerns a tax return, mention the year and filing status. Providing these specifics helps prevent delays.

3. Explanation of Your Situation

Describe your issue or request in clear, concise terms. If you disagree with an IRS decision, explain why, referencing supporting documents like tax returns or receipts. If you are requesting relief or making a correction, outline your steps and the reason for the change.

4. Supporting Documentation

If applicable, attach copies of documents that support your case. This may include tax returns, payment records, or correspondence with other entities. Ensure all documents are legible and organized for easy review.

5. Contact Information

Provide accurate contact details where the IRS can reach you. Include your phone number, email address, or other preferred communication methods.

6. Signature

Conclude your letter with a formal closing, such as “Sincerely,” followed by your signature and printed name. This adds professionalism and ensures the IRS knows exactly who is sending the letter.

7. Keep Copies

Before mailing, make copies of your letter and any attachments. This way, you have a record of what was sent for future reference.

Use clear, concise language when communicating with the IRS. Avoid jargon and overly complex sentences. Stick to simple and direct wording to make your point easily understood. For example, instead of saying “I would like to kindly request,” use “I request.” This ensures your communication is straightforward and professional.

Follow a formal letter format with proper headings. Start with your contact information at the top, followed by the IRS’s address, the date, and a clear subject line. Organize your letter into short paragraphs, each focusing on one key point, to improve readability and comprehension.

Be specific about the issue you’re addressing. If you’re responding to an IRS notice, include the notice number, your taxpayer identification number (TIN), and the relevant tax year. Always reference any supporting documents clearly so the IRS can easily track the information.

Use a polite yet assertive tone. IRS communication should maintain respect and professionalism, while also being firm and clear about your expectations. Avoid overly casual language or ambiguous statements.

Finally, ensure that your letter is free of errors. Proofread for spelling, grammar, and factual accuracy. A well-organized, error-free letter will leave a positive impression and improve the likelihood of your issue being resolved promptly.

Misunderstandings about income reporting are frequent. If the IRS has questioned your reported earnings, be clear about any discrepancies. Attach supporting documents like W-2 forms, 1099s, or bank statements to verify your income. If you missed reporting certain income, explain the situation, clarify the source, and state when you realized the error.

Incorrect deductions are another common issue. If you claimed deductions that the IRS flagged, double-check your eligibility for those expenses. Provide receipts and proof of payment to back up your claims. If the mistake was unintentional, explain why the deduction was made and how you will avoid it in the future.

Filing status confusion often arises due to changes in personal circumstances. If the IRS challenges your filing status, such as claiming “Head of Household” when you’re unsure, explain your situation clearly. Attach documentation like a marriage certificate or proof of dependent support to support your position.

Missing or incorrect signatures can delay processing. If your form is incomplete or lacks a signature, submit an amended return promptly with the necessary corrections. Be sure to include any missed information, such as your signature, date, and relevant updates on your tax filings.

Late payments or unpaid taxes should be explained if they have caused the IRS to assess penalties. In such cases, clearly state any mitigating factors, such as a medical emergency or loss of employment, and show evidence of your attempts to make payments. The IRS may reduce penalties based on reasonable cause if you provide proper documentation.

Send your letter to the IRS using a method that provides proof of delivery. Certified mail with return receipt is a reliable option. This allows you to track the letter and confirms when it was received. Make sure to request a return receipt, which will be sent back to you once the IRS receives your letter. Keep a copy of the tracking information for your records.

Track Delivery Status

Check the delivery status using the tracking number from the USPS or other courier service. If the IRS accepts the letter, you’ll get an update showing it was delivered. This serves as confirmation that your submission reached the correct office.

Save Your Documentation

Retain all receipts, tracking records, and the return receipt. These documents prove your communication with the IRS and will be useful if you need to follow up or dispute any issues in the future.

Meaning is preserved, and repetition is reduced.

To streamline communication with the IRS, focus on concise and direct language. Avoid redundancy while ensuring that all necessary details are included. This improves the clarity and professionalism of your letter, making it easier for the IRS agent to process your request.

- Use bullet points or numbered lists for clear presentation of multiple items or requests.

- Be specific about dates, amounts, and other relevant details to avoid back-and-forth clarifications.

- Summarize key points briefly, emphasizing the core of the issue or request.

- Avoid restating the same information in different ways–once is enough.

- Organize your letter logically, with each paragraph addressing a distinct aspect of the matter.

By eliminating unnecessary repetitions and focusing on clarity, your letter will be more efficient and effective, improving the chances of a prompt response.